Spectra Finance

Spectra is a permissionless interest-rate derivatives protocol. Tokenize yield from ERC‑4626 vaults into Principal & Yield Tokens. Create fixed-rate pools, trade yield, and earn fees across chains.

Spectra is a permissionless interest-rate derivatives protocol. Tokenize yield from ERC‑4626 vaults into Principal & Yield Tokens. Create fixed-rate pools, trade yield, and earn fees across chains.

Napier Finance is a modular yield tokenization protocol. Users can fix, trade, and curate yield markets on Ethereum using flexible tools like Principal and Yield Tokens.

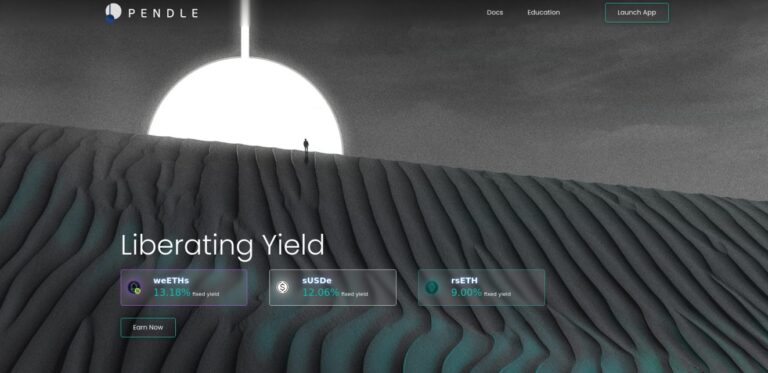

Pendle tokenizes yield, letting users split assets into principal and yield components. It features a custom AMM for yield trading and offers governance and rewards through vePENDLE.

PancakeSwap is a decentralized exchange (DEX) on the BNB Smart Chain, offering fast and low-cost trading. It features liquidity pools, yield farming, and staking, allowing users to earn rewards.

Chainflip is a DEX for native cross-chain swaps. It uses a Just-In-Time (JIT) Automated Market Maker (AMM) to offer low slippage and competitive pricing for assets, including Bitcoin.

THORSwap is a decentralized exchange (DEX) powered by THORChain, which facilitates cryptocurrency trading in a non-custodial and decentralized manner.

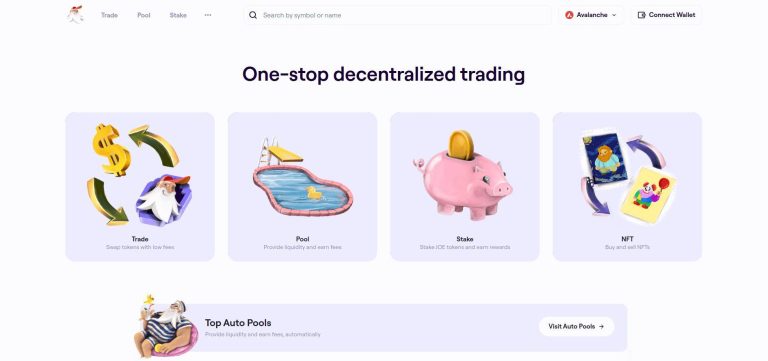

Trader Joe XYZ is a one-stop decentralized trading platform on Avalanche, offering trading, lending, borrowing, staking, and shopping, with a focus on user-friendly DeFi activities.

Slingshot Finance is a decentralized finance (DeFi) platform that operates on a Web3 framework, allowing users to store, swap and trade in the Ethereum ecosystem.

Bancor Network facilitates on-chain trading and liquidity provision through automated market-makers, enabling token swaps, single-sided liquidity.

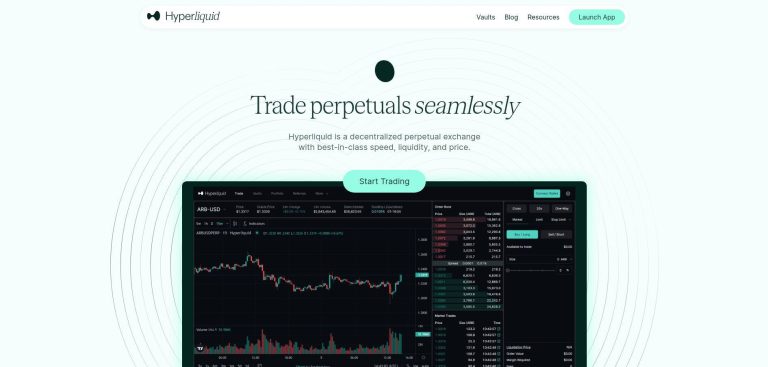

Hyperliquid is a decentralized perpetual exchange with advanced order types, instant trade finality, low fees, up to 50x leverage, and a fully on-chain order books.

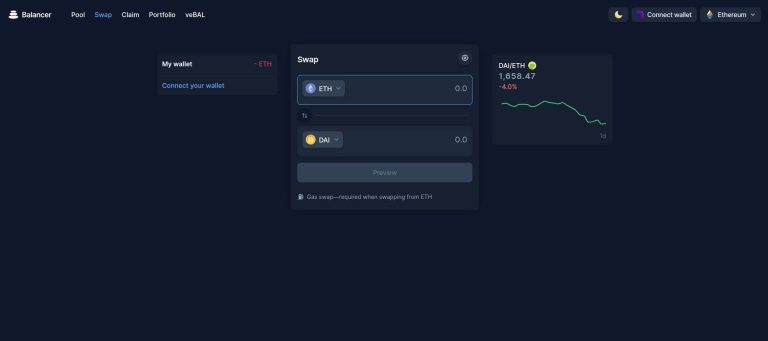

Balancer is an Ethereum-based DeFi protocol for custom liquidity pools, enabling trustless trading, automated portfolio management, and innovative liquidity strategies.

Sushi is a community-driven DeFi ecosystem offering swapping, lending, borrowing, leverage, and a multi-chain DEX, catering to a broad user base.

KyberSwap, DeFi's first Dynamic Market Maker, offers decentralized crypto trading with high flexibility, capital efficiency, across multiple blockchain networks.

Curve is a leading DeFi Automated Market Maker (AMM), specializing in efficient stablecoin trading with low slippage, low fees, and incentivized liquidity provision.

Uniswap is a decentralized, open-source protocol on Ethereum for automated liquidity provision and token trading, fostering a seamless DeFi ecosystem.