DeFi Yield Aggregators: Optimizing Returns with Strategic Harvesting

Embark on a journey of maximized profits and streamlined yield farming with our highlighted DeFi Yield Aggregators. These innovative platforms consolidate various yield-generating opportunities within the DeFi ecosystem, implementing automated strategies to optimize your returns efficiently. Yield Aggregators work diligently to explore, evaluate, and exploit the best yield farming pools and strategies, allocating your assets intelligently to navigate the complex, ever-changing landscape of decentralized finance yields. Engage in a hassle-free, profitable experience where the intricate details are handled for you, providing a gateway to diversified and robust earnings without the need for constant monitoring and adjustment. With DeFi Yield Aggregators, revel in the confluence of simplicity and maximized yield, as your assets are expertly maneuvered to harvest the fruits of the DeFi field.

Alpaca Finance

Alpaca Finance offers leveraged yield farming, lending, and automated vaults on Binance Smart Chain, optimizing yield strategies and managing risks.

Beefy Finance

Beefy Finance is a decentralized finance, multichain yield optimizer and aggregator that maximizes DeFi rewards through smart-contract enforced strategies.

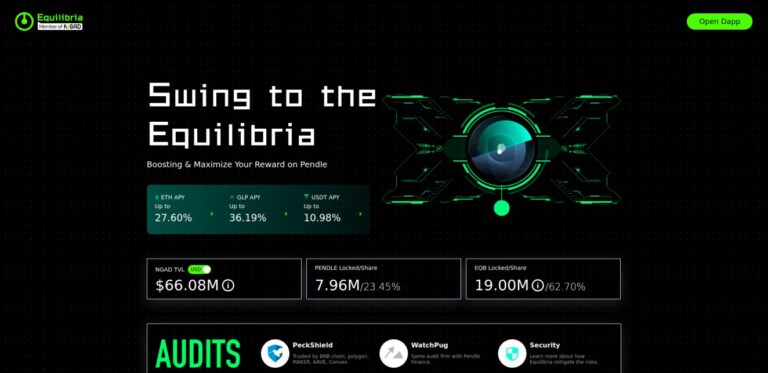

Equilibria

Equilibria is a DeFi platform built on top of Pendle, specializing in yield optimization and risk management. It offers structured financial products that enhance returns while managing volatility.

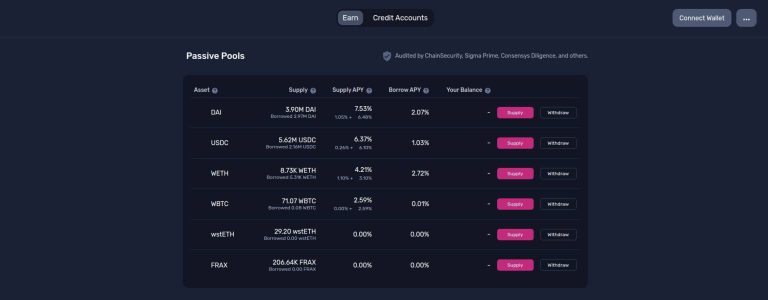

Gearbox

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

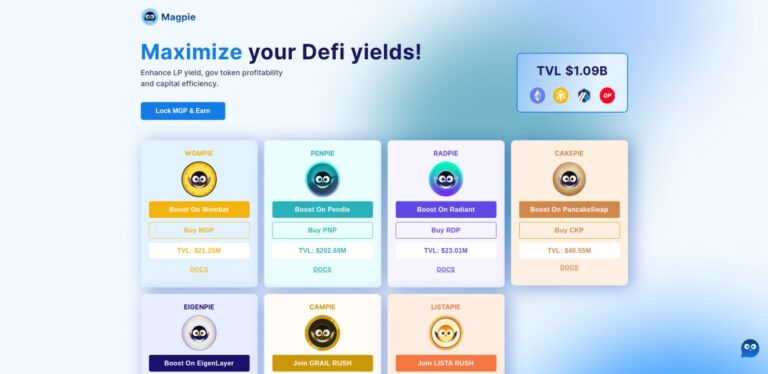

Magpie

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

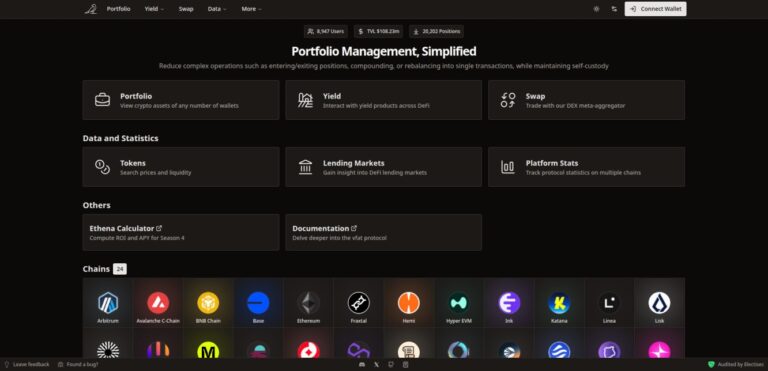

vfat

vfat vfat is a yield farming dashboard that aggregates DeFi protocols. Track rewards and LP positions across multiple chains. Scan APRs, compare farms, and find new opportunities.