Aave

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.

Abracadabra

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

Alchemix

Alchemix offers decentralized finance solutions, enabling users to obtain self-repaying loans against future earnings through asset deposits and yield generation.

Arcade

Arcade is a decentralized lending platform for NFT-backed loans. Users can bundle assets into Smart Vaults for larger loans. Loans are peer-to-peer, fixed-term, and non-liquidating.

Avalon Finance

Avalon Finance is a CeDeFi lending platform enabling Bitcoin holders to borrow stablecoins at fixed rates. It offers USDa, a Bitcoin-backed stablecoin, and operates across multiple chains.

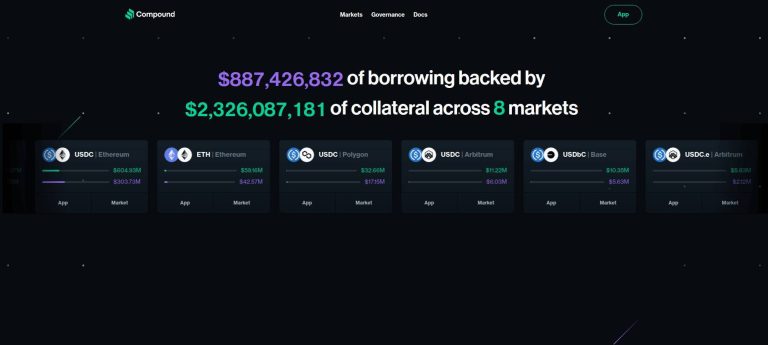

Compound

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

eBTC

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

Euler Finance

Euler is a modular, permissionless lending & borrowing protocol. Users can create or use vaults for any ERC‑20 asset. Capital efficiency is enabled by isolated risk markets and dynamic rates.

Gondi

Gondi is a decentralized NFT lending protocol offering flexible, oracle-less loans in WETH or USDC. It supports asset vaults, instant refinancing, and tranche-based risk management.

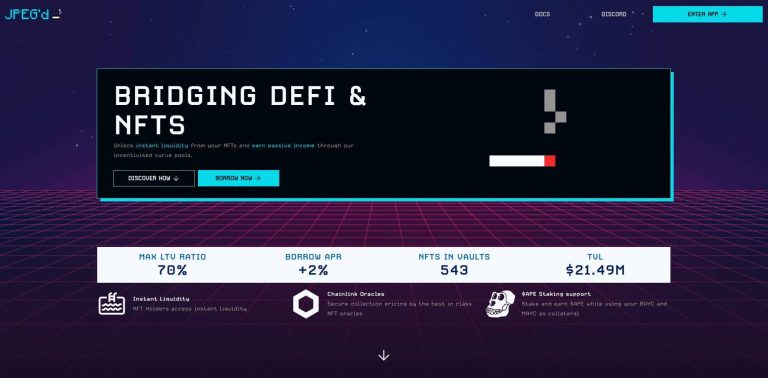

JPEG'd

JPEG'd is a decentralized (DeFi) lending & borrowing protocol on Ethereum ecosystem, enabling NFT holders to use their assets as collateral for loans.

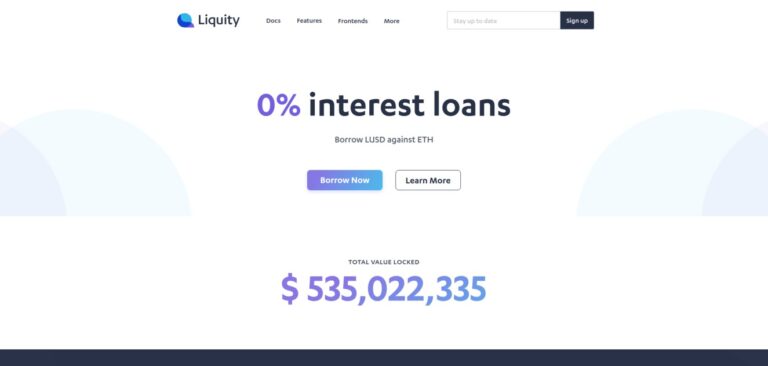

Liquity

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

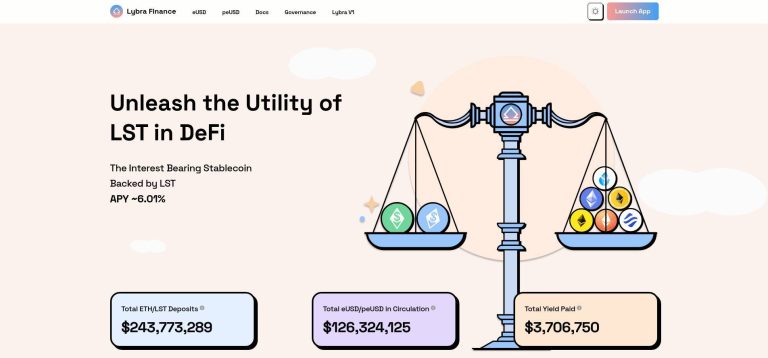

Lybra Finance

Lybra Finance allows users to deposit staked ETH, mint eUSD/peUSD stablecoins, earn interest, and engage in decentralized finance protocols with peUSD.

MakerDAO

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

Morpho

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

NFTfi

NFTfi is a peer-to-peer lending protocol for NFT-backed loans. Borrow crypto like wETH or DAI using top NFT collections. Loans are fixed-term and have no auto-liquidation risk.

Resupply

Resupply is a decentralized stablecoin protocol that loans reUSD against interest-bearing stablecoins. Earn yield from Curve or Fraxlend while borrowing reUSD, with RSUP token incentives.

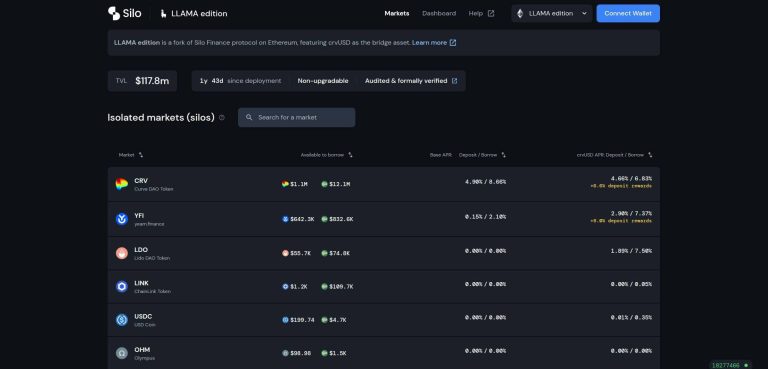

Silo Finance

Silo Finance provides secure, permissionless lending markets in the ethereum ecosystem isolating risks per asset, enhancing DeFi lending efficiency via isolated-pool approach.

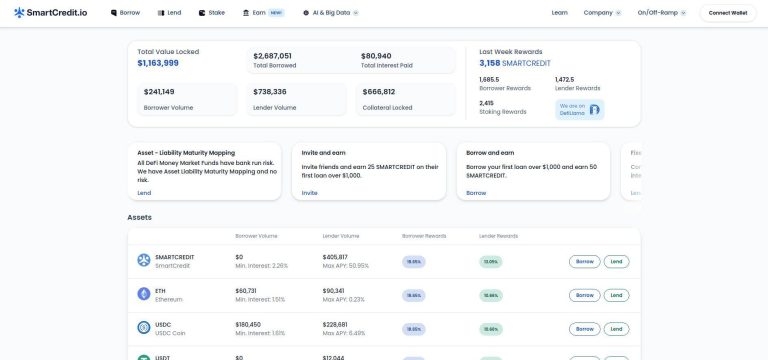

SmartCredit

SmartCredit.io is a decentralized, peer-to-peer global lending marketplace in DeFi, connecting lenders and borrowers directly for earning interest or obtaining loans.

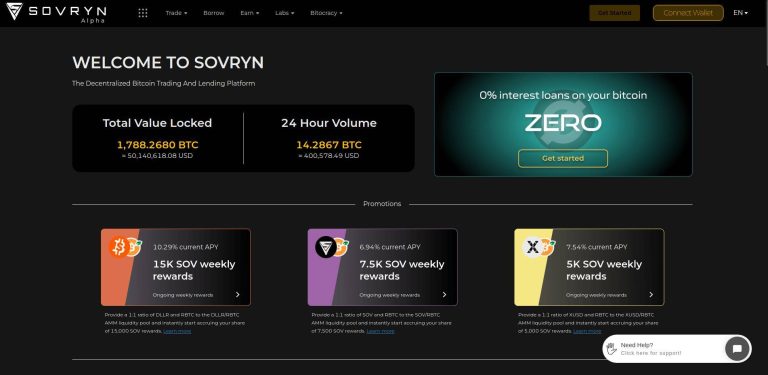

Sovryn

Sovryn, built on RSK that is EVM based chain, facilitates decentralized trading, lending, and borrowing, extending decentralized finance features to Bitcoin users.

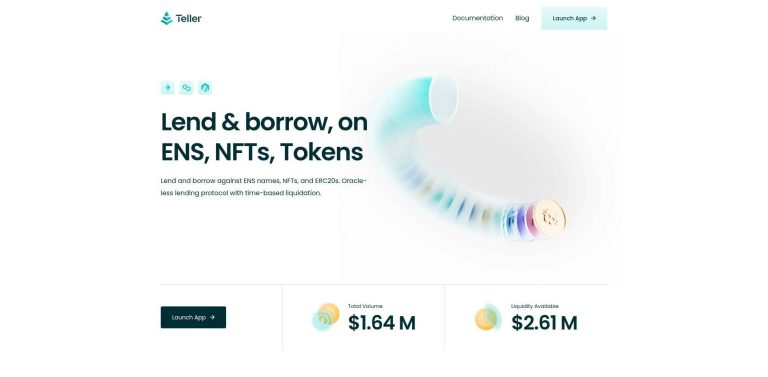

Teller

Teller is a decentralized lending protocol on Ethereum for lending and borrowing against ENS names, NFTs, and ERC20 tokens, offering oracle-less, time-based liquidation.