DeFi Yield Aggregators: Optimizing Returns with Strategic Harvesting

Embark on a journey of maximized profits and streamlined yield farming with our highlighted DeFi Yield Aggregators. These innovative platforms consolidate various yield-generating opportunities within the DeFi ecosystem, implementing automated strategies to optimize your returns efficiently. Yield Aggregators work diligently to explore, evaluate, and exploit the best yield farming pools and strategies, allocating your assets intelligently to navigate the complex, ever-changing landscape of decentralized finance yields. Engage in a hassle-free, profitable experience where the intricate details are handled for you, providing a gateway to diversified and robust earnings without the need for constant monitoring and adjustment. With DeFi Yield Aggregators, revel in the confluence of simplicity and maximized yield, as your assets are expertly maneuvered to harvest the fruits of the DeFi field.

Asymmetry Finance

Asymmetry Finance is a DeFi protocol focused on yield generation through optimized liquidity provision. It offers afUSD, afETH, afeETH, and afCVX for diverse strategies and financial solutions.

Aura Finance

Aura Finance amplifies DeFi yield and governance, optimizing Balancer Pool Tokens, boosting BAL rewards, and enabling community-driven governance and innovation.

Beefy Finance

Beefy Finance is a decentralized finance, multichain yield optimizer and aggregator that maximizes DeFi rewards through smart-contract enforced strategies.

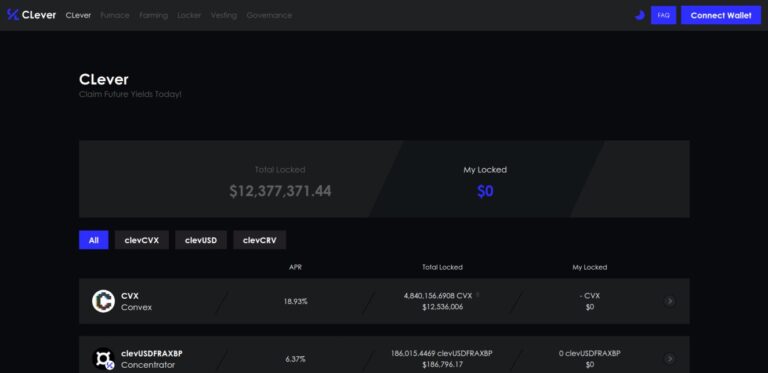

CLever

CLever is a CVX wrapper built on top of Convex, allowing users to earn boosted yields on their CVX tokens. It offers strategies for locking CVX and automating yield harvesting.

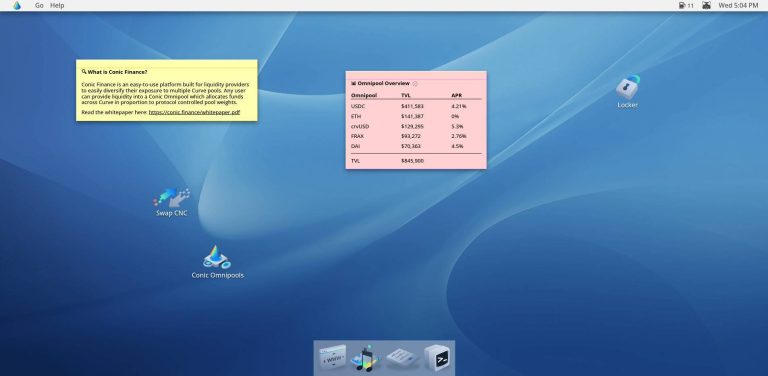

Conic Finance

Conic Finance allows liquidity providers to diversify across multiple Curve pools via Omnipools on Ethereum ecosystem, governed by Conic DAO votes.

Convex Finance

Convex Finance amplifies rewards for Curve liquidity providers and CRV holders, simplifying liquidity provisioning and decentralized finance yield optimization.

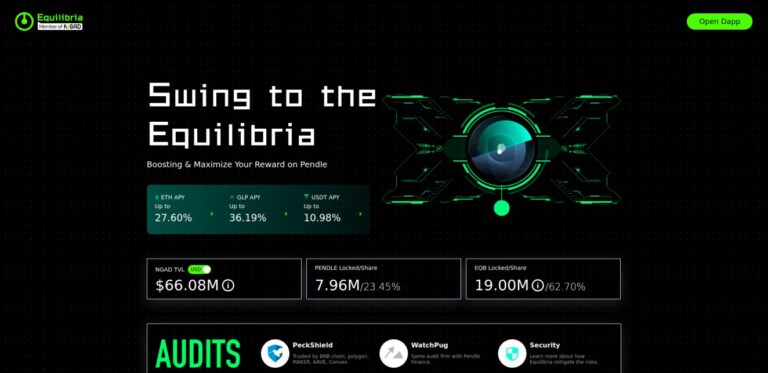

Equilibria

Equilibria is a DeFi platform built on top of Pendle, specializing in yield optimization and risk management. It offers structured financial products that enhance returns while managing volatility.

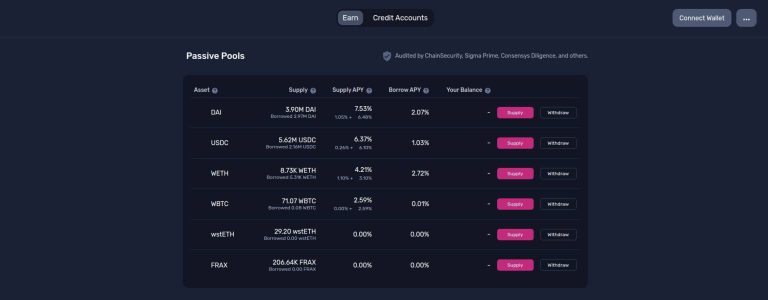

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

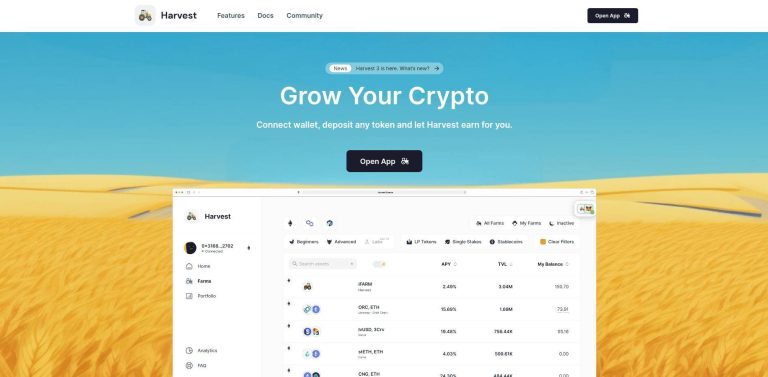

Harvest Finance

Harvest Finance automates yield farming via Ethereum-based vaults, optimizing returns, reducing gas costs, and offering user-friendly farming opportunities.

infiniFi

infiniFi is a fractional-reserve yield aggregator minting iUSD/iETH against USDC/ETH. Lock or remain liquid to optimize yield via both liquid and illiquid farms.

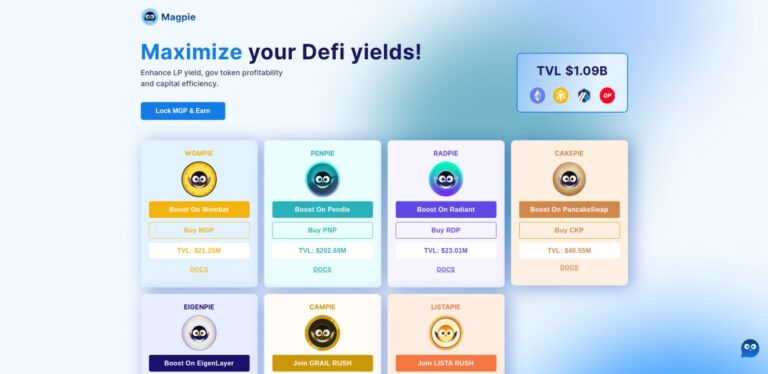

Magpie

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

Pickle Finance

Pickle Finance enhances yields via auto-compounding rewards, ensuring time and gas savings for a more efficient user experience in the DeFi ecosystem.

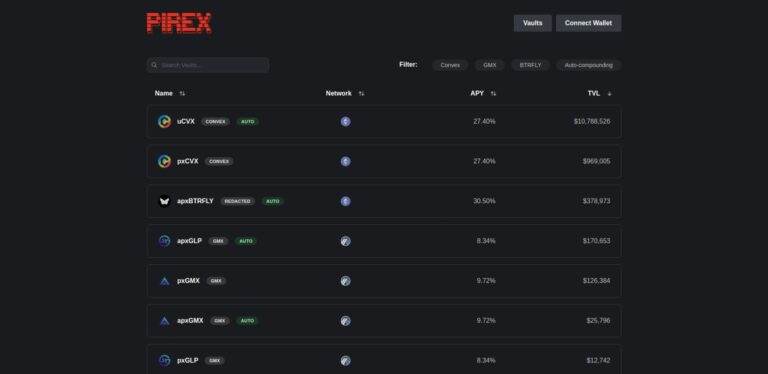

Pirex

Pirex is a CVX wrapper designed to maximize yields on Convex Finance. It allows users to tokenize their locked CVX, providing liquidity and flexibility while continuing to earn rewards.

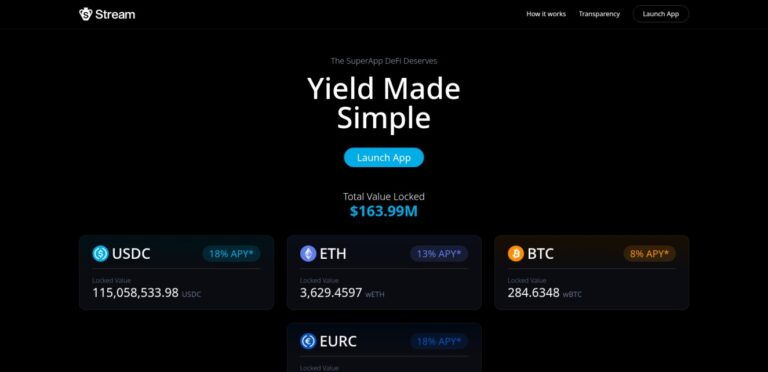

Stream Protocol

Stream is a delta-neutral yield protocol using market-making and funding rate strategies. Deposit USDC, EURC, ETH, or wBTC into vaults that bridge across chains via LayerZero.

Superform

Superform is a cross-chain yield router and aggregator. Users deposit assets into SuperVaults and earn optimized yield across vaults-on any chain-in a single transaction.

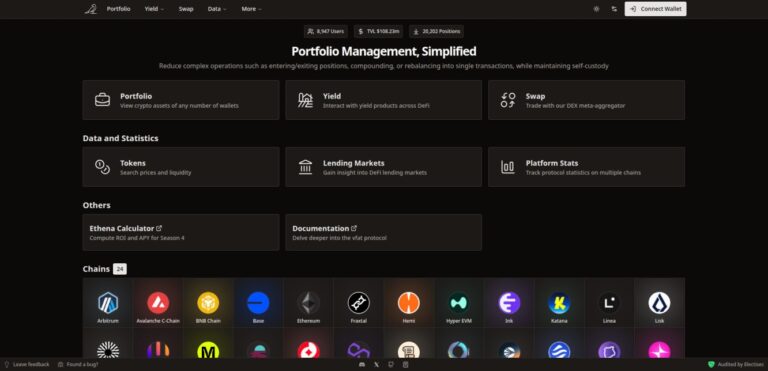

vfat

vfat vfat is a yield farming dashboard that aggregates DeFi protocols. Track rewards and LP positions across multiple chains. Scan APRs, compare farms, and find new opportunities.

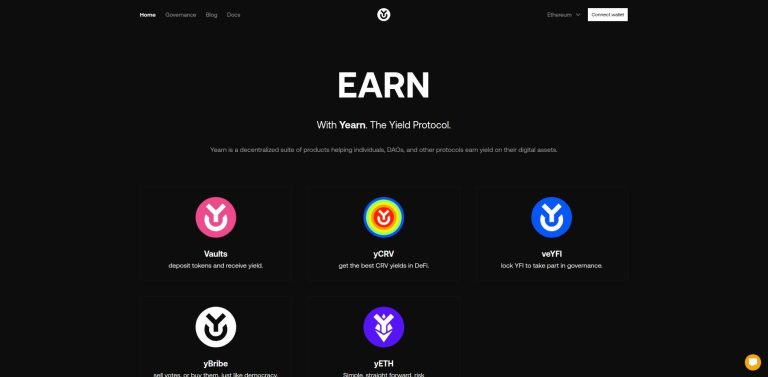

Yearn

Yearn Finance provides a decentralized suite of products for individuals, DAOs, and protocols to optimize earnings on their digital assets in the Ethereum ecosystem.

YieldFi

YieldFi is a fully on-chain asset management protocol offering curated yield index tokens like YUSD, YETH, and YBTC. It combines institutional-grade strategies with DeFi-native transparency.

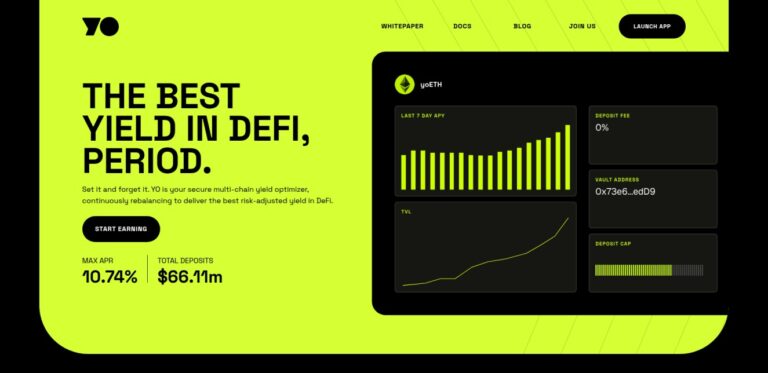

YO Protocol

YO is a multi‑chain, risk‑aware yield optimizer protocol. Deposit BTC, ETH, SOL or USDC into trusted vaults. Receive static ERC‑4626 yoTokens (e.g. yoETH) that auto‑accrue yield.