DeFi Staking Providers: Maximizing Yield Through Liquid Derivatives

Dive into a realm of optimized yields with our chosen cadre of DeFi Staking Providers, offering innovative solutions in Ethereum Liquid Staking Derivatives. These esteemed providers facilitate effortless staking of your Ethereum, granting you the freedom to trade derivative tokens representing your staked assets. The seamless fusion of staking and liquidity ensures you can actively engage your capital while contributing to the network’s security and consensus mechanisms. Delve into a space where your assets are perpetually working for you, generating returns and providing liquidity as you navigate through the multifaceted universe of decentralized finance. With our DeFi Staking Providers, you engage in a dance of liquidity and stability, mastering the art of staking in a fluid financial environment.

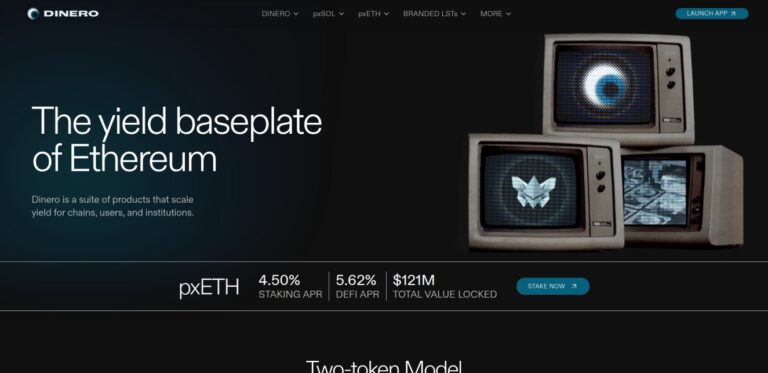

Dinero

Dinero facilitates on-chain liquidity, governance, cash flow in DeFi, offering products like Pirex for yield tokenization, and Hidden Hand for governance incentives.

Frax Finance

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

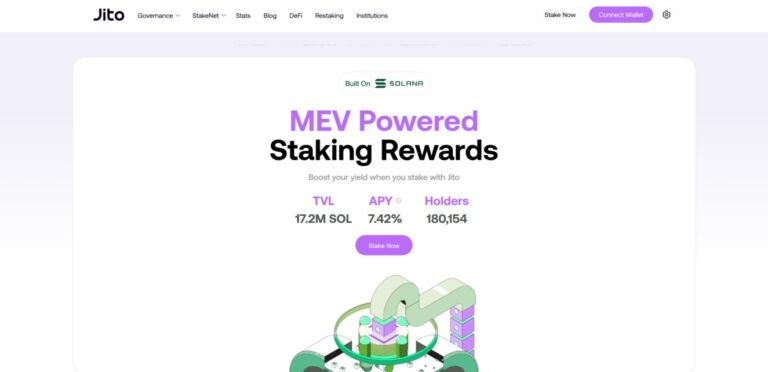

Jito Network

Jito is Solana’s MEV-powered liquid staking protocol. Stake SOL to receive JitoSOL while earning MEV rewards. Validators are optimized for maximum staking yield.

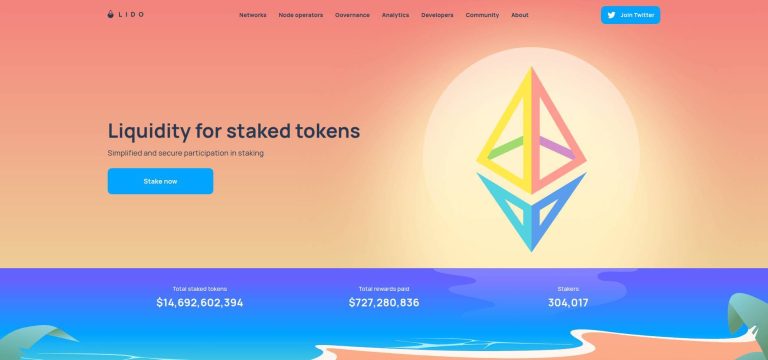

Lido

Lido offers liquid staking for Ethereum, Polygon, and Solana, enabling users to earn rewards without locking assets, enhancing decentralized finance liquidity.

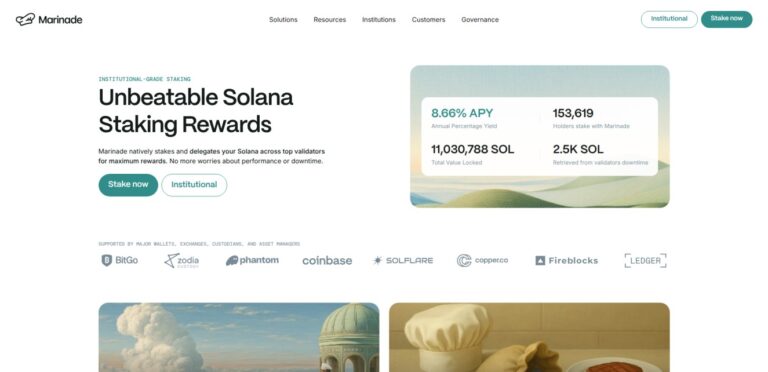

Marinade Finance

Marinade is Solana’s leading liquid staking protocol. Stake SOL to receive mSOL while earning rewards. Choose native staking or liquid staking with optimized validator delegation.

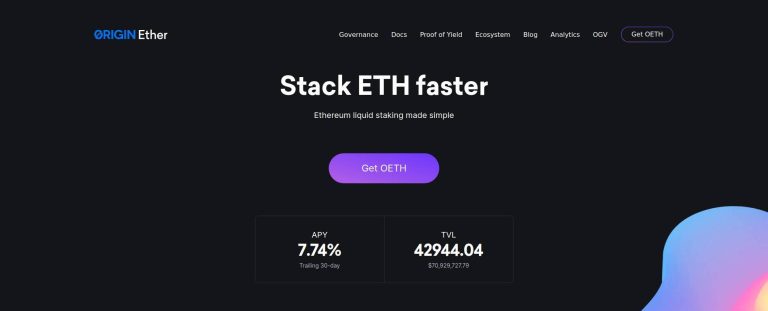

Origin Protocol

Origin Protocol (OETH) is an ETH staking yield aggregator, maximizing yields through meticulous strategies, fully collateralized by ETH and blue-chip liquid staking derivatives.

Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol, enabling users to stake ETH with lower entry requirements, earning staking rewards without locking ETH or maintaining infrastructure.

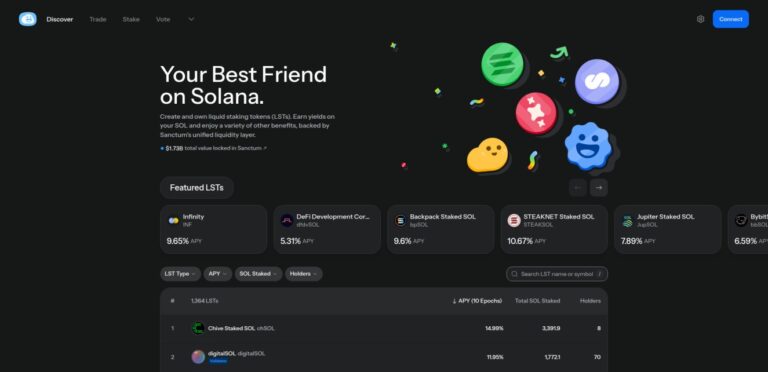

Sanctum

Sanctum is a liquid staking ecosystem on Solana. Stake SOL to receive LSTs that auto-compound and stay tradable. One namespace: stake, trade, and issue your own LSTs.

SolBlaze

SolBlaze is a DeFi platform on Solana offering liquid staking with BlazeStake and BlazeRewards. It provides tools like a Solana faucet, RPC status page, and a token minter.

Solv Protocol

Solv Protocol brings liquid staking and yield to BTC holders. Mint SolvBTC 1:1 with Bitcoin, stake for yield, and access LSTs. Powered by SAL middleware and cross-chain DeFi infrastructure.

Stakewise

StakeWise offers effortless Ethereum staking through a secure infrastructure, with real-time monitoring, DeFi strategy integrations, and tools for app integration.

Swell

Swell Network simplifies liquid staking for ETH, helping users optimize yield in DeFi by staking ETH, earning swETH, and maximizing returns within the ETH DeFi ecosystem.