DeFi Asset Management: Crafting a Symphony of Financial Efficiency

Step into a realm of strategic and automated asset optimization with our premium selection of DeFi Asset Management Platforms. These meticulously designed platforms provide intuitive solutions for managing, tracking, and optimizing your portfolio of digital assets in the decentralized finance space. With features ranging from automated yield farming strategies to dynamic portfolio rebalancing, these platforms embody the convergence of ease-of-use and sophisticated asset management, crafting a harmonious symphony of financial efficiency and innovation. Engage with tools and interfaces that not only simplify your investment process but also maximize the potential returns on your assets through intelligent and automated protocols. With DeFi Asset Management Platforms, you’re orchestrating a masterpiece of financial brilliance, where each asset moves fluidly, contributing to your overarching investment melody.

Awaken

Awaken is a crypto tax engine built for DeFi, NFTs, and multi-chain activity. Sync full history for swaps, bridges, staking, and more. Auto-categorizes income and gains with audit-ready precision.

Cygnus Finance

Cygnus is a modular protocol for issuing native, yield‑bearing assets like cgUSD, clBTC, and cgETH. It delivers real yield sourced from short-term U.S. Treasuries and onchain derivative strategies.

DeBank

DeBank is a comprehensive DeFi dashboard and portfolio management platform, aggregating users' DeFi positions across over multiple protocols and blockchains.

DeFi Saver

DeFi Saver offers a dashboard for managing DeFi positions, automating leverage management, refinancing loans, and executing custom transactions.

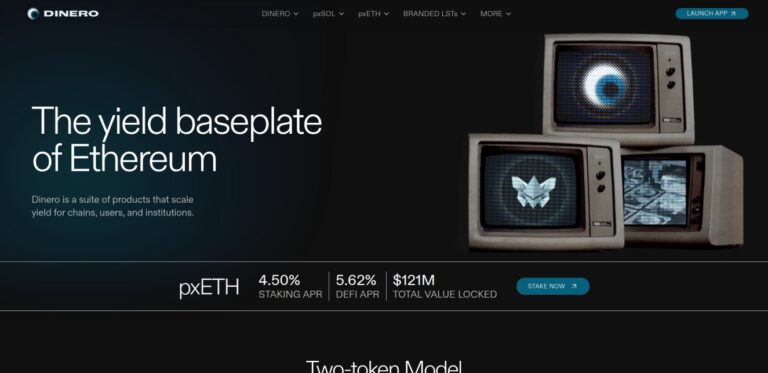

Dinero

Dinero facilitates on-chain liquidity, governance, cash flow in DeFi, offering products like Pirex for yield tokenization, and Hidden Hand for governance incentives.

Furucombo

Furucombo is an innovative decentralized platform aimed at simplifying the process of utilizing various DeFi (Decentralized Finance) protocols to maximize users' returns.

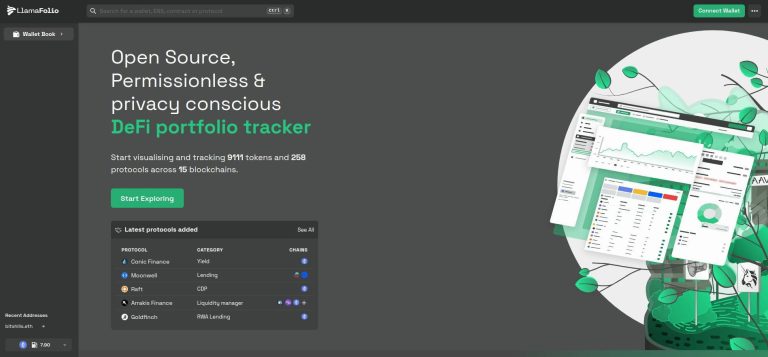

LlamaFolio

LlamaFolio is a privacy-conscious DeFi portfolio tracker, supporting multiple tokens and protocols across different blockchains for comprehensive asset management.

Revoke Cash

Revoke.cash enables users to revoke token approvals on ethereum ecosystem, aiding in enhancing wallet security by preventing unauthorized access to funds.

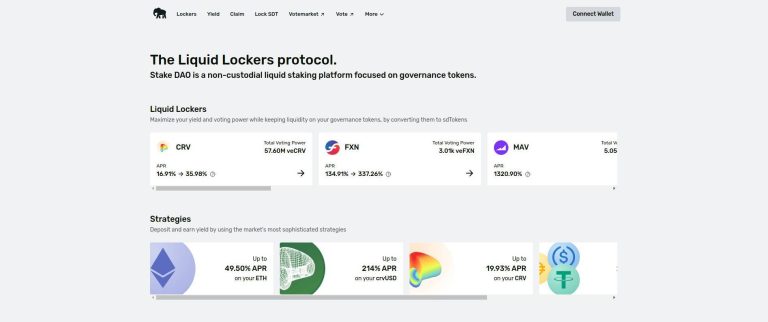

StakeDAO

Stake DAO offers yield generation, Liquid Lockers, non-custodial asset management, staking, governance, and diverse strategies for decentralized finance users.

YieldFi

YieldFi is a fully on-chain asset management protocol offering curated yield index tokens like YUSD, YETH, and YBTC. It combines institutional-grade strategies with DeFi-native transparency.

Zapper

Zapper provides DeFi portfolio management and analysis, offering insights on your and others financial activities within the decentralized finance ecosystem.

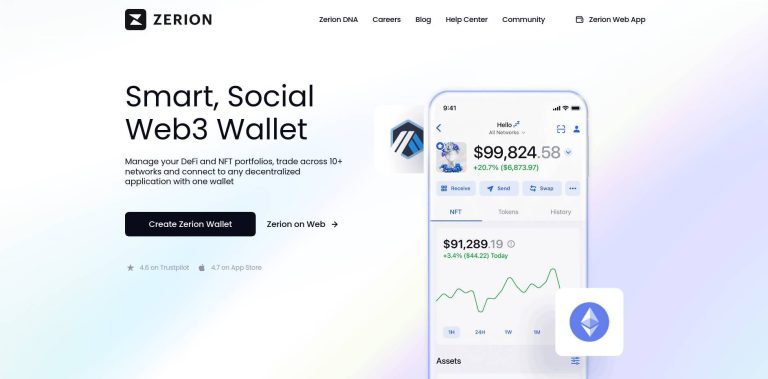

Zerion

Zerion aggregates various DeFi protocols, enabling users to manage portfolios, track investments, and explore DeFi opportunities through a unified interface.