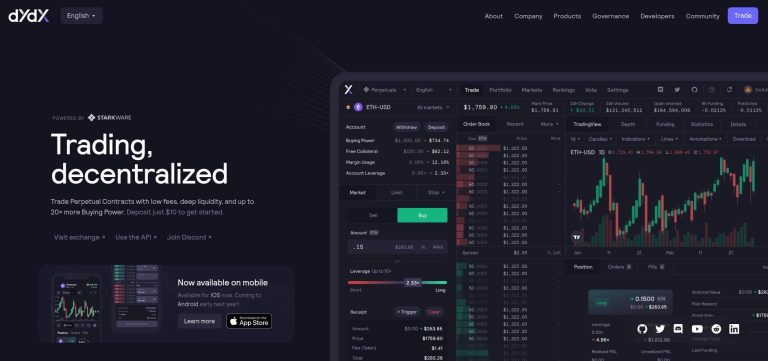

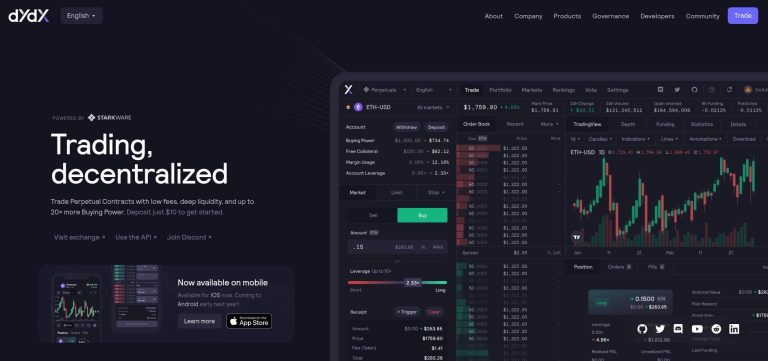

Dydx

dYdX is a powerful decentralized platform for trading perpetual contracts with low fees and high liquidity, offering up to 20x buying power, instant trade executions.

dYdX is a powerful decentralized platform for trading perpetual contracts with low fees and high liquidity, offering up to 20x buying power, instant trade executions.

Bancor Network facilitates on-chain trading and liquidity provision through automated market-makers, enabling token swaps, single-sided liquidity.

Volmex Finance facilitates crypto volatility trading through Perpetual Futures and Volatility Tokens, providing a 24/7 transparent, permissionless platform with low fees.

DeGate leverages ZK rollup technology to offer a decentralized exchange (DEX) with notable fast transaction speeds, minimized fees, and a strong focus on self-custody.

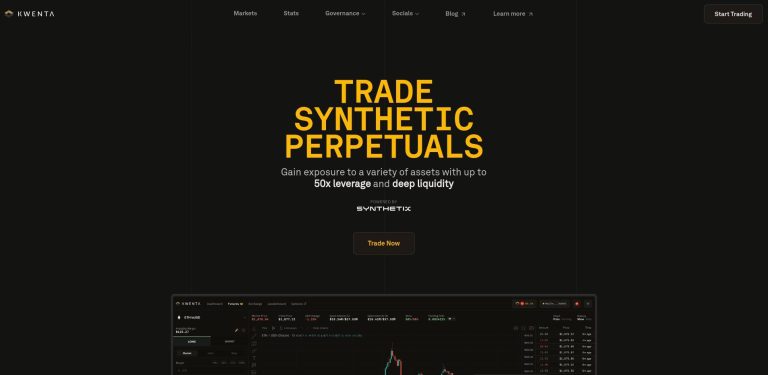

Kwenta is a decentralized derivatives trading platform on Synthetix, offering synthetic asset and perpetual futures trading with low gas fees via Optimism.

MUX Network is a decentralized finance (DeFi) leveraged trading protocol offering up to 100x leverage, zero price impact, and multi-chain liquidity books.

Velora is a leading DeFi aggregator offering a secure, comprehensive interface that unites decentralized exchanges and lending protocols, for optimized DeFi trading.

CoW Swap utilizes CoW Protocol for decentralized trading via batch auctions, mitigating price slippage and liquidity fragmentation, enhancing price offerings.

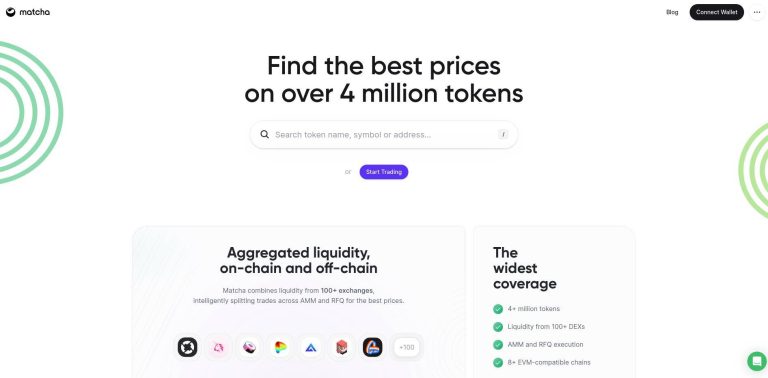

Matcha is a 0x Labs-powered DEX offering peer-to-peer token swaps, best price aggregation across DEX networks, and extensive token access for decentralized finance.

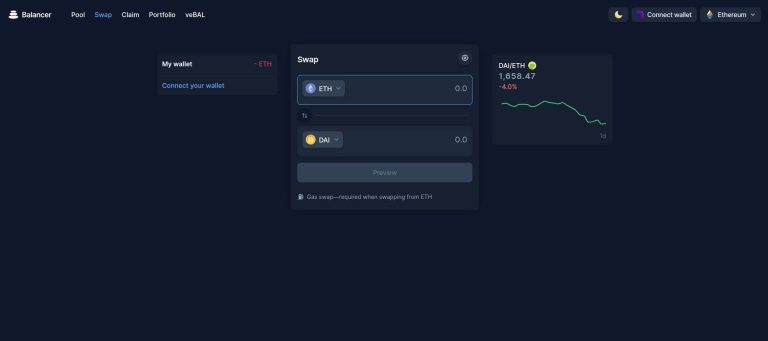

Balancer is an Ethereum-based DeFi protocol for custom liquidity pools, enabling trustless trading, automated portfolio management, and innovative liquidity strategies.

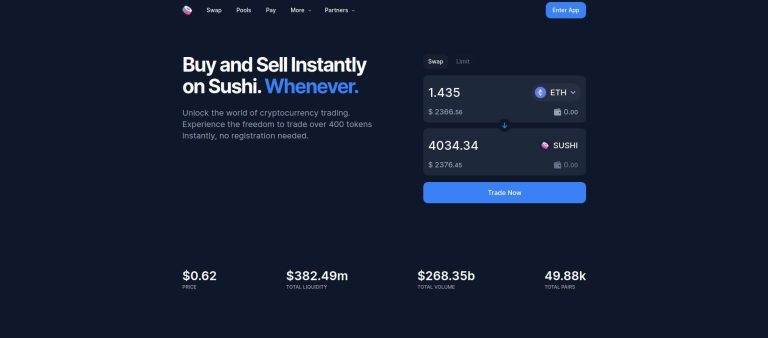

Sushi is a community-driven DeFi ecosystem offering swapping, lending, borrowing, leverage, and a multi-chain DEX, catering to a broad user base.

KyberSwap, DeFi's first Dynamic Market Maker, offers decentralized crypto trading with high flexibility, capital efficiency, across multiple blockchain networks.

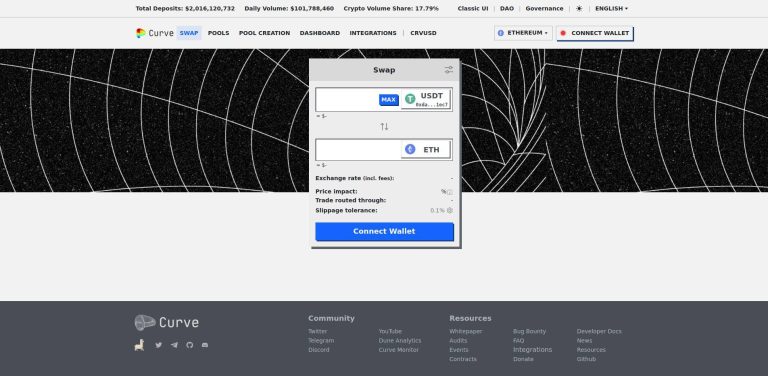

Curve is a leading DeFi Automated Market Maker (AMM), specializing in efficient stablecoin trading with low slippage, low fees, and incentivized liquidity provision.

Aevo facilitates trading perpetuals, options using off-chain matching, on-chain settlement on Ethereum, aiming for enhanced performance, security, and comprehensive trading strategies.

ApeX facilitates high-performance, decentralized derivatives trading with cross-margined perpetual contracts, multi-chain support, up to 30x leverage, and governance tokens.

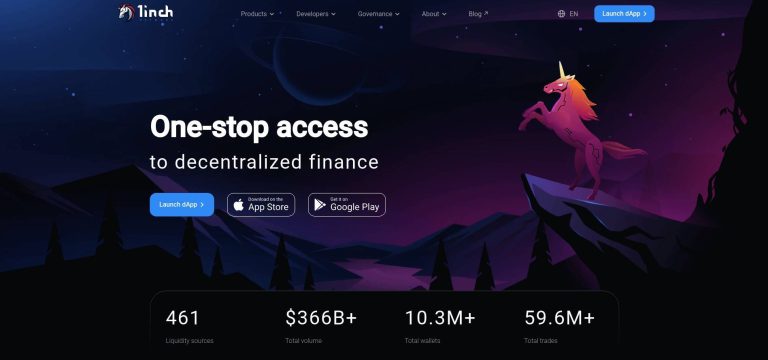

1inch is a DeFi aggregator optimizing trades across multiple DEXes, ensuring best rates, low slippage, with a feature-rich wallet, and various protocols enhancing capital efficiency and trading capabilities.

Uniswap is a decentralized, open-source protocol on Ethereum for automated liquidity provision and token trading, fostering a seamless DeFi ecosystem.