Missing out on token airdrops can feel like watching free money slip through your fingers—especially when others are farming thousands in rewards with simple onchain activity. But with new ecosystems, stablecoins, and points programs launching weekly, it’s harder than ever to know where to focus. This guide breaks down how serious DeFi users identify, qualify for, and maximize airdrops—without wasting gas or time.

What Are Crypto Airdrops and Why They Matter in DeFi

Crypto airdrops are one of the most powerful tools in decentralized finance (DeFi) for launching ecosystems, rewarding early users, and jumpstarting community momentum. At their core, airdrops are a token distribution mechanism—similar to how Bitcoin used proof-of-work mining to issue coins. But instead of burning electricity, airdrops reward onchain activity, early usage, and community participation.

Without users, protocols are just code. Airdrops solve this by aligning incentives: you interact with the product, you get ownership.

Types of Airdrops

The most common airdrop formats include:

- Retroactive Airdrops – Rewarding past usage. Think of early Uniswap or Ethereum Name Service (ENS) users suddenly waking up to thousands in tokens. Surprise drops based on historical activity.

- Participation-Based Airdrops – Tasks are outlined in advance. These include points systems, staking programs, or mission checklists. Projects like Ether.fi, Ethena, and EigenLayer fall here—where users farm eligibility through sustained and strategic engagement.

- Governance Airdrops – Given to communities of aligned products. For example, SafeDAO’s SAFE airdrop was distributed to users of the Safe smart wallet, rewarding contribution to the broader Ethereum ecosystem.

The Evolution of Airdrop Strategies in DeFi

The early days of airdrops were simple: swap once, receive tokens. But as users and capital got smarter, so did the strategies. Today’s airdrops are gamified, competitive, and often involve points programs—pre-token scoring systems that simulate airdrops but aren’t guaranteed until token launch.

This shift has turned passive users into airdrop farmers, running multiple wallets, bridging to new chains, and hunting signals on Twitter and Discord. For protocols, it's a growth flywheel. For users, it's become a grind.

And while some airdrops still surprise, most now hint at rewards in advance, turning DeFi into an attention economy—where your time, gas, and engagement are the currency.

Why Protocols Offer Airdrops

We’ve already touched on how airdrops kickstart ecosystems—but there’s more going on under the surface. From a protocol’s perspective, airdrops aren’t just giveaways—they're strategic tools for growth, adoption, and decentralization.

User Acquisition and Retention

In a world where thousands of DeFi apps compete for attention, airdrops are an effective way to get users in the door. But it doesn’t stop at acquisition—well-designed airdrops also build retention loops. When users receive tokens, especially with staking or governance utility, they’re more likely to stick around and participate.

Token Distribution and Decentralization

Many protocols aim for fair token distribution to avoid overly concentrated ownership and build credible neutrality. Airdrops help scatter governance power across thousands of real users—especially when designed around usage rather than VC allocations. A standout example is Hyperliquid, which excluded venture capital entirely and rewarded real onchain activity. The result? One of the most well-received and widely-used perpetuals platforms—and one of the most valuable airdrops in DeFi history.

This strengthens the community ownership narrative—especially important for long-term legitimacy in Ethereum and similar ecosystems where decentralization is a core value.

Community Building and Engagement

Airdrops create instant community alignment. Tokens give users a reason to care, vote, and build. Community members become evangelists, testers, and defenders of the protocol—because now they have skin in the game.

It’s not just about holders—it’s about builders, contributors, and onchain citizens.

The Growth Flywheel of Airdrops

The airdrop growth flywheel looks something like this:

- Users interact with a protocol (often incentivized by a points system)

- Tokens are airdropped, rewarding that activity

- Users reinvest rewards back into the ecosystem (staking, LPs, governance)

- Protocol metrics improve, attracting more users, investors, and developers

- Loop restarts—now with more momentum

It’s not perfect—but when done right, this flywheel can turn a small project into a sticky ecosystem.

Identifying Potential Airdrop Opportunities

If you're serious about airdrop hunting, finding the right opportunities early is half the game. While protocols don’t always telegraph their plans, there are consistent patterns—if you know where to look. It’s not just about luck. It’s about building an information edge and tracking signals that most miss.

Here’s how serious airdrop farmers do it.

Twitter / Social Media Monitoring Techniques

Despite the rebrand, Crypto Twitter (CT)—not “X”—is still the go-to source for real-time alpha. The most effective way to use it is by curating custom lists:

- Track DeFi protocols, especially newer ones with no token.

- Add founders, developers, and KOLs who reliably share early-stage opportunities.

- Follow shills—yes, even them. Sometimes they catch things early, even if you ignore the rest.

Set aside a few minutes each day to scroll through your lists. That single habit alone will surface more signal than most “airdrop hunters” ever see.

Developer Activity Indicators

One major sign a protocol is legit (and potentially gearing up for a token launch) is consistent developer activity. If no one’s building, there’s likely no product—and no airdrop.

Here are a few tools to track real onchain builders:

- CryptoMiso – Tracks GitHub commit activity across crypto projects.

- Token Terminal – Active Developers – Offers a clean dashboard showing developer counts across protocols.

- Artemis Developer Activity – Visualizes developer trends over time across chains and protocols.

Look for projects with regular commits, new features, and testnet deployments. These are the ones putting in the work—and often the ones preparing for a token.

Funding Round Tracking

VC-backed projects usually launch tokens—and often airdrop to users to decentralize supply. Keep an eye on:

- Announcements from crypto venture firms

- DeFi-focused funds like a16z, Paradigm, or Polychain Capital

- Platforms like Messari and DefiLlama’s Raise tab

If a new protocol just raised a seed or Series A and doesn’t yet have a token, there’s a good chance it’s coming—and they’ll need users to justify the valuation.

Community Growth Patterns

Don’t ignore Discord, Telegram, and Farcaster. Projects with fast-growing communities often signal upcoming announcements.

Look for ecosystems that are clearly heating up—like Sonic, Sui, HyperEVM. Growth without a token is the exact sweet spot.

High-Potential Projects to Watch in 2025

Some ecosystems are more than just a single airdrop opportunity—they’re launchpads for dozens. These emerging networks and protocol clusters are actively growing, with many apps still tokenless, underfarmed, and full of points programs or early incentives.

Below are some of the ecosystems we’re actively watching in 2025:

🌀 HyperEVM Ecosystem

The HyperEVM ecosystem is arguably the most exciting airdrop farming zone in 2025. After the highly successful HYPE airdrop and the launch of HyperEVM, the network has exploded with new DeFi protocols—many of which are actively running points programs or are strongly expected to reward early users.

Most major protocols on the chain are now integrated into a growing loop of staking, lending, LPing, and bridging incentives—making HyperEVM a top-tier opportunity for serious airdrop hunters.

🧠 Why HyperEVM Matters

HyperEVM isn’t just another chain — it’s currently one of the most capital-efficient places to farm early points with real upside.

Here’s why:

- Bridging is frictionless. Tools like HyperUnit and HyBridgeHL let you move serious size on-chain with minimal cost.

- Transaction fees stay cheap, finality is fast, and the growing protocol stack keeps expanding week after week.

- The ecosystem allows you to stack multiple points systems simultaneously, while still earning yield and staying market-neutral — a rare combo in DeFi.

- HYPE Season 2 is highly anticipated, adding another layer of speculative upside for those positioned early.

The best part?

Most of these protocols still have sub-10k user counts. In airdrop terms, you’re extremely early — exactly where you want to be before the wider farming meta fully catches on.

Here are key tokenless protocols currently live in the ecosystem:

- StakedHype – Core liquid staking protocol for HYPE

- HyperLend – Lending & borrowing markets with stHYPE incentives

- Felix Protocol – Stablecoin protocol (feUSD) with points farming

- HypurrFi – Lending platform with delta-neutral yield options

- HyperBeat – Stake HYPE → stHYPE → earn yield + points

- HyperSwap – DEX with incentivized LP pools and swaps

- KittenSwap – Low-cap DEX alternative with gamified farming

These all integrate in a way that allows layered farming—for example, using stHYPE from HyperBeat as collateral on HypurrFi or HyperLend, then reusing borrowed assets across the system.

🧪 The Real Strategy (Delta-Neutral Farming)

One of the most effective approaches in HyperEVM right now is layered delta-neutral farming — stacking yield, minimizing directional risk, and farming multiple point streams at once.

Here’s how the loop works:

- Start by bridging funds to HyperEVM using HyperUnit, one of the most efficient ways to move size on-chain.

- Accumulate and stake HYPE via HyperBeat or StakedHype to mint stHYPE, the core liquid staking token of the ecosystem.

- Supply your stHYPE collateral into lending protocols like HypurrFi or HyperLend, borrowing against your position to unlock more capital.

- Hedge your exposure by shorting HYPE (via hyperliquid), or rotate borrowed funds back into stablecoin yield opportunities using HyperSwap.

- With capital now cycling, you’re simultaneously earning yields and qualifying for points across multiple protocols.

Bonus Plays for Extra Exposure

- Register .hl domains via HL Names for potential governance or ecosystem snapshot rewards.

- Supply UBTC & UETH liquidity on HypurrFi or HyperLend for boosted yields and additional protocol points.

- Deploy idle stablecoins into Felix Protocol to farm feUSD-based points while generating passive yield.

👉 Explore more protocols: Hyperliquid Ecosystem on DefiLlama

Bottom line:

These setups allow you to farm 10+ separate point systems while maintaining capital efficiency, market-neutral exposure, and yield — all while positioning yourself early across the entire HyperEVM stack.

💵 Stablecoins: The New Airdrop Battleground

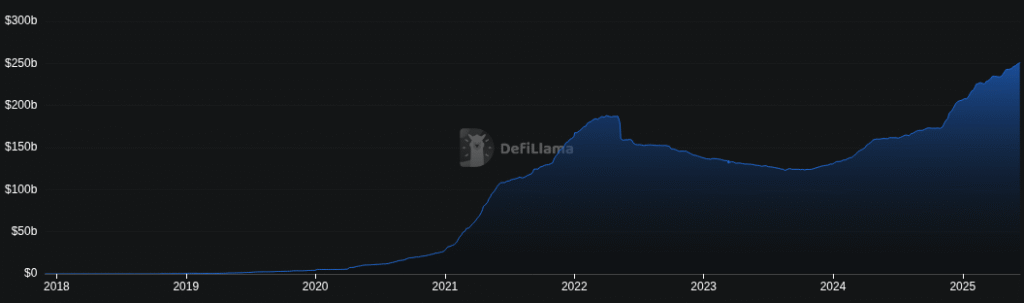

The stablecoin market has quietly become one of the strongest comeback stories in all of DeFi. After peaking in early 2022, total stablecoin TVL collapsed alongside broader crypto markets as risk appetite vanished.

But in 2024–2025, stablecoin TVL has fully recovered — now pushing into new all-time highs, driven by both institutional inflows and an explosion of new stablecoin protocols experimenting with points programs and incentive loops.

Where previous cycles were mostly about USDT, USDC and DAI, today we’re seeing dozens of new entrants offering:

- Yield-bearing stablecoins

- LSD-backed stablecoins

- Delta-neutral models

- Borrowing/lending stablecoin loops

- Over-collateralized DeFi-native designs

And nearly all of them are using points-based airdrop farming to attract early users.

The result:

A completely new battleground for airdrop hunters — with huge asymmetric reward potential for those positioned early across these new protocols.

🔎 Stablecoin Protocols Actively Offering Incentives

These are the most promising stablecoin projects currently running points programs and airdrop farming opportunities:

InfiniFi – Duration-matching stablecoin protocol with a robust points system called “Bills.” Users earn rewards by minting and holding their stablecoin while participating in DeFi activities. The protocol focuses on duration-matching mechanics where longer-term participation yields higher point multipliers.

Level Finance – High-yield stablecoin protocol powered by blue-chip lending integration. Users deposit USDC/USDT to mint lvlUSD and farm Level XP through multiple pathways: direct staking (6.04% + 40x XP boost), Curve LP farming, and lending positions.

Coinshift – Business-focused treasury management protocol with their csUSDL stablecoin. Users earn $SHIFT rewards by staking csUSDL, completing platform missions, and climbing leaderboard rankings.

Resolv – True-delta stablecoin protocol that eliminates traditional fiat dependencies. Season 2 points farming is active with 2x staking multipliers for RESOLV holders. Users earn points by holding USR stablecoin across multiple networks and providing liquidity.

Reservoir – Next-generation stablecoin protocol offering rUSD with multi-collateral backing and instant liquidity. Users earn points by holding rUSD, participating in staking pools, and engaging with the protocol's DeFi integrations.

Falcon – Next-generation synthetic dollar protocol offering USDf overcollateralized stablecoin and sUSDf yield-bearing token. Users earn “Falcon Miles” points through minting USDf from digital assets and staking.

Rings – Meta-stablecoin protocol on Sonic blockchain offering scUSD and scETH through fee-free minting from stablecoins or ETH derivatives. Users stake assets in Veda-vaults for high yields and earn Sonic Points for the upcoming S airdrops.

Cygnus – Omni-chain Liquidity Validation System (LVS) and first Web3 Instagram App Layer protocol. Users earn Cygnus Points through LVS staking and restaking across multiple chains, with pooled asset mechanisms generating diverse revenue streams.

YieldFi – Yield-bearing stablecoin protocol centered around yUSD with automated DeFi optimization. Users farm rewards by providing yUSD liquidity and participating in defi activites.

OpenEden – Tokenized U.S. Treasury yield protocol offering USDO stablecoins. Users earn “Bills” points by bridging liquidity and participating in DeFi bounties.

These protocols represent the cutting edge of stablecoin innovation, where traditional stability meets DeFi-native yields and governance participation. Most offer multiple earning pathways — from simple holding to complex yield strategies — making them accessible to both casual and sophisticated DeFi users.

The key advantage: unlike volatile token farming, stablecoin protocols let you maintain dollar-denominated exposure while accumulating points for potential airdrops, making them ideal for risk-conscious farmers who want upside without downside.

These protocols represent the cutting edge of stablecoin innovation, where traditional stability meets DeFi-native yields and governance participation. Most offer multiple earning pathways — from simple holding to complex yield strategies — making them accessible to both casual and sophisticated DeFi users.

The key advantage: unlike volatile token farming, stablecoin protocols let you maintain dollar-denominated exposure while accumulating points for potential airdrops, making them ideal for risk-conscious farmers who want upside without downside.

🔬 The Liquity V2 Meta (and its Forks)

One of the clearest examples of DeFi-native stablecoin innovation is Liquity V2 — the most immutable borrowing and stability pool mechanism in the ecosystem. What makes Liquity V2 unique is its simplicity, full decentralization, and liquidation mechanism that allows stability providers to acquire discounted collateral over time.

Since the launch of V2, many “Friendly Forks” have emerged — teams that fork the Liquity V2 codebase while building small variations around the same core model. This creates an entire farmable stablecoin cluster directly built on top of the Liquity architecture.

What makes this ecosystem especially attractive for farmers is that each Friendly Fork operates its own points programs and airdrop potential — but at the same time, Liquity V2 Stability Pool participants also receive allocation from every Friendly Fork’s airdrop through the official program.

In other words: farming Liquity V2 directly also positions you for multiple additional forks automatically.

Key protocols involved:

- Asymmetry Finance – Liquity V2 fork deployed on Ethereum mainnet.

- Felix Protocol – Liquity V2 fork running on Hyperliquid HyperEVM.

- Orki Finance – Liquity V2 fork launched on Swell L2.

- Quill Finance – Liquity V2 fork operating on Scroll.

You can learn more about the Friendly Fork Program directly in Liquity’s official docs.

To explore the full list of forks and track new deployments across chains, visit Forqyt’s dashboard.⚔️

DeFi vs. On-Chain Finance

A critical distinction to make here: many of the protocols launching stablecoins today are simply on-chain versions of TradFi, using centralized collateral, opaque risk management, or permissioned systems disguised as DeFi.

Our focus remains on truly decentralized protocols — where smart contracts, not institutions, control the system. Projects like Liquity V2 stand out because they offer zero governance, immutable contracts, and permissionless access — which aligns directly with the original Ethereum ethos.

🧪 Liquity V2 Farming Strategies

For airdrop hunters and yield farmers, the Liquity offers multiple ways to position:

Liquidity Provision & Compounding

- Supply rETH, wstETH, or ETH as collateral to Liquity V2.

- Borrow BOLD, the stablecoin issued by Liquity V2.

- Stake your BOLD into either yBOLD or sBOLD vaults which automatically compound liquidations into more BOLD.

- By staying active here, you're farming not only BOLD liquidations but also qualifying for current and future Friendly Fork rewards (14+ forks and counting).

Leverage-Enhanced Stability Pool Stacking

- Deposit your sBOLD collateral on Euler Finance.

- Borrow USDC against sBOLD and recycle that capital back into BOLD Stability Pools, increasing your exposure to liquidation rewards and maximizing Friendly Fork farming yield.

The Bottom Line

The stablecoin wars are only just beginning. The protocols highlighted above offer some of the most asymmetric, decentralized, and points-heavy airdrop opportunities in the market right now — many of which are being completely missed by the wider farming crowd.

Qualifying for Airdrops: Essential Strategies

When it comes to qualifying for airdrops in 2025, the game has evolved. Today, most protocols simply lay out the path for you — typically in the form of points dashboards, missions, and structured campaigns. Long gone are the early days where you had to purely guess what behavior might be rewarded. That said, hidden opportunities and surprise drops still exist — and often reward the sharpest farmers who notice them early.

Take the recent example of Venice AI: testers who simply used the platform to chat with the AI received a surprise token airdrop worth tens of thousands for some. There was no elaborate farming strategy — just being early, using a product, and catching the window of opportunity.

In this section we’ll break down how to approach qualifying for the right airdrops, avoid wasted effort, and maximize positioning.

🚫 Don’t Farm Every Shitcoin

The first rule: not every airdrop is worth chasing.

Twitter is full of spammy garbage projects that flood users with meaningless airdrop promises. Your focus should be on protocols with actual product, innovation, and adoption potential. We’ve covered more on scam filtering in our How to Avoid DeFi Scams article.

What Type of Protocols Produce the Best Airdrops?

The most valuable airdrops in DeFi history all share a pattern: they were first movers doing something new, with real usage.

Some key examples:

- Uniswap (UNI) — First widely adopted AMM DEX.

- Ethereum Name Service (ENS) — First decentralized name system.

- Arbitrum (ARB) — First widely adopted L2 rollup.

- Hyperliquid (HYPE) — First CEX-like perps DEX with smooth user experience.

The core formula:

New innovation → Real users → Early participation → High-value airdrop.

🧠 The Capital Rotation Principle

With so many protocols offering points farming today, the key question is:

Where should you park your capital, time, and attention?

One common signal: TVL growth.

Protocols attracting organic liquidity early often indicate strong market confidence — and may reward those early depositors heavily.

A good example is USUAL Protocol — one of the first fully on-chain stablecoin issuers that aggregates tokenized US Treasury Bills and real-world asset yields into its USD0 stablecoin, while redistributing 90% of protocol revenue directly back to users through staking and its native $USUAL token. The airdrop heavily rewarded early adopters who recognized its unique RWA model and rapid TVL growth.

You can track these rising candidates easily using dashboards like DefiLlama Stablecoins, filtering for newer protocols experiencing rapid growth.

How to Maximize Your Airdrop Farming Edge

While many simply farm passively, those willing to deploy capital strategically — and take on controlled risk — often earn significantly more.

One of the most effective methods is to maximize your borrowing power against collateral rather than over-diversifying into dozens of tiny positions.

Example Farming Approach:

- You have $100k in stablecoins.

- Instead of splitting it across 10 farms with $10k each, you concentrate your position:

- Convert your stablecoins into the farming asset (e.g. BOLD, sBOLD, etc.)

- Deposit your $100k as collateral on a lending protocol (e.g. Euler Finance with sBOLD collateral).

- Borrow 80% LTV ($80k USDC).

- Recycle that $80k into additional points-generating protocols or Stability Pools.

- Outcome: you now have $180k deployed while still only risking your original $100k.

Why This Works

- You're farming points on a larger notional amount, which almost every points system rewards.

- You reduce fragmentation of your capital.

- You avoid complex manual looping while still leveraging capital efficiently.

- You position yourself for top tier airdrop eligibility, where total volume often influences reward tiers.

Reminder: No Reward Without Risk

Of course, leverage carries risk — liquidation risk, price moves, or oracle risks always exist. But for experienced farmers who know how to size positions, this method offers one of the best points-to-risk ratios currently possible in DeFi farming.

Risk Management in Airdrop Farming

Before we dive into hidden risks, let’s briefly acknowledge a few core farming risks that should already be on your radar when deploying capital into DeFi airdrop strategies:

- Liquidation risk when borrowing against collateralized positions (especially when stacking leverage for point farming).

- Slippage risk when swapping large amounts or interacting with low liquidity pairs.

- Use Hardware wallets to protect private keys.

- Contract safety — avoid interacting with unverified or unaudited protocols.

- Obvious scam airdrops promoted across social media.

We won’t repeat these fundamentals in full detail here — but you can read more on the security side in our How to Avoid DeFi Scams article.

Instead, let’s now focus on the hidden risks that many newer airdrop farmers aren’t seeing — especially as farming gets more sophisticated and more centralized platforms enter the space disguised as “DeFi.”

The Hidden Divide: DeFi vs. On-Chain Finance

As we’ve discussed earlier, there’s now essentially two separate worlds in crypto:

- True DeFi — decentralized, immutable, non-custodial, permissionless protocols.

- On-Chain Finance — traditional finance structures wrapped inside a DeFi skin, often involving custodians, opaque risks, and off-chain decision-making.

For many retail farmers chasing yields and airdrops, this distinction is not always clear. They may unknowingly add layers of risk they don’t fully understand — risks that don't show up on the front-end, but absolutely matter in practice.

🔬 Case Study: Hidden Risks Inside “Safe” Pools

Let’s break this down with a real-world example using two protocols that many DeFi farmers interact with today:

- Pendle Finance — where most major yields today are tokenized for boosted yield and point farming.

- Equilibria — a platform that lets users boost Pendle LP positions further without needing PENDLE tokens directly.

Both are highly respected protocols with significant TVL. On the surface, it seems simple:

“Deposit stablecoins into high-yield pools and farm multiple points.”

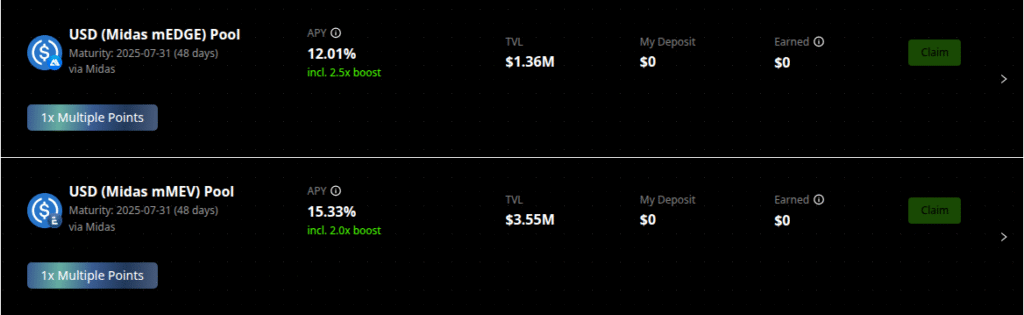

For example, two pools on Equilibria at the time of writing:

- USD (Midas mEDGE) Pool — 12.01% APY + 1x multiple points

- USD (Midas mMEV) Pool — 15.33% APY + 1x multiple points

- TVL: Over $4.9M combined

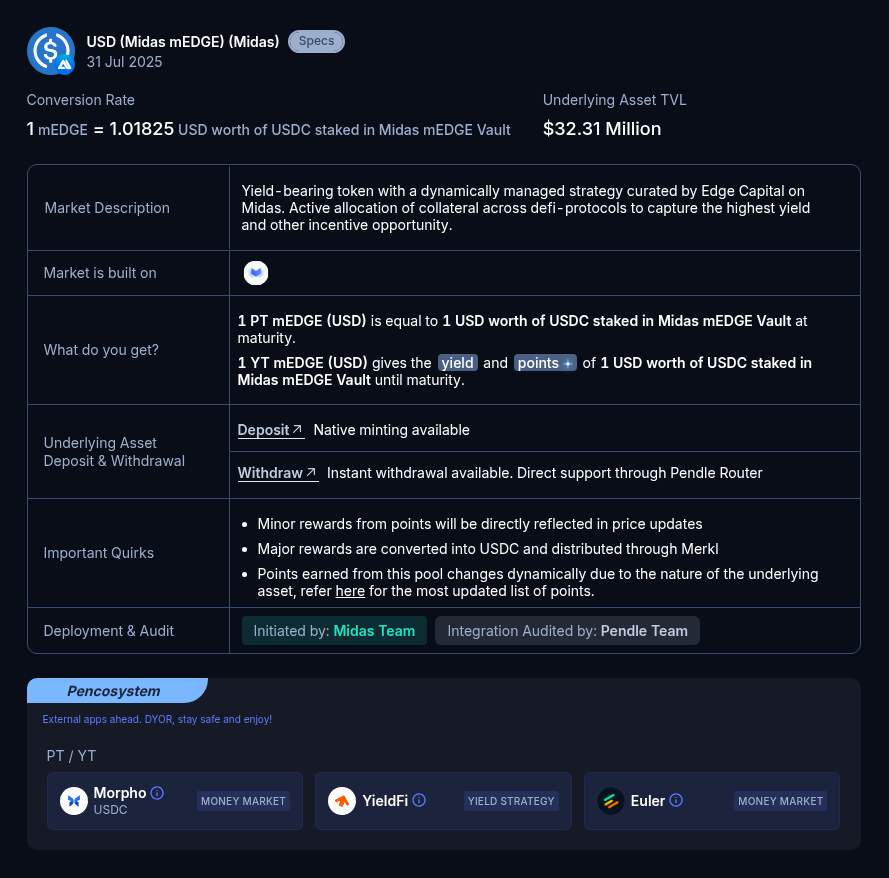

It looks like you’re simply staking USDC, USDT, or DAI into a DeFi farm — but under the surface, it’s very different.

What Is Midas?

- Midas is a centralized yield platform that tokenizes yield-bearing assets.

- These tokenized assets (mEDGE, mMEV, etc.) are offered as Pendle pools, often listed on aggregators.

- The mEDGE vault is actively managed by a third-party (Edge Capital), meaning your capital is essentially being rehypothecated by a centralized asset manager.

- You’re no longer purely exposed to smart contract risk — you're also exposed to active management decisions, centralized custody, and off-chain risk factors you may not even be aware of.

Many users staking into these pools likely think they’re simply depositing stablecoins into decentralized smart contracts — but are actually taking on significant hidden third-party risk.

This Example Isn’t Rare

Midas pools on Pendle are just one example of many. As on-chain finance rapidly expands, more centralized managers are wrapping yield-bearing stablecoins into tokenized vaults to market themselves as “DeFi yields.”

The more layers between your capital and the underlying protocol, the more opaque, non-obvious risk you take on as a farmer.

The Key Lesson:

- Understand exactly where your collateral goes.

- Read beyond the front-end UI.

- Don’t confuse tokenized DeFi exposure with real decentralized control.

- The best airdrop farming setups remain those that leverage decentralized, transparent, immutable protocols — where you can fully verify collateral flows, liquidations, and treasury management directly onchain.

Building Your Personalized Airdrop Strategy

At this point you have everything you need:

- You know how to identify high-potential airdrops.

- You understand how to qualify, optimize, and stack your positions.

- You know how to avoid scammy, TradFi-disguised protocols.

- And you’ve seen how capital stacking lets you maximize point multipliers.

Now it’s time to build your personal farming setup — your own airdrop battle station.

Wallet Architecture: Don’t Use Just One Wallet

Most people start in DeFi with one address, one ENS name, and pile everything together. That’s a mistake.

Smart airdrop hunters build out a multi-wallet system that separates activity, protects funds, and creates flexibility.

If you haven’t read it yet, we highly recommend reviewing our full DeFi Scam Protection Playbook, where we go in depth on advanced wallet setups.

Here’s a simplified version of what you should aim for:

The Trio Setup: Maximum Security Meets Maximum Efficiency

1️⃣ GridPlus: Hardware Wallet Standard for DeFi

- Smartcard-based seed management — physical keys separated across locations.

- Full transaction visibility on a large touchscreen — verify every transaction down to contract data.

- Smartcard swapping allows easy management of multiple wallets & ENS subdomains.

- Superior security vs traditional Ledger or Trezor devices.

🔗 GridPlus

2️⃣ Rabby Wallet: Transaction Simulator & Front-End Firewall

- Transaction simulation shows you exactly what will happen before you sign.

- Address whitelisting to prevent accidental sends.

- Seamless multichain support.

- Pure upgrade over MetaMask for any serious DeFi user.

3️⃣ ENS Subdomains: The Underrated Security Layer

- Use ENS subdomains like

defi.yourname.ethorairdrops.yourname.ethto compartmentalize wallets. - Each subdomain tied to a separate wallet/address.

- Even if one wallet gets compromised, others remain safe.

- Also serves as personal DeFi brand identity across multiple protocols.

Build Your DeFi Farming Control Panel

Beyond wallet structure, you’ll want to build a personal workflow system that allows you to operate efficiently:

- Bookmark all protocols you're actively farming — skip search bars.

- Set up your DeBank Dashboard to track TVL, open positions, pending rewards, claimable points.

- Use DefiLlama’s stablecoin, TVL, and airdrop sections as your primary free research hub.

- Keep protocol Discords, Twitter lists, and announcement feeds easily accessible.

- Maintain a simple spreadsheet (or Notion workspace) to track your active farms, points balances, and estimated farming value.

The reality is simple:

The more organized and systematized you are, the better your airdrop returns will be. Most people leave rewards on the table simply by failing to track properly.

Conclusion: Stay Ahead of the Airdrop Curve

Airdrop farming today isn’t about luck. It’s about knowledge, positioning, and execution.

- You’ve learned how to identify the right projects before the crowd.

- You know which ecosystems are heating up right now.

- You’ve seen how points meta works — and how capital deployment can amplify your positioning.

- And you now understand the real risks most farmers don’t even realize they’re taking.

The edge goes to those who stay organized, play both offense and defense, and constantly adapt to evolving market conditions.

🚀 Want to Keep Leveling Up?

If you’re serious about mastering DeFi yield farming, airdrop hunting, and on-chain opportunity discovery — this is only the beginning.

👉 Check out our full Unleash DeFi: Complete Guide from Start to Mastery for a complete step-by-step framework to build your entire DeFi workflow.

👉 And for ongoing airdrop opportunities, follow our constantly updated DeFi Airdrops Watchlist where we track projects we’re farming and monitoring ourselves in real time.

FAQs (Frequently Asked Questions)

What are crypto airdrops and why are they important in DeFi?

Crypto airdrops are distributions of free tokens to users, serving as powerful tools in decentralized finance (DeFi) to kickstart ecosystems, incentivize user acquisition, promote fair token distribution, and build engaged communities.

How can I identify potential airdrop opportunities in the DeFi space?

To identify promising airdrop opportunities, monitor social media platforms like Crypto Twitter, track developer activity on projects, follow funding rounds of VC-backed protocols, and observe community growth on Discord, Telegram, and Farcaster.

What strategies can I use to qualify for and maximize value from DeFi token airdrops?

Qualify by engaging with protocols that show strong fundamentals rather than chasing every token. Employ capital rotation by farming points on larger notional amounts with stablecoins, manage risk carefully, and build a diversified wallet architecture for security and efficiency.

Why do DeFi protocols offer airdrops and how do they benefit users?

Protocols offer airdrops to jumpstart ecosystems, attract and retain users, ensure fair token distribution to avoid centralization, and foster community alignment. Users benefit by receiving free tokens that may appreciate in value as the protocol grows.

What is the ‘Trio Setup' for wallet architecture in DeFi airdrop farming?

The Trio Setup combines three elements: GridPlus hardware wallet for secure seed management; Rabby Wallet with transaction simulation and front-end firewall for safe interactions; and ENS subdomains for added security layers. This setup balances maximum security with operational efficiency.

What risks should I be aware of when participating in DeFi airdrop farming?

Risks include liquidation due to leverage, price manipulation of tokens, hidden vulnerabilities within seemingly safe pools, and centralized platform risks. Proper risk management involves understanding collateral flows, avoiding indiscriminate farming of low-quality tokens, and maintaining robust wallet security practices.