Aevo

Aevo facilitates trading perpetuals, options using off-chain matching, on-chain settlement on Ethereum, aiming for enhanced performance, security, and comprehensive trading strategies.

Apex

ApeX facilitates high-performance, decentralized derivatives trading with cross-margined perpetual contracts, multi-chain support, up to 30x leverage, and governance tokens.

Avantis

Avantis is a decentralized perpetual trading platform on Base, offering up to 75x leverage across crypto, forex, and commodities. It features loss protection and uses USDC for liquidity.

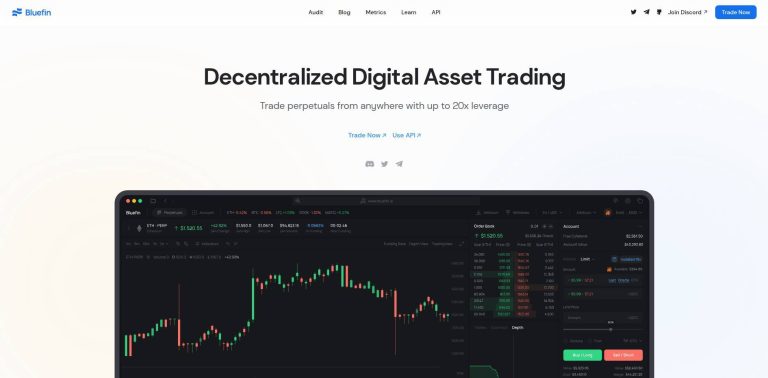

Bluefin

Bluefin provides decentralized derivatives trading, featuring up to 20x leverage, prioritizing security, user experience, competitive fees, and programmatic trading via API.

DeGate

DeGate leverages ZK rollup technology to offer a decentralized exchange (DEX) with notable fast transaction speeds, minimized fees, and a strong focus on self-custody.

Drift Protocol

Drift Protocol is a decentralized exchange on Solana, specializing in perpetual futures trading with up to 20x leverage. It also supports spot trading, borrowing, and lending.

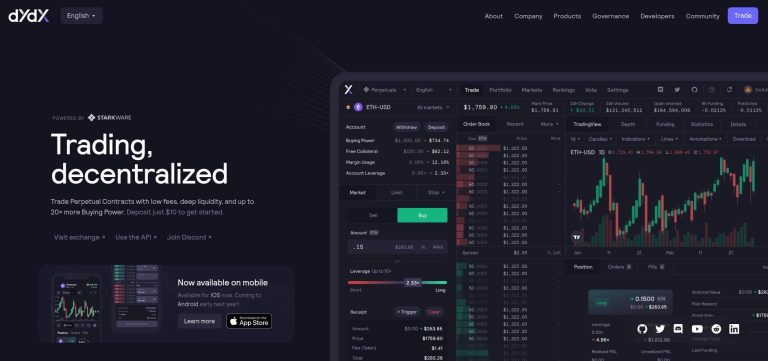

Dydx

dYdX is a powerful decentralized platform for trading perpetual contracts with low fees and high liquidity, offering up to 20x buying power, instant trade executions.

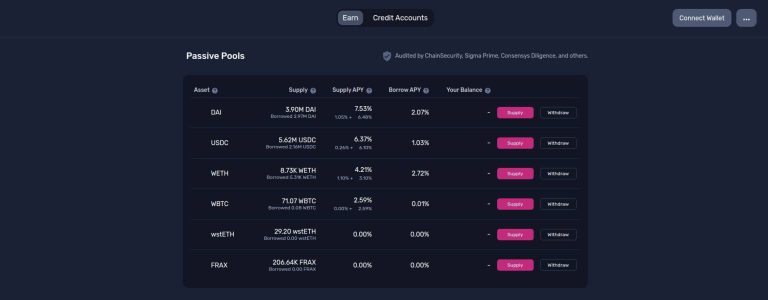

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

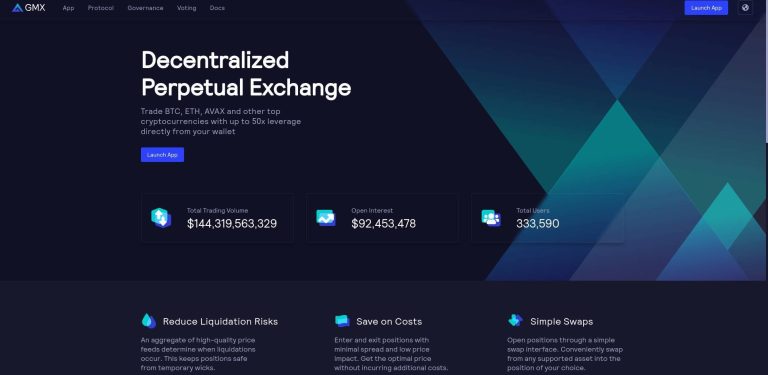

GMX

GMX is a decentralized perpetual exchange on Arbitrum and Avalanche, offering up to 30X leverage, low fees, deep liquidity, and transparent trading experiences.

HMX

HMX is a decentralized perpetual exchange on Arbitrum and Blast, offering up to 1,000x leverage across crypto, forex, and commodities. It supports cross-margin and multi-asset collateral.

Hyperliquid

Hyperliquid is a decentralized perpetual exchange with advanced order types, instant trade finality, low fees, up to 50x leverage, and a fully on-chain order books.

Jupiter

Jupiter is a decentralized exchange aggregator on Solana, offering fast transactions, low fees, and access to most SOL-based tokens. It features limit orders and cross-chain swaps.

Kwenta

Kwenta is a decentralized derivatives trading platform on Synthetix, offering synthetic asset and perpetual futures trading with low gas fees via Optimism.

Level

Level Finance is a decentralized perpetual exchange offering leveraged trading with user-driven risk management and revenue-sharing mechanisms.

MUX Protocol

MUX Network is a decentralized finance (DeFi) leveraged trading protocol offering up to 100x leverage, zero price impact, and multi-chain liquidity books.

Perpetual Protocol

Perpetual Protocol facilitates on-chain perpetual futures trading through a decentralized exchange, offering governance via PERP token, and USDC revenue-sharing.

Pika

Pika Protoco offers a decentralized perpetual swap exchange with up to 200x leverage, low slippage, diverse trading pairs, and reduced fees on Ethereum Layer 2.

Storm Trade

Storm Trade is a decentralized exchange on the TON blockchain, offering perpetual futures trading via a Telegram Web App. It features a user-friendly interface, and robust security measures.

Vela Exchange

Vela Exchange is a decentralized perpetual trading platform on Arbitrum and Base, offering up to 100x leverage, multi-chain deposits, and Chainlink-powered price feeds.

Vertex

Vertex Protocol is a decentralized exchange built on Arbitrum and Mantle, offering spot, perpetuals, and money markets with universal cross-margin accounts.

Volmex

Volmex Finance facilitates crypto volatility trading through Perpetual Futures and Volatility Tokens, providing a 24/7 transparent, permissionless platform with low fees.