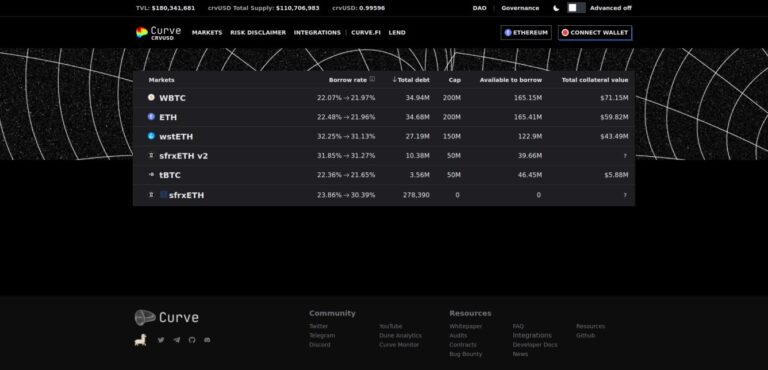

crvUSD

crvUSD is a decentralized stablecoin launched by Curve Finance. It is overcollateralized and pegged to the US dollar. Users mint crvUSD by depositing collateral such as ETH.

eBTC

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

Ethena

Ethena is a DeFi platform offering a synthetic dollar (USDe) and internet-native yield. It generates yield by staking Ethereum and shorting Ethereum futures, stabilizing USDe's value and providing returns.

First Digital USD

First Digital USD (FDUSD) is a USD-pegged stablecoin issued by First Digital Labs. It is fully backed by cash and cash-equivalent assets, ensuring transparency and trust.

Frax Finance

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

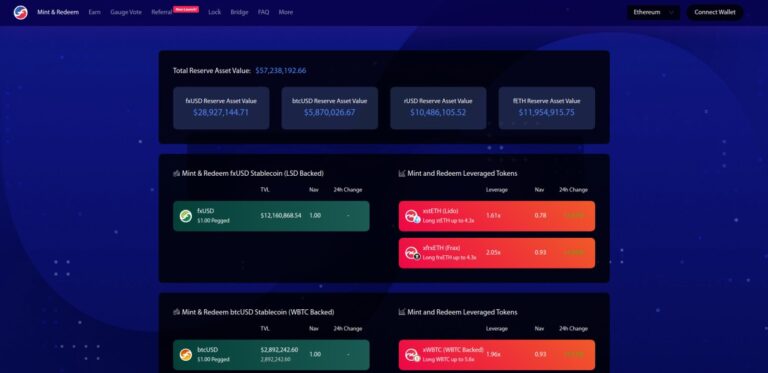

Fx Protocol

f(x) Protocol by AladdinDAO is a DeFi protocol on Ethereum that offers a decentralized stablecoin (fxUSD) and leveraged ETH tokens (fETH and xETH), all backed by staked ETH.

Gemini Dollar

Gemini Dollar (GUSD) is a stablecoin issued by Gemini, pegged 1:1 with the U.S. dollar. Reserves are held in FDIC-insured banks, money market funds, and U.S. Treasury bills.

GHO

GHO is a decentralized, multi-collateral stablecoin on Aave. It is minted using assets supplied as collateral on Ethereum markets. The Aave DAO manages GHO's supply and interest rates.

Liquity

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

MakerDAO

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

PAX Gold

PAX Gold (PAXG) is a regulated digital asset by Paxos, backed by one fine troy ounce of London Good Delivery gold. Each token is stored in secure vaults and built on Ethereum.

PayPal USD

PayPal USD (PYUSD) is a stablecoin by PayPal, backed 1:1 by U.S. dollar deposits and equivalents. It is an ERC-20 token on Ethereum and Solana, used for payments and transfers within PayPal.

Tether

Tether (USDT) is the largest stablecoin, pegged 1:1 to the US dollar. It has a market cap over $100 billion, backed by 90% cash and equivalents. Issued on multiple blockchains like Ethereum and Tron.

Tether Gold

Tether Gold (XAUt) is a digital token backed by one troy ounce of physical gold, held in a secure vault. Each token is transferable on the blockchain and redeemable for physical gold.

Threshold Network (tBTC)

Threshold Network is a protocol that bridges Bitcoin to Ethereum with tBTC, a fully backed Bitcoin token. It enables trustless use in DeFi while maintaining security and decentralization.

TrueUSD

TrueUSD (TUSD) is a USD-pegged stablecoin with daily reserve attestations. It ensures transparency via on-chain verification and is available on Ethereum, TRON, and BSC.

USD Coin

USD Coin (USDC) is a stablecoin issued by Circle, pegged 1:1 to the US dollar. It is used for digital payments and global transfers, with over $33.6 billion in circulation.

Usual

Usual is a decentralized protocol for issuing fiat-backed stablecoins like USD0, secured by real-world assets. It offers transparent stablecoins and redistributes value through the $USUAL token.