Aave

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.

Abracadabra

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

Alchemix

Alchemix offers decentralized finance solutions, enabling users to obtain self-repaying loans against future earnings through asset deposits and yield generation.

Alpaca Finance

Alpaca Finance offers leveraged yield farming, lending, and automated vaults on Binance Smart Chain, optimizing yield strategies and managing risks.

Approved Zone

Approved.zone is an Ethereum smart contracts approvals dashboard for managing Ethereum smart contract approvals in the decentralized finance space.

APY Vision

APY.Vision is an analytics platform tracking liquidity pool gains and impermanent loss, helping investors optimize returns across various decentralized finance protocols.

Aragon

Aragon is a platform for creating and managing DAOs. It provides tools for no-code setup, governance, and treasury management, using the Aragon App and Aragon OSx framework.

Arcade

Arcade is a decentralized lending platform for NFT-backed loans. Users can bundle assets into Smart Vaults for larger loans. Loans are peer-to-peer, fixed-term, and non-liquidating.

Asymmetry Finance

Asymmetry Finance is a DeFi protocol focused on yield generation through optimized liquidity provision. It offers afUSD, afETH, afeETH, and afCVX for diverse strategies and financial solutions.

Aura Finance

Aura Finance amplifies DeFi yield and governance, optimizing Balancer Pool Tokens, boosting BAL rewards, and enabling community-driven governance and innovation.

Avalon Finance

Avalon Finance is a CeDeFi lending platform enabling Bitcoin holders to borrow stablecoins at fixed rates. It offers USDa, a Bitcoin-backed stablecoin, and operates across multiple chains.

Awaken

Awaken is a crypto tax engine built for DeFi, NFTs, and multi-chain activity. Sync full history for swaps, bridges, staking, and more. Auto-categorizes income and gains with audit-ready precision.

Babylon

Babylon enables native Bitcoin staking—lock BTC directly to secure Proof-of-Stake chains. Stake BTC without wrapping, maintain self-custody, and earn rewards on a fast unbonding timeline.

Bedrock

Bedrock is a multi-asset liquid restaking protocol for assets like Ethereum and Bitcoin, offering secure, oracle-less staking integrated with platforms like EigenLayer.

Beefy Finance

Beefy Finance is a decentralized finance, multichain yield optimizer and aggregator that maximizes DeFi rewards through smart-contract enforced strategies.

Bloxy

Bloxy.info is a product by Bitquery providing various data analytics and blockchain querying services for decentralized finance (DeFi) ecosystem.

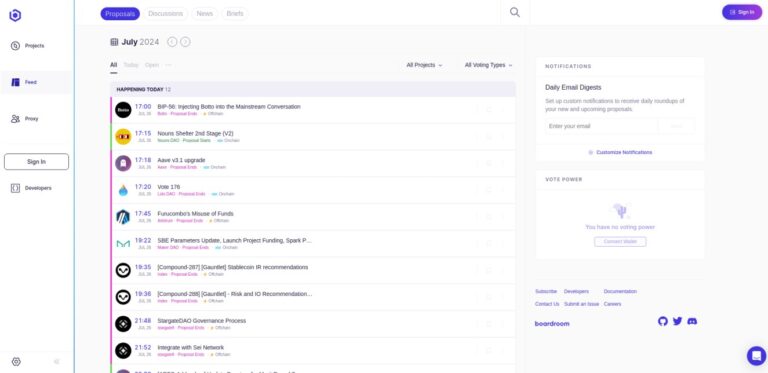

Boardroom

Boardroom is a governance platform for DAOs, offering tools for proposal creation, voting, and treasury management. It streamlines decision-making with integrated dashboards and analytics.

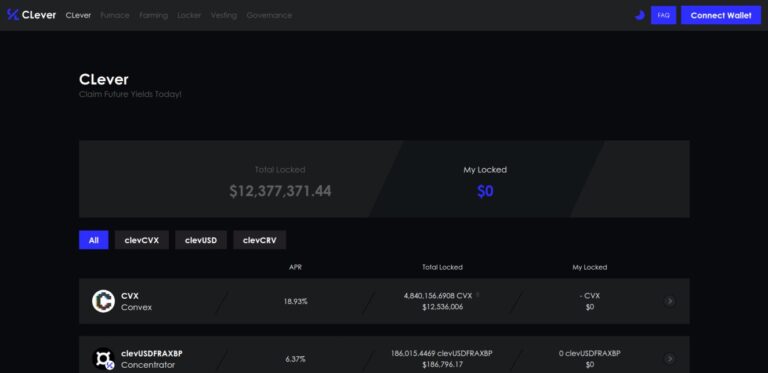

CLever

CLever is a CVX wrapper built on top of Convex, allowing users to earn boosted yields on their CVX tokens. It offers strategies for locking CVX and automating yield harvesting.

Clusters

Clusters is a universal naming service linking all your wallets across blockchains to one human-readable name. Register a cluster like “alice/” and attach addresses (e.g. alice/eth, alice/sol).

Coinshift

Coinshift is a self-custodial treasury platform for DAOs and teams. Mint csUSDL, an institutional-grade stablecoin backed by secure DeFi yield. Earn real yield while farming SHIFT points.

Collab.Land

Collab.Land provides token-gated access to communities on Discord and Telegram. It verifies user membership through token ownership, automating community management.

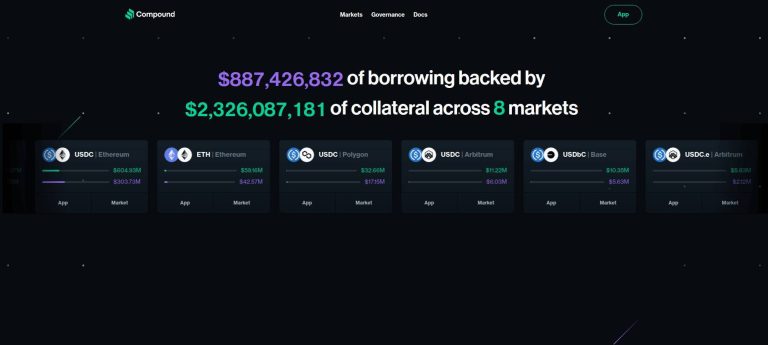

Compound

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

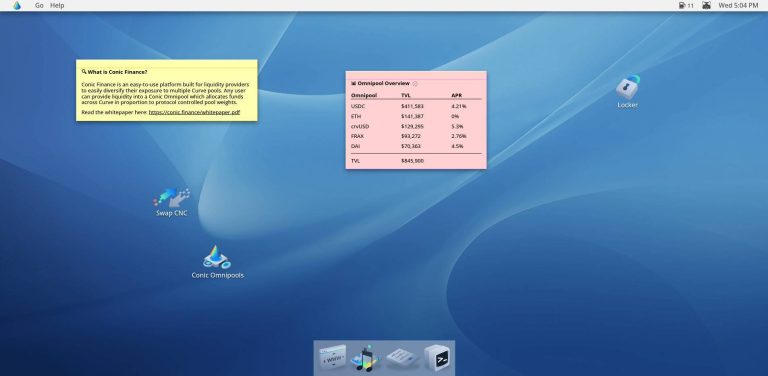

Conic Finance

Conic Finance allows liquidity providers to diversify across multiple Curve pools via Omnipools on Ethereum ecosystem, governed by Conic DAO votes.

Convex Finance

Convex Finance amplifies rewards for Curve liquidity providers and CRV holders, simplifying liquidity provisioning and decentralized finance yield optimization.

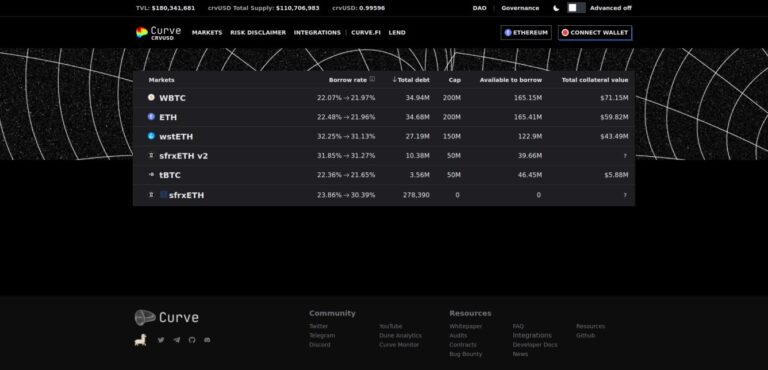

crvUSD

crvUSD is a decentralized stablecoin launched by Curve Finance. It is overcollateralized and pegged to the US dollar. Users mint crvUSD by depositing collateral such as ETH.

Cygnus Finance

Cygnus is a modular protocol for issuing native, yield‑bearing assets like cgUSD, clBTC, and cgETH. It delivers real yield sourced from short-term U.S. Treasuries and onchain derivative strategies.

DeBank

DeBank is a comprehensive DeFi dashboard and portfolio management platform, aggregating users' DeFi positions across over multiple protocols and blockchains.

DeFi Saver

DeFi Saver offers a dashboard for managing DeFi positions, automating leverage management, refinancing loans, and executing custom transactions.

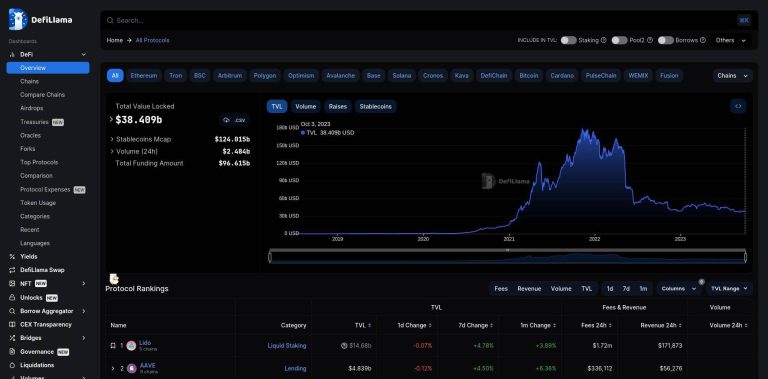

DeFiLlama

DeFiLlama is a comprehensive DeFi dashboard aggregating data across multiple blockchains, enabling users to compare protocols, and monitor yields.

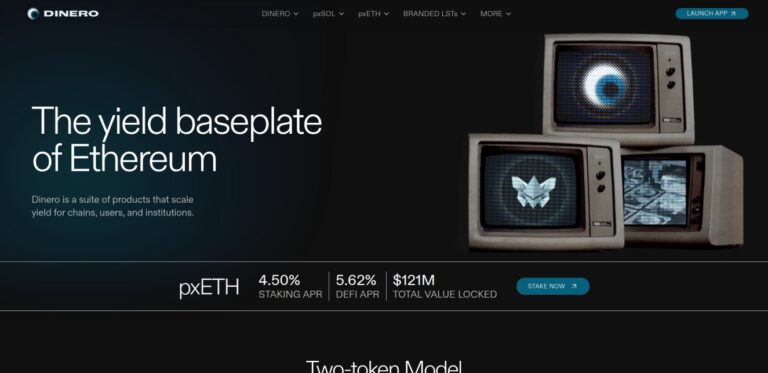

Dinero

Dinero facilitates on-chain liquidity, governance, cash flow in DeFi, offering products like Pirex for yield tokenization, and Hidden Hand for governance incentives.

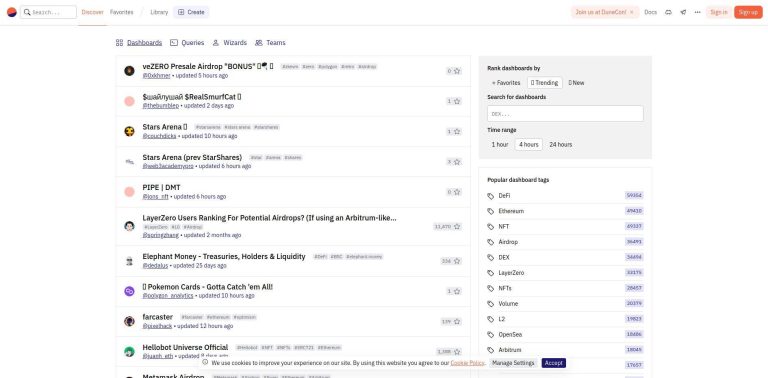

Dune

Dune provides blockchain ecosystem analytics, enabling users to explore, visualize, and share decentralized finance data across various blockchains using SQL.

eBTC

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

EigenLayer

Eigenlayer serves as a first Ethereum restaking interface, enabling users to manage Ethereum restaking, view token data, and track Total Value Locked.

ENS

ENS (Ethereum Name Service) is a decentralized service on Ethereum that lets users register .eth domains, turning complex addresses into simple, user-owned names for Web3.

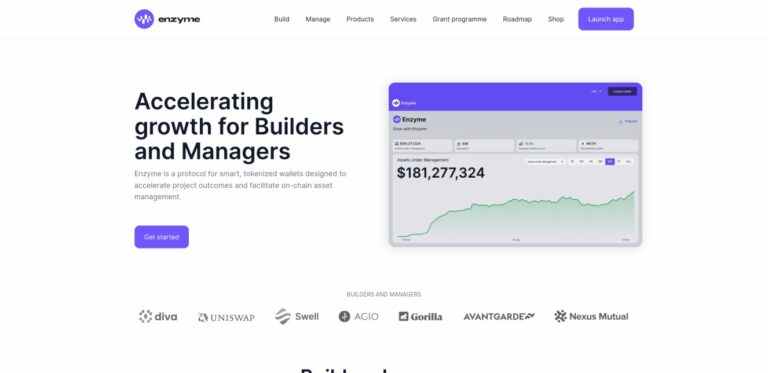

Enzyme Finance

Enzyme is a DeFi platform for on-chain asset management. It provides tools for managing digital assets and strategies, supporting automated reporting and risk management.

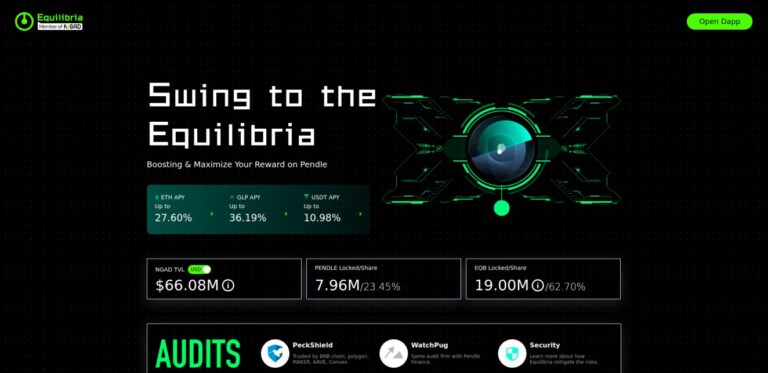

Equilibria

Equilibria is a DeFi platform built on top of Pendle, specializing in yield optimization and risk management. It offers structured financial products that enhance returns while managing volatility.

Ethena

Ethena is a DeFi platform offering a synthetic dollar (USDe) and internet-native yield. It generates yield by staking Ethereum and shorting Ethereum futures, stabilizing USDe's value and providing returns.

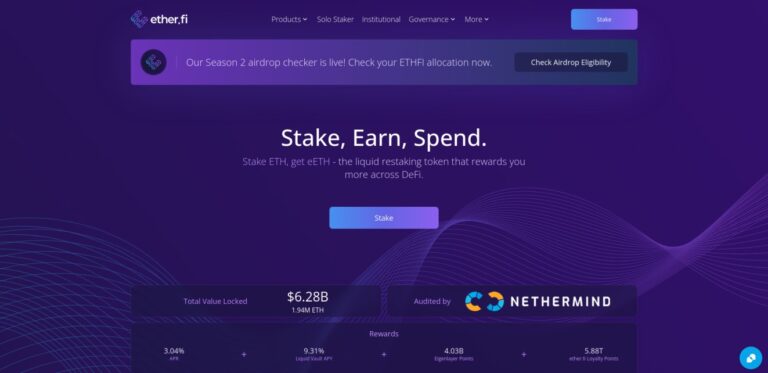

Ether.fi

ether.fi is a liquid restaking protocol on EigenLayer, allowing users to stake ETH and receive eETH, a liquid token for DeFi. It supports rewards from EigenLayer and lets stakers control their keys.

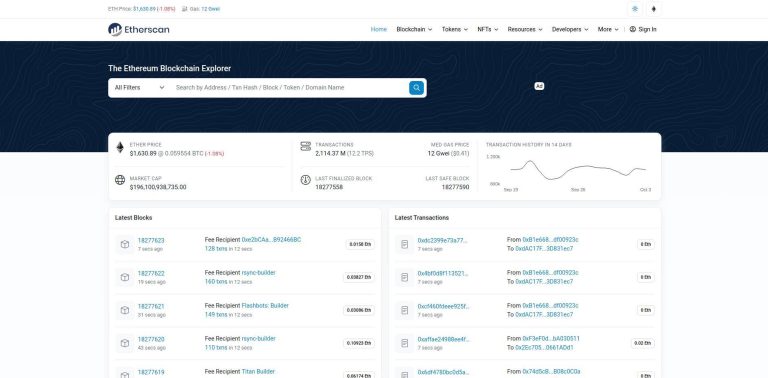

Etherscan

Etherscan is an Ethereum blockchain explorer for searching, verifying, and exploring transactions, addresses, with tools to monitor network activity, and execute transactions.

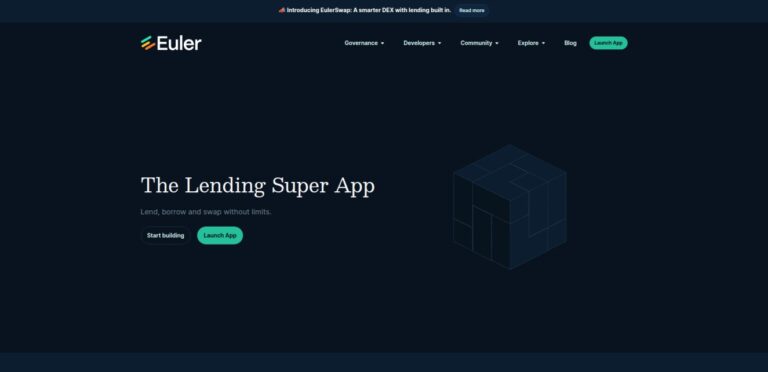

Euler Finance

Euler is a modular, permissionless lending & borrowing protocol. Users can create or use vaults for any ERC‑20 asset. Capital efficiency is enabled by isolated risk markets and dynamic rates.

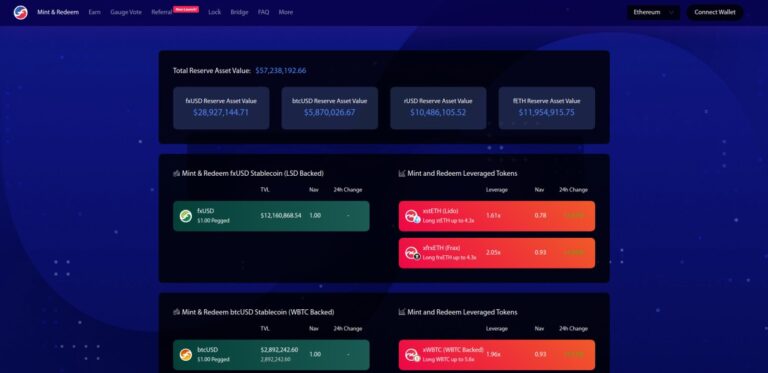

f(x) Protocol

f(x) Protocol by AladdinDAO is a DeFi protocol on Ethereum that offers a decentralized stablecoin (fxUSD) and leveraged ETH tokens (fETH and xETH), all backed by staked ETH.

Falcon

Falcon Finance is a synthetic dollar protocol offering USDf, an overcollateralized stablecoin backed by crypto assets. Stake USDf to earn sUSDf and access sustainable DeFi yields.

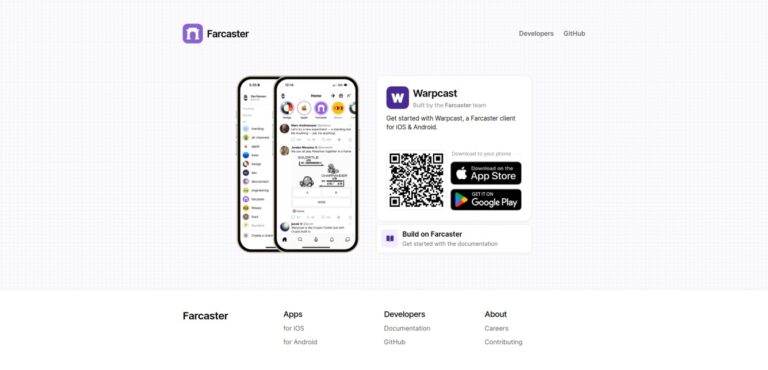

Farcaster

Farcaster is a decentralized social network protocol using Ethereum for on-chain data and distributed Hubs for storage. Warpcast is the main client app, available on iOS and Android.

First Digital USD

First Digital USD (FDUSD) is a USD-pegged stablecoin issued by First Digital Labs. It is fully backed by cash and cash-equivalent assets, ensuring transparency and trust.

Fluidkey

Fluidkey is a self‑custodial, privacy‑focused wallet and financial hub. Use stealth addresses and private ENS to receive funds with unlinkable on‑chain privacy.

Frax Finance

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

Furucombo

Furucombo is an innovative decentralized platform aimed at simplifying the process of utilizing various DeFi (Decentralized Finance) protocols to maximize users' returns.

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

Gemini Dollar

Gemini Dollar (GUSD) is a stablecoin issued by Gemini, pegged 1:1 with the U.S. dollar. Reserves are held in FDIC-insured banks, money market funds, and U.S. Treasury bills.

Getmoni

Moni is a Web3 analytics platform using machine learning to discover and track early crypto projects. It offers social stats analysis, project tracking, watchlists, alerts, and daily alpha reports.

GHO

GHO is a decentralized, multi-collateral stablecoin on Aave. It is minted using assets supplied as collateral on Ethereum markets. The Aave DAO manages GHO's supply and interest rates.

Gondi

Gondi is a decentralized NFT lending protocol offering flexible, oracle-less loans in WETH or USDC. It supports asset vaults, instant refinancing, and tranche-based risk management.

Harvest Finance

Harvest Finance automates yield farming via Ethereum-based vaults, optimizing returns, reducing gas costs, and offering user-friendly farming opportunities.

infiniFi

infiniFi is a fractional-reserve yield aggregator minting iUSD/iETH against USDC/ETH. Lock or remain liquid to optimize yield via both liquid and illiquid farms.

Instadapp

Instadapp Lite autonomously executes DeFi strategies via smart contract vaults, leveraging popular protocols for enhanced yields, minimizing transaction costs.

Insurace

InsurAce is a decentralized multi-chain DeFi insurance protocol offering optimized pricing, broader coverage, and sustainable investment returns.

iYield

iYield is a crypto financial planning dashboard that tracks assets, liabilities, income, and expenses. It calculates your net worth and savings rate, providing personalized insights and goal tracking.

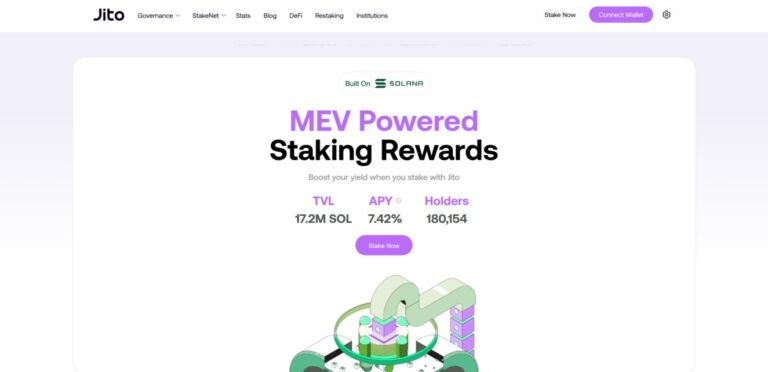

Jito Network

Jito is Solana’s MEV-powered liquid staking protocol. Stake SOL to receive JitoSOL while earning MEV rewards. Validators are optimized for maximum staking yield.

JPEG'd

JPEG'd is a decentralized (DeFi) lending & borrowing protocol on Ethereum ecosystem, enabling NFT holders to use their assets as collateral for loans.

Karak Network

Karak Network is a DeFi protocol focused on restaking. It provides a secure and scalable platform for decentralized restaking, enhancing network security and yield opportunities for users.

Kelp

KelpDAO is a liquid restaking protocol on EigenLayer, supporting tokens like ETH and stETH. It offers the rsETH token for earning yields while maintaining liquidity, with various DeFi integrations.

L2BEAT

L2BEAT is a Layer 2 analytics platform examining Ethereum's Layer 2 projects, offering insights on technologies, market shares, usage, and total value locked on DeFi.

Level

Level is a stablecoin protocol offering lvlUSD, a yield-bearing asset backed by USDC and USDT. Users can stake lvlUSD to earn slvlUSD, enhancing returns through DeFi lending strategies.

Lido

Lido offers liquid staking for Ethereum, Polygon, and Solana, enabling users to earn rewards without locking assets, enhancing decentralized finance liquidity.

Lightning Network

Lightning Network enables instant, scalable blockchain payments with low fees, utilizing smart contracts for security across decentralized payment channels.

Liquity

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

Llama Airforce

Llama Airforce provides analytics and insights tailored to the Curve ecosystem, with a specialized design catering to Votium and Hidden Hand bribe markets.

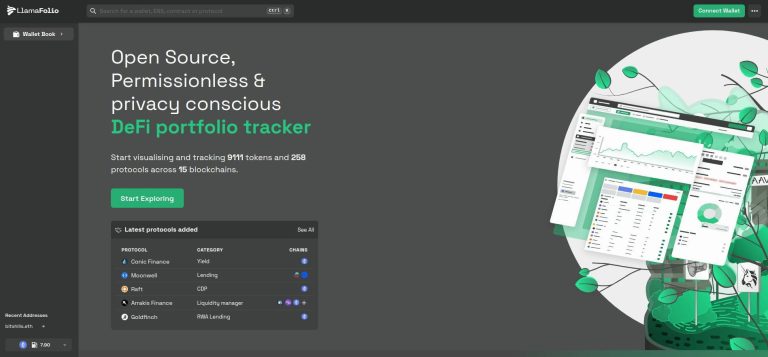

LlamaFolio

LlamaFolio is a privacy-conscious DeFi portfolio tracker, supporting multiple tokens and protocols across different blockchains for comprehensive asset management.

LlamaNodes

LlamaNodes offers fast, secure blockchain access via public, premium RPCs, with low latency, robust redundancy, advanced monitoring, and multi-chain support.

Lybra Finance

Lybra Finance allows users to deposit staked ETH, mint eUSD/peUSD stablecoins, earn interest, and engage in decentralized finance protocols with peUSD.

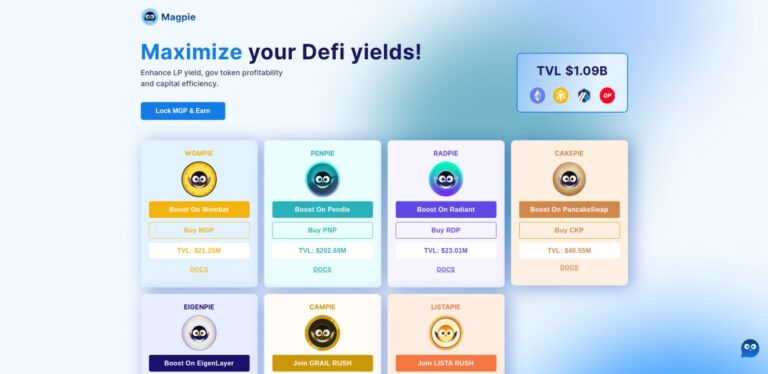

Magpie

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

MakerDAO

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

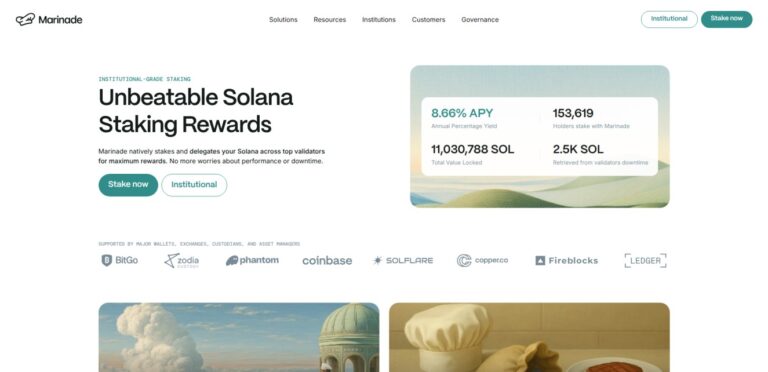

Marinade Finance

Marinade is Solana’s leading liquid staking protocol. Stake SOL to receive mSOL while earning rewards. Choose native staking or liquid staking with optimized validator delegation.

Mirror

Mirror is a decentralized platform for content creation. It allows writers to publish articles, launch crowdfunding campaigns, and issue NFTs, ensuring direct ownership and revenue transparency.

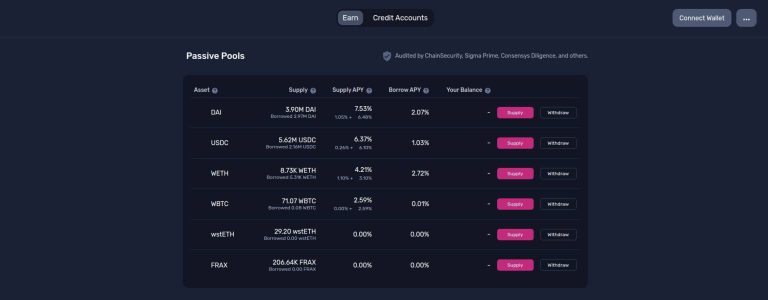

Morpho

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

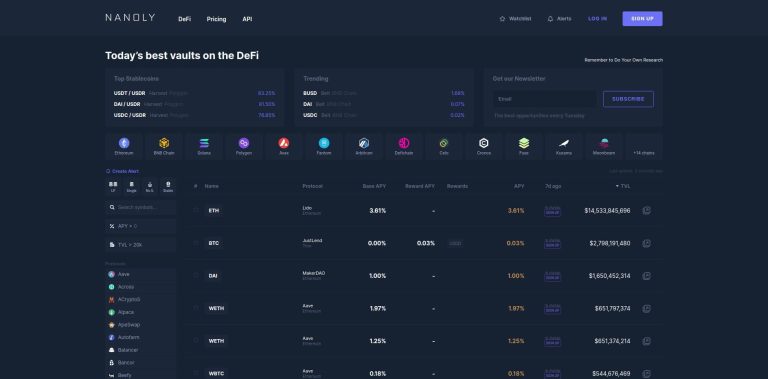

Nanoly

Nanoly showcases top DeFi vaults daily across multiple blockchains, aiding users in identifying trending vault opportunities for enhanced asset management.

Nansen

Nansen offers on-chain insights for decentralized finance (DeFi) investors and teams, providing analytics and data to identify top investors and investment opportunities.

Nexus Mutual

Nexus Mutual offers a decentralized finance insurance alternative for DeFi assets, providing various cover products like, Yield Token, and Custody Cover.

NFTfi

NFTfi is a peer-to-peer lending protocol for NFT-backed loans. Borrow crypto like wETH or DAI using top NFT collections. Loans are fixed-term and have no auto-liquidation risk.

Noon

Noon is a yield-bearing stablecoin backed by delta-neutral strategies. Mint USN with USDC or USDT, stake to earn yield via sUSN. Returns come from funding arbitrage and tokenized Treasuries.

OpenEden

OpenEden’s USDO is a fully-backed, rebasing stablecoin. Pegged 1:1 to USD and collateralized by tokenized U.S. Treasury bills. Holders earn daily yield through on-chain rebasing.

Opium Finance

Opium Finance is a decentralized finance (DeFi) platform allowing users to create markets, offering financial tools like insurance, staking, and turbo products.

Origin Protocol

Origin Protocol (OETH) is an ETH staking yield aggregator, maximizing yields through meticulous strategies, fully collateralized by ETH and blue-chip liquid staking derivatives.

PAX Gold

PAX Gold (PAXG) is a regulated digital asset by Paxos, backed by one fine troy ounce of London Good Delivery gold. Each token is stored in secure vaults and built on Ethereum.

PayPal USD

PayPal USD (PYUSD) is a stablecoin by PayPal, backed 1:1 by U.S. dollar deposits and equivalents. It is an ERC-20 token on Ethereum and Solana, used for payments and transfers within PayPal.

Pickle Finance

Pickle Finance enhances yields via auto-compounding rewards, ensuring time and gas savings for a more efficient user experience in the DeFi ecosystem.

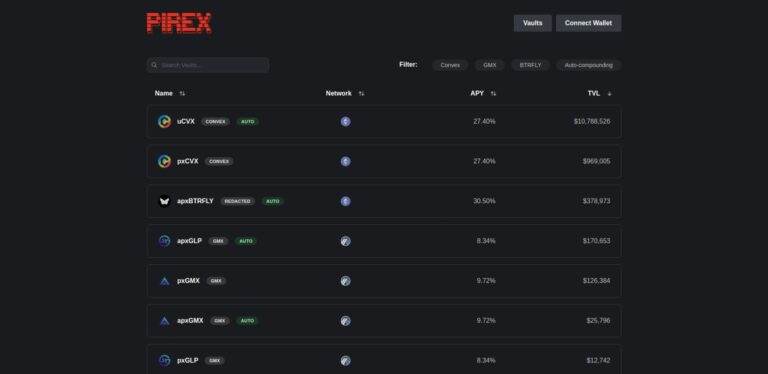

Pirex

Pirex is a CVX wrapper designed to maximize yields on Convex Finance. It allows users to tokenize their locked CVX, providing liquidity and flexibility while continuing to earn rewards.

PoolTogether

PoolTogether is a decentralized finance, no-loss savings game on Ethereum ecosystem, where deposited funds earn interest used for daily prize draws.

QuickNode

QuickNode facilitates blockchain development with elastic APIs, blockchain analytics, developer tools for creating Web3, DeFi apps, and managing NFT data.

Railgun

Railgun is a privacy-preserving protocol that allows transactions and smart contract interactions on Ethereum, enhancing user privacy within the decentralized finance ecosystem.

Renzo

Renzo Protocol is a liquid restaking platform on EigenLayer, enabling easy restaking of Ethereum and Liquid Staking Tokens. It supports multiple networks and over 100 DeFi integrations.

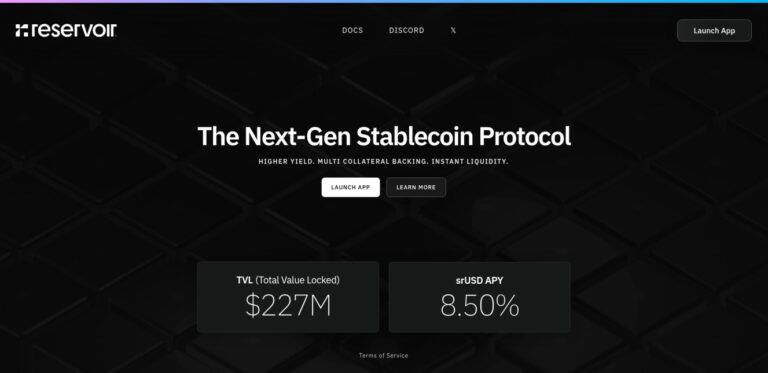

Reservoir

Reservoir is a next-gen stablecoin system issuing rUSD, srUSD, and trUSD. Backed by DeFi and real-world collateral, it offers liquid, savings, and term yield.

Resolv

Resolv is a DeFi protocol offering USR, a delta-neutral stablecoin backed by ETH and BTC. It maintains price stability through hedging strategies and an insurance layer.

Resupply

Resupply is a decentralized stablecoin protocol that loans reUSD against interest-bearing stablecoins. Earn yield from Curve or Fraxlend while borrowing reUSD, with RSUP token incentives.

Revoke Cash

Revoke.cash enables users to revoke token approvals on ethereum ecosystem, aiding in enhancing wallet security by preventing unauthorized access to funds.

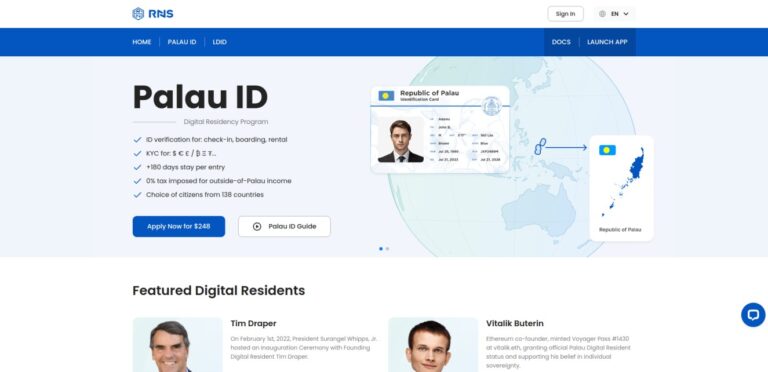

RNS.ID

RNS.ID is a Web 3.0 digital identity platform on the RSK blockchain. It provides decentralized, self-sovereign identities that allow users to manage and verify their personal information securely.

Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol, enabling users to stake ETH with lower entry requirements, earning staking rewards without locking ETH or maintaining infrastructure.

Sablier

Sablier enables real-time token streaming for payroll, airdrops, and more, with ERC-721 NFT representation, supporting various blockchain networks.

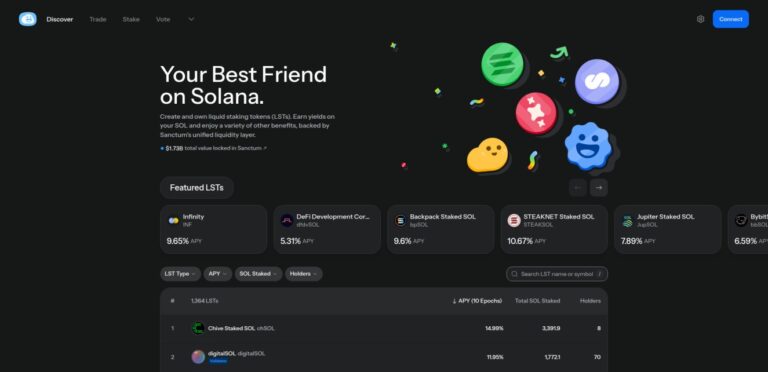

Sanctum

Sanctum is a liquid staking ecosystem on Solana. Stake SOL to receive LSTs that auto-compound and stay tradable. One namespace: stake, trade, and issue your own LSTs.