DEX Margin Trading: Leverage the Decentralized Market’s Potential

Elevate your trading strategy and amplify your returns with our elite selection of Decentralized Exchanges offering Margin Trading. These innovative platforms allow you to borrow funds to execute trades with leverage, opening the doors to enhanced profit possibilities while maintaining the principles of decentralization and security. Engage with a trading experience that is not only flexible but also highly liquid, with integrated smart contracts automatically managing your positions and margin calls in real time. With DEX Margin Trading, explore a realm where the decentralized finance market’s volatility becomes a powerful ally in your trading arsenal, providing opportunities for seasoned traders to capitalize on market movements with precision and confidence.

Apex

ApeX facilitates high-performance, decentralized derivatives trading with cross-margined perpetual contracts, multi-chain support, up to 30x leverage, and governance tokens.

Aster DEX

Aster is a decentralized perpetuals DEX with up to 100x leverage. It offers MEV-resistant one-click trades and pro tools across BNB, Ethereum, Arbitrum, and Solana—no bridging needed.

edgeX

edgeX edgeX is a decentralized perpetuals DEX built on StarkEx. It offers 100x leverage, vault based liquidity, and full on-chain settlement with zero slippage and isolated margin per market.

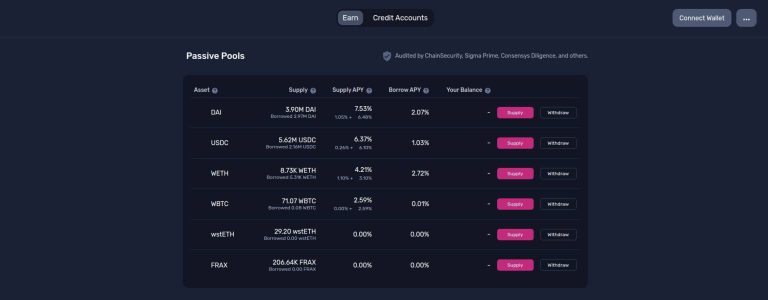

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

KiloEx

KiloEx is a decentralized perpetuals DEX offering up to 100x leverage. Trade crypto, forex, indices, and commodities with self-custody. Available on BNB Chain, opBNB, Manta, and Base.

MUX Protocol

MUX Network is a decentralized finance (DeFi) leveraged trading protocol offering up to 100x leverage, zero price impact, and multi-chain liquidity books.

MYX Finance

MYX Finance is a decentralized perpetuals DEX offering zero-slippage trading, up to 50x leverage, and gasless execution via its Matching Pool Mechanism (MPM).

Satori

Satori is a decentralized derivatives platform for perpetuals and spot. It uses off-chain order aggregation with on-chain settlement. Trade with up to 50× leverage across multiple chains.