What is Stake DAO?

Stake DAO is a decentralized finance (DeFi) platform that focuses on enhancing the utility and returns of governance tokens. Launched in early 2021, Stake DAO has evolved with the rise of innovative veTokenomics and aims to shift the focus from purely monetary gains to governance power. The platform allows users to maximize the potential of their governance tokens through various products and strategies, all while maintaining liquidity.

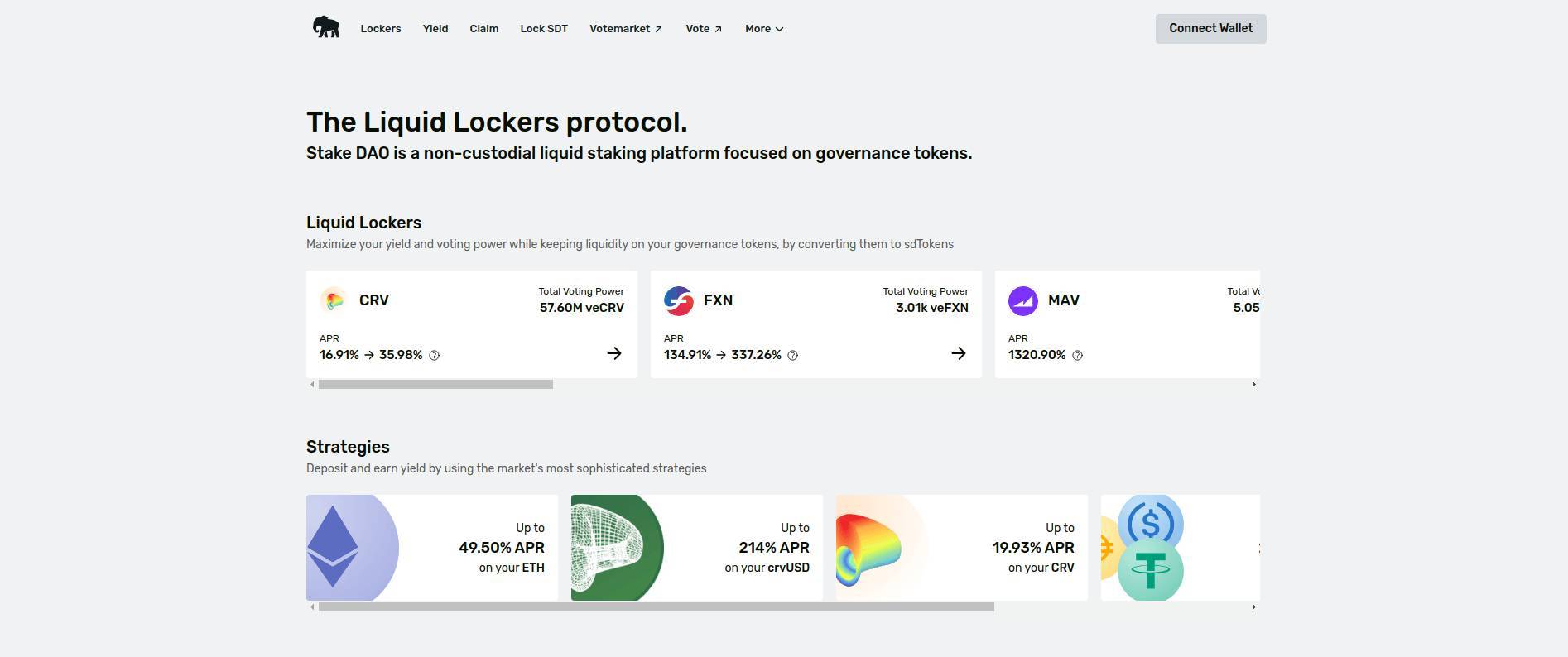

One of the key features of Stake DAO is its Liquid Lockers. These allow users to lock their governance tokens in exchange for sdTokens, which are liquid versions of the locked tokens. Users can stake these sdTokens on Stake DAO to earn rewards while retaining their voting rights. This system enables users to boost their yield and voting power without sacrificing liquidity. For example, users can convert CRV tokens to sdCRV and stake them to receive maximum protocol APR, platform fees, and SDT incentives, along with boosted voting power on Curve.

In addition to Liquid Lockers, Stake DAO offers a variety of Strategies designed to boost returns on liquidity provider (LP) tokens. These strategies work in conjunction with Liquid Lockers to provide enhanced yields across multiple blockchains. Users can deposit their tokens in these strategies to earn higher returns, benefiting from the boosted yields provided by the veToken balance of the corresponding Liquid Locker.

Stake DAO also features a Votemarket, an on-chain platform that incentivizes governance voting by offering tokens in exchange for votes. This encourages greater participation in governance processes and helps align user incentives with protocol growth.

Governance of Stake DAO is managed by holders of the veSDT token, who can propose and enact changes to the protocol. This community-driven approach ensures that the platform evolves in a way that benefits all stakeholders.