Introduction to DEX Aggregators

In the dynamic world of decentralized finance (DeFi), DEX aggregators have become essential tools for traders. These platforms consolidate liquidity from various decentralized exchanges (DEXes) and market makers, ensuring users can access the best possible trade prices. By pooling fragmented liquidity, DEX aggregators optimize trading efficiency and minimize slippage, making them invaluable for navigating the crypto market.

Importance in DeFi

- Enhanced Trade Execution: By leveraging liquidity from multiple sources, DEX aggregators improve trade execution, reducing slippage and maximizing value for traders.

- User Empowerment: These platforms provide users with comprehensive market data, enabling informed decision-making and access to optimal swap rates.

This article explores how DEX aggregators work, the benefits they offer, notable platforms, and practical guidance on choosing and using them effectively in the DeFi ecosystem.

Understanding Decentralized Exchanges (DEXs) and Liquidity

Decentralized Exchanges (DEXs) are platforms that facilitate peer-to-peer trading of cryptocurrencies without relying on intermediaries. Unlike centralized exchanges, which require users to trust a central authority with their funds, DEXs leverage blockchain technology to ensure transparency and security. Through the use of smart contracts, DEXs allow for direct transactions between buyers and sellers, enhancing both privacy and control over digital assets.

Importance of DEXs in DeFi

- Peer-to-Peer Trading: DEXs empower users to trade directly with each other, eliminating the need for a third party. This direct interaction reduces counterparty risk and increases the autonomy of traders, as they are not dependent on a centralized entity for trade execution.

- Security: Since DEXs do not hold users' funds, they are less vulnerable to hacks compared to centralized exchanges. Users retain control over their private keys and assets, which mitigates the risk of large-scale theft.

- Transparency: All transactions conducted on a DEX are recorded on the blockchain, providing an immutable ledger that can be audited by anyone. This level of transparency helps in building trust within the DeFi community and ensures accountability.

Liquidity in DEXs

Liquidity refers to the ease with which an asset can be converted into another without affecting its price. In the context of DEXs, liquidity is a critical factor for several reasons:

- Efficient Markets: High liquidity allows for quick execution of trades at stable prices, minimizing slippage—the difference between the expected price and the actual execution price. This is crucial for maintaining market efficiency and fairness.

- User Experience: Adequate liquidity leads to smoother trading experiences by reducing the time taken for order matching. This is particularly important in volatile markets where speed is essential.

- Market Stability: Liquid markets are generally more stable and less susceptible to price manipulation. High liquidity ensures that even large trades can be executed without causing significant price fluctuations.

The importance of liquidity in DEXs cannot be overstated. Without sufficient liquidity, even the most promising DeFi platforms can struggle to attract users. This is where DEX aggregators play a crucial role. By pooling liquidity from various sources, a DEX aggregator ensures that users get the best possible prices for their trades while minimizing slippage and other inefficiencies.

How Do DEX Aggregators Function?

DEX aggregators are sophisticated platforms designed to streamline and optimize token trading across multiple decentralized exchanges (DEXs). Their primary purpose is to aggregate liquidity from various sources, ensuring users receive the best possible prices for their trades. This functionality makes them indispensable tools in the decentralized finance (DeFi) ecosystem.

How They Work

- Smart Order Routing: DEX aggregators employ specialized algorithms to scan multiple DEXs for the best rates on token swaps. These algorithms are crucial for finding the most favorable trading conditions in real-time, helping users avoid manually checking each platform.

- Considering Factors: The algorithms consider several key factors, such as the size of liquidity pools and real-time pricing data. This comprehensive analysis allows aggregators to identify the most optimal trades, considering both availability and cost-effectiveness.

- Optimizing Trades: When a user initiates a trade, the DEX aggregator evaluates the swap rates across different platforms. By comparing these rates, the aggregator ensures that the user receives the best possible price, maximizing the trade's value.

- Reducing Slippage: Slippage refers to the difference between the expected price of a trade and the actual execution price. DEX aggregators minimize slippage by splitting large orders into smaller ones and routing these through the most efficient paths. This not only preserves value but also enhances the trading experience by achieving closer-to-expected prices.

Things to Keep in Mind

While DEX aggregators offer numerous advantages, there are a few considerations to keep in mind:

- Swap Fees: Trades executed through DEX aggregators may incur additional swap fees charged by the underlying exchanges. It's essential for users to be aware of these costs, as they can impact overall profitability.

- Network Congestion: During times of high network demand, transaction fees (gas fees) on the blockchain can increase, affecting the overall cost of trading. Users should consider this when planning their trades, especially during peak times.

By understanding how DEX aggregators function and considering these factors, traders can make more informed decisions and optimize their experiences in the world of decentralized finance (DeFi).

Benefits and Advantages of Using DEX Aggregators

DEX aggregators have become indispensable tools in the decentralized finance (DeFi) ecosystem, offering a range of benefits that significantly enhance the trading experience. By integrating multiple decentralized exchanges (DEXs) into a single platform, these aggregators streamline trading processes and provide users with optimal trading conditions.

1. Enhanced Trade Execution

- Optimized Pricing: DEX aggregators use advanced order routing algorithms to find the best swap rates available across various DEXs. This ensures that users receive the most favorable prices by leveraging liquidity from multiple sources simultaneously.

- Reduced Slippage: By pooling liquidity from different platforms, DEX aggregators reduce slippage—the difference between the expected and actual execution price. This is particularly crucial for large trades, where slippage can significantly impact the overall cost.

2. Access to Deeper Liquidity Pools

- More Market Depth: By aggregating liquidity from multiple exchanges, DEX aggregators provide access to larger liquidity pools. This increased market depth allows users to execute substantial transactions without causing significant price fluctuations, enhancing market stability.

- More Trading Options: Aggregators enable access to a broader range of tokens and trading pairs. This expanded selection allows traders to explore less active markets and capitalize on unique trading opportunities.

3. Cost Efficiency

- Lower Fees: Many DEX aggregators offer fee returns in their native tokens or have fee structures that minimize costs for users. Some platforms may not require upfront fees at all, depending on their liquidity sources and transaction methods.

- Easier Trading: The unified interface of a DEX aggregator simplifies the trading process by providing a single point of access to multiple exchanges. This convenience saves time and reduces the risk of errors that can occur when manually comparing and executing trades on different platforms.

4. User Empowerment

- Equal Opportunities: DEX aggregators democratize access to better trading conditions, allowing individual traders to benefit from the same liquidity and pricing advantages that were traditionally available only to large institutional investors.

- Better Security: Operating on a non-custodial basis, DEX aggregators allow users to maintain control over their assets, reducing the risk of losing funds to exchange hacks or other security breaches. Additionally, many DEX aggregators offer protection against Miner Extractable Value (MEV) attacks, which can occur when miners exploit transaction ordering to their advantage.

The growth and adoption of DEX aggregators have surged during the recent DeFi boom. They have become essential tools for both novice and experienced DeFi users by consolidating liquidity and optimizing trading experiences. As the DeFi landscape continues to evolve, the role of DEX aggregators is likely to expand, further enhancing the efficiency and fairness of financial markets.

Notable DEX Aggregator Platforms to Explore

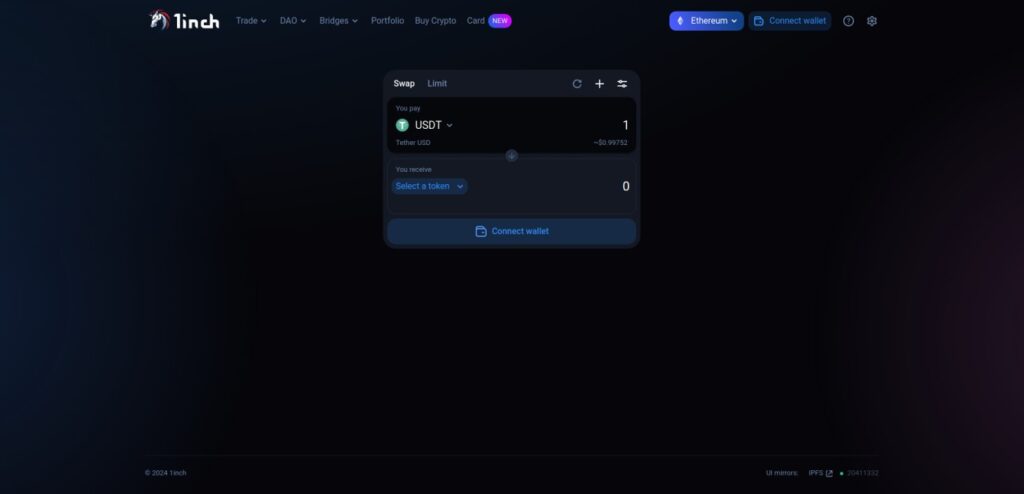

1. 1inch

1inch is a leading DEX aggregator known for providing deep liquidity and innovative trading features across multiple blockchain networks, including Ethereum, Binance Smart Chain, and Polygon. The platform's standout feature is the Pathfinder algorithm, which finds the best possible paths for token swaps, minimizing gas fees and maximizing trade efficiency. This algorithm can split trades across various protocols, optimizing for the best rates and reducing slippage.

Key Features of 1inch:

- Pathfinder Algorithm: Optimizes trading routes across multiple DEXs to provide the best swap rates and reduce gas costs.

- Fusion Mode: Allows gas-free transactions by matching orders directly with market makers.

- Advanced Order Types: Includes limit orders for precise trade execution.

- MEV Protection: Guards against sandwich attacks, ensuring secure and fair trades.

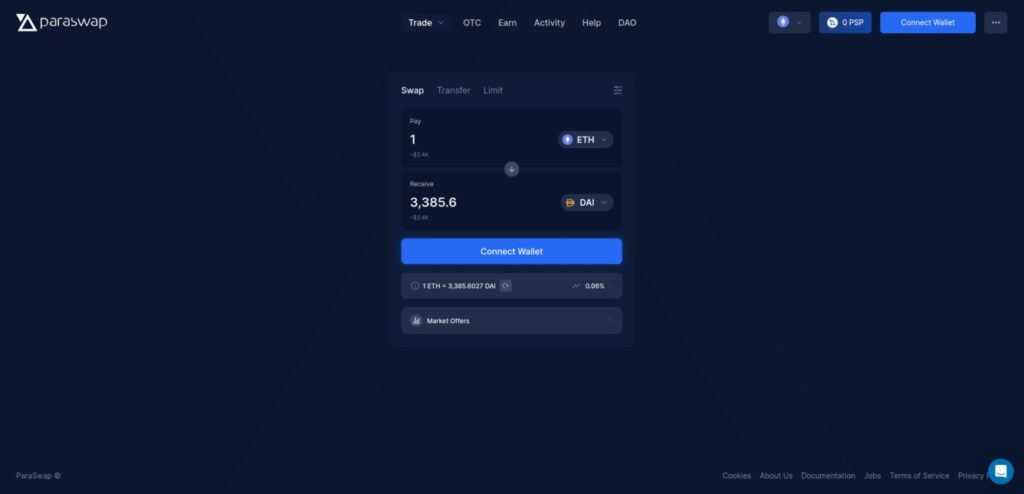

2. ParaSwap

ParaSwap is a prominent DEX aggregator known for its deep liquidity and advanced trading features. It aggregates liquidity from over 100 protocols across multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon. ParaSwap stands out for its ability to offer competitive pricing through features like smart order routing and on-chain Request for Quotes (RFQ), which integrates quotes from top market makers. The platform also offers advanced trading tools such as limit orders, allowing users to set specific conditions for their trades.

Key Features of ParaSwap:

- Deep Liquidity Access: Aggregates from over 100 protocols, offering robust liquidity options.

- Advanced Trading Features: Includes limit orders and smart routing for optimal trade execution.

- MEV Protection: Safeguards users from front-running and other forms of trade manipulation.

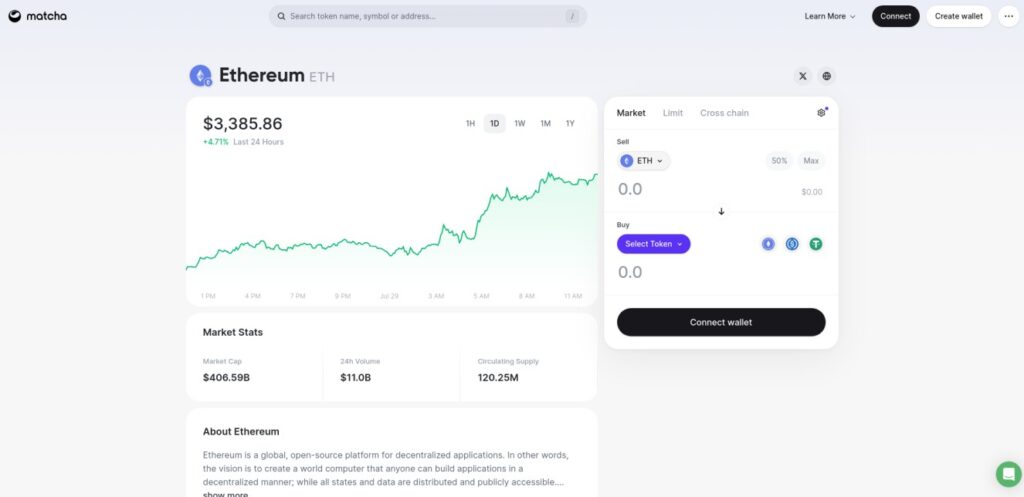

3. Matcha

Matcha, powered by the 0x protocol, is renowned for its extensive liquidity aggregation and advanced trading features. It sources liquidity from over 130 DEXs and is designed to provide the best available prices by using smart order routing. This system splits trades across multiple liquidity sources to minimize costs and maximize efficiency. Key features include protection against Miner Extractable Value (MEV) attacks, ensuring that users are safeguarded from front-running and sandwich attacks.

Key Features of Matcha:

- MEV Protection: Prevents front-running and sandwich attacks to ensure fair trade execution.

- Smart Order Routing: Optimizes trades by leveraging liquidity from multiple sources.

- Multi-Chain Support: Facilitates trading across Ethereum, BSC, and Polygon, with seamless transitions and competitive pricing.

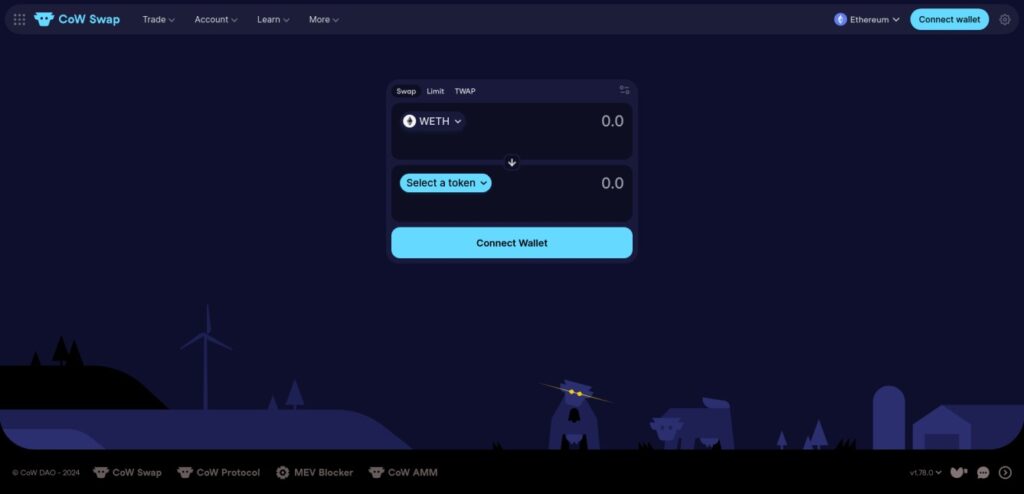

4. CowSwap (CoW Protocol)

CowSwap, operating on the CoW Protocol, offers a unique approach to DEX aggregation by using batch auction mechanisms. This method significantly reduces gas costs for users and improves price execution through CoW (Coincidence of Wants) settlements, where direct matches between buyers and sellers are made without relying solely on external liquidity. Additionally, CowSwap provides gasless orders, allowing users to place trades without the need for ETH to cover gas fees. This feature, along with its user-friendly interface, makes CowSwap accessible to a wide range of users

Key Features of CowSwap:

- Batch Auction Mechanism: Aggregates multiple trades into a single transaction to save on gas fees and optimize execution.

- CoW Settlements: Matches buy and sell orders directly, reducing reliance on external liquidity and lowering costs.

- Gasless Orders: Users can trade without needing ETH for gas fees, enhancing cost efficiency.

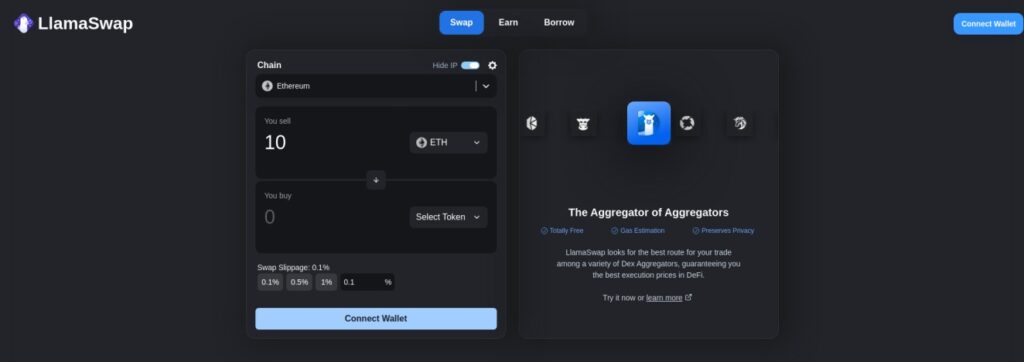

5. LlamaSwap

LlamaSwap, a product of DeFiLlama, is a data-driven DEX aggregator designed for seamless multi-chain token swaps. It aggregates liquidity from various decentralized exchanges, providing users with the best possible trading rates. LlamaSwap supports multiple blockchains, including Ethereum, Binance Smart Chain, and Avalanche, allowing users to trade across different ecosystems with ease. The platform emphasizes transparency and optimal trade execution through advanced routing algorithms, ensuring competitive pricing for all trades.

Key Features of LlamaSwap:

- Data-Driven Aggregation: Uses extensive DeFiLlama data to optimize trades.

- Multi-Chain Support: Facilitates token swaps across multiple blockchains.

- Competitive Pricing: Ensures the best rates through smart routing.

For a comprehensive list of DEX aggregators, including these and many others, you can visit the DeFiShills Aggregators page. This resource provides detailed information on each platform, helping users choose the most suitable aggregator for their trading needs.

These platforms exemplify the innovation and versatility of DEX aggregators in the DeFi space. By providing access to diverse liquidity pools and optimizing trade execution, they are essential tools for both novice and seasoned traders looking to maximize their DeFi experience.

DEX Aggregators vs. Centralized Exchanges: A Comparative Analysis

Decentralized exchange aggregators (DEX aggregators) and centralized exchanges (CEXs) represent two distinct approaches to cryptocurrency trading, each offering unique advantages and challenges. Understanding the differences between these platforms is crucial for traders to make informed decisions based on their specific needs and preferences.

Characteristics and Trade-offs

Centralized Exchanges (CEXs):

- Custodial Nature: CEXs hold users' funds in custodial wallets, meaning users must trust the exchange to securely manage their assets. This setup provides convenience but requires a significant level of trust.

- Regulation and Compliance: CEXs are typically subject to regulatory oversight, which often includes Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This ensures compliance with legal standards but can compromise user privacy.

- Liquidity and Speed: Centralized exchanges usually offer deep liquidity and fast transaction speeds due to their consolidated order books. This can lead to better trade execution and less slippage, particularly for high-volume traders.

DEX Aggregators:

- Non-Custodial Trading: Users retain control over their private keys and assets, providing enhanced security. However, this also means that users are responsible for managing their own security measures, such as protecting their private keys.

- Decentralization: DEX aggregators operate without a central authority, offering greater privacy and resistance to censorship. This decentralization can protect against regulatory interference and provide users with greater autonomy.

- Liquidity Sourcing: DEX aggregators aggregate liquidity from multiple decentralized exchanges, potentially leading to better price execution by accessing a wider range of liquidity pools. This can be especially beneficial for trading less common tokens.

Advantages of Decentralized Liquidity Protocols

- Security and Control:

- User Sovereignty: DEX aggregators empower users to maintain control over their assets, reducing the risk of losing funds to exchange hacks.

- Reduced Risk of Hacks: Without a central point of failure, decentralized systems are less susceptible to large-scale hacks compared to centralized exchanges, which hold significant amounts of user funds.

- Privacy and Anonymity:

- No Mandatory KYC: Decentralized platforms do not require KYC, preserving user anonymity and privacy.

- Censorship Resistance: Transactions on decentralized platforms are less likely to be censored or blocked, providing users with greater freedom in their trading activities.

Potential Risks

Despite the advantages, DEX aggregators come with certain risks:

- Smart Contract Vulnerabilities: The reliance on smart contracts introduces the risk of coding errors or exploits. Users must trust that the smart contracts have been thoroughly audited and are secure.

- Liquidity Fragmentation: While DEX aggregators aim to consolidate liquidity, some tokens may still experience fragmented liquidity across different platforms, potentially leading to less favorable trade execution.

DEX aggregators offer a compelling alternative to traditional centralized exchanges, providing enhanced security, privacy, and potentially better pricing through decentralized liquidity protocols. However, they also require users to take on more responsibility for security and navigating fragmented liquidity.

Exploring Cross-Chain DEX Aggregators

Cross-chain DEX aggregators represent a significant advancement in the decentralized finance (DeFi) ecosystem, enabling seamless trading of assets across multiple blockchains. Unlike traditional DEX aggregators, which operate within a single blockchain ecosystem, cross-chain aggregators facilitate transactions between different blockchain networks, expanding the range of tradable assets and enhancing overall market liquidity.

Notable Cross-Chain DEX Aggregators

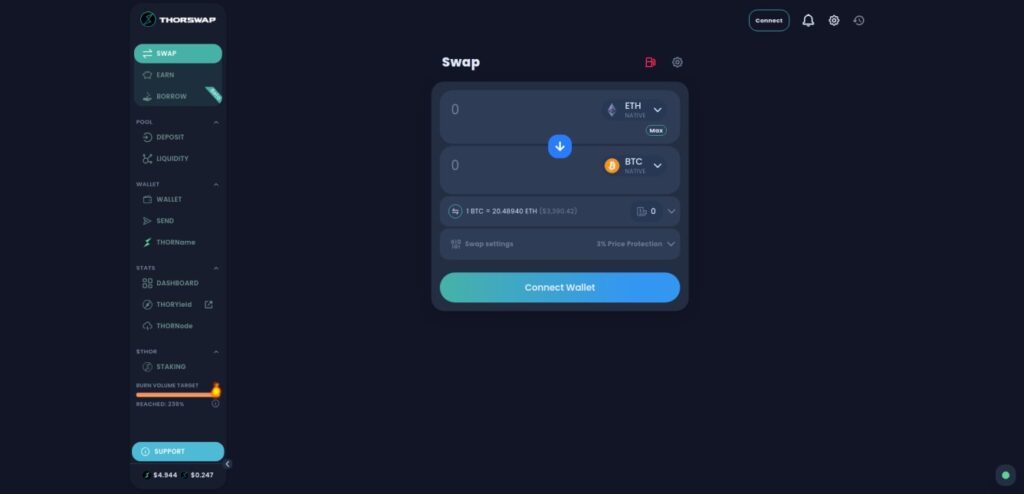

1. ThorSwap

ThorSwap is a prominent cross-chain DEX aggregator built on the Thorchain network. It facilitates the trading of native digital assets across multiple blockchains without needing wrapped tokens or synthetic assets. This platform uses a unique consensus mechanism called Tendermint and the native token, RUNE, to secure the network and facilitate transactions.

Key Features:

- Native Asset Swaps: ThorSwap enables users to swap native assets directly across blockchains, preserving the original token's form.

- Decentralized Liquidity Pools: Users can provide liquidity and earn fees and rewards in RUNE.

- Non-Custodial Trading: Ensures that users maintain control over their assets throughout the trading process.

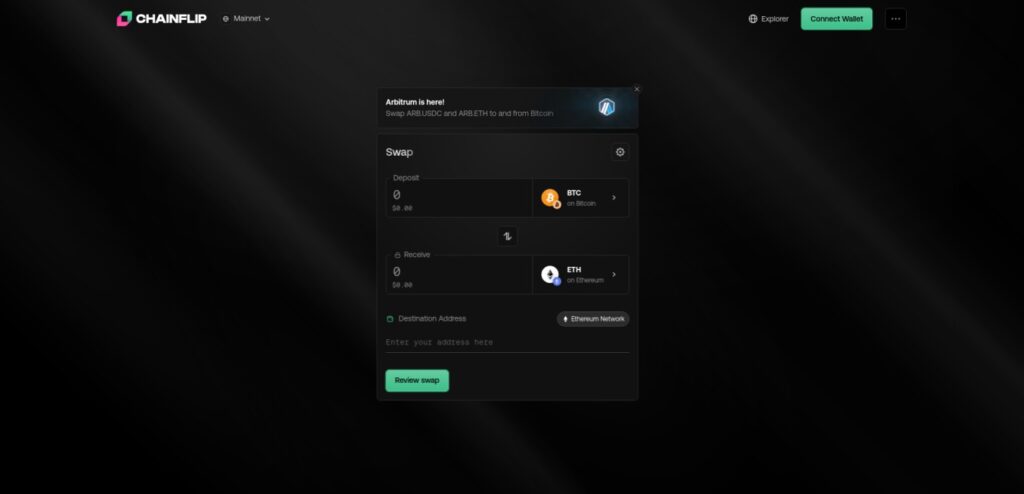

2. Chainflip

Chainflip is another innovative cross-chain DEX aggregator that facilitates seamless trading between different blockchain networks. Unlike traditional DEXs, Chainflip focuses on providing a simple user experience for cross-chain swaps, leveraging a unique protocol to ensure efficient and secure transactions.

Key Features:

- Cross-Chain Compatibility: Supports a wide range of blockchains, enabling users to trade assets from multiple ecosystems.

Cross-chain DEX aggregators are poised to become integral to the DeFi ecosystem, providing the infrastructure necessary for a more interconnected and liquid market. By facilitating seamless asset transfers across different blockchains, they enhance accessibility and efficiency for traders and investors alike.

How to Choose the Right DEX Aggregator

Selecting the right DEX aggregator is crucial for optimizing your trading experience in the DeFi space. Here are some key factors to consider when making your choice:

1. Supported Assets

- Variety of Tokens: Ensure the aggregator supports a wide range of cryptocurrencies, including those you plan to trade. Some aggregators offer broader market access by listing a more extensive selection of tokens, which can be beneficial for diversifying your portfolio.

- Specialty Tokens: If you're interested in trading niche or less common tokens, verify that the aggregator has access to the necessary liquidity pools for these assets. This is essential for executing trades without significant slippage or delays.

2. Liquidity and Depth

- Liquidity Availability: The amount of liquidity an aggregator can access significantly impacts trade execution, particularly for large orders. Aggregators with connections to multiple DEXs can offer better liquidity, minimizing slippage and providing smoother transactions.

- Market Depth Insights: Some platforms provide insights into market depth, helping traders understand the liquidity landscape. This information can be crucial for gauging the potential impact of trades on market prices, especially in less liquid markets.

3. Fees and Costs

- Transaction Fees: Understand the fee structure, including platform and transaction fees from the underlying DEXs. Some aggregators offer gas fee optimization features, such as discounts or special tokens, to reduce costs on networks like Ethereum.

Choosing the right DEX aggregator involves balancing supported assets, liquidity access, and fee structures to optimize your trading experience.

Example: Different Results from Two Aggregators

To illustrate how different DEX aggregators can yield varying results, consider the example of CowSwap and ParaSwap. Both platforms offer unique mechanisms and pricing strategies, which can lead to different outcomes for the same trade.

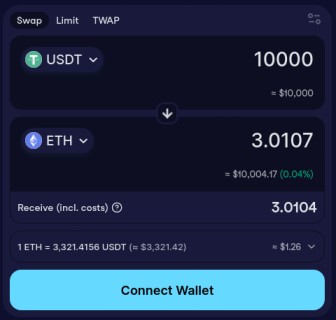

CowSwap:

- Mechanism: CowSwap utilizes a batch auction mechanism to find the best prices across multiple DEXs. It includes fees in the amount received by the user, which means there are no upfront costs. Additionally, CowSwap does not require users to hold ETH to cover gas fees, making it convenient for those who may not have ETH available.

- Example Trade: For a swap of 10,000 USDT to ETH, CowSwap might offer an amount received of approximately 3.0104 ETH, with fees deducted from the received ETH amount.

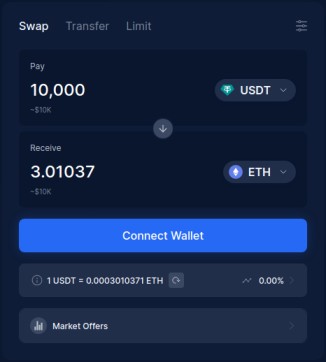

ParaSwap:

- Mechanism: ParaSwap aggregates liquidity across multiple sources, offering competitive rates by potentially splitting trades across different DEXs. Users need to cover the gas fees with ETH, and the platform offers various fee structures depending on the liquidity source.

- Example Trade: For the same 10,000 USDT to ETH swap, ParaSwap might offer an amount received of approximately 3.01037 ETH, with a different fee structure and requiring users to have ETH to cover the transaction fees.

By comparing these results, users can see that while the difference in the amount of ETH received is slight, the fee structure and requirements (like needing ETH for gas on ParaSwap) can influence the overall trading experience. It's essential for users to consider these differences when selecting an aggregator, as the optimal choice can depend on factors such as available assets, fee structures, and the specific trading conditions of the moment.

How to Use a DEX Aggregator: A Step-by-Step Guide

Using a DEX aggregator can greatly enhance your trading experience in the DeFi space by providing access to multiple liquidity pools and ensuring the best trade execution. Here's a comprehensive guide on how to get started:

1. Connect Your Wallet

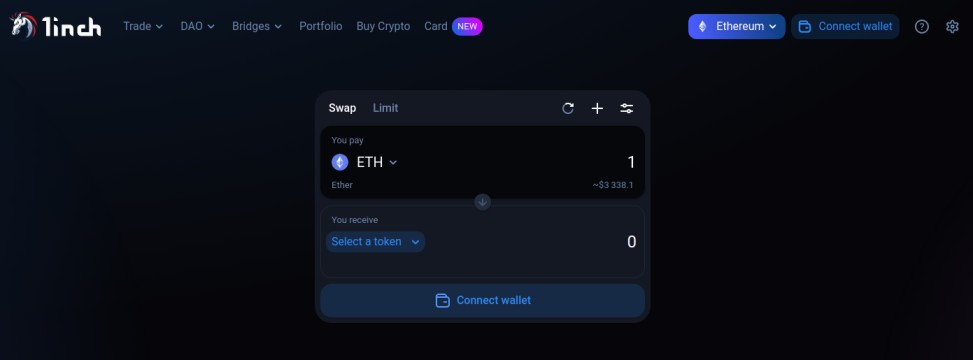

- Begin by connecting a compatible cryptocurrency wallet to the DEX aggregator platform. For this guide, we are using 1inch. A popular option is the Rabby wallet, known for its user-friendly interface and strong security features.

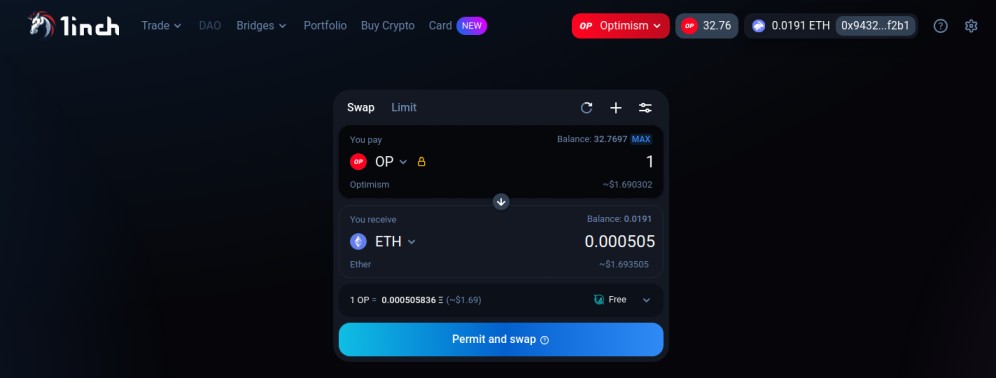

2. Select Your Network and Trading Pairs

- Choose the blockchain network you wish to use (e.g., Ethereum, Binance Smart Chain). Then, select the cryptocurrency pair you intend to trade. The DEX aggregator will display the available rates across various exchanges, allowing you to choose the best option.

3. Review Trade Details and Execute Transaction

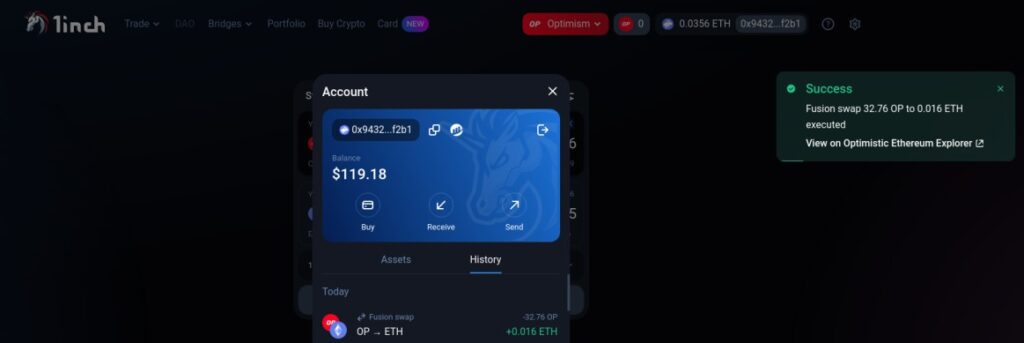

- Carefully review the trade details, including the selected route, expected price, and any associated fees. Some platforms, like 1inch, offer features such as gas fee optimization to reduce costs. Once satisfied with the details, confirm and execute the transaction.

4. Monitor the Transaction, Optionally View Explorer

- After executing the trade, monitor the transaction status through the aggregator platform or your connected wallet. You can also view the transaction details on a blockchain explorer for verification and additional transparency.

5. Security Best Practices:

- Always verify the URL of the DEX aggregator platform to avoid phishing scams. Ensure your wallet's security settings are configured correctly, and consider using hardware wallets like Ledger, Trezor, or GridPlus for added protection. These devices provide a secure environment for managing your private keys, significantly reducing the risk of unauthorized access.

This guide provides a straightforward path to using DEX aggregators, highlighting the importance of security and thoroughness in the DeFi trading process. By following these steps, you can confidently navigate the decentralized finance ecosystem and make the most of the benefits offered by DEX aggregators.

Embracing the Power of DEX Aggregators

DEX aggregators significantly enhance the DeFi trading experience by consolidating liquidity from various platforms, providing users with optimal prices, and minimizing slippage and costs. These tools empower traders by offering a streamlined way to explore a vast array of tokens and markets, thereby giving them greater control and efficiency in their trading activities.

As the DeFi ecosystem continues to expand, DEX aggregators will become increasingly crucial in making decentralized trading more accessible and user-friendly. They not only democratize access to financial markets but also enhance security and transparency, setting the stage for a more inclusive financial future.

This comprehensive overview has provided insights into the functionality and benefits of DEX aggregators, as well as practical guidance on choosing and using these platforms effectively.

FAQs (Frequently Asked Questions)

What is the significance of DEX aggregators in improving trade execution for DeFi users?

DEX aggregators improve trade execution by aggregating liquidity from multiple decentralized exchanges (DEXs). This aggregation allows users to find the best prices and minimize slippage, ensuring optimal trading conditions and better overall value for each transaction.

How do DEX aggregators function?

DEX aggregators function by utilizing advanced algorithms to scan various DEXs and liquidity sources for the best rates on token swaps. They consider factors such as liquidity pool size, real-time pricing, and transaction fees to provide users with the most efficient and cost-effective trade routes.

What are the benefits and advantages of using DEX aggregators?

The primary benefits of using DEX aggregators include access to a wide range of liquidity pools, competitive pricing, and reduced slippage. Additionally, these platforms simplify the trading process by offering a single interface for accessing multiple DEXs, saving time and reducing complexity for users.

What are notable DEX aggregator platforms to explore?

Notable DEX aggregator platforms include 1inch, ParaSwap, ThorSwap, and Chainflip. These platforms are recognized for their extensive liquidity access, advanced features like gas fee optimization, and support for cross-chain swaps.

How do DEX aggregators compare to centralized exchanges?

While centralized exchanges (CEXs) typically offer deep liquidity and fast trade execution, they require users to trust the platform with their assets. In contrast, DEX aggregators provide non-custodial trading, enhancing security and privacy. However, DEX aggregators may face challenges such as smart contract vulnerabilities and varying liquidity across platforms.

What is the significance of cross-chain DEX aggregation?

Cross-chain DEX aggregation is crucial for enabling seamless trading of assets across different blockchains. It addresses the challenge of isolated liquidity by allowing users to access a broader range of tokens and liquidity pools, thereby enhancing market efficiency and providing more trading opportunities.

How do DEX aggregators empower users to navigate the decentralized financial landscape?

DEX aggregators empower users by providing access to diverse liquidity sources and optimal trade execution. They democratize financial markets by offering tools that cater to both novice and experienced traders, making decentralized finance more accessible and efficient.