In traditional finance, derivatives trading is dominated by centralized institutions, creating barriers such as high fees, lack of transparency, and limited access. These limitations frustrate many investors looking for more control and freedom. DeFi derivatives offer a decentralized alternative, enabling 24/7 global trading without intermediaries. By utilizing blockchain technology, DeFi derivatives platforms like dYdX and GMX are reshaping the financial landscape, offering increased transparency, reduced costs, and unprecedented accessibility. Let’s explore how these platforms are revolutionizing derivatives trading.

Introduction

DeFi derivatives are financial instruments that derive their value from underlying assets, such as cryptocurrencies, commodities, or even stocks, within decentralized finance ecosystems. Unlike traditional derivatives, which rely on centralized intermediaries like banks or brokerage firms, decentralized derivatives operate through smart contracts on blockchain networks. This removes intermediaries, reduces costs, and enables global access to trading 24/7.

The significance of DeFi derivatives lies in their ability to democratize finance by providing users full control over their assets while fostering transparency and security. DeFi derivatives platforms, such as dYdX and GMX, are rapidly growing, offering a range of products from perpetual futures to assets. These platforms allow users to hedge, speculate, or gain exposure to a variety of financial markets without the traditional gatekeepers. As the market continues to mature, DeFi derivatives are set to revolutionize the global financial landscape by making it more accessible, efficient, and equitable.

Understanding DeFi Derivatives

What Are DeFi Derivatives?

DeFi derivatives are financial contracts that derive their value from an underlying asset, which can be cryptocurrencies, commodities, or even real-world assets. These contracts allow investors to speculate on or hedge against price movements without actually holding the asset.

Difference Between Centralized and Decentralized Derivatives

Traditional derivatives, such as those found on centralized exchanges, rely on intermediaries like brokers or financial institutions to manage transactions. In contrast, decentralized derivatives operate within a trustless, peer-to-peer system powered by smart contracts. This ensures that trades are executed automatically and transparently, removing the need for middlemen and reducing the risk of fraud or manipulation.

Decentralized derivatives offer several advantages over centralized ones:

- Trustless: Smart contracts eliminate the need for trust in intermediaries.

- Global Access: Users can access markets 24/7 without geographical restrictions.

- Lower Costs: By removing intermediaries, decentralized platforms often reduce transaction fees.

Common Types of DeFi Derivatives

- Perpetual Futures: A derivative contract that allows traders to speculate on the future price of an asset without an expiration date. For example, platforms like dYdX and Hyperliquid allow traders to leverage perpetual futures with high liquidity.

- Options: Similar to traditional finance, options in DeFi give traders the right (but not the obligation) to buy or sell an asset at a specific price before a certain date. Derive and Aevo are notable platforms that offer decentralized options.

- Tokenized Assets: These are tokenized representations of real-world assets like stocks or commodities. They allow users to trade assets that are not natively available on the blockchain.

DeFi derivatives offer flexibility, transparency, and reduced friction compared to traditional markets, making them an exciting innovation within decentralized finance.

How DeFi Derivatives Work

Smart Contracts Powering DeFi Derivatives

At the core of DeFi derivatives is the use of smart contracts—self-executing contracts where the terms of the agreement are directly written into code on the blockchain. These smart contracts automatically enforce the conditions of a trade, reducing the need for intermediaries. They ensure that, when certain conditions are met (like price changes or time expiry), the contract executes predefined actions, such as transferring funds or liquidating positions.

This automation makes decentralized derivatives more secure and efficient, as trades can happen instantly without relying on centralized exchanges to verify and approve each transaction.

Example: Futures Contracts in DeFi

Futures contracts allow traders to speculate on the future price of an asset. In traditional markets, futures have expiration dates, but in the world of DeFi, perpetual futures are popular. Platforms like dYdX and GMX offer perpetual futures contracts, which don’t expire and can be held indefinitely.

For example, in GMX, traders can go long (bet that the price will rise) or short (bet that the price will fall) on an asset with leverage, meaning they can control a larger position than their initial capital allows. The system uses a funding rate mechanism to balance long and short positions and keep the contract price close to the underlying asset’s price.

Traditional Derivatives vs. Decentralized Alternatives

In traditional finance, derivatives trading is usually confined to regulated exchanges, with central authorities overseeing transactions and ensuring compliance with legal and regulatory frameworks. These exchanges charge high fees, impose restrictions, and require users to trust a central intermediary to facilitate trades.

In contrast, DeFi derivatives are:

- Decentralized: Transactions are peer-to-peer, governed by immutable smart contracts.

- Transparent: All transactions are visible on the blockchain, ensuring that participants can audit the process.

- Accessible: Traders can access decentralized derivative platforms 24/7 without needing permission from any authority.

By eliminating intermediaries, DeFi derivatives offer lower fees, faster execution, and greater access to global markets, opening up new opportunities for retail and institutional traders alike.

Key Concepts

Composability in DeFi and Its Impact on the Derivative Ecosystem

One of the most powerful features of decentralized finance is composability—the ability of different protocols to interact with one another seamlessly, allowing for new financial products to be built on top of existing ones. In the context of DeFi derivatives, composability enables platforms to integrate features from other DeFi protocols, such as lending, borrowing, or trading assets across multiple platforms.

For example, a trader could use a lending protocol like Compound to borrow funds, then use those funds to open a futures position on a platform like dYdX.

Similarly, tokenized assets can be used in combination with other protocols to create complex financial strategies. This fluid interaction between protocols accelerates innovation and provides users with a wide array of tools to manage risk and gain exposure to various markets.

Composability also enhances liquidity and capital efficiency across the DeFi ecosystem, as assets and contracts can be easily moved between platforms. This level of interoperability is what sets DeFi apart from traditional finance, where systems are siloed, and interaction between financial institutions is often limited by regulation or technological barriers.

Liquidity Mining and Yield Farming in Derivatives Platforms

Liquidity mining and yield farming have been critical to the growth of decentralized derivatives platforms. By incentivizing users to provide liquidity, platforms can increase their available liquidity, ensuring that trades can be executed efficiently with minimal slippage.

On derivatives platforms, liquidity providers (LPs) often deposit tokens into liquidity pools, allowing the protocol to facilitate leveraged trades or options contracts. In return, these LPs receive rewards in the form of native tokens, creating a yield farming opportunity. For example, platforms like dYdX and GMX offer users the ability to earn trading fees and governance tokens by staking liquidity in their protocols.

This mechanism not only drives participation but also enhances market depth, making derivatives trading on decentralized platforms more viable and attractive to both retail and institutional traders. By offering these rewards, derivatives platforms can compete with traditional centralized exchanges and continuously grow their user base.

Types of DeFi Derivatives

Perpetual Futures and Decentralized Derivatives Exchanges

Explanation of Perpetual Futures

Perpetual futures are one of the most popular types of decentralized derivatives. Unlike traditional futures contracts, which have a fixed expiration date, perpetual futures allow traders to maintain their positions indefinitely. Platforms such as dYdX, GMX, and Hyperliquid are leading the way in offering decentralized perpetual futures contracts. These platforms provide users with the ability to speculate on the price of assets (like Bitcoin or Ethereum) using leverage, meaning they can control larger positions than their initial investment.

Perpetual futures are widely used for hedging against price fluctuations or for speculative trading. Traders can go long (betting on the price increase) or short (betting on the price decrease), all managed automatically by smart contracts. This trustless system ensures there is no need for intermediaries, lowering costs and increasing efficiency.

Role of Funding Rates in Maintaining Equilibrium

A key feature of perpetual futures is the funding rate mechanism. Since these contracts never expire, there needs to be a system that keeps the contract price closely aligned with the price of the underlying asset. Funding rates achieve this by periodically requiring traders to pay a fee—either long or short traders, depending on market conditions.

- When more traders are long (betting the price will rise), the funding rate will be positive, and long traders will pay a fee to short traders.

- When more traders are short, the rate will be negative, and shorts will pay longs.

This system incentivizes balance between buyers and sellers, ensuring that the contract price remains near the spot price of the underlying asset. dYdX, for example, implements this system to maintain price stability, while GMX and Hyperliquid use similar mechanisms to prevent large deviations from the market price.

Example Platforms Offering Decentralized Futures

dYdX

One of the largest decentralized trading platforms, dYdX offers perpetual futures with up to 20x leverage, deep liquidity, and a smooth trading experience. Its decentralized nature ensures transparency and security in executing trades.

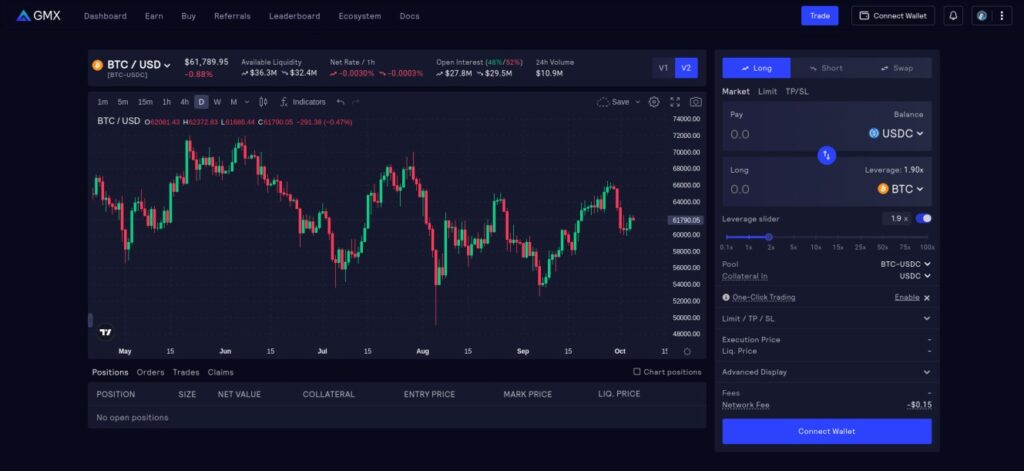

GMX

GMX operates as a decentralized perpetual exchange on Arbitrum and Avalanche, offering users leverage of up to 30x. It is known for its low fees, high liquidity, and transparent fee structures, making it a popular choice for decentralized derivatives trading.

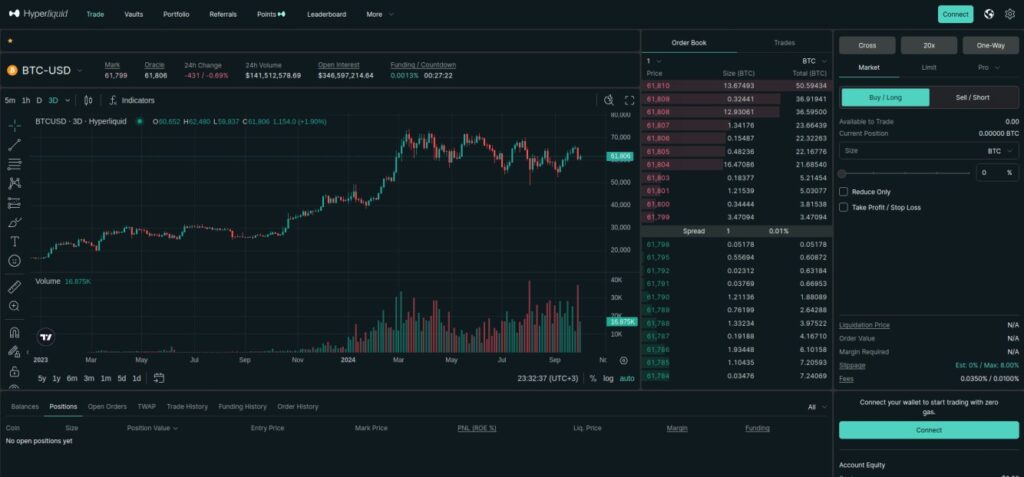

Hyperliquid:

Hyperliquid focuses on providing fast, decentralized perpetual futures trading with deep liquidity. The platform is designed for scalability and offers an easy-to-use interface for high-leverage traders looking to gain exposure to various crypto assets.

These platforms provide traders with various options to engage in decentralized futures trading, each with unique features that cater to different user preferences, such as fees, leverage options, and supported assets.

Explore other decentralized trading platforms and see what they have to offer.

Options Contracts

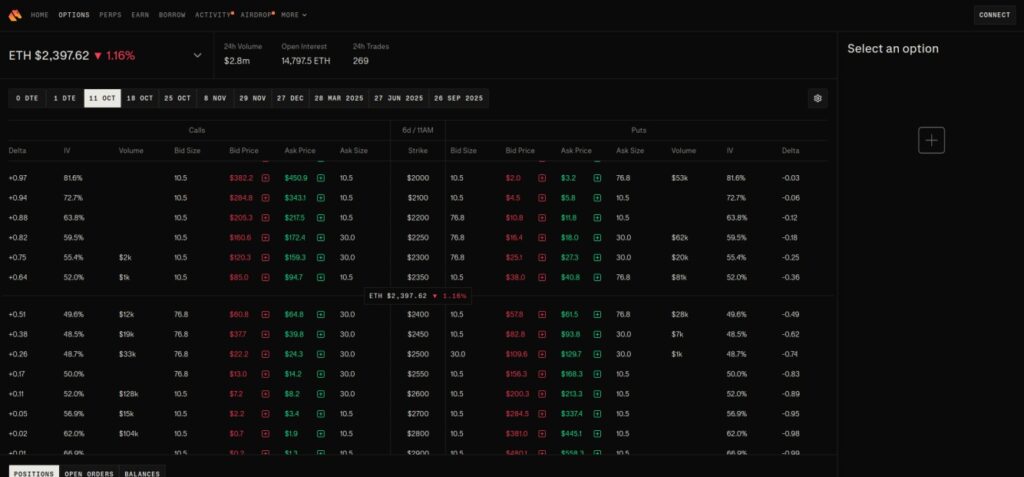

Introduction to Options Trading in DeFi: Call and Put Options

In DeFi, options contracts allow traders to either buy call options (expecting prices to rise) or buy put options (expecting prices to fall) on crypto assets like Bitcoin or Ethereum. These decentralized options give traders greater control over their assets, with execution happening via smart contracts without intermediaries. This setup ensures transparency, cost-effectiveness, and 24/7 access.

Key Platforms: Derive, Aevo, and Hegic

Derive

Derive is an innovative DeFi platform offering a decentralized, non-custodial exchange for crypto options and other derivatives. It aims to simplify the options trading process while maintaining robust security. Derive’s on-chain architecture ensures that traders have full control of their assets, and its intuitive interface allows users to set up complex strategies with ease. It is gaining popularity due to its deep liquidity and flexible trading pairs.

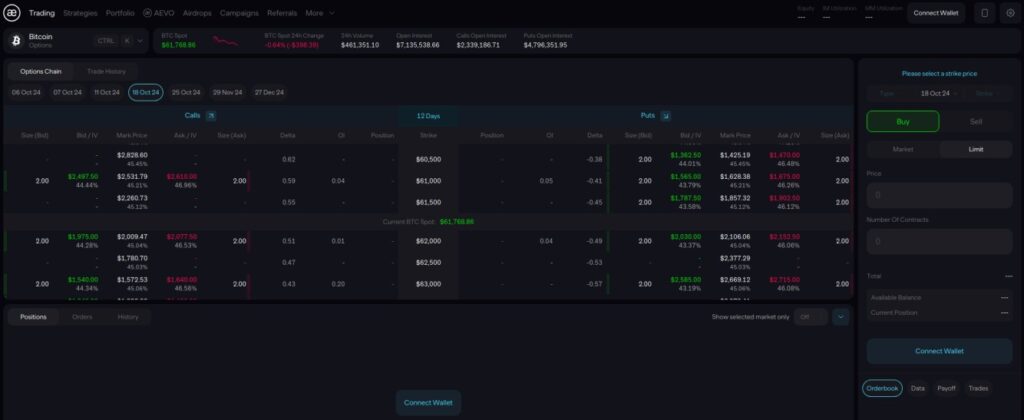

Aevo

Aevo is a high-performance decentralized derivatives exchange that integrates both options and perpetual contracts. With a custom Layer 2 (L2) rollup on the Optimism stack, Aevo achieves low latency and high transaction throughput. Aevo offers on-chain security with off-chain order matching, allowing users to trade call and put options efficiently while reducing transaction costs. The platform supports multiple expiration dates and strike prices for assets like BTC and ETH, making it one of the top choices for sophisticated traders. Aevo also offers innovative products such as Pre-Launch Token Futures, attracting considerable trading volume.

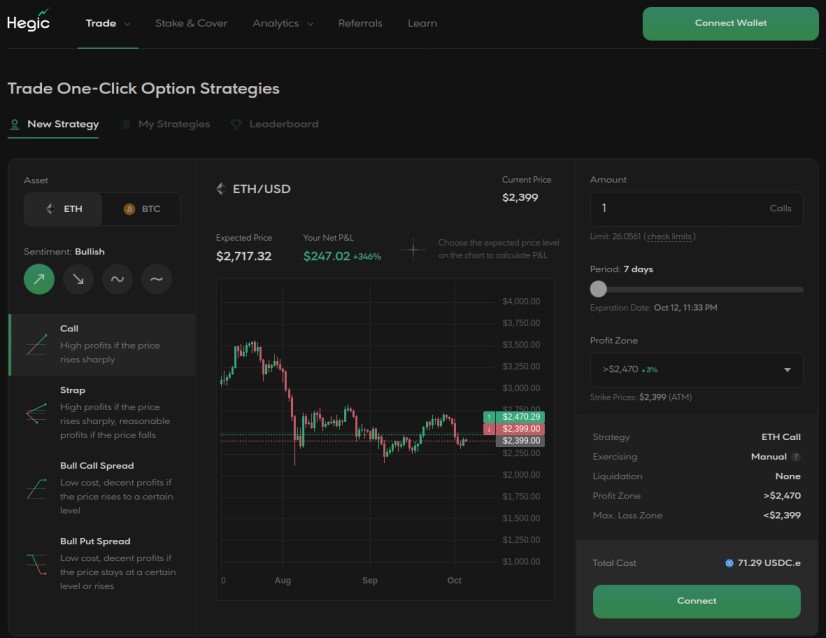

Hegic

Hegic is known for its user-friendly, non-custodial options protocol. It offers seamless access to ETH and BTC options with no expiration date, which is unique in the market. Users can easily create or participate in options contracts, and Hegic’s automated structure ensures that fees are minimized while simplifying the trading process. It’s particularly well-suited for users who want an intuitive experience for managing their options positions without dealing with overly complex features.

Discover a detailed list of options trading platforms that cater to various trading needs and preferences.

Use Cases for Crypto Options

Options in DeFi are highly flexible, serving various needs such as:

- Hedging: Traders use put options to protect their portfolios against downward price movements.

- Speculation: Call options allow traders to profit from price increases, while put options help them gain from price drops without owning the underlying asset.

- Yield Generation: Selling options is a popular way for users to earn premiums, creating a passive income strategy in the volatile crypto markets.

These platforms are instrumental in bringing the benefits of decentralized finance to options trading, offering risk management and speculative opportunities in a transparent, decentralized manner.

Liquid Staking Derivatives

Introduction to Liquid Staking Derivatives

Liquid staking derivatives are a form of DeFi derivative that allows users to stake their assets, such as Ethereum or Solana, while still maintaining liquidity through tokenized representations of the staked assets. Typically, when users stake their assets to secure a network or participate in proof-of-stake (PoS) consensus mechanisms, their assets become locked and inaccessible for trading or collateralization. Liquid staking derivatives solve this problem by issuing derivative tokens that represent the value of the staked assets, enabling users to continue utilizing their capital within the DeFi ecosystem while earning staking rewards.

These liquid staking derivatives represent both the underlying staked asset and the rewards it accrues. Platforms like Lido Finance and Rocket Pool have pioneered the use of liquid staking in the DeFi space, issuing tokens like stETH (staked ETH) and rETH (Rocket Pool ETH), which users can trade or deploy in various DeFi strategies.

How Liquid Staking Derivatives Work

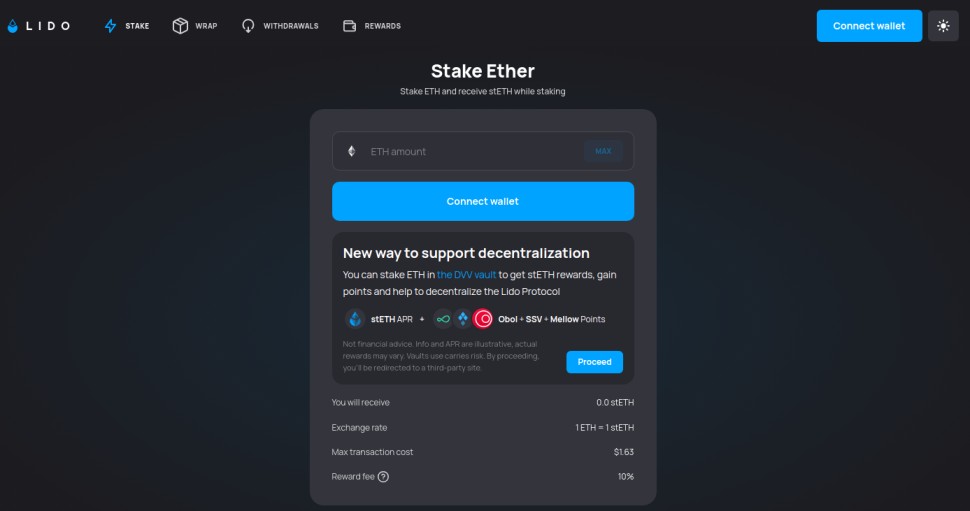

When a user stakes an asset like ETH via a platform like Lido, they receive an equivalent amount of stETH, which represents their staked Ethereum. As the staked ETH generates rewards, the balance of stETH increases over time, reflecting the accrued staking rewards. This derivative token can then be used within DeFi protocols, allowing users to trade, lend, or provide liquidity with their staked capital while still earning staking rewards in the background.

Derivative tokens maintain their peg to the staked asset by always being redeemable for the underlying assets through unstaking. This mechanism introduces arbitrage opportunities. As users trade staked tokens, supply and demand naturally balance, ensuring that the value of these tokens accurately reflects the underlying staked assets and their accrued rewards.

Key Platforms Offering Liquid Staking Derivatives

Lido Finance

One of the most popular platforms for liquid staking, Lido allows users to stake assets like ETH, Solana, and others. In return, users receive tokens like stETH (staked Ethereum), which can be used in other DeFi applications. Lido has become the go-to solution for Ethereum staking ahead of Ethereum 2.0, providing both staking rewards and liquidity to its users.

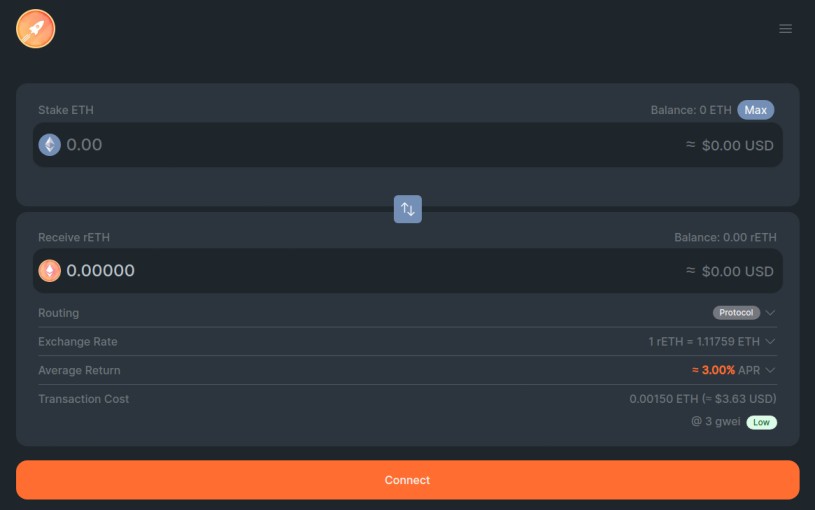

Rocket Pool

Another prominent liquid staking platform, Rocket Pool offers a decentralized staking service, issuing rETH for Ethereum staking. Like Lido, Rocket Pool allows users to participate in Ethereum staking while maintaining liquidity through its derivative token, which can be utilized across the DeFi ecosystem for trading, lending, or yield farming.

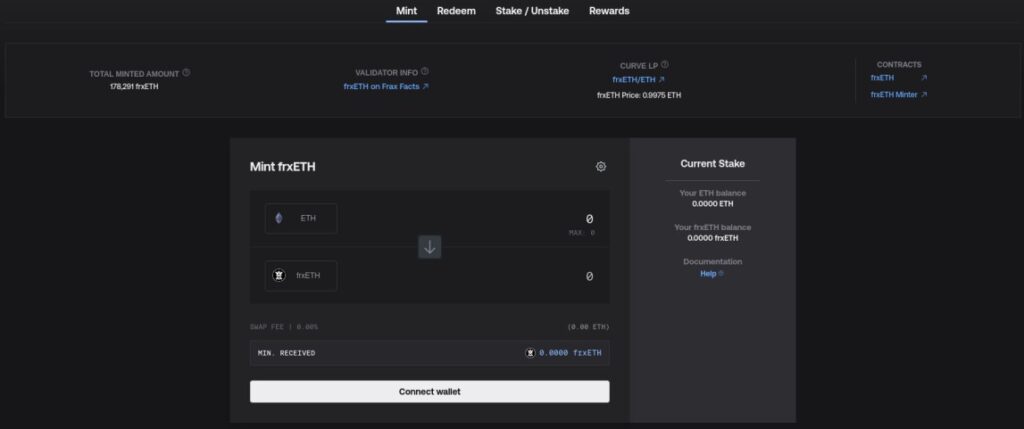

Frax Ether

(Frax Finance) also provides a liquid staking solution with Frax Ether (frxETH). Similar to stETH, frxETH allows users to benefit from staking rewards while using the derivative in DeFi applications. Frax Ether integrates with various DeFi platforms, further increasing the utility of liquid staking derivatives.

Explore the diverse range of liquid staking products, such as restaking and liquid restaking, to deepen your understanding.

Use Cases for Liquid Staking Derivatives

Liquid staking derivatives bring several key benefits to DeFi participants:

- Maintain Liquidity: Users can stake their assets and still have access to liquid tokens that can be used in trading, lending, or liquidity pools. This flexibility maximizes the utility of assets without sacrificing staking rewards.

- Collateral in DeFi: Liquid staking derivatives can be used as collateral in DeFi protocols, enabling users to borrow stablecoins or other assets against their staked holdings. This unlocks additional value from staked assets while keeping the rewards flowing.

- Yield Optimization: Liquid staking tokens can be deployed in yield farming strategies or added to liquidity pools, allowing users to stack DeFi rewards on top of their staking earnings.

The Role of Liquid Staking Derivatives in DeFi Derivatives

Liquid staking derivatives represent a dynamic blend of staking rewards and DeFi liquidity, enabling stakers to maximize capital efficiency. They play an important role in the broader DeFi derivatives landscape, where they act as tradable, collateralizable instruments tied to the performance of the underlying staked asset. These derivatives enhance DeFi liquidity while maintaining the decentralized security of proof-of-stake networks, making them a crucial innovation in the evolving world of decentralized finance.

Tokenized Assets

What Are Tokenized Assets and Why They Matter

Tokenized assets are blockchain-based representations of real-world assets such as commodities, and stablecoins. These digital assets are digitized versions of physical or financial instruments, and they derive their value from the underlying asset they represent. In decentralized finance (DeFi), tokenized assets enable traders and investors to access traditional financial markets while interacting with them in a decentralized, permissionless environment.

By utilizing tokenized assets, DeFi breaks down the barriers that often limit access to financial markets due to geographic, financial, or regulatory restrictions. These assets allow users to trade, hedge against volatility, and diversify their portfolios across various asset classes without needing to hold or manage the underlying physical assets. This ability to interact with traditional markets in a 24/7 decentralized environment eliminates intermediaries like brokers, increasing both transparency and accessibility for global users.

How Tokenized Assets Track Real-World Markets

Tokenized assets rely on decentralized oracles, which provide real-time pricing data from traditional markets. For example, tokenized gold assets such as XAUT (Tether Gold) and PAXG (Paxos Gold) reflect the market value of physical gold. These tokenized versions of gold allow users to trade or hold gold in a decentralized manner while maintaining an up-to-date reflection of its price.

Similarly, stablecoins like USDT, and USDC are pegged to fiat currencies (typically the U.S. dollar). These stablecoins derive their value from the underlying fiat currencies, offering a stable medium of exchange and acting as collateral in DeFi applications. Although stablecoins are not speculative in nature, they are considered derivatives because their value is directly tied to the underlying asset, making them essential for liquidity and collateral use in decentralized protocols.

Tokenized Commodities and Stablecoins as Derivatives

Tokenized commodities and stablecoins are essentially derivatives, as their value is derived from an underlying asset (e.g., gold or fiat currency). These assets provide investors and traders with the flexibility to engage with real-world markets while benefiting from the advantages of blockchain technology. For instance, tokenized gold allows users to invest in precious metals without the logistical burden of holding physical gold, while still offering a secure, inflation-resistant asset in times of economic uncertainty.

Similarly, stablecoins serve as the backbone of DeFi, providing stability and liquidity. They are widely used across lending, borrowing, and trading protocols, acting as a trusted store of value within a volatile crypto ecosystem. By maintaining their peg to fiat currencies, stablecoins enable users to interact with more volatile assets while ensuring access to a stable, predictable asset for collateral and transactional purposes.

Learn more about different types of stablecoins, and how they work.

Indexes

Introduction to DeFi Indexes as Derivatives

DeFi indexes are derivative products in that they derive their value from a basket of underlying assets, much like traditional financial indexes such as the S&P 500. These decentralized indexes allow investors to gain broad exposure to multiple tokens, sectors, or assets through a single index token. By aggregating a group of tokens, DeFi indexes provide traders with diversified exposure, minimizing the risk tied to any single asset and reducing portfolio management complexity.

In the context of DeFi derivatives, these indexes can be seen as composite derivatives, where the value of the index token is linked to a group of underlying assets. This makes them a powerful tool for hedging, speculative trading, and gaining sector-specific exposure within DeFi.

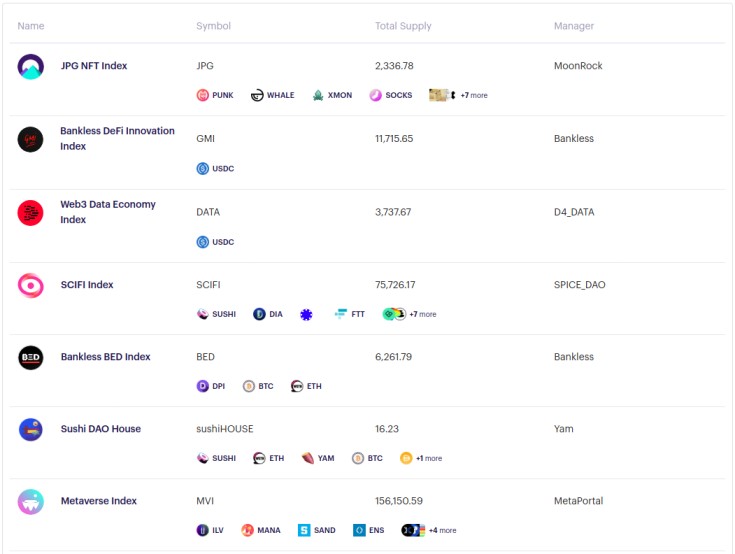

Set Protocol

Set Protocol facilitates the creation and trading of index derivatives by bundling multiple tokens into a single “Set” token. These index-like products are essentially tokenized portfolios of crypto assets, allowing investors to gain exposure to a basket of assets through one single asset. For instance, a DeFi Set could include popular DeFi tokens like Aave, Compound, and Uniswap, representing the DeFi sector as a whole. TokenSets, Set Protocol's marketplace, enables users to trade these Sets easily, providing flexibility to invest in pre-built or custom Sets.

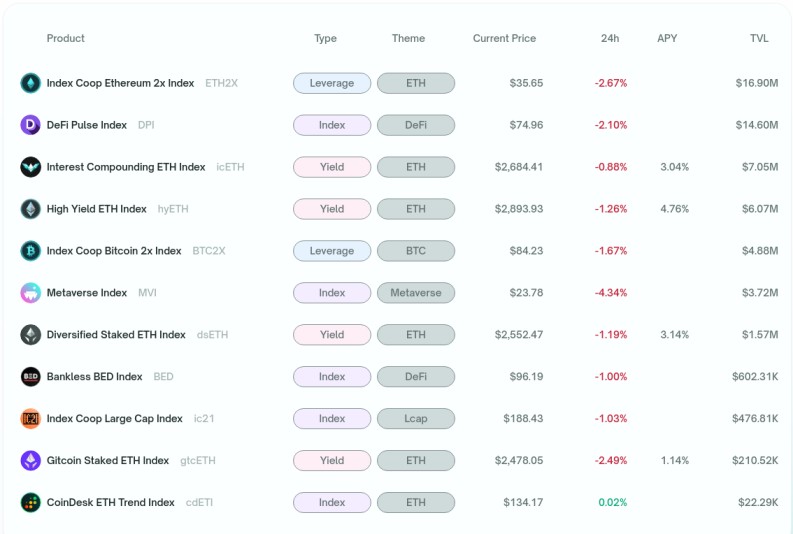

Index Coop

Index Coop takes a similar approach by creating popular DeFi-focused indexes, such as the DeFi Pulse Index (DPI), which tracks the top DeFi projects. This index is essentially a derivative that derives its value from the collective performance of major DeFi tokens like Aave, and Maker. By investing in the DPI token, traders can speculate on the overall health and growth of the DeFi sector.

These index derivatives allow for simplified exposure to decentralized markets, functioning much like ETFs in traditional finance, but with the added benefits of decentralization, transparency, and automation through smart contracts.

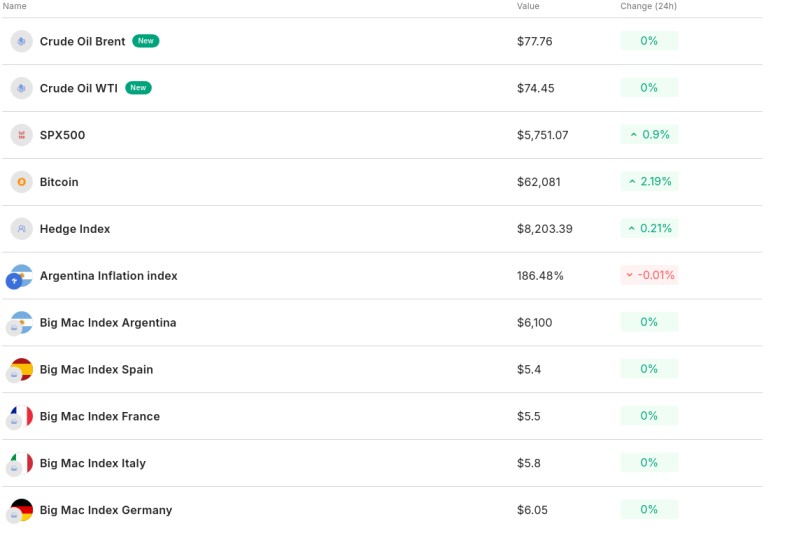

Truflation: Inflation-Adjusted Indexes

Truflation provides an inflation index that tracks real-world inflation metrics through blockchain-powered oracles. While not a traditional index of crypto assets, the Truflation Index could be used to create inflation-adjusted assets or structured products, giving traders a way to hedge against inflation. For example, a tokenized asset pegged to inflation could be created and traded, allowing users to maintain the purchasing power of their assets. This effectively makes the Truflation data another derivative product in DeFi, enabling inflation-hedged investment strategies.

The Role of Index Derivatives in DeFi

DeFi index derivatives simplify access to a broad range of markets by packaging multiple tokens into a single tradable asset. This approach reduces risk, offers sector-wide exposure, and provides a passive investment strategy through automated rebalancing. Furthermore, these index derivatives can be used in more complex strategies like yield farming or as collateral in other DeFi protocols, adding another layer of utility to the DeFi ecosystem.

By integrating index derivatives, platforms like Set Protocol, Index Coop, and Truflation are expanding the functionality of DeFi markets, offering users exposure to a diversified range of assets while maintaining the decentralized ethos of the crypto space.

How to Get Started with DeFi Derivatives

1. Setting Up a Wallet

To begin trading DeFi derivatives on platforms like GMX, or, dYdX, you first need to set up and connect a compatible wallet. A DeFi wallet is your key to interacting with decentralized applications (dApps) and managing your funds securely without relying on centralized intermediaries. Below is a step-by-step guide to get you started:

- Choose a Wallet: For a seamless DeFi experience, consider using Rabby Wallet, which offers user-friendly features and enhanced security for DeFi users. Discover more about Rabby Wallet.

- Install the Wallet: Visit the Rabby Wallet website or browser extension store to download the wallet. Follow the installation steps to add it as a browser extension (e.g., for Chrome or Brave).

- Create or Import a Wallet: Open the wallet and choose to either create a new wallet or import an existing one using your seed phrase. Securely back up your seed phrase, as it’s essential for recovering your wallet.

- Fund Your Wallet: Transfer ETH or other compatible tokens to your wallet by copying your wallet’s public address and using a centralized exchange like Bybit or MEXC for the transfer.

- Connect Your Wallet to GMX:

- Visit the GMX platform and click on “Connect Wallet.”

- Choose Rabby or your preferred wallet and follow the prompts to authorize the connection.

- Once connected, you’re ready to start trading derivatives.

2. Choosing the Right Platform

Selecting the ideal DeFi derivatives platform is crucial for optimizing your trading strategy. Key factors to consider include liquidity, fees, and available leverage. Let’s break down these considerations using GMX as an example.

- Liquidity: Liquidity is the lifeblood of any derivatives platform. Higher liquidity ensures that trades can be executed efficiently with minimal slippage. GMX operates on Arbitrum and Avalanche, offering deep liquidity pools that allow traders to take large leveraged positions without excessive price impact. Platforms with larger liquidity pools are generally more reliable for high-volume trading.

- Fee Structure: Compare the trading fees across different platforms. GMX is known for its low-fee structure, where traders pay minimal fees for opening and closing positions, which is particularly attractive for high-frequency traders. Other platforms, such as dYdX and Hyperliquid, may have different fee structures that vary based on transaction volume or leverage used. Make sure to evaluate these based on your expected trading volume and strategy.

- Available Leverage: Leverage allows you to control a larger position than your initial capital. GMX offers up to 30x leverage, giving traders the ability to amplify both gains and risks. dYdX and Hyperliquid also offer significant leverage (up to 20x and 10x, respectively). When choosing a platform, consider the level of leverage you’re comfortable with and how it fits into your risk management strategy.

3. Executing Your First Trade on GMX

- Deposit Funds: After connecting your wallet to GMX, navigate to the trading interface. Choose the asset you want to trade (e.g., ETH, BTC) and select whether you want to go long (betting the price will rise) or short (betting the price will fall).

- Set Leverage: Use the leverage slider to choose how much leverage you want to apply (up to 30x). Be cautious with high leverage, as it can magnify both gains and losses.

- Confirm the Trade:

- Enter the amount you want to trade and click “Open Position.”

- Confirm the transaction through your wallet and wait for the trade to execute.

By following these steps, you'll be able to easily navigate and start trading DeFi derivatives on GMX or other platforms like dYdX and Perpetual Protocol.

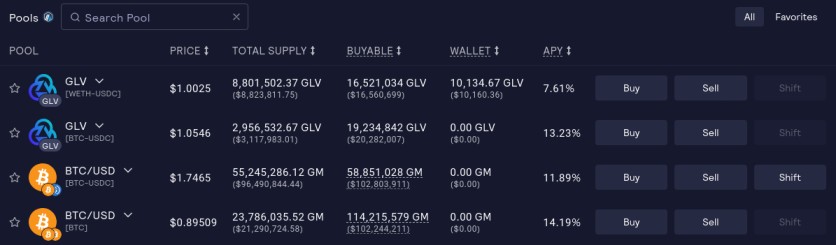

Maximizing Yield: A Simple DeFi Derivative Liquidity Strategy with Vaults

One of the most lucrative yet simple strategies in DeFi derivatives is becoming a liquidity provider (LP) for decentralized exchanges that offer perpetual contracts. In this section, we are going to focus on platforms like GMX, Hyperliquid, and MUX, which allow users to provide liquidity to support the perpetual traders on their exchanges. In return, liquidity providers earn fees from trading activity, liquidations, and other platform rewards. This strategy combines passive income opportunities with exposure to the cutting-edge derivatives market.

How Liquidity Provision Works

When you provide liquidity on a derivative exchange, you're essentially becoming the counterparty to traders. On platforms like GMX, MUX, and Hyperliquid, liquidity providers pool assets to enable traders to open leveraged positions. You earn a share of the platform's fees, including trading fees, borrowing fees, and liquidation fees, depending on the performance of the traders. These liquidity pools provide the capital that traders need to leverage their positions.

How It Works on GMX, Hyperliquid and MUX

GMX

GMX offers a variety of options, from the old v1 GLP (GMX Liquidity Provider) vaults to newer v2 GM pools, and now the latest GVL (GMX Liquidity Vault). All of these allow you to deposit assets like ETH, BTC, or stablecoins. The pools are used to back leveraged positions taken by traders. As a liquidity provider, you earn a cut of the trading fees generated from the perpetual contracts, along with other rewards in the form of ETH, AVAX or GMX. GMX even uses an automated balancing mechanism to incentivize liquidity shifts between long and short positions, optimizing the pool's performance.

Hyperliquid

Hyperliquid presents the HLP (Hyperliquidity Provider), an advanced liquidity pool where you can deposit assets and earn fees generated from traders' perpetual contract activities. Hyperliquid uses an on-chain order book model that ensures fast execution and transparent fees. Liquidity providers earn from trader liquidations, borrowing costs, and transaction fees, making it a powerful passive income stream for those who prefer to provide liquidity rather than trade directly.

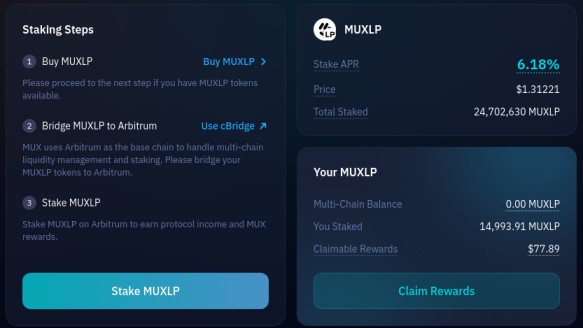

MUX

On MUX, LPs can participate in the MUXLP pool, which unifies liquidity from multiple chains and allows for zero price impact trading. MUX LPs benefit from aggregated liquidity sources, optimized trading costs, and high leverage (up to 100x). As a liquidity provider, you earn rewards from the platform’s transaction fees and liquidation events, similar to GMX and Hyperliquid, but with a unique multi-chain setup that maximizes exposure.

Benefits of Vault-Based Yield Farming on Derivative Platforms

- Stable Yield: One of the most appealing aspects of providing liquidity on these platforms is the relatively stable and passive yield that comes from the platform's trading activity. You earn consistent fees regardless of market volatility, as traders continue to open and close leveraged positions.

- Risk Diversification: By providing liquidity in a diversified pool of assets (like stablecoins and crypto), you balance your exposure to both long and short positions. This reduces the risk of sudden market movements wiping out your capital.

- Earn from Liquidations: Liquidity providers also earn from trader liquidations, which can occur when traders over-leverage and their positions are forcibly closed. This provides an additional stream of income, especially during periods of high volatility.

- Protocol-Specific Incentives: Many platforms, such as GMX and MUX, offer their native tokens (e.g., GMX, MUX) or other rewards on top of the trading fees, providing an additional incentive to participate in these vaults.

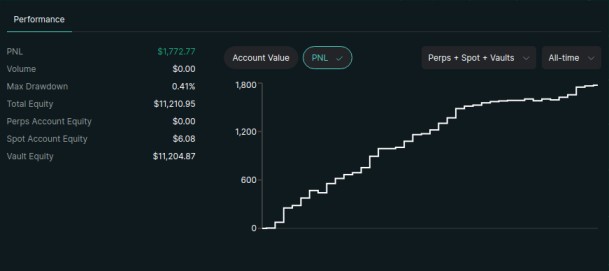

How to Get Started with Vaults

- Choose a Platform: Start by picking a platform that suits your risk tolerance and desired rewards. GMX, Hyperliquid, and MUX all have user-friendly interfaces and clear guides for liquidity provision.

- Deposit Assets: On platforms like GMX and MUX, you can deposit crypto assets such as ETH, BTC, or stablecoins. These assets are pooled into the vault to back leveraged trading.

- Earn Fees and Rewards: Once your assets are deposited, you start earning fees from the trading activity on the platform, along with any additional rewards or staking incentives. On platforms like MUX, you can further optimize your earnings by participating in multiplexing features that enhance liquidity routing.

- Monitor and Adjust: Use the platform’s dashboard to monitor your positions, track earnings, and rebalance your liquidity if needed. For example, as shown in Hyperliquid dashboard, you can keep track of your PnL, equity, and vault performance, giving you a clear picture of your earnings over time.

By providing liquidity through vaults on these decentralized derivative exchanges, you can tap into a lucrative stream of passive income while supporting the broader DeFi ecosystem. With the combination of low fees, high leverage, and cutting-edge technology, these platforms offer one of the most exciting opportunities in decentralized finance today.

Conclusion

Decentralized derivatives are revolutionizing global finance by providing traders and investors with new tools for hedging, speculation, and risk management—without the need for intermediaries. The rise of platforms like GMX, Hyperliquid, and others is a testament to how DeFi derivatives offer transparency, liquidity, and flexibility unmatched by traditional financial systems. From perpetual contracts to options and tokenized assets, these platforms allow users to gain exposure to a wide range of financial instruments in a permissionless and borderless environment.

As DeFi continues to grow and evolve, the opportunities within decentralized derivatives will only expand. Whether you’re an experienced trader looking to hedge against volatility, or an investor seeking to diversify your portfolio with yield-generating liquidity pools, DeFi derivatives present a compelling option for anyone looking to participate in the future of finance.

Now is the time to explore DeFi derivative platforms and take advantage of the innovative products they offer. By getting involved, you can diversify your holdings, earn passive income through liquidity provision, and stay ahead of the curve in the evolving landscape of decentralized finance.

FAQs (Frequently Asked Questions)

What are DeFi derivatives?

DeFi derivatives are financial contracts that derive their value from an underlying asset or index, allowing traders to speculate on price movements in a decentralized manner. They utilize smart contracts to automate and secure transactions without the need for intermediaries.

How do DeFi derivatives differ from traditional derivatives?

Traditional derivatives are typically traded on centralized exchanges and are subject to regulatory oversight, while DeFi derivatives operate on decentralized platforms, offering greater accessibility, transparency, and composability. This allows for innovative trading strategies and products that may not be available in traditional finance.

What are perpetual futures in DeFi?

Perpetual futures are a type of derivative contract that allows traders to speculate on the future price of an asset without an expiration date. They include a funding rate mechanism to maintain price equilibrium between the perpetual contract and the underlying asset.

What role do tokenized assets play in DeFi?

Tokenized assets are blockchain-based representations of real-world assets, allowing users to gain exposure to various markets without holding the actual assets. They rely on decentralized oracles for price feeds and can serve as collateral in DeFi lending and trading platforms.

How can I get started with trading DeFi derivatives?

To start trading DeFi derivatives, you should first set up a cryptocurrency wallet compatible with your chosen platform. Next, select a suitable DeFi derivatives platform like GMX or dYdX, deposit funds into your wallet, and execute your first trade by navigating through the platform's interface.

What are liquid staking derivatives and their benefits?

Liquid staking derivatives allow users to stake their assets while retaining liquidity through tokenized representations of their staked assets. This enables users to participate in staking rewards while still being able to trade or use their tokens in other DeFi applications, enhancing capital efficiency.