DeFi Stablecoins: Anchoring Value with Decentralized Stability

Explore a haven of monetary stability in the tumultuous seas of crypto volatility with our selected DeFi Stablecoin Platforms. These platforms host an array of stablecoins, each meticulously pegged to stable assets like fiat currencies, commodities, or algorithms, offering a reliable refuge and medium of exchange in the dynamic DeFi landscape. Engage with various protocols that issue, manage, and stabilize these digital assets, providing you with options that suit your risk profile and financial needs. Whether you’re looking for a safe harbor during market storms, a steady medium for transactions, or a stable base for your DeFi adventures, our collection of Stablecoin Platforms offers a palette of decentralized solutions designed to anchor your value securely. With DeFi Stablecoin Platforms, you navigate confidently, with your assets steadfast and resilient against the tides of market uncertainty.

Coinshift

Coinshift is a self-custodial treasury platform for DAOs and teams. Mint csUSDL, an institutional-grade stablecoin backed by secure DeFi yield. Earn real yield while farming SHIFT points.

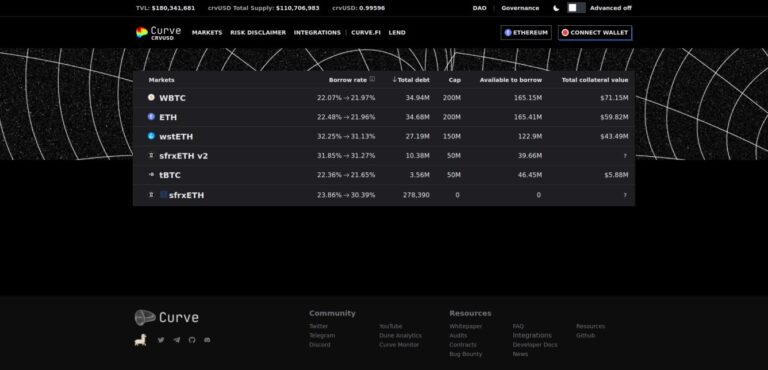

crvUSD

crvUSD is a decentralized stablecoin launched by Curve Finance. It is overcollateralized and pegged to the US dollar. Users mint crvUSD by depositing collateral such as ETH.

eBTC

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

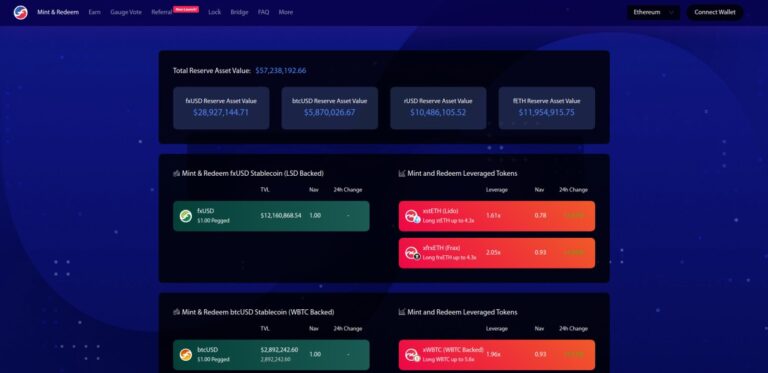

f(x) Protocol

f(x) Protocol by AladdinDAO is a DeFi protocol on Ethereum that offers a decentralized stablecoin (fxUSD) and leveraged ETH tokens (fETH and xETH), all backed by staked ETH.

Frax Finance

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

GHO

GHO is a decentralized, multi-collateral stablecoin on Aave. It is minted using assets supplied as collateral on Ethereum markets. The Aave DAO manages GHO's supply and interest rates.

Level

Level is a stablecoin protocol offering lvlUSD, a yield-bearing asset backed by USDC and USDT. Users can stake lvlUSD to earn slvlUSD, enhancing returns through DeFi lending strategies.

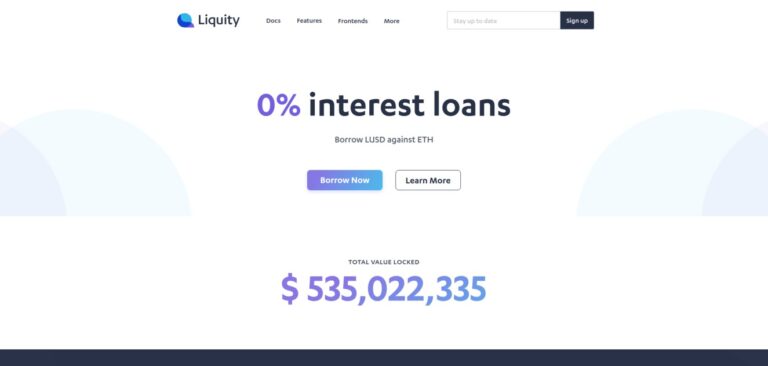

Liquity

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

MakerDAO

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

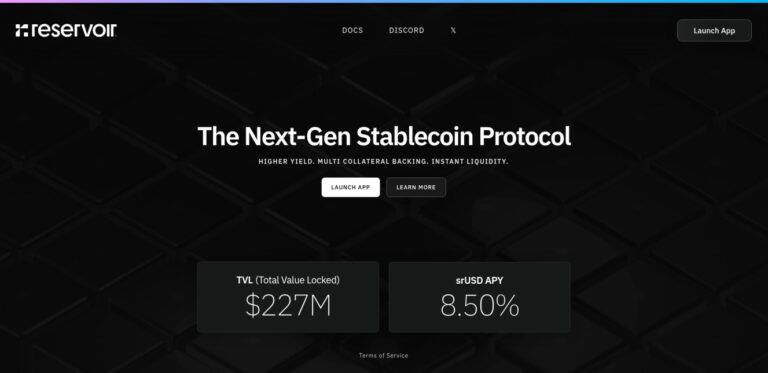

Reservoir

Reservoir is a next-gen stablecoin system issuing rUSD, srUSD, and trUSD. Backed by DeFi and real-world collateral, it offers liquid, savings, and term yield.

Resolv

Resolv is a DeFi protocol offering USR, a delta-neutral stablecoin backed by ETH and BTC. It maintains price stability through hedging strategies and an insurance layer.

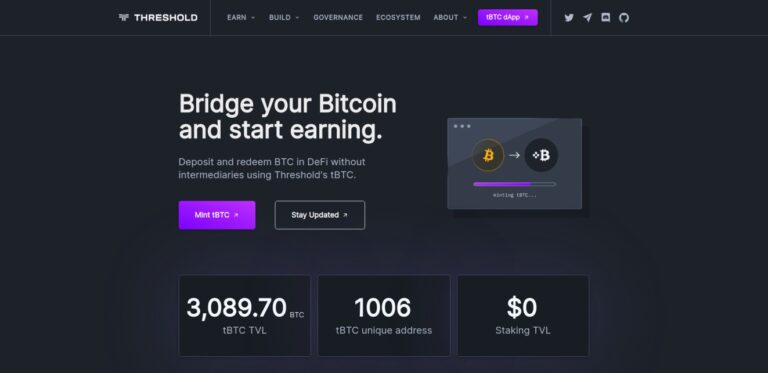

Threshold Network (tBTC)

Threshold Network is a protocol that bridges Bitcoin to Ethereum with tBTC, a fully backed Bitcoin token. It enables trustless use in DeFi while maintaining security and decentralization.