Kelp

KelpDAO is a liquid restaking protocol on EigenLayer, supporting tokens like ETH and stETH. It offers the rsETH token for earning yields while maintaining liquidity, with various DeFi integrations.

KelpDAO is a liquid restaking protocol on EigenLayer, supporting tokens like ETH and stETH. It offers the rsETH token for earning yields while maintaining liquidity, with various DeFi integrations.

Renzo Protocol is a liquid restaking platform on EigenLayer, enabling easy restaking of Ethereum and Liquid Staking Tokens. It supports multiple networks and over 100 DeFi integrations.

Taho Wallet is a community-owned Web3 wallet for NFTs and DeFi. It features Ledger integration, low swap fees, and is open source. Available on Firefox, Brave, and Chrome

Drift Protocol is a decentralized exchange on Solana, specializing in perpetual futures trading with up to 20x leverage. It also supports spot trading, borrowing, and lending.

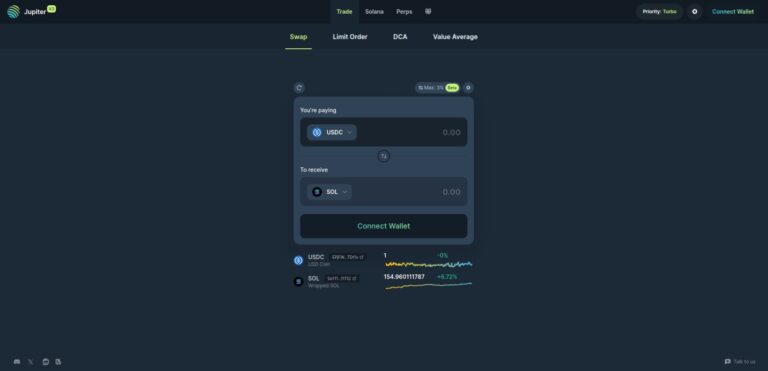

Jupiter is a decentralized exchange aggregator on Solana, offering fast transactions, low fees, and access to most SOL-based tokens. It features limit orders and cross-chain swaps.

Storm Trade is a decentralized exchange on the TON blockchain, offering perpetual futures trading via a Telegram Web App. It features a user-friendly interface, and robust security measures.

Avantis is a decentralized perpetual trading platform on Base, offering up to 75x leverage across crypto, forex, and commodities. It features loss protection and uses USDC for liquidity.

HMX is a decentralized perpetual exchange on Arbitrum and Blast, offering up to 1,000x leverage across crypto, forex, and commodities. It supports cross-margin and multi-asset collateral.

Vertex Protocol is a decentralized exchange built on Arbitrum and Mantle, offering spot, perpetuals, and money markets with universal cross-margin accounts.

THORSwap is a decentralized exchange (DEX) powered by THORChain, which facilitates cryptocurrency trading in a non-custodial and decentralized manner.

Solflare is a secure Solana blockchain wallet for buying, storing, swapping tokens and NFTs, with DeFi access, hardware wallet support, and live chat assistance.

Joule enables Lightning network in-browser payments, identity management, one-click payments, channel management, and secure invoice handling.

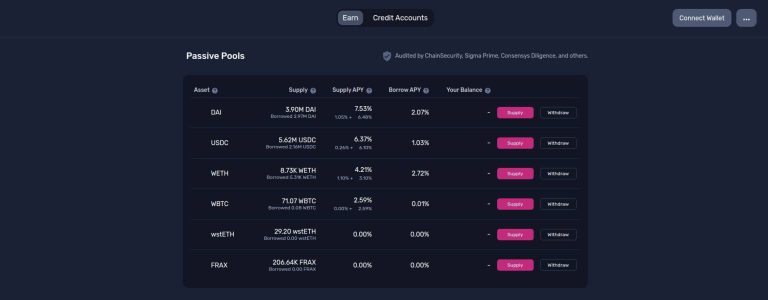

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

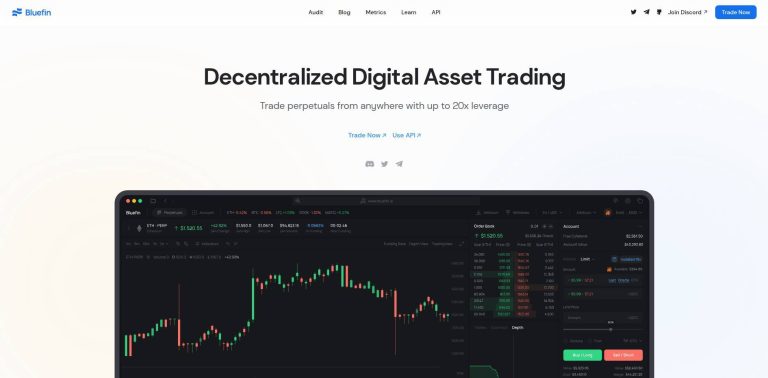

Bluefin provides decentralized derivatives trading, featuring up to 20x leverage, prioritizing security, user experience, competitive fees, and programmatic trading via API.

Trader Joe XYZ is a one-stop decentralized trading platform on Avalanche, offering trading, lending, borrowing, staking, and shopping, with a focus on user-friendly DeFi activities.

Slingshot Finance is a decentralized finance (DeFi) platform that operates on a Web3 framework, allowing users to store, swap and trade in the Ethereum ecosystem.

OpenOcean aggregates liquidity across 19+ blockchains for optimal swap rates, reducing slippage and gas costs in Decentralized Finance (DeFi) trading.

APY.Vision is an analytics platform tracking liquidity pool gains and impermanent loss, helping investors optimize returns across various decentralized finance protocols.

Bloxy.info is a product by Bitquery providing various data analytics and blockchain querying services for decentralized finance (DeFi) ecosystem.

Opium Finance is a decentralized finance (DeFi) platform allowing users to create markets, offering financial tools like insurance, staking, and turbo products.

Nexus Mutual offers a decentralized finance insurance alternative for DeFi assets, providing various cover products like, Yield Token, and Custody Cover.

InsurAce is a decentralized multi-chain DeFi insurance protocol offering optimized pricing, broader coverage, and sustainable investment returns.

DeFi Saver offers a dashboard for managing DeFi positions, automating leverage management, refinancing loans, and executing custom transactions.

Furucombo is an innovative decentralized platform aimed at simplifying the process of utilizing various DeFi (Decentralized Finance) protocols to maximize users' returns.

NFT20 is a protocol facilitating liquidity for NFT (Non-Fungible Tokens) through pools, enabling developers to build advanced NFT applications for DeFi.

QuickNode facilitates blockchain development with elastic APIs, blockchain analytics, developer tools for creating Web3, DeFi apps, and managing NFT data.

Dinero facilitates on-chain liquidity, governance, cash flow in DeFi, offering products like Pirex for yield tokenization, and Hidden Hand for governance incentives.

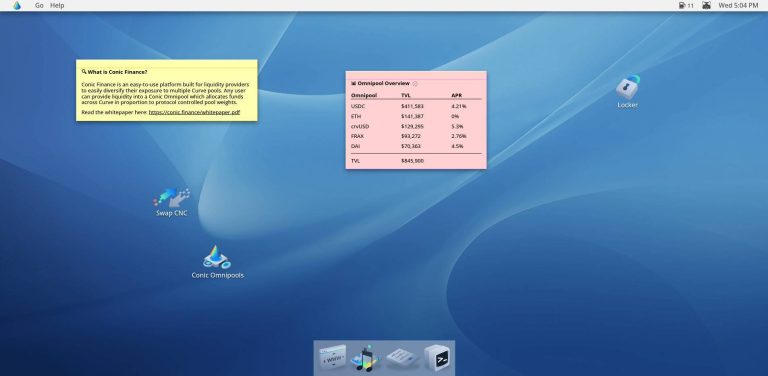

Conic Finance allows liquidity providers to diversify across multiple Curve pools via Omnipools on Ethereum ecosystem, governed by Conic DAO votes.

Unrekt is a Smart Contract Allowance Checker for multiple blockchains like Ethereum and Binance Smart Chain, allowing users to find and revoke addresses that can spend their tokens.

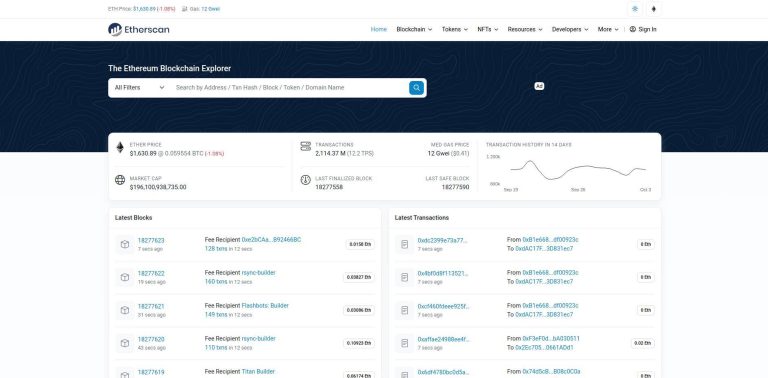

Etherscan is an Ethereum blockchain explorer for searching, verifying, and exploring transactions, addresses, with tools to monitor network activity, and execute transactions.

Revoke.cash enables users to revoke token approvals on ethereum ecosystem, aiding in enhancing wallet security by preventing unauthorized access to funds.

Approved.zone is an Ethereum smart contracts approvals dashboard for managing Ethereum smart contract approvals in the decentralized finance space.

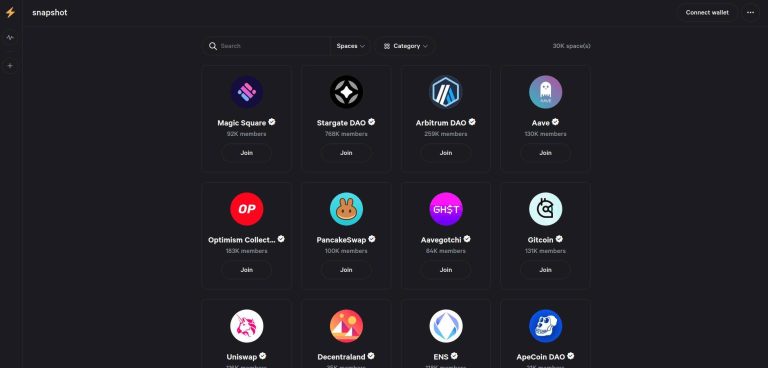

Snapshot is an off-chain voting platform for DAOs, DeFi protocols, and NFT communities, enabling gas-free decentralized governance with customization.

LlamaNodes offers fast, secure blockchain access via public, premium RPCs, with low latency, robust redundancy, advanced monitoring, and multi-chain support.

WalletConnect facilitates secure web3 communications between wallets and apps, offering developer toolkits, multi-chain wallet connections, and notifications.

Lightning Network enables instant, scalable blockchain payments with low fees, utilizing smart contracts for security across decentralized payment channels.

Sablier enables real-time token streaming for payroll, airdrops, and more, with ERC-721 NFT representation, supporting various blockchain networks.

PoolTogether is a decentralized finance, no-loss savings game on Ethereum ecosystem, where deposited funds earn interest used for daily prize draws.

SuperRare is an ethereum-based digital art marketplace for tokenizing, buying, displaying, and trading authentic artworks, with community-curated storefronts.

Alpaca Finance offers leveraged yield farming, lending, and automated vaults on Binance Smart Chain, optimizing yield strategies and managing risks.

Beefy Finance is a decentralized finance, multichain yield optimizer and aggregator that maximizes DeFi rewards through smart-contract enforced strategies.

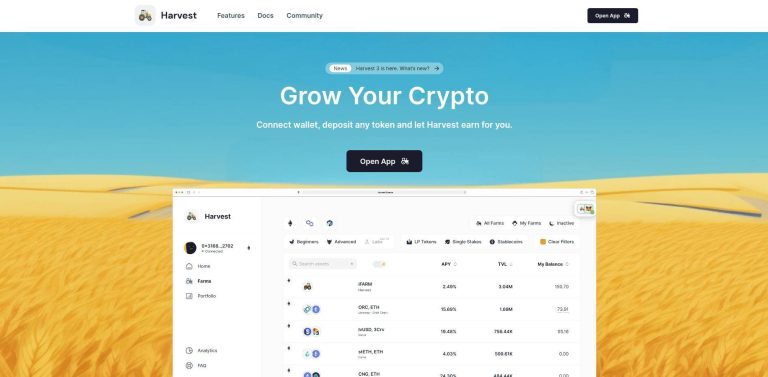

Harvest Finance automates yield farming via Ethereum-based vaults, optimizing returns, reducing gas costs, and offering user-friendly farming opportunities.

Instadapp Lite autonomously executes DeFi strategies via smart contract vaults, leveraging popular protocols for enhanced yields, minimizing transaction costs.

Perpetual Protocol facilitates on-chain perpetual futures trading through a decentralized exchange, offering governance via PERP token, and USDC revenue-sharing.

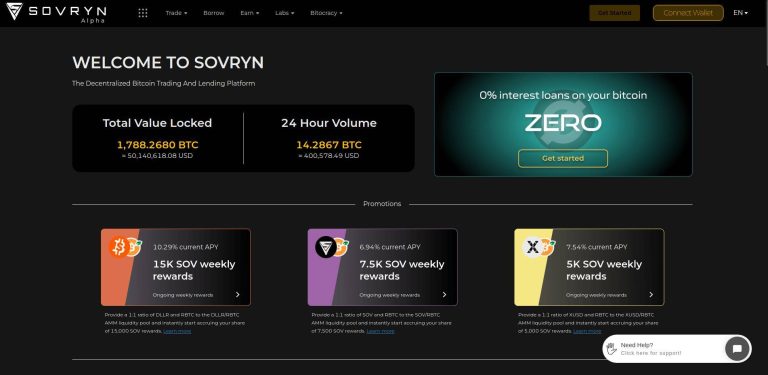

Sovryn, built on RSK that is EVM based chain, facilitates decentralized trading, lending, and borrowing, extending decentralized finance features to Bitcoin users.

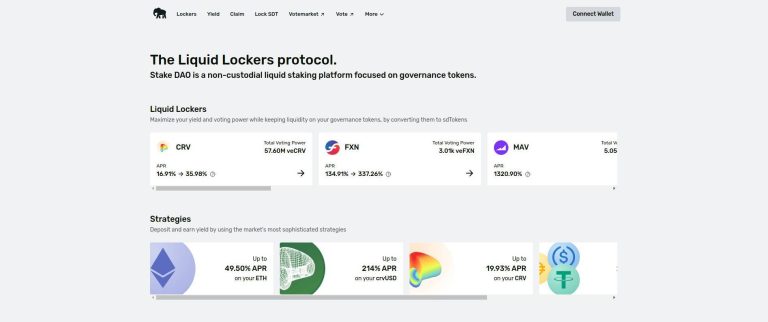

Stake DAO offers yield generation, Liquid Lockers, non-custodial asset management, staking, governance, and diverse strategies for decentralized finance users.

Llama Airforce provides analytics and insights tailored to the Curve ecosystem, with a specialized design catering to Votium and Hidden Hand bribe markets.

CryptoPunks, by Larva Labs, features 10,000 unique Ethereum-based characters, pioneering the CryptoArt movement and inspiring the ERC-721 standard.

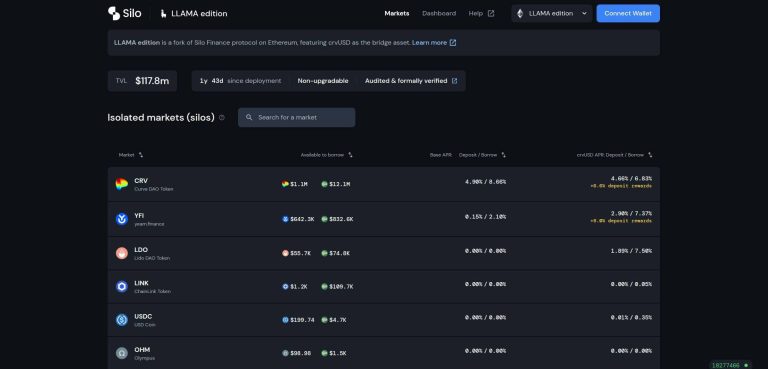

Silo Finance provides secure, permissionless lending markets in the ethereum ecosystem isolating risks per asset, enhancing DeFi lending efficiency via isolated-pool approach.

L2BEAT is a Layer 2 analytics platform examining Ethereum's Layer 2 projects, offering insights on technologies, market shares, usage, and total value locked on DeFi.

Alchemix offers decentralized finance solutions, enabling users to obtain self-repaying loans against future earnings through asset deposits and yield generation.

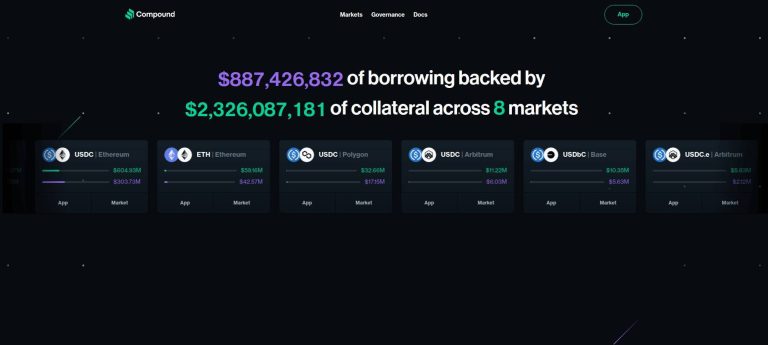

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

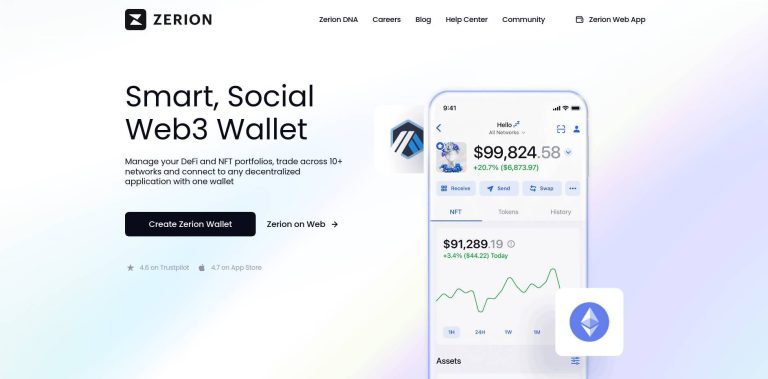

Zerion aggregates various DeFi protocols, enabling users to manage portfolios, track investments, and explore DeFi opportunities through a unified interface.

Zapper provides DeFi portfolio management and analysis, offering insights on your and others financial activities within the decentralized finance ecosystem.

Eigenlayer serves as a first Ethereum restaking interface, enabling users to manage Ethereum restaking, view token data, and track Total Value Locked.

Railgun is a privacy-preserving protocol that allows transactions and smart contract interactions on Ethereum, enhancing user privacy within the decentralized finance ecosystem.

Pickle Finance enhances yields via auto-compounding rewards, ensuring time and gas savings for a more efficient user experience in the DeFi ecosystem.

Yearn Finance provides a decentralized suite of products for individuals, DAOs, and protocols to optimize earnings on their digital assets in the Ethereum ecosystem.

Convex Finance amplifies rewards for Curve liquidity providers and CRV holders, simplifying liquidity provisioning and decentralized finance yield optimization.

Aura Finance amplifies DeFi yield and governance, optimizing Balancer Pool Tokens, boosting BAL rewards, and enabling community-driven governance and innovation.

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

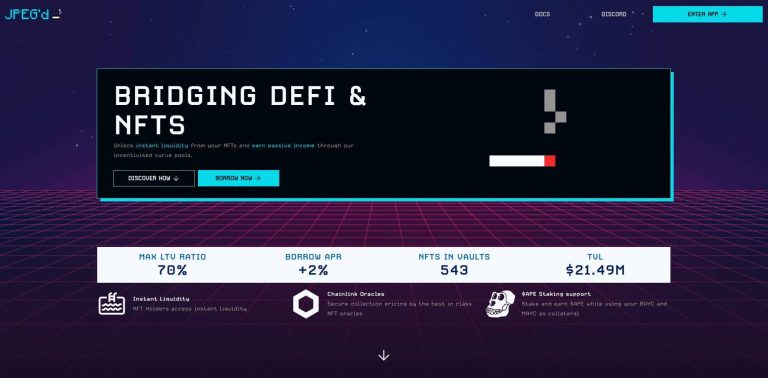

JPEG'd is a decentralized (DeFi) lending & borrowing protocol on Ethereum ecosystem, enabling NFT holders to use their assets as collateral for loans.

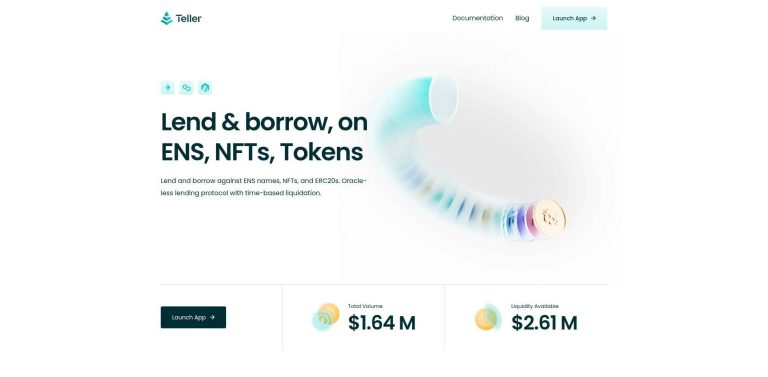

Teller is a decentralized lending protocol on Ethereum for lending and borrowing against ENS names, NFTs, and ERC20 tokens, offering oracle-less, time-based liquidation.

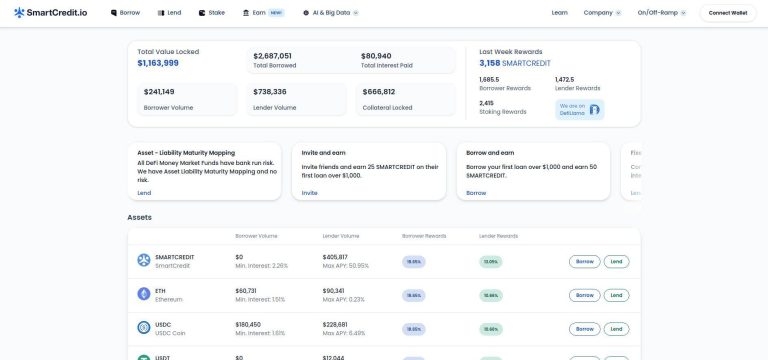

SmartCredit.io is a decentralized, peer-to-peer global lending marketplace in DeFi, connecting lenders and borrowers directly for earning interest or obtaining loans.

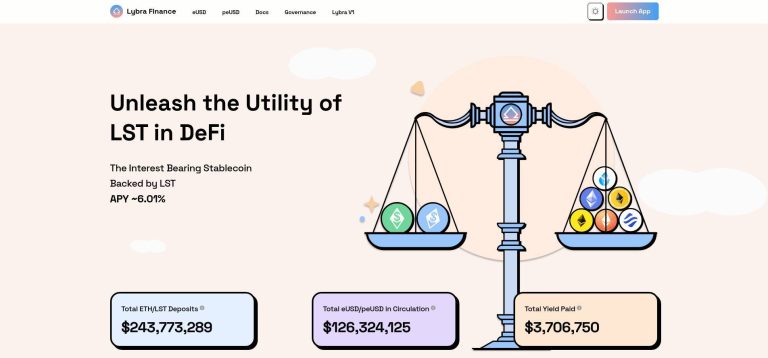

Lybra Finance allows users to deposit staked ETH, mint eUSD/peUSD stablecoins, earn interest, and engage in decentralized finance protocols with peUSD.

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.

LlamaFolio is a privacy-conscious DeFi portfolio tracker, supporting multiple tokens and protocols across different blockchains for comprehensive asset management.

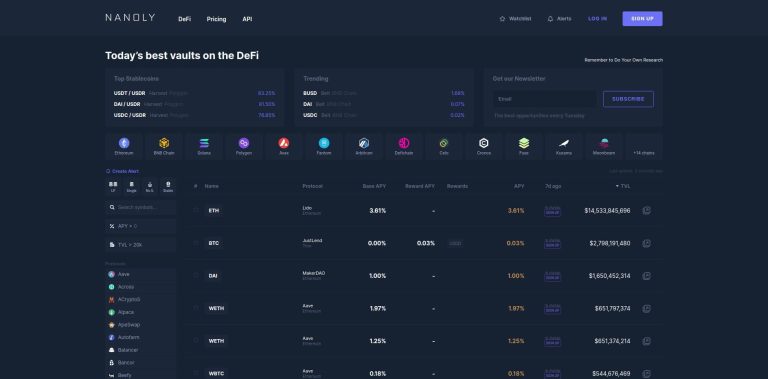

Nanoly showcases top DeFi vaults daily across multiple blockchains, aiding users in identifying trending vault opportunities for enhanced asset management.

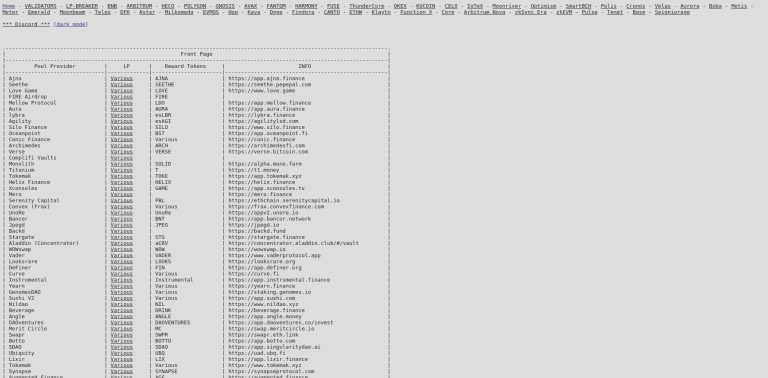

vfat.tools provides a platform for exploring yield farming opportunities across various blockchains and DeFi projects, aiding users in navigating the yield farming landscape.

Token Terminal aggregates financial data from various blockchains and decentralized applications, aiding users in analyzing and comparing crypto projects based on diverse metrics.

Nansen offers on-chain insights for decentralized finance (DeFi) investors and teams, providing analytics and data to identify top investors and investment opportunities.

Dune provides blockchain ecosystem analytics, enabling users to explore, visualize, and share decentralized finance data across various blockchains using SQL.

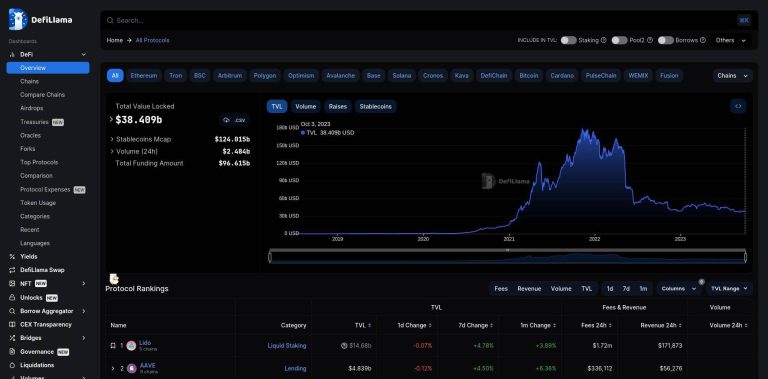

DeFiLlama is a comprehensive DeFi dashboard aggregating data across multiple blockchains, enabling users to compare protocols, and monitor yields.

DeBank is a comprehensive DeFi dashboard and portfolio management platform, aggregating users' DeFi positions across over multiple protocols and blockchains.

Swell Network simplifies liquid staking for ETH, helping users optimize yield in DeFi by staking ETH, earning swETH, and maximizing returns within the ETH DeFi ecosystem.

StakeWise offers effortless Ethereum staking through a secure infrastructure, with real-time monitoring, DeFi strategy integrations, and tools for app integration.

Rocket Pool is a decentralized Ethereum staking protocol, enabling users to stake ETH with lower entry requirements, earning staking rewards without locking ETH or maintaining infrastructure.

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

Origin Protocol (OETH) is an ETH staking yield aggregator, maximizing yields through meticulous strategies, fully collateralized by ETH and blue-chip liquid staking derivatives.

Lido offers liquid staking for Ethereum, Polygon, and Solana, enabling users to earn rewards without locking assets, enhancing decentralized finance liquidity.

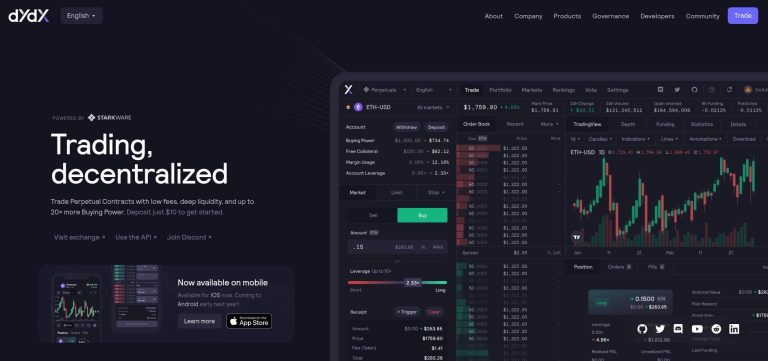

dYdX is a powerful decentralized platform for trading perpetual contracts with low fees and high liquidity, offering up to 20x buying power, instant trade executions.

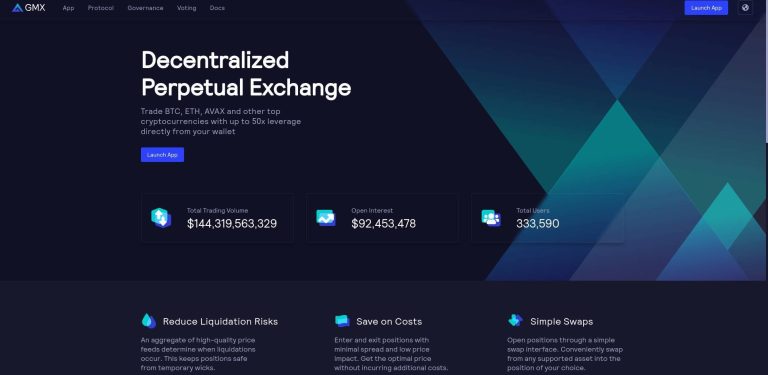

GMX is a decentralized perpetual exchange on Arbitrum and Avalanche, offering up to 30X leverage, low fees, deep liquidity, and transparent trading experiences.

Bancor Network facilitates on-chain trading and liquidity provision through automated market-makers, enabling token swaps, single-sided liquidity.

Raydium is a Solana-based decentralized finance protocol offering light-speed swaps, liquidity provision, yield earning, and a launchpad for new projects.

Blur is a fast NFT marketplace targeting professional traders. It emphasizes speedy trades, zero marketplace fees, and a community-oriented approach with a dedicated token ($BLUR)

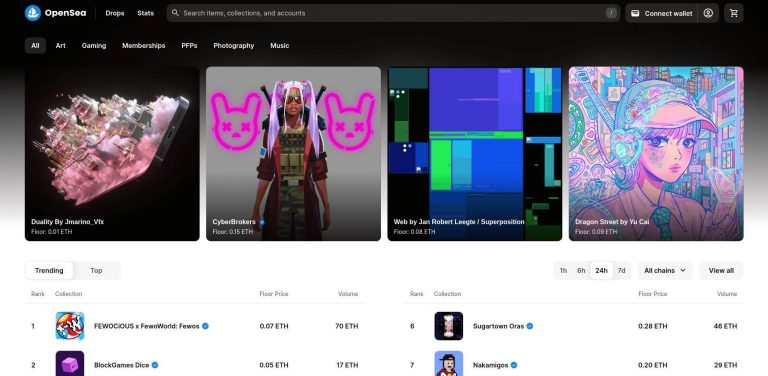

OpenSea is a decentralized marketplace for digital assets and NFTs, enabling users to buy, sell, and discover rare items like art, domains, and virtual worlds.

LooksRare is a decentralized platform on Ethereum for creating, exchanging, and trading NFTs, emphasizing community engagement and rewarding participants.

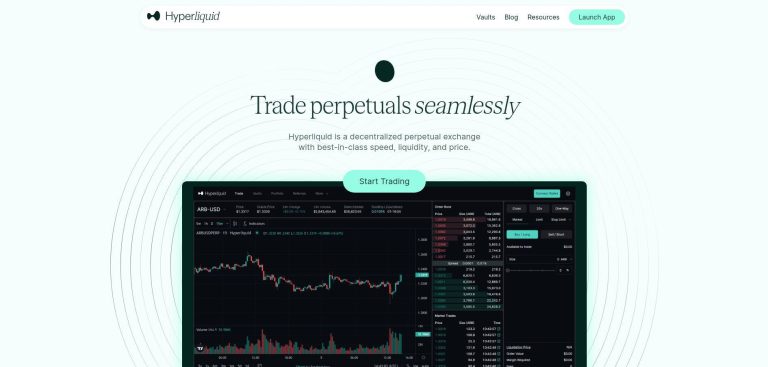

Hyperliquid is a decentralized perpetual exchange with advanced order types, instant trade finality, low fees, up to 50x leverage, and a fully on-chain order books.

Volmex Finance facilitates crypto volatility trading through Perpetual Futures and Volatility Tokens, providing a 24/7 transparent, permissionless platform with low fees.

Pika Protoco offers a decentralized perpetual swap exchange with up to 200x leverage, low slippage, diverse trading pairs, and reduced fees on Ethereum Layer 2.

DeGate leverages ZK rollup technology to offer a decentralized exchange (DEX) with notable fast transaction speeds, minimized fees, and a strong focus on self-custody.

Kwenta is a decentralized derivatives trading platform on Synthetix, offering synthetic asset and perpetual futures trading with low gas fees via Optimism.

MUX Network is a decentralized finance (DeFi) leveraged trading protocol offering up to 100x leverage, zero price impact, and multi-chain liquidity books.

Velora is a leading DeFi aggregator offering a secure, comprehensive interface that unites decentralized exchanges and lending protocols, for optimized DeFi trading.

CoW Swap utilizes CoW Protocol for decentralized trading via batch auctions, mitigating price slippage and liquidity fragmentation, enhancing price offerings.

Matcha is a 0x Labs-powered DEX offering peer-to-peer token swaps, best price aggregation across DEX networks, and extensive token access for decentralized finance.

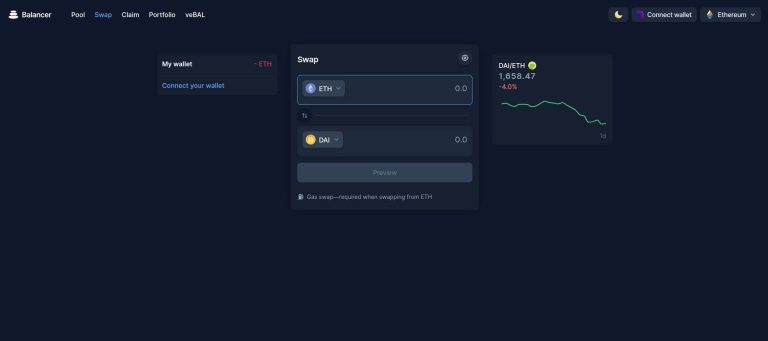

Balancer is an Ethereum-based DeFi protocol for custom liquidity pools, enabling trustless trading, automated portfolio management, and innovative liquidity strategies.

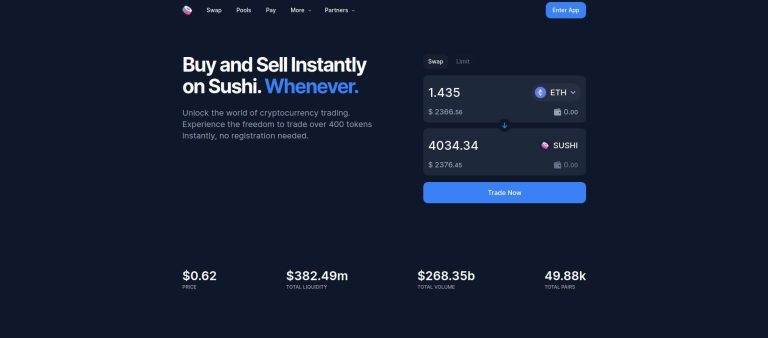

Sushi is a community-driven DeFi ecosystem offering swapping, lending, borrowing, leverage, and a multi-chain DEX, catering to a broad user base.