DEX Margin Trading: Leverage the Decentralized Market’s Potential

Elevate your trading strategy and amplify your returns with our elite selection of Decentralized Exchanges offering Margin Trading. These innovative platforms allow you to borrow funds to execute trades with leverage, opening the doors to enhanced profit possibilities while maintaining the principles of decentralization and security. Engage with a trading experience that is not only flexible but also highly liquid, with integrated smart contracts automatically managing your positions and margin calls in real time. With DEX Margin Trading, explore a realm where the decentralized finance market’s volatility becomes a powerful ally in your trading arsenal, providing opportunities for seasoned traders to capitalize on market movements with precision and confidence.

Aevo

Aevo facilitates trading perpetuals, options using off-chain matching, on-chain settlement on Ethereum, aiming for enhanced performance, security, and comprehensive trading strategies.

Apex

ApeX facilitates high-performance, decentralized derivatives trading with cross-margined perpetual contracts, multi-chain support, up to 30x leverage, and governance tokens.

Aster DEX

Aster is a decentralized perpetuals DEX with up to 100x leverage. It offers MEV-resistant one-click trades and pro tools across BNB, Ethereum, Arbitrum, and Solana—no bridging needed.

Avantis

Avantis is a decentralized perpetual trading platform on Base, offering up to 75x leverage across crypto, forex, and commodities. It features loss protection and uses USDC for liquidity.

Axiom

Axiom is Solana’s all‑in‑one trading terminal built for memecoin and perp markets. Track wallet behavior, monitor Twitter signals, snipe token migrations instantly.

Blitz Exchange

Blitz is a decentralized exchange on Blast offering spot and perpetual trading with up to 20x leverage. It features unified cross-chain liquidity via Vertex Edge and supports USDB and wETH as margin.

Bluefin

Bluefin provides decentralized derivatives trading, featuring up to 20x leverage, prioritizing security, user experience, competitive fees, and programmatic trading via API.

DeGate

DeGate leverages ZK rollup technology to offer a decentralized exchange (DEX) with notable fast transaction speeds, minimized fees, and a strong focus on self-custody.

Derive

Derive is a decentralized options and perpetuals platform built on an Optimistic Rollup. It offers self-custodial trading with advanced risk management and programmable strategies.

Drift Protocol

Drift Protocol is a decentralized exchange on Solana, specializing in perpetual futures trading with up to 20x leverage. It also supports spot trading, borrowing, and lending.

Dydx

dYdX is a powerful decentralized platform for trading perpetual contracts with low fees and high liquidity, offering up to 20x buying power, instant trade executions.

edgeX

edgeX edgeX is a decentralized perpetuals DEX built on StarkEx. It offers 100x leverage, vault based liquidity, and full on-chain settlement with zero slippage and isolated margin per market.

Ethereal

Ethereal is a decentralized exchange offering spot and perpetual trading with sub-20ms latency. Built on the Ethena Network, it uses USDe as collateral and ensures self-custody for users.

Extended Exchange

Extended Exchange is a decentralized perpetuals DEX. Trade crypto, forex, and commodities with up to 50x leverage. Built on a hybrid matching model for low latency and full custody.

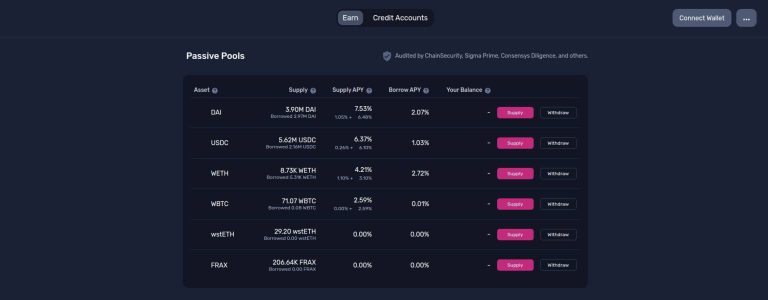

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

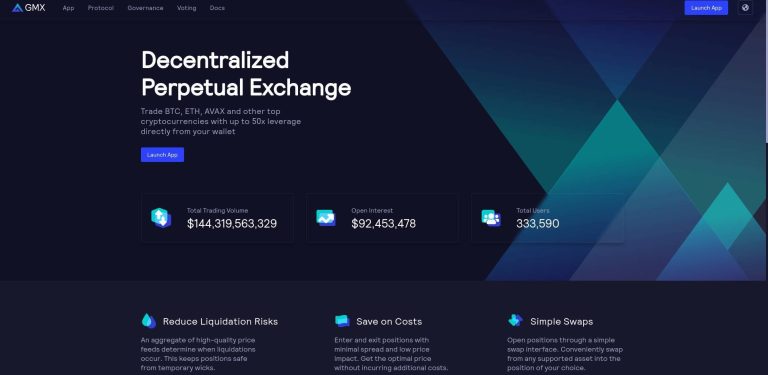

GMX

GMX is a decentralized perpetual exchange on Arbitrum and Avalanche, offering up to 30X leverage, low fees, deep liquidity, and transparent trading experiences.

GMX-Solana

GMX-Solana is a perpetuals DEX on Solana offering up to 100x leverage. Trade with GLV liquidity pools and earn GT token rewards. Chainlink data integration ensures secure price feeds.

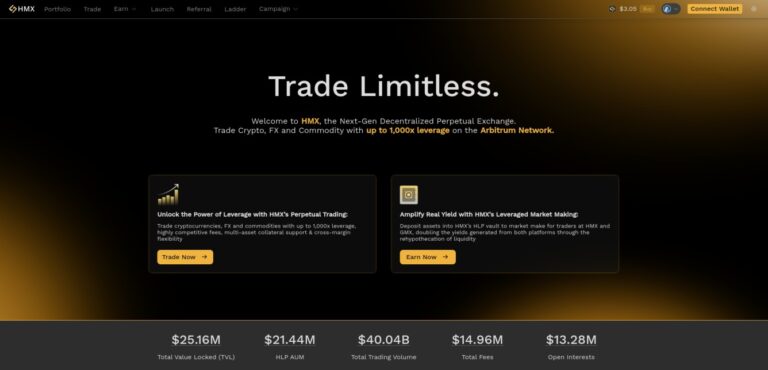

HMX

HMX is a decentralized perpetual exchange on Arbitrum and Blast, offering up to 1,000x leverage across crypto, forex, and commodities. It supports cross-margin and multi-asset collateral.

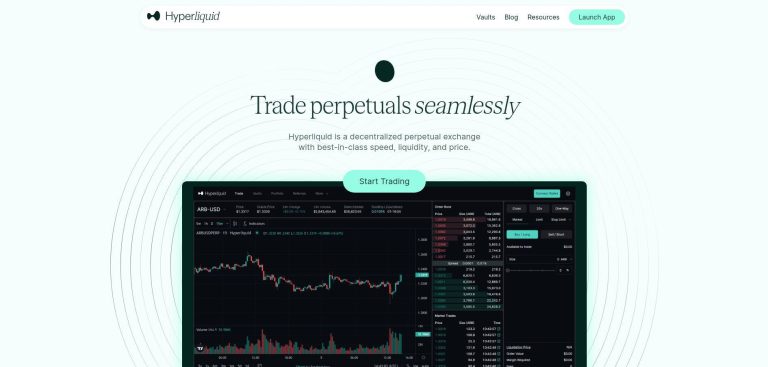

Hyperliquid

Hyperliquid is a decentralized perpetual exchange with advanced order types, instant trade finality, low fees, up to 50x leverage, and a fully on-chain order books.

Jupiter

Jupiter is a decentralized exchange aggregator on Solana, offering fast transactions, low fees, and access to most SOL-based tokens. It features limit orders and cross-chain swaps.

KiloEx

KiloEx is a decentralized perpetuals DEX offering up to 100x leverage. Trade crypto, forex, indices, and commodities with self-custody. Available on BNB Chain, opBNB, Manta, and Base.

Kuma

Kuma is a high-performance decentralized perpetuals exchange on Arbitrum Orbit. It offers gas-free trading, instant execution, and self-custodial settlement via its XCHAIN Layer 2.

Kwenta

Kwenta is a decentralized derivatives trading platform on Synthetix, offering synthetic asset and perpetual futures trading with low gas fees via Optimism.

Lighter

Lighter is a decentralized perpetuals exchange built on a purpose‑built zk‑rollup. With sub-5 ms latency and high throughput, it delivers CEX-grade speed on-chain.

LogX Network

LogX is a DeFi SuperApp offering perpetuals, options, spot, and prediction markets. Built on Arbitrum Orbit, it enables gasless, high-speed trading with smart wallets and cross-chain liquidity.

MUX Protocol

MUX Network is a decentralized finance (DeFi) leveraged trading protocol offering up to 100x leverage, zero price impact, and multi-chain liquidity books.

MYX Finance

MYX Finance is a decentralized perpetuals DEX offering zero-slippage trading, up to 50x leverage, and gasless execution via its Matching Pool Mechanism (MPM).

Ostium

Ostium Ostium is a decentralized perpetuals DEX on Arbitrum. Trade forex, commodities, indices, and crypto with up to 200x leverage. Offers self-custody, transparent pricing, and on-chain settlement.

Paradex

Paradex is a Layer 2 perpetuals DEX built on Starknet. It offers self-custodial trading with deep liquidity, low fees, and capital-efficient on-chain risk management.

Perpetual Protocol

Perpetual Protocol facilitates on-chain perpetual futures trading through a decentralized exchange, offering governance via PERP token, and USDC revenue-sharing.

Pika

Pika Protoco offers a decentralized perpetual swap exchange with up to 200x leverage, low slippage, diverse trading pairs, and reduced fees on Ethereum Layer 2.

RabbitX

RabbitX is a decentralized perpetuals exchange built on Starknet. It offers zero-fee trading, up to 50x leverage, and supports over 100 markets across multiple blockchains.

Satori

Satori is a decentralized derivatives platform for perpetuals and spot. It uses off-chain order aggregation with on-chain settlement. Trade with up to 50× leverage across multiple chains.

Storm Trade

Storm Trade is a decentralized exchange on the TON blockchain, offering perpetual futures trading via a Telegram Web App. It features a user-friendly interface, and robust security measures.

Vertex

Vertex Protocol is a decentralized exchange built on Arbitrum and Mantle, offering spot, perpetuals, and money markets with universal cross-margin accounts.

Volmex

Volmex Finance facilitates crypto volatility trading through Perpetual Futures and Volatility Tokens, providing a 24/7 transparent, permissionless platform with low fees.