DeFi Staking Providers: Maximizing Yield Through Liquid Derivatives

Dive into a realm of optimized yields with our chosen cadre of DeFi Staking Providers, offering innovative solutions in Ethereum Liquid Staking Derivatives. These esteemed providers facilitate effortless staking of your Ethereum, granting you the freedom to trade derivative tokens representing your staked assets. The seamless fusion of staking and liquidity ensures you can actively engage your capital while contributing to the network’s security and consensus mechanisms. Delve into a space where your assets are perpetually working for you, generating returns and providing liquidity as you navigate through the multifaceted universe of decentralized finance. With our DeFi Staking Providers, you engage in a dance of liquidity and stability, mastering the art of staking in a fluid financial environment.

Bedrock

Bedrock is a multi-asset liquid restaking protocol for assets like Ethereum and Bitcoin, offering secure, oracle-less staking integrated with platforms like EigenLayer.

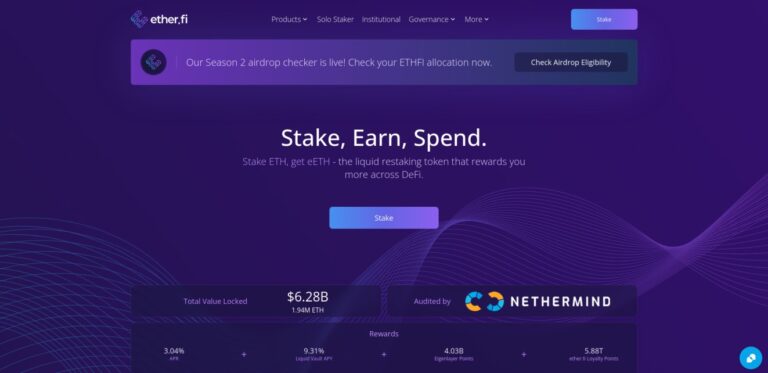

Ether.fi

ether.fi is a liquid restaking protocol on EigenLayer, allowing users to stake ETH and receive eETH, a liquid token for DeFi. It supports rewards from EigenLayer and lets stakers control their keys.

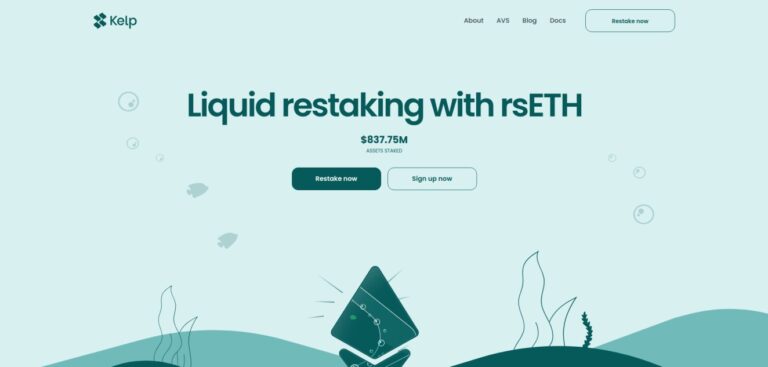

Kelp

KelpDAO is a liquid restaking protocol on EigenLayer, supporting tokens like ETH and stETH. It offers the rsETH token for earning yields while maintaining liquidity, with various DeFi integrations.

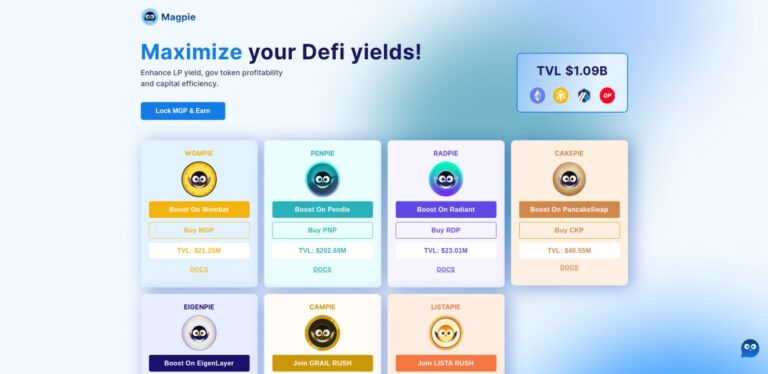

Magpie

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

Renzo

Renzo Protocol is a liquid restaking platform on EigenLayer, enabling easy restaking of Ethereum and Liquid Staking Tokens. It supports multiple networks and over 100 DeFi integrations.

Solv Protocol

Solv Protocol brings liquid staking and yield to BTC holders. Mint SolvBTC 1:1 with Bitcoin, stake for yield, and access LSTs. Powered by SAL middleware and cross-chain DeFi infrastructure.

Swell

Swell Network simplifies liquid staking for ETH, helping users optimize yield in DeFi by staking ETH, earning swETH, and maximizing returns within the ETH DeFi ecosystem.