DeFi Stablecoins: Anchoring Value with Decentralized Stability

Explore a haven of monetary stability in the tumultuous seas of crypto volatility with our selected DeFi Stablecoin Platforms. These platforms host an array of stablecoins, each meticulously pegged to stable assets like fiat currencies, commodities, or algorithms, offering a reliable refuge and medium of exchange in the dynamic DeFi landscape. Engage with various protocols that issue, manage, and stabilize these digital assets, providing you with options that suit your risk profile and financial needs. Whether you’re looking for a safe harbor during market storms, a steady medium for transactions, or a stable base for your DeFi adventures, our collection of Stablecoin Platforms offers a palette of decentralized solutions designed to anchor your value securely. With DeFi Stablecoin Platforms, you navigate confidently, with your assets steadfast and resilient against the tides of market uncertainty.

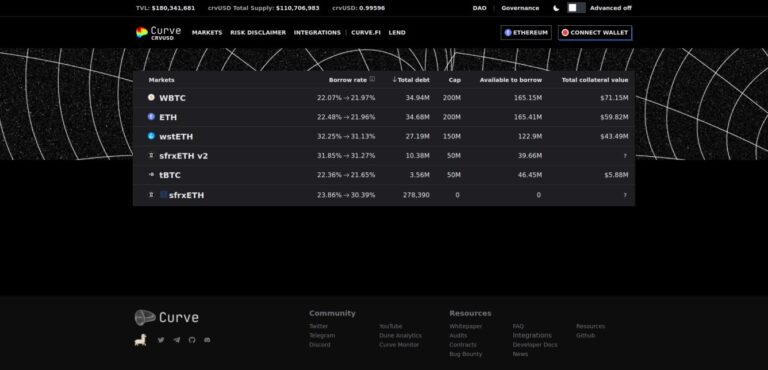

crvUSD

crvUSD is a decentralized stablecoin launched by Curve Finance. It is overcollateralized and pegged to the US dollar. Users mint crvUSD by depositing collateral such as ETH.

Tether

Tether (USDT) is the largest stablecoin, pegged 1:1 to the US dollar. It has a market cap over $100 billion, backed by 90% cash and equivalents. Issued on multiple blockchains like Ethereum and Tron.

USDC

USD Coin (USDC) is a stablecoin issued by Circle, pegged 1:1 to the US dollar. It is used for digital payments and global transfers, with over $33.6 billion in circulation.