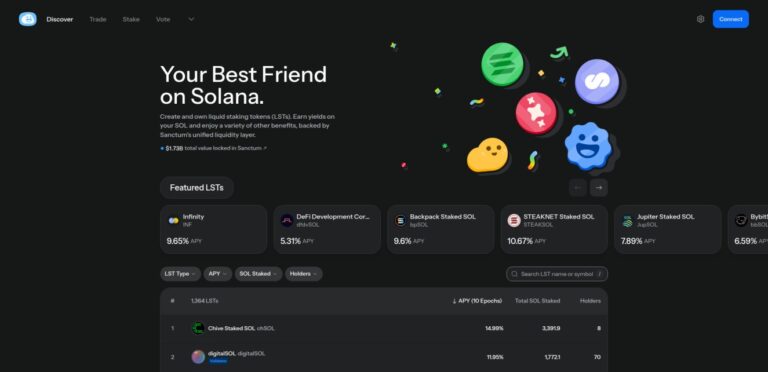

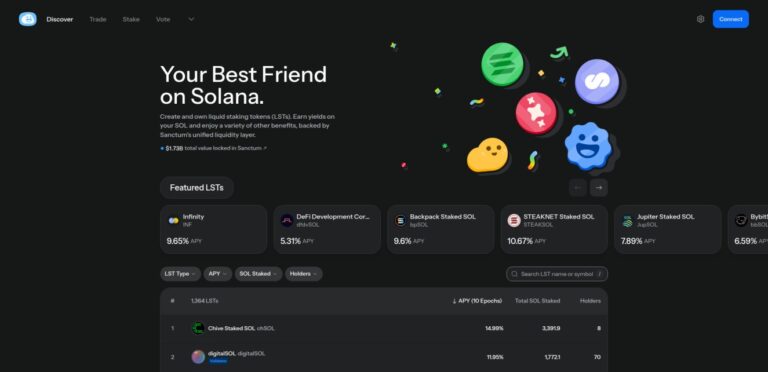

Sanctum

Sanctum is a liquid staking ecosystem on Solana. Stake SOL to receive LSTs that auto-compound and stay tradable. One namespace: stake, trade, and issue your own LSTs.

Sanctum is a liquid staking ecosystem on Solana. Stake SOL to receive LSTs that auto-compound and stay tradable. One namespace: stake, trade, and issue your own LSTs.

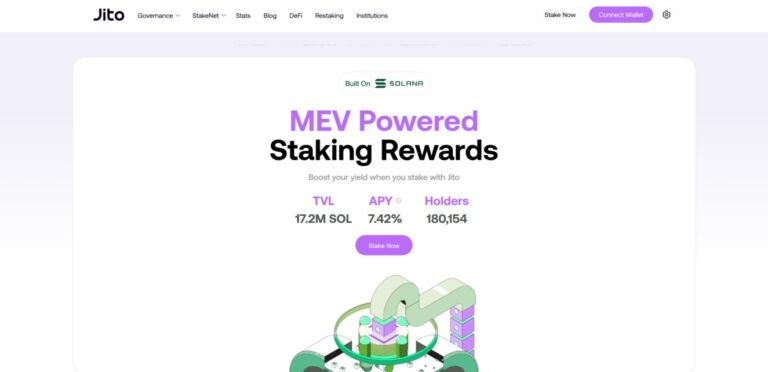

Jito is Solana’s MEV-powered liquid staking protocol. Stake SOL to receive JitoSOL while earning MEV rewards. Validators are optimized for maximum staking yield.

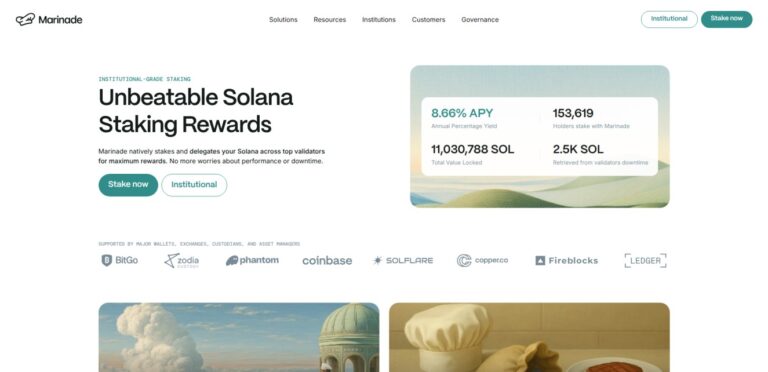

Marinade is Solana’s leading liquid staking protocol. Stake SOL to receive mSOL while earning rewards. Choose native staking or liquid staking with optimized validator delegation.

Solv Protocol brings liquid staking and yield to BTC holders. Mint SolvBTC 1:1 with Bitcoin, stake for yield, and access LSTs. Powered by SAL middleware and cross-chain DeFi infrastructure.

Babylon enables native Bitcoin staking—lock BTC directly to secure Proof-of-Stake chains. Stake BTC without wrapping, maintain self-custody, and earn rewards on a fast unbonding timeline.

Bedrock is a multi-asset liquid restaking protocol for assets like Ethereum and Bitcoin, offering secure, oracle-less staking integrated with platforms like EigenLayer.

Karak Network is a DeFi protocol focused on restaking. It provides a secure and scalable platform for decentralized restaking, enhancing network security and yield opportunities for users.

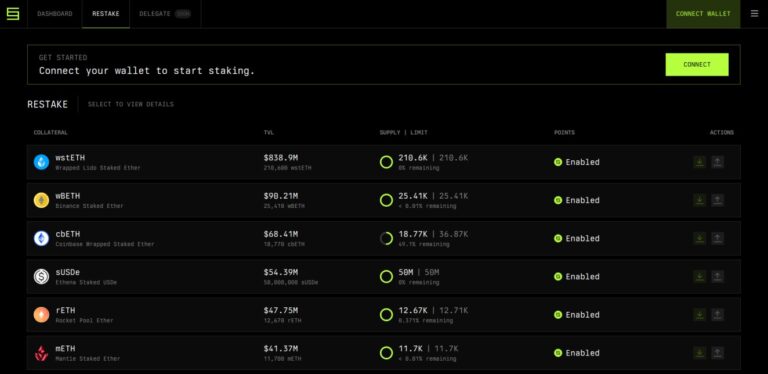

Symbiotic is a DeFi protocol offering permissionless restaking and shared security. It enhances scalability and security for decentralized networks through flexible, modular contracts.

SolBlaze is a DeFi platform on Solana offering liquid staking with BlazeStake and BlazeRewards. It provides tools like a Solana faucet, RPC status page, and a token minter.

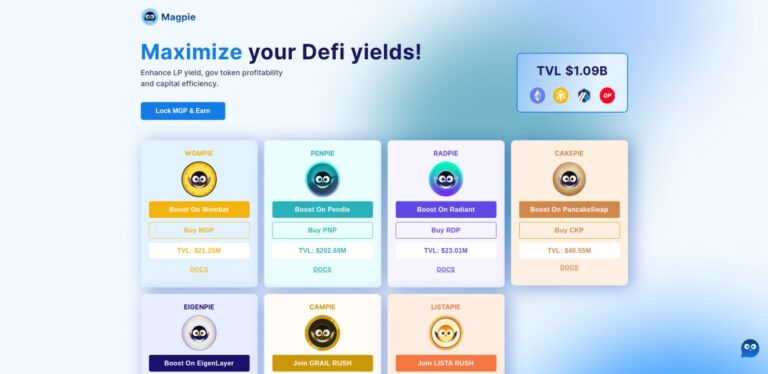

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

ether.fi is a liquid restaking protocol on EigenLayer, allowing users to stake ETH and receive eETH, a liquid token for DeFi. It supports rewards from EigenLayer and lets stakers control their keys.

KelpDAO is a liquid restaking protocol on EigenLayer, supporting tokens like ETH and stETH. It offers the rsETH token for earning yields while maintaining liquidity, with various DeFi integrations.

Renzo Protocol is a liquid restaking platform on EigenLayer, enabling easy restaking of Ethereum and Liquid Staking Tokens. It supports multiple networks and over 100 DeFi integrations.

Dinero facilitates on-chain liquidity, governance, cash flow in DeFi, offering products like Pirex for yield tokenization, and Hidden Hand for governance incentives.

Eigenlayer serves as a first Ethereum restaking interface, enabling users to manage Ethereum restaking, view token data, and track Total Value Locked.

Swell Network simplifies liquid staking for ETH, helping users optimize yield in DeFi by staking ETH, earning swETH, and maximizing returns within the ETH DeFi ecosystem.

StakeWise offers effortless Ethereum staking through a secure infrastructure, with real-time monitoring, DeFi strategy integrations, and tools for app integration.

Rocket Pool is a decentralized Ethereum staking protocol, enabling users to stake ETH with lower entry requirements, earning staking rewards without locking ETH or maintaining infrastructure.

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.

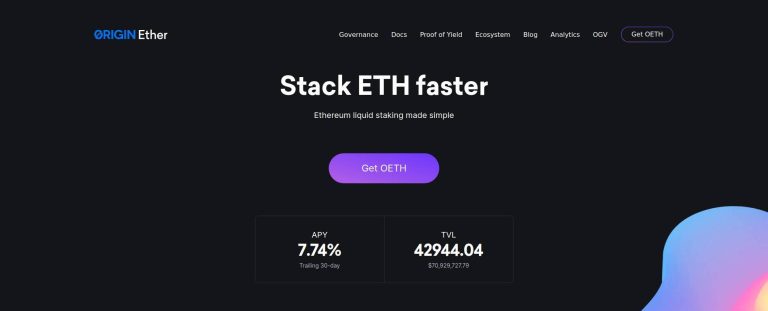

Origin Protocol (OETH) is an ETH staking yield aggregator, maximizing yields through meticulous strategies, fully collateralized by ETH and blue-chip liquid staking derivatives.

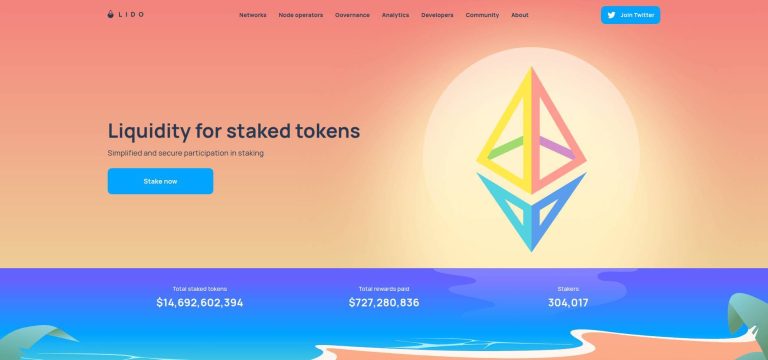

Lido offers liquid staking for Ethereum, Polygon, and Solana, enabling users to earn rewards without locking assets, enhancing decentralized finance liquidity.