Napier Finance

Napier Finance is a modular yield tokenization protocol. Users can fix, trade, and curate yield markets on Ethereum using flexible tools like Principal and Yield Tokens.

Napier Finance is a modular yield tokenization protocol. Users can fix, trade, and curate yield markets on Ethereum using flexible tools like Principal and Yield Tokens.

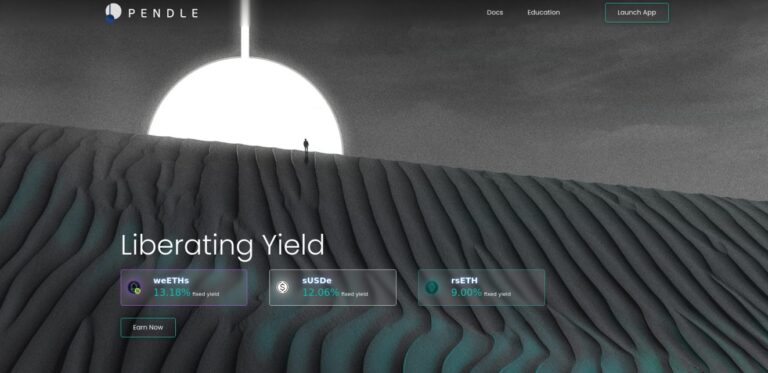

Pendle tokenizes yield, letting users split assets into principal and yield components. It features a custom AMM for yield trading and offers governance and rewards through vePENDLE.

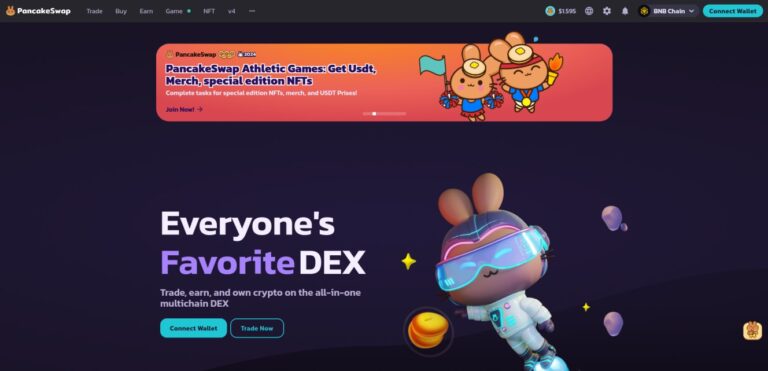

PancakeSwap is a decentralized exchange (DEX) on the BNB Smart Chain, offering fast and low-cost trading. It features liquidity pools, yield farming, and staking, allowing users to earn rewards.

THORSwap is a decentralized exchange (DEX) powered by THORChain, which facilitates cryptocurrency trading in a non-custodial and decentralized manner.

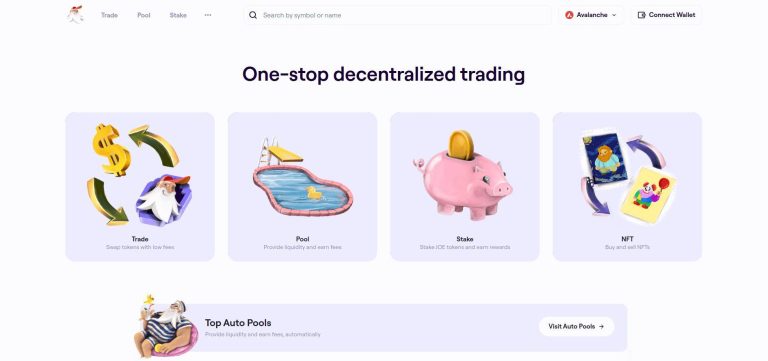

Trader Joe XYZ is a one-stop decentralized trading platform on Avalanche, offering trading, lending, borrowing, staking, and shopping, with a focus on user-friendly DeFi activities.

Slingshot Finance is a decentralized finance (DeFi) platform that operates on a Web3 framework, allowing users to store, swap and trade in the Ethereum ecosystem.

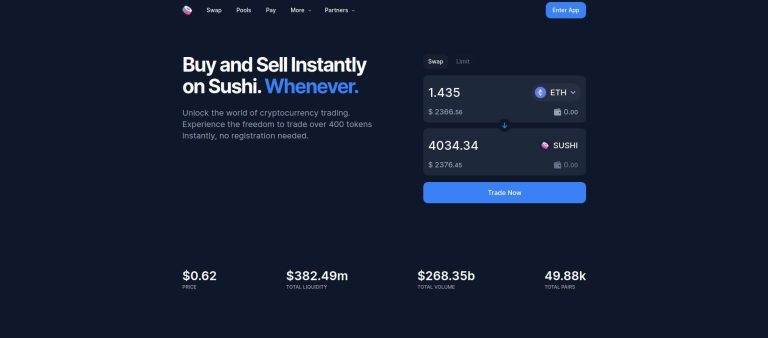

Sushi is a community-driven DeFi ecosystem offering swapping, lending, borrowing, leverage, and a multi-chain DEX, catering to a broad user base.

KyberSwap, DeFi's first Dynamic Market Maker, offers decentralized crypto trading with high flexibility, capital efficiency, across multiple blockchain networks.

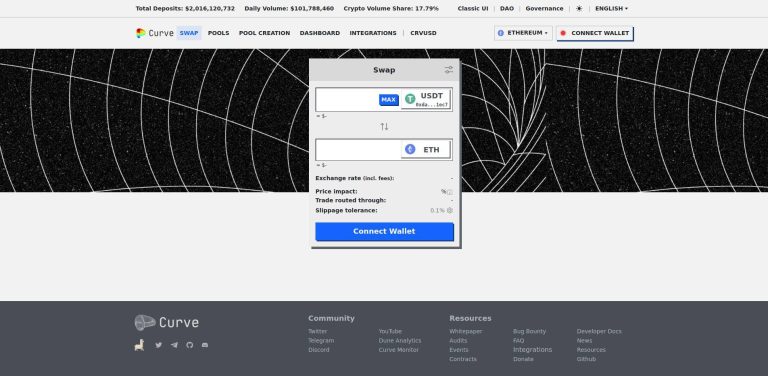

Curve is a leading DeFi Automated Market Maker (AMM), specializing in efficient stablecoin trading with low slippage, low fees, and incentivized liquidity provision.

Uniswap is a decentralized, open-source protocol on Ethereum for automated liquidity provision and token trading, fostering a seamless DeFi ecosystem.