DeFi Stablecoins: Anchoring Value with Decentralized Stability

Explore a haven of monetary stability in the tumultuous seas of crypto volatility with our selected DeFi Stablecoin Platforms. These platforms host an array of stablecoins, each meticulously pegged to stable assets like fiat currencies, commodities, or algorithms, offering a reliable refuge and medium of exchange in the dynamic DeFi landscape. Engage with various protocols that issue, manage, and stabilize these digital assets, providing you with options that suit your risk profile and financial needs. Whether you’re looking for a safe harbor during market storms, a steady medium for transactions, or a stable base for your DeFi adventures, our collection of Stablecoin Platforms offers a palette of decentralized solutions designed to anchor your value securely. With DeFi Stablecoin Platforms, you navigate confidently, with your assets steadfast and resilient against the tides of market uncertainty.

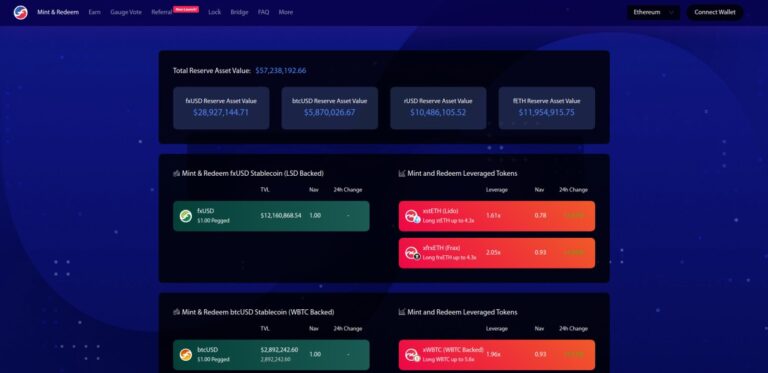

f(x) Protocol

f(x) Protocol by AladdinDAO is a DeFi protocol on Ethereum that offers a decentralized stablecoin (fxUSD) and leveraged ETH tokens (fETH and xETH), all backed by staked ETH.

Frax Finance

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.