DEX Margin Trading: Leverage the Decentralized Market’s Potential

Elevate your trading strategy and amplify your returns with our elite selection of Decentralized Exchanges offering Margin Trading. These innovative platforms allow you to borrow funds to execute trades with leverage, opening the doors to enhanced profit possibilities while maintaining the principles of decentralization and security. Engage with a trading experience that is not only flexible but also highly liquid, with integrated smart contracts automatically managing your positions and margin calls in real time. With DEX Margin Trading, explore a realm where the decentralized finance market’s volatility becomes a powerful ally in your trading arsenal, providing opportunities for seasoned traders to capitalize on market movements with precision and confidence.

Blitz Exchange

Blitz is a decentralized exchange on Blast offering spot and perpetual trading with up to 20x leverage. It features unified cross-chain liquidity via Vertex Edge and supports USDB and wETH as margin.

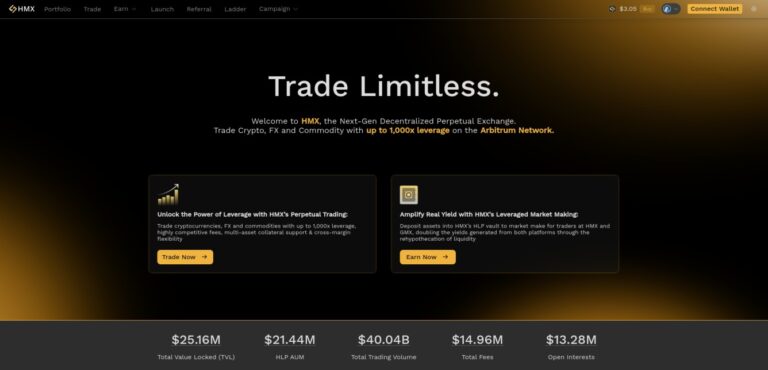

HMX

HMX is a decentralized perpetual exchange on Arbitrum and Blast, offering up to 1,000x leverage across crypto, forex, and commodities. It supports cross-margin and multi-asset collateral.

RabbitX

RabbitX is a decentralized perpetuals exchange built on Starknet. It offers zero-fee trading, up to 50x leverage, and supports over 100 markets across multiple blockchains.