DEX Margin Trading: Leverage the Decentralized Market’s Potential

Elevate your trading strategy and amplify your returns with our elite selection of Decentralized Exchanges offering Margin Trading. These innovative platforms allow you to borrow funds to execute trades with leverage, opening the doors to enhanced profit possibilities while maintaining the principles of decentralization and security. Engage with a trading experience that is not only flexible but also highly liquid, with integrated smart contracts automatically managing your positions and margin calls in real time. With DEX Margin Trading, explore a realm where the decentralized finance market’s volatility becomes a powerful ally in your trading arsenal, providing opportunities for seasoned traders to capitalize on market movements with precision and confidence.

Apex

ApeX facilitates high-performance, decentralized derivatives trading with cross-margined perpetual contracts, multi-chain support, up to 30x leverage, and governance tokens.

Kuma

Kuma is a high-performance decentralized perpetuals exchange on Arbitrum Orbit. It offers gas-free trading, instant execution, and self-custodial settlement via its XCHAIN Layer 2.

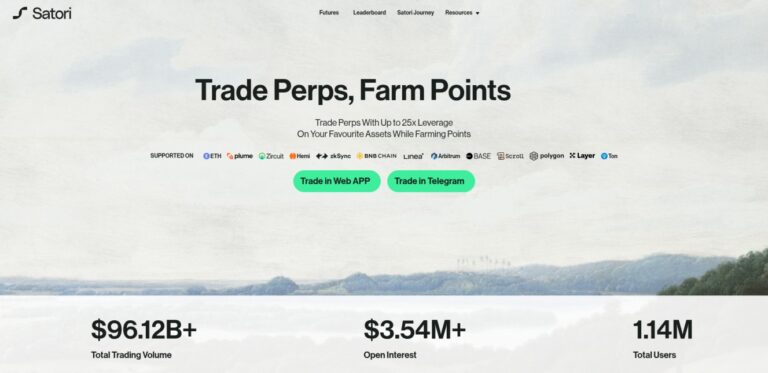

Satori

Satori is a decentralized derivatives platform for perpetuals and spot. It uses off-chain order aggregation with on-chain settlement. Trade with up to 50× leverage across multiple chains.

Volmex

Volmex Finance facilitates crypto volatility trading through Perpetual Futures and Volatility Tokens, providing a 24/7 transparent, permissionless platform with low fees.