DeFi Lending & Borrowing: Empowering Financial Flexibility and Autonomy

Step into a dynamic ecosystem with our carefully selected DeFi Lending & Borrowing Platforms, where your assets are not static, but active participants in a vibrant financial dance. These platforms facilitate seamless lending and borrowing of cryptocurrencies, allowing you to earn attractive interest rates on your idle assets or secure crucial funds without liquidating your holdings. With smart contracts at their core, these platforms ensure transparent, secure, and efficient transactions, all while you maintain complete control over your assets. Engage with a financial environment where opportunities abound, offering you the flexibility to maximize your capital's potential while minimizing risks. With DeFi Lending & Borrowing Platforms, experience the epitome of decentralized financial empowerment, where every asset has a role to play in your financial symphony.

Aave

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.

Abracadabra

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

Alchemix

Alchemix offers decentralized finance solutions, enabling users to obtain self-repaying loans against future earnings through asset deposits and yield generation.

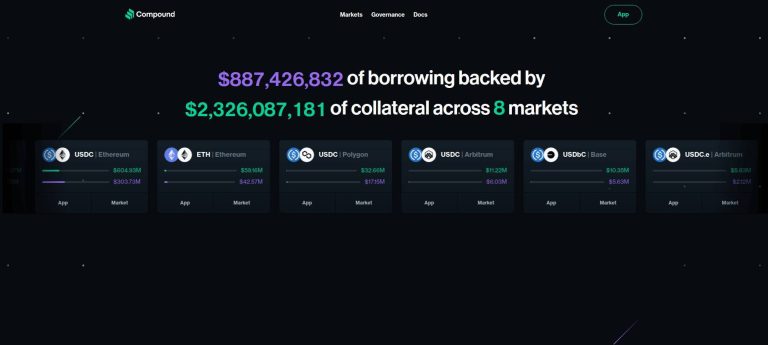

Compound

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

eBTC

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

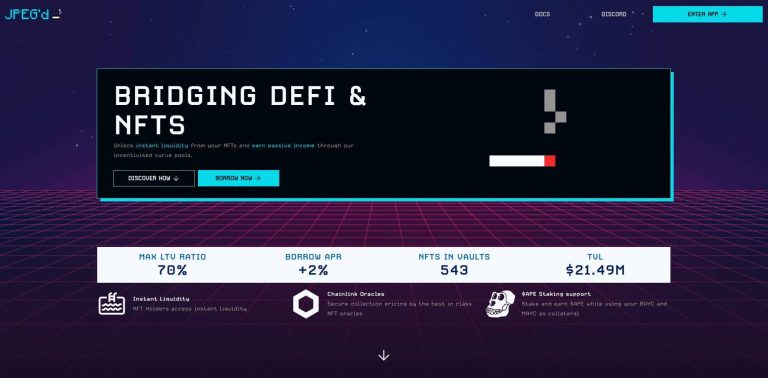

JPEG'd

JPEG'd is a decentralized (DeFi) lending & borrowing protocol on Ethereum ecosystem, enabling NFT holders to use their assets as collateral for loans.

Liquity

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

Lybra Finance

Lybra Finance allows users to deposit staked ETH, mint eUSD/peUSD stablecoins, earn interest, and engage in decentralized finance protocols with peUSD.

MakerDAO

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

Morpho

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

Prisma Finance

Prisma Finance is a decentralized Ethereum protocol allowing users to deposit ETH liquid staking tokens as collateral to mint stablecoin mkUSD an to participate in DeFi ecosystem.

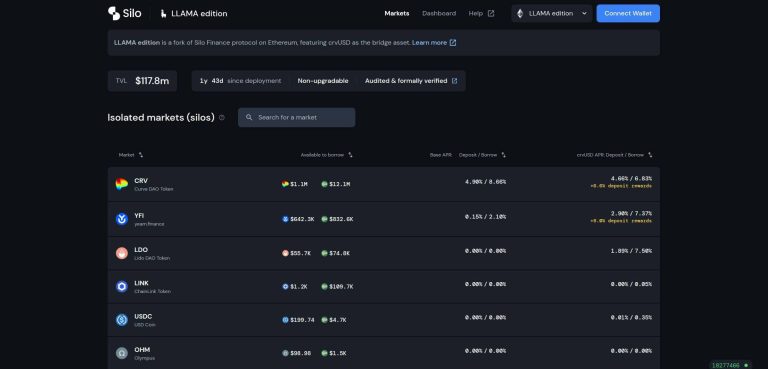

Silo Finance

Silo Finance provides secure, permissionless lending markets in the ethereum ecosystem isolating risks per asset, enhancing DeFi lending efficiency via isolated-pool approach.

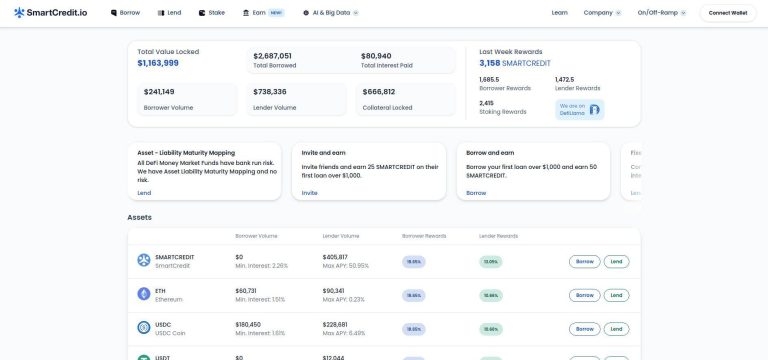

SmartCredit

SmartCredit.io is a decentralized, peer-to-peer global lending marketplace in DeFi, connecting lenders and borrowers directly for earning interest or obtaining loans.

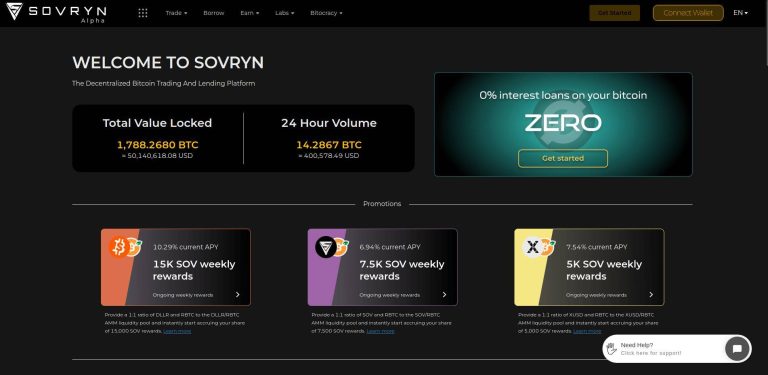

Sovryn

Sovryn, built on RSK that is EVM based chain, facilitates decentralized trading, lending, and borrowing, extending decentralized finance features to Bitcoin users.

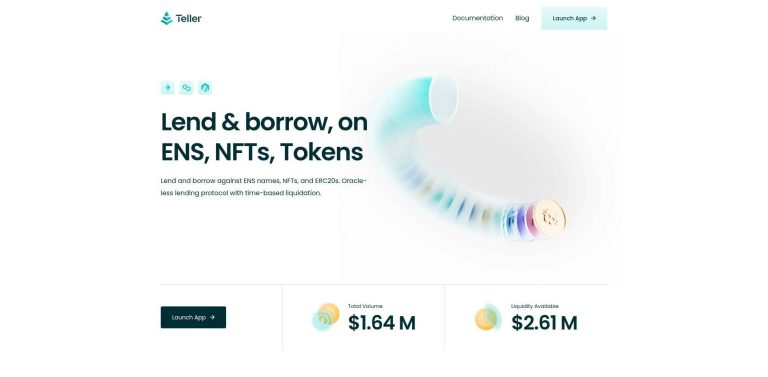

Teller

Teller is a decentralized lending protocol on Ethereum for lending and borrowing against ENS names, NFTs, and ERC20 tokens, offering oracle-less, time-based liquidation.