Noon

Noon is a yield-bearing stablecoin backed by delta-neutral strategies. Mint USN with USDC or USDT, stake to earn yield via sUSN. Returns come from funding arbitrage and tokenized Treasuries.

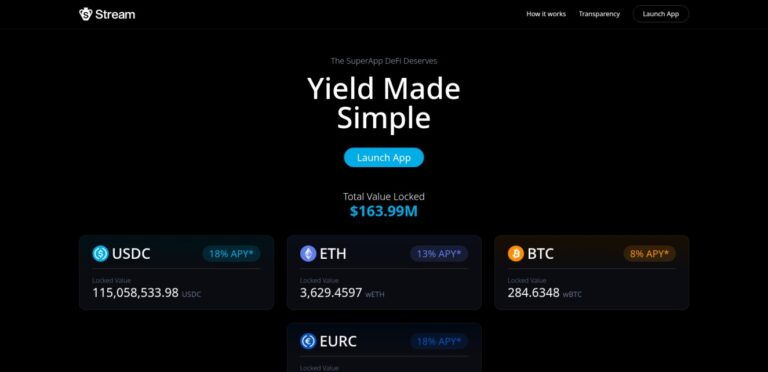

Stream Protocol

Stream is a delta-neutral yield protocol using market-making and funding rate strategies. Deposit USDC, EURC, ETH, or wBTC into vaults that bridge across chains via LayerZero.

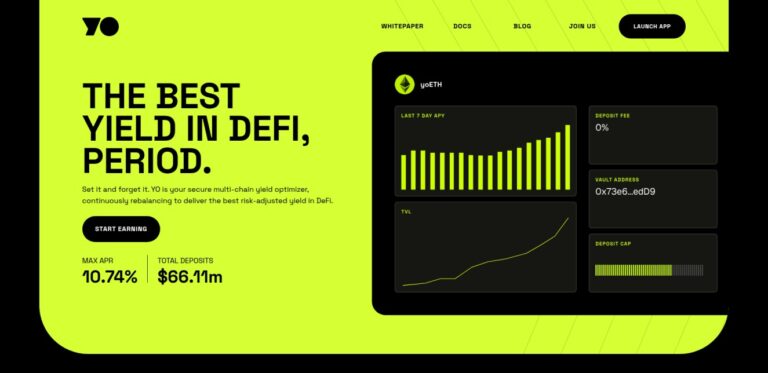

YO Protocol

YO is a multi‑chain, risk‑aware yield optimizer protocol. Deposit BTC, ETH, SOL or USDC into trusted vaults. Receive static ERC‑4626 yoTokens (e.g. yoETH) that auto‑accrue yield.

Axiom

Axiom is Solana’s all‑in‑one trading terminal built for memecoin and perp markets. Track wallet behavior, monitor Twitter signals, snipe token migrations instantly.

edgeX

edgeX edgeX is a decentralized perpetuals DEX built on StarkEx. It offers 100x leverage, vault based liquidity, and full on-chain settlement with zero slippage and isolated margin per market.

Extended Exchange

Extended Exchange is a decentralized perpetuals DEX. Trade crypto, forex, and commodities with up to 50x leverage. Built on a hybrid matching model for low latency and full custody.

Satori

Satori is a decentralized derivatives platform for perpetuals and spot. It uses off-chain order aggregation with on-chain settlement. Trade with up to 50× leverage across multiple chains.

Lighter

Lighter is a decentralized perpetuals exchange built on a purpose‑built zk‑rollup. With sub-5 ms latency and high throughput, it delivers CEX-grade speed on-chain.

Solv Protocol

Solv Protocol brings liquid staking and yield to BTC holders. Mint SolvBTC 1:1 with Bitcoin, stake for yield, and access LSTs. Powered by SAL middleware and cross-chain DeFi infrastructure.

OpenEden

OpenEden’s USDO is a fully-backed, rebasing stablecoin. Pegged 1:1 to USD and collateralized by tokenized U.S. Treasury bills. Holders earn daily yield through on-chain rebasing.

infiniFi

infiniFi is a fractional-reserve yield aggregator minting iUSD/iETH against USDC/ETH. Lock or remain liquid to optimize yield via both liquid and illiquid farms.

Superform

Superform is a cross-chain yield router and aggregator. Users deposit assets into SuperVaults and earn optimized yield across vaults-on any chain-in a single transaction.

Coinshift

Coinshift is a self-custodial treasury platform for DAOs and teams. Mint csUSDL, an institutional-grade stablecoin backed by secure DeFi yield. Earn real yield while farming SHIFT points.

Reservoir

Reservoir is a next-gen stablecoin system issuing rUSD, srUSD, and trUSD. Backed by DeFi and real-world collateral, it offers liquid, savings, and term yield.

Cygnus Finance

Cygnus is a modular protocol for issuing native, yield‑bearing assets like cgUSD, clBTC, and cgETH. It delivers real yield sourced from short-term U.S. Treasuries and onchain derivative strategies.

YieldFi

YieldFi is a fully on-chain asset management protocol offering curated yield index tokens like YUSD, YETH, and YBTC. It combines institutional-grade strategies with DeFi-native transparency.

Rings

Rings is a yield-bearing meta-stablecoin protocol on the Sonic blockchain. Users can mint scUSD and scETH, stake them in Veda Vaults, and participate in governance via veNFTs.

Sonic

Sonic is a high-speed, EVM-compatible Layer-1 blockchain developed by the Fantom team. It offers up to 400,000 TPS, sub-second finality, and a developer-first incentive model.

Aster DEX

Aster is a decentralized perpetuals DEX with up to 100x leverage. It offers MEV-resistant one-click trades and pro tools across BNB, Ethereum, Arbitrum, and Solana—no bridging needed.

GMX-Solana

GMX-Solana is a perpetuals DEX on Solana offering up to 100x leverage. Trade with GLV liquidity pools and earn GT token rewards. Chainlink data integration ensures secure price feeds.

Ostium

Ostium Ostium is a decentralized perpetuals DEX on Arbitrum. Trade forex, commodities, indices, and crypto with up to 200x leverage. Offers self-custody, transparent pricing, and on-chain settlement.

Paradex

Paradex is a Layer 2 perpetuals DEX built on Starknet. It offers self-custodial trading with deep liquidity, low fees, and capital-efficient on-chain risk management.

Gondi

Gondi is a decentralized NFT lending protocol offering flexible, oracle-less loans in WETH or USDC. It supports asset vaults, instant refinancing, and tranche-based risk management.

Arcade

Arcade is a decentralized lending platform for NFT-backed loans. Users can bundle assets into Smart Vaults for larger loans. Loans are peer-to-peer, fixed-term, and non-liquidating.

NFTfi

NFTfi is a peer-to-peer lending protocol for NFT-backed loans. Borrow crypto like wETH or DAI using top NFT collections. Loans are fixed-term and have no auto-liquidation risk.

Napier Finance

Napier Finance is a modular yield tokenization protocol. Users can fix, trade, and curate yield markets on Ethereum using flexible tools like Principal and Yield Tokens.

Level

Level is a stablecoin protocol offering lvlUSD, a yield-bearing asset backed by USDC and USDT. Users can stake lvlUSD to earn slvlUSD, enhancing returns through DeFi lending strategies.

Ethereal

Ethereal is a decentralized exchange offering spot and perpetual trading with sub-20ms latency. Built on the Ethena Network, it uses USDe as collateral and ensures self-custody for users.

Falcon

Falcon Finance is a synthetic dollar protocol offering USDf, an overcollateralized stablecoin backed by crypto assets. Stake USDf to earn sUSDf and access sustainable DeFi yields.

Resolv

Resolv is a DeFi protocol offering USR, a delta-neutral stablecoin backed by ETH and BTC. It maintains price stability through hedging strategies and an insurance layer.

Brahma

Brahma is a smart account platform for DeFi automation. It enables on-chain workflows like swaps and bridging. Built on Safe, it supports risk control and multichain use.

Usual

Usual is a decentralized protocol for issuing fiat-backed stablecoins like USD0, secured by real-world assets. It offers transparent stablecoins and redistributes value through the $USUAL token.

Karak Network

Karak Network is a DeFi protocol focused on restaking. It provides a secure and scalable platform for decentralized restaking, enhancing network security and yield opportunities for users.

Asymmetry Finance

Asymmetry Finance is a DeFi protocol focused on yield generation through optimized liquidity provision. It offers afUSD, afETH, afeETH, and afCVX for diverse strategies and financial solutions.

Farcaster

Farcaster is a decentralized social network protocol using Ethereum for on-chain data and distributed Hubs for storage. Warpcast is the main client app, available on iOS and Android.

Storm Trade

Storm Trade is a decentralized exchange on the TON blockchain, offering perpetual futures trading via a Telegram Web App. It features a user-friendly interface, and robust security measures.

Hyperliquid

Hyperliquid is a decentralized perpetual exchange with advanced order types, instant trade finality, low fees, up to 50x leverage, and a fully on-chain order books.

Rainbow

Rainbow offers a user-friendly Ethereum wallet for managing ETH, ERC-20 tokens, NFTs, and accessing decentralized applications with a simple interface.

Our criteria for featuring airdrops include:

- Innovation and Product Market Fit: We seek projects offering novel solutions with a clear market use case. Whether it's new financial protocols, unique dApps, or groundbreaking blockchain innovations, we highlight airdrops with real potential.

- Comprehensive Coverage: DeFiShills explores airdrops from all corners of the DeFi world, providing a wide range of opportunities across various blockchains and technologies.

- Engaging and Rewarding: We focus on airdrops that not only distribute tokens but also engage the community meaningfully through staking, liquidity mining, governance participation, and more, allowing you to earn rewards while supporting innovative projects.

- Insider Insights and Updates: As a community-driven platform, we share our experiences and insights into the airdrops we list. Whether actively farming these airdrops or possessing deep project knowledge, we provide the information needed to make informed decisions.