Staking your crypto can lock your assets for months, leaving you unable to access funds or take advantage of new opportunities in the fast-moving DeFi world. This illiquidity can cause missed gains and limit your ability to react to market changes. Liquid staking solves this problem by allowing you to earn staking rewards while keeping your assets accessible, giving you the flexibility to trade, lend, or use them in DeFi without being locked in.

Introduction to Liquid Staking

What is Staking?

Staking is the process of locking up cryptocurrency to help secure a proof-of-stake (PoS) blockchain network, such as Ethereum. By staking your assets, you contribute to the network's security and operations while earning rewards. Ethereum staking can be done in several ways:

- Home Staking (Solo Staking): This is the most decentralized and secure method of staking, where users run their own validator node at home. To stake on Ethereum, you need 32 ETH to operate a validator. While this method provides full control over your staked ETH and rewards, it also requires technical expertise, constant uptime, and can be resource-intensive.

- Staking as a Service: This option allows users to stake their ETH through a third-party service provider, which runs the validator on their behalf. While this removes the need for technical know-how, users must trust the service provider with their staked assets. The service typically charges fees for running the validator, and the user earns a share of the rewards.

- Pooled Staking: In pooled staking, users contribute smaller amounts of ETH into a pool, which collectively stakes enough ETH to operate validators. This method is ideal for users who do not have the 32 ETH required for solo staking. Pooled staking is typically offered through platforms that manage validators and distribute rewards to participants. Liquid staking falls under pooled staking, as users stake their assets via a protocol and receive liquid staking tokens in return.

If you want to learn more about Ethereum Solo Staking in detail, you can check out the official Ethereum staking documentation.

What is Liquid Staking?

Liquid staking is a specialized form of pooled staking where, in addition to staking your assets, you receive a liquid staking token that represents the value of your staked assets. These tokens can be used in decentralized finance (DeFi) applications, traded, or lent out, all while earning staking rewards. Essentially, liquid staking lets you stake without locking up your funds entirely, offering both flexibility and liquidity.

Traditional Staking vs. Liquid Staking

In traditional staking, whether through home staking or staking as a service, your assets are locked in the network, and you can’t access or use them until the staking period ends. Liquid staking removes this restriction by issuing a derivative token that allows you to continue using your staked assets in DeFi applications while still earning staking rewards.

Why is Liquid Staking Gaining Popularity?

As the crypto space evolves, users are looking for ways to maximize the utility of their assets without sacrificing returns. Liquid staking addresses the growing need for flexibility in staking, allowing users to maintain liquidity while earning rewards. With the rise of DeFi, many stakers are keen to explore how they can use their staked assets to participate in yield farming, lending, or other DeFi activities, which has driven the popularity of liquid staking.

Key Benefits Over Traditional Staking

- Flexibility: Liquid staking allows users to retain access to their funds while they are staked, offering flexibility in managing assets.

- Liquidity: You can use liquid staking tokens in DeFi protocols, trade them, or even borrow against them.

- Higher Yield Opportunities: By leveraging liquid staking tokens in DeFi platforms, you can stack multiple income streams—staking rewards and DeFi yields—thereby maximizing returns without compromising the security of your staked assets.

How Liquid Staking Works

Step-by-Step Process of Liquid Staking

- Staking Tokens in a Network: To begin, users stake their tokens on a proof-of-stake (PoS) blockchain network through a liquid staking protocol. By doing so, they contribute to the network’s security and decentralization, just like in traditional staking.

- Receiving Liquid Staking Tokens (e.g., staked ETH -> stETH): In return for staking, users receive a derivative token that represents the value of the staked asset. For example, staking Ether (ETH) through Lido will give you stETH, a liquid staking token that can be used within the DeFi ecosystem.

- Using Liquid Staking Tokens While Earning Staking Rewards: The magic of liquid staking lies in the flexibility it offers. Even though your original tokens are locked in staking, your liquid staking tokens can be used in a variety of DeFi applications. This means you continue to earn staking rewards while also being able to trade, lend, or provide liquidity using the liquid staking tokens.

Example Protocols

Several liquid staking protocols have emerged to offer these services:

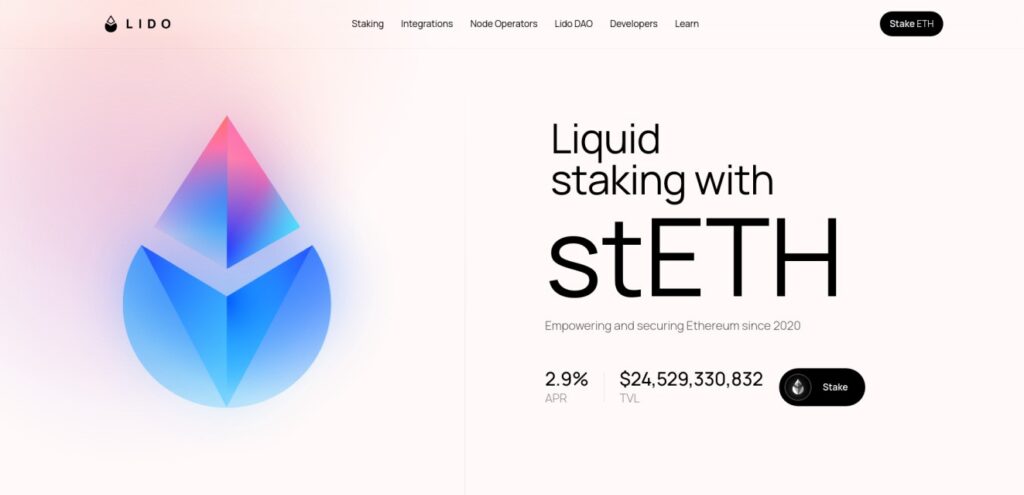

- Lido: The most widely used liquid staking protocol for Ethereum, also supporting other networks like Solana and Polygon.

- Rocket Pool: A decentralized Ethereum liquid staking protocol that allows users to run their own nodes or stake smaller amounts.

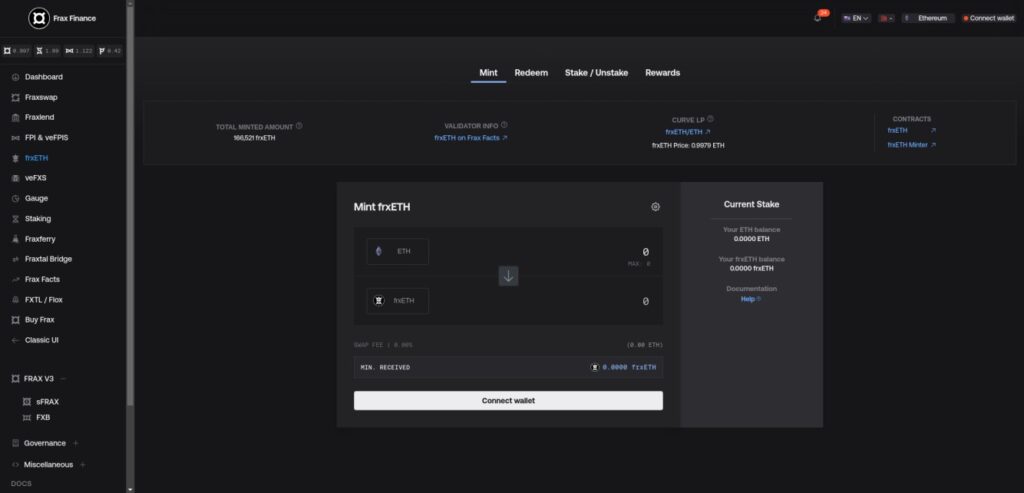

- Frax Ether: A liquid staking protocol from the Frax ecosystem, specifically for Ethereum. Frax Ether offers a decentralized and scalable staking solution, providing users with frxETH tokens that can be used in the broader Frax ecosystem for additional yield opportunities.

Rebasing vs. Non-Rebasing Liquid Staking Tokens (LSTs)

Liquid staking tokens can generally be categorized as either rebasing or non-rebasing. Understanding the difference is crucial for users, as it impacts how their rewards are reflected.

- Rebasing Tokens: These tokens, like stETH from Lido, automatically adjust their balance in your wallet as staking rewards accrue. This means the number of tokens you hold increases over time, making it easy to see the growth of your staked assets directly in your wallet.

- Non-Rebasing Tokens: Tokens like rETH from Rocket Pool, on the other hand, do not change in number. Instead, their value increases over time to reflect staking rewards. This means your balance stays constant, but each token becomes more valuable as rewards are earned.

Both models have their advantages, with rebasing tokens offering a more visible reward accumulation, while non-rebasing tokens maintain a fixed balance but gain value. Your choice of token depends on your preference and how you plan to use it within DeFi.

Technical Explanation: How Liquid Staking Tokens Are Backed by Staked Assets

Liquid staking tokens, such as stETH from Lido or rETH from Rocket Pool, are fully backed by the assets staked on their respective blockchain networks. These tokens act as a 1:1 representation of the staked assets, allowing you to unlock liquidity without needing to withdraw your stake. As your staked assets accrue rewards, the value of the liquid staking tokens increases proportionally. Protocols like Lido allow you to always exchange your liquid staking tokens back into the original staked asset, ensuring users can withdraw their stake at any time.

Advantages and Benefits of Liquid Staking

1. Enhanced Liquidity for Stakers

Traditional staking locks up your assets for a set period, often making it difficult to access funds when needed. Liquid staking solves this by providing liquid staking tokens, which you can use even while your original assets are locked in the staking process. This enhanced liquidity allows you to respond to market conditions or take advantage of new investment opportunities without needing to unstake your assets.

2. Combining Yield Opportunities: Staking Rewards + DeFi Yields

Liquid staking allows users to earn staking rewards while simultaneously using their liquid staking tokens in decentralized finance (DeFi) protocols. For example, you can stake your Ethereum to earn staking rewards, and then use the liquid staked ETH (like stETH) to earn additional yields by lending, farming, or participating in liquidity pools. This dual-income strategy maximizes the earning potential of your assets.

3. Easier Participation in DeFi with Staked Assets

With liquid staking, your staked tokens are not locked away and idle. You can use liquid staking tokens across a range of DeFi platforms to engage in activities like yield farming, collateralized lending, or liquidity provision. This makes liquid staking highly attractive to DeFi participants who want to earn both staking rewards and DeFi yields without sacrificing liquidity.

4. Reducing the Risks of Slashing

In proof-of-stake networks, slashing penalties can be imposed if validators fail to perform their duties properly, causing stakers to lose a portion of their assets. Many liquid staking providers, such as Lido and Rocket Pool, use a diversified validator network and employ risk mitigation strategies to minimize slashing risks. Some providers even cover any potential losses due to slashing from their own insurance funds.

5. Potential for Higher Returns Due to Composability in DeFi

The composability of liquid staking tokens—meaning they can be combined with other DeFi strategies—allows users to unlock higher returns. By using your liquid staking tokens in conjunction with yield farming, lending, and other DeFi opportunities, you can stack multiple layers of income on top of your staking rewards. This “composability” is one of the key reasons liquid staking is gaining traction among yield seekers in the DeFi space.

Risks and Limitations of Liquid Staking

1. Counterparty Risk: Relying on Staking Providers or Protocols

Liquid staking requires the use of a third-party provider or protocol to manage your staked assets and issue liquid staking tokens. This introduces counterparty risk, as you are placing trust in the protocol's security, governance, and operational reliability. Should the provider face issues such as mismanagement or hacks, your staked assets could be compromised.

2. Smart Contract Risks

As with many DeFi services, liquid staking protocols rely on smart contracts to manage staking, issue derivative tokens, and integrate with other DeFi platforms. Smart contracts, while highly efficient, can be vulnerable to bugs or exploits. If a smart contract associated with a liquid staking protocol is hacked or fails, users could lose their staked assets or their liquid staking tokens.

3. Liquidity Concerns During High Volatility

Although liquid staking tokens provide liquidity for your staked assets, this liquidity is not always guaranteed, especially during periods of high market volatility. If a large number of users try to redeem or sell their liquid staking tokens at the same time, there may not be enough buyers or liquidity available, leading to delays or potential losses.

4. The Risk of Illiquidity in Staked Tokens if Liquid Staking Derivatives Depeg

Liquid staking derivatives (such as stETH, rETH) are designed to closely track the value of the underlying staked assets. However, in extreme market conditions or if confidence in a liquid staking protocol falters, these derivatives may temporarily depeg from their intended value. While you can always redeem your staked assets through the protocol, a depeg could affect other DeFi activities, such as using these tokens as collateral. For example, if a liquid staking derivative depegs, it may reduce the collateral value in lending protocols, potentially leading to liquidation risks or reduced borrowing power.

5. Security Risks Associated with DeFi Usage

When liquid staking tokens are used within DeFi platforms, they inherit the risks of those platforms. For example, using liquid staking tokens in lending protocols or liquidity pools exposes them to the risks of those platforms, such as rug pulls, hacks, or liquidation events. This means that users must be cautious about where and how they utilize their liquid staking tokens within DeFi ecosystems.

Liquid Staking Providers: Comparison

Overview of Popular Liquid Staking Protocols for Ethereum

1. Lido (ETH)

Lido is the largest liquid staking platform for Ethereum, allowing users to stake their ETH and receive stETH in return. This liquid staking token can be used across multiple DeFi platforms, enabling users to earn staking rewards while maintaining liquidity. Lido's extensive validator network and decentralized governance have made it a dominant choice for Ethereum liquid staking.

2. Rocket Pool

Rocket Pool is a decentralized liquid staking protocol specifically for Ethereum. It allows users to become node operators with a minimum of 16 ETH, making it more accessible than the standard 32 ETH required by Ethereum staking. Rocket Pool issues rETH, a liquid staking token that users can utilize in DeFi platforms while continuing to earn staking rewards.

3. Frax Ether

Frax Ether, part of the Frax Finance ecosystem, offers a unique liquid staking solution for Ethereum. Users stake ETH and receive frxETH, which can be deployed within the broader Frax ecosystem to earn additional yield. Frax Ether is recognized for its innovative approach to DeFi, offering liquidity and yield-enhancing opportunities through its native integrations.

Overview of Popular Liquid Staking Protocols for Solana

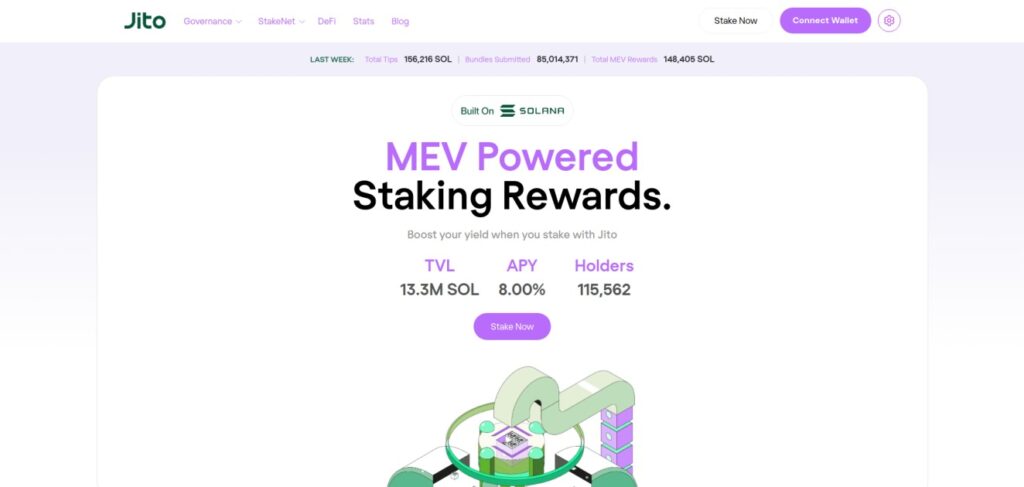

1. Jito

Jito is a Solana-focused liquid staking protocol designed to maximize rewards for stakers by optimizing validator performance. When users stake their SOL through Jito, they receive jitoSOL, a liquid staking token that can be used in Solana's DeFi ecosystem. Jito's key differentiator is its focus on enhancing validator efficiency, which leads to improved staking rewards and better network performance.

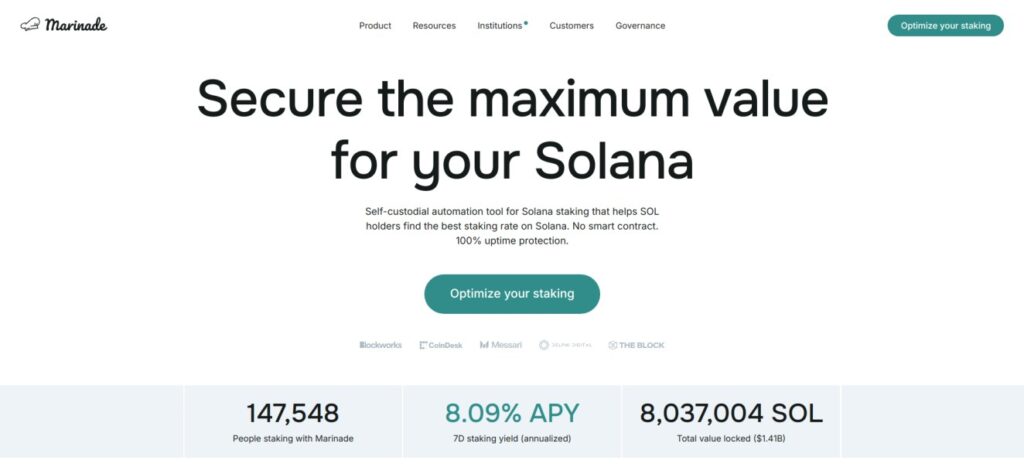

2. Marinade

Marinade is one of the largest decentralized liquid staking protocols on Solana. It allows users to stake SOL and receive mSOL as a liquid staking token. Marinade focuses on decentralization by spreading stake across a large number of validators, reducing centralization risks. The mSOL token can be deployed in various Solana DeFi protocols, offering stakers both liquidity and additional earning opportunities through yield farming and lending.

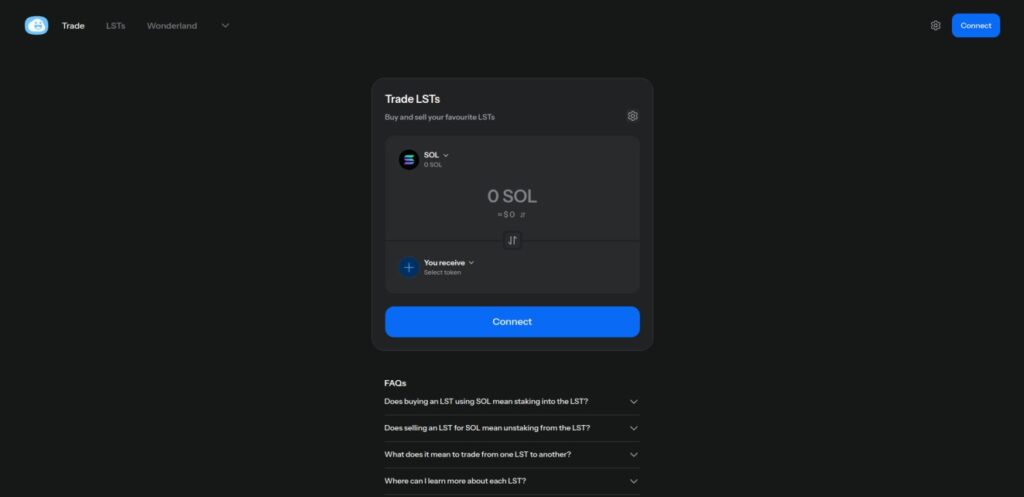

3. Sanctum

Sanctum provides a liquid staking solution for Solana that prioritizes user control and protocol security. When users stake their SOL through Sanctum, they receive sanctumSOL in return. Sanctum aims to combine liquidity with DeFi integration, allowing users to utilize sanctumSOL across Solana's decentralized applications while earning staking rewards. The protocol is also designed to offer users a seamless experience for staking and managing assets.

Comparing Rewards, Fees, and Decentralized vs. Centralized Options

Rewards:

All liquid staking protocols offer staking rewards, though the exact rates can vary depending on the network and the specific validator set used by the protocol. For Ethereum-based liquid staking, protocols like Lido and Rocket Pool typically offer rewards in the range of 4-5% APR. On other networks, such as Solana, liquid staking rewards are generally aligned with the network’s overall staking APR, which tends to range between 6-7%. These rewards may fluctuate based on network conditions and validator performance.

Fees:

Fees for liquid staking vary depending on the protocol and network being used. Most liquid staking protocols charge a percentage of staking rewards as fees, typically ranging from 5% to 10%. These fees are often split between the protocol’s governance (such as a DAO) and the node operators or validators. It's important for users to review the documentation of the specific liquid staking protocol they are considering to understand the exact fee structure and how it may affect their staking rewards.

Decentralized vs. Centralized:

Decentralized Options: Lido and Rocket Pool are both decentralized, though to different extents. Lido is governed by a DAO, which oversees staking operations and protocol upgrades. Rocket Pool enables users to run their own nodes with just 16 ETH, promoting decentralization by lowering the barriers to validator participation.

Centralized Options (e.g., Coinbase Staking, Binance Staking): While decentralized protocols like Lido, and Rocket Pool offer more transparency and control, centralized options such as Coinbase Staking and Binance Staking introduce third-party custodial risks. These services handle staking on behalf of users, but they also involve trusting a centralized entity to manage your assets, which introduces middleman risk. In the event of regulatory action, platform shutdowns, or mismanagement, users may lose access to their staked assets. Additionally, centralized services may not prioritize network decentralization, potentially leading to validator centralization and reduced network security.

Why Decentralization Matters: Decentralized protocols are critical to maintaining the security and independence of blockchain networks. Staking through decentralized platforms ensures that power is distributed across many validators, reducing the risk of control by any single entity. For this reason, users should avoid centralized staking platforms when possible and instead opt for decentralized solutions, which offer both enhanced security and community governance.

Criteria for Choosing a Liquid Staking Provider

When selecting a liquid staking provider, it's important to first evaluate what your specific goals are—whether you're prioritizing decentralization, security, yield, or DeFi integration. Different protocols excel in different areas, so aligning your choice with your objectives is key. Here are some important factors to consider:

Fees: Lower fees can lead to higher overall staking rewards. If maximizing returns is your main goal, it's worth comparing fees across platforms. Some protocols offer lower fees due to their unique design, while others charge slightly more in exchange for additional benefits like better security or integration options.

Security: If your primary concern is the safety of your assets, choose a provider with a solid security track record, such as those that have undergone external audits or have been battle-tested over time. Larger, well-established platforms like Lido and Rocket Pool tend to have robust security measures and large user bases, making them reliable options for risk-averse users.

Decentralization: If decentralization is a priority, protocols like Rocket Pool (Ethereum) and Marinade (Solana) might be more appealing, as they distribute validation across a wider network of operators. Decentralized options contribute to network security and reduce the risk of centralization, making them attractive to users concerned with maintaining the integrity of the blockchain.

Yield Opportunities: For those focused on maximizing yield, newer or more innovative protocols like Frax Ether may offer unique strategies to enhance returns. These protocols might come with higher risk, but they also tend to provide competitive advantages in terms of yield generation through their design or integration with DeFi ecosystems.

DeFi Integration: If you plan to use your liquid staking tokens within DeFi, the provider’s integration with other DeFi platforms becomes critical. Protocols like Lido and Frax Ether have strong DeFi integration, offering a variety of opportunities for lending, yield farming, and liquidity provision. Choosing a provider with wide DeFi support will give you more flexibility and options to maximize your returns.

In short, understanding what you value most—whether it’s decentralization, security, yield, or DeFi compatibility—will help guide your decision when choosing a liquid staking provider. Be sure to review the protocol's documentation to ensure it aligns with your goals.

Liquid Staking Use Cases in DeFi

1. Earning Additional Yield on Liquid Staking Tokens

One of the most attractive features of liquid staking is the ability to earn extra yield by using your liquid staking tokens in DeFi protocols while continuing to receive staking rewards. For example, stETH (Lido’s liquid staking token for Ethereum) can be deposited in protocols like Curve or Yearn Finance, where it can generate additional yield through lending, liquidity provision, or other strategies. This dual-income approach allows users to maximize returns on their staked assets.

2. Leveraging Staked Assets in Lending Protocols

Liquid staking tokens can also be used as collateral in lending protocols, unlocking liquidity without needing to sell your tokens. For example, platforms like Aave or Compound allow users to deposit liquid staking tokens and borrow stablecoins or other assets in return. This enables users to leverage their staked positions for additional liquidity or investments while still earning staking rewards. Borrowers can reinvest borrowed assets into other DeFi opportunities, creating a leveraged yield strategy.

3. Participation in Liquidity Pools

Liquid staking tokens can be added to liquidity pools on decentralized exchanges (DEXs) like Uniswap or Balancer to earn trading fees and liquidity mining rewards. By providing liquidity with tokens like stETH or rETH, users not only contribute to the pool's liquidity but also earn a portion of the transaction fees. Many protocols offer incentives for providing liquidity with liquid staking tokens, allowing users to further increase their overall yield.

By integrating liquid staking tokens into these DeFi strategies, users can multiply their income streams and further enhance the returns on their staked assets.

Liquid Staking and Network Security

1. Impact of Liquid Staking on Blockchain Security

Liquid staking plays a crucial role in maintaining and even enhancing the security of proof-of-stake (PoS) blockchain networks. In PoS systems, network security depends on the amount of assets staked by validators. The more assets staked, the more secure and decentralized the network becomes, as it becomes harder for any single entity to control a majority of the staked tokens. By encouraging more users to stake their assets without worrying about liquidity, liquid staking protocols help ensure that more tokens are staked, ultimately boosting the overall security of the network.

2. How Liquid Staking Decentralizes Validator Participation

One of the key issues in PoS networks is the risk of centralization—when a small group of validators controls a significant portion of the network’s staked assets. Liquid staking mitigates this by allowing smaller holders to participate in staking without the usual high entry requirements (e.g., the 32 ETH required for Ethereum staking). Protocols like Rocket Pool even allow individuals to become validators with reduced minimum staking amounts. This reduces the concentration of staking power in a few entities, promoting decentralization and reducing the risk of validator monopolies.

3. Liquid Staking’s Role in Increasing Network Activity and Security via Staking

By lowering the barriers to staking and offering liquidity through derivative tokens, liquid staking incentivizes more users to stake their assets. This increased participation leads to higher overall network security, as more validators are active, making the network more resistant to attacks. Additionally, liquid staking allows participants to keep their funds productive in DeFi, contributing to the network's economic activity while maintaining a high level of security through staked collateral.

Moreover, the availability of liquid staking solutions also prevents “staking fatigue,” where users might be discouraged from staking due to the long lock-up periods. By keeping assets liquid, more users are willing to commit their tokens to staking, thus maintaining a high level of engagement and security over time.

How to Participate in Liquid Staking

Step-by-Step Guide for Staking via Liquid Staking Protocols

While each liquid staking protocol may have unique features, the overall process is largely the same across platforms. Below is a step-by-step guide using Lido and Rocket Pool as examples for Ethereum staking.

1. Choose a Liquid Staking Protocol

- For this guide, we’ll focus on Lido and Rocket Pool. Both are popular Ethereum liquid staking providers, and the staking process on these platforms is representative of most liquid staking protocols.

- Lido allows users to stake ETH and receive stETH, a liquid staking token.

- Rocket Pool enables users to stake ETH and receive rETH, another liquid staking token.

2. Connect Your Wallet

- Navigate to the liquid staking protocol’s website or dApp (e.g., Lido or Rocket Pool).

- Connect your cryptocurrency wallet to the platform. For Ethereum staking, wallets like MetaMask, Rabby, or Rainbow are commonly used.

- Ensure that your wallet has a sufficient balance of ETH, which will be staked in the process.

3. Choose the Amount of ETH to Stake

- After connecting your wallet, choose how much ETH you would like to stake.

- On Lido, you can stake any amount of ETH, while Rocket Pool requires a minimum of 0.01 ETH for staking.

- Input the amount and confirm the transaction in your wallet. Once confirmed, your ETH will be staked through the protocol.

4. Receive Liquid Staking Tokens

- After staking, you’ll receive liquid staking tokens that represent your staked ETH.

- With Lido, you’ll receive stETH, and with Rocket Pool, you’ll receive rETH.

- These tokens are automatically added to your wallet and represent your staked assets. You’ll continue to earn staking rewards as the value of these tokens increases over time, reflecting the yield from staking.

Example of a Staking Dashboard:

Once you’ve staked your ETH, you can monitor your staking performance through a dashboard. For example:

- Lido: The dashboard shows the total amount of stETH you hold, the value of rewards accumulated, and any additional DeFi opportunities available for using stETH in the ecosystem.

- Rocket Pool: Similarly, the Rocket Pool dashboard displays your rETH balance, current staking rewards, and options to further utilize your rETH within DeFi platforms.

Both dashboards provide easy-to-use interfaces for tracking your staked assets, rewards, and any actions you may want to take with your liquid staking tokens.

General Process Across Protocols:

The process described above applies to most liquid staking protocols. Whether using Lido, Rocket Pool, or another provider like Frax Ether or Marinade, the steps remain consistent: choose a protocol, connect your wallet, select an amount to stake, and receive liquid staking tokens. Each protocol's dashboard will allow you to monitor your staked assets and rewards as they grow.

Tools to Monitor Staking Performance

To ensure you're maximizing your staking rewards and DeFi opportunities, consider using the following tools:

- Zapper.fi: A comprehensive DeFi dashboard that allows you to track your liquid staking tokens, staking rewards, and overall DeFi positions in real-time.

- DeBank: Similar to Zapper, DeBank provides an overview of your wallet’s holdings, including liquid staking tokens, and lets you monitor the performance of your DeFi strategies.

- Dune Analytics: For those who prefer a deeper dive into the metrics, Dune provides customizable dashboards that can track protocol-specific data, including staking rewards and liquid staking token prices.

Tax Implications of Liquid Staking

Overview of Possible Tax Obligations from Staking Rewards and DeFi Usage

When participating in liquid staking, users are typically subject to two main types of taxable events:

- Staking Rewards: The staking rewards earned from the liquid staking protocol are often considered taxable income in many jurisdictions. This income may be taxable at the time it is received (i.e., when your staked assets generate rewards and the value of your liquid staking tokens increases). The value of the staking rewards is typically determined by the market value of the tokens at the time they are received.

- DeFi Transactions: Using liquid staking tokens in DeFi protocols—such as lending, borrowing, or liquidity provision—may trigger taxable events, especially when you exchange or sell your liquid staking tokens. For example, when you swap stETH for ETH or other tokens, you may need to report any capital gains or losses based on the price difference from when you first received the tokens.

Best Practices for Tracking and Reporting Staking Income

Given the complexity of tax obligations in liquid staking and DeFi usage, it’s important to follow these best practices:

- Use Tax Software for Crypto: Tools like CoinTracker, TokenTax, or Koinly can help automate the tracking of staking rewards, DeFi transactions, and any gains or losses. These platforms provide tax reports that are compatible with various tax authorities worldwide.

- Keep Detailed Records of Transactions: Document every staking-related transaction, including the dates, token amounts, and token values at the time of staking, receiving rewards, and performing any DeFi activities. This is crucial for accurate tax reporting and compliance.

- Separate Staking Income from Capital Gains: Ensure you track staking rewards (which may be taxed as income) separately from any capital gains or losses that arise from trading or using your liquid staking tokens in DeFi. Keeping a clear record of the type of taxable event will simplify your reporting process.

- Stay Updated on Regulations: Tax regulations for cryptocurrencies are rapidly evolving. It’s essential to stay informed about new rules in your jurisdiction and consult a tax professional familiar with cryptocurrency taxation to ensure full compliance.

Future of Liquid Staking

1. New Opportunities in Liquid Staking Protocols

The future of Ethereum liquid staking continues to evolve with the emergence of innovative protocols offering more competitive rewards and enhanced features. New projects such as Swell, Origin Protocol, Dinero, and Asymmetry Finance (afETH) are iterating on the liquid staking model, providing stakers with exciting new ways to earn higher yields and unlock more utility from their staked ETH. These platforms are exploring better integration with DeFi ecosystems, offering unique rewards structures, and optimizing staking efficiency.

2. The Concept of Restaking

A major new development in the staking space is restaking, specifically popularized by protocols like Eigenlayer. Restaking allows users to take their staked assets (such as staked ETH) and “restake” them to provide additional security or functionality to other blockchain protocols. Essentially, it lets users reuse their staked assets as a security layer for multiple networks, providing enhanced network security while allowing users to earn additional rewards.

Liquid Restaking builds on this concept by enabling users to retain liquidity through liquid staking tokens while participating in restaking. This allows for greater flexibility, as users can earn rewards from multiple layers of staking without being locked into one position. Liquid restaking represents a promising advancement that can strengthen the overall security of multiple decentralized networks while maximizing staking yields.

For a comprehensive list of liquid staking and restaking protocols, including the latest innovations and opportunities, visit the Staking Resources.

3. Yield Opportunities Through Layer 2 Networks

Another significant opportunity lies in bridging liquid staking assets to Layer 2 (L2) networks such as Arbitrum, Optimism, and others. By moving liquid staking tokens to these L2 solutions, users can reduce transaction costs and access a wider range of DeFi applications. These Layer 2 networks offer faster transactions and lower fees, making them ideal for yield farming, lending, and other DeFi strategies using liquid staking tokens.

With Ethereum scaling through L2s, the potential for staking on these networks continues to grow, providing stakers with countless opportunities to maximize returns while reducing friction in DeFi participation.

Conclusion

Liquid staking offers a unique blend of flexibility, liquidity, and higher yield opportunities, making it a powerful alternative to traditional staking. By allowing users to earn staking rewards while keeping their assets liquid and usable in DeFi, liquid staking opens the door to more dynamic financial strategies. Key benefits include the ability to combine staking rewards with DeFi yields, enhanced liquidity during staking, and reduced risks associated with validator participation.

As the DeFi ecosystem continues to grow, liquid staking serves as a gateway to advanced DeFi opportunities, including yield farming, lending, and even the emerging concept of liquid restaking. By integrating liquid staking tokens into these strategies, users can optimize their returns without compromising the security of their staked assets.

For those looking to maximize the potential of their crypto assets, liquid staking provides an innovative approach to earning passive income with minimal restrictions. With the right tools and risk management strategies, liquid staking can help you unlock new financial possibilities while maintaining the security of your staked positions.

FAQs (Frequently Asked Questions)

What is staking in cryptocurrency?

Staking is the process of locking up cryptocurrency to help secure a blockchain network and, in return, earn rewards. This typically involves committing your assets for a set period.

How does liquid staking differ from traditional staking?

Liquid staking is a specialized form of pooled staking that allows users to retain access to their staked assets. Unlike traditional staking, which locks assets for months, liquid staking enables users to utilize their staked tokens within DeFi applications.

What are the key benefits of liquid staking?

Key benefits of liquid staking include enhanced liquidity for stakers, the ability to combine staking rewards with additional DeFi yields, easier participation in DeFi with staked assets, reduced risks of slashing penalties, and potential for higher returns due to composability in DeFi.

What are some risks associated with liquid staking?

Risks include counterparty risk from relying on third-party providers or protocols, smart contract risks inherent in DeFi services, liquidity concerns during market volatility, potential illiquidity if liquid staking derivatives depeg, and security risks associated with using DeFi platforms.

How can I participate in liquid staking?

To participate in liquid staking, you should choose a liquid staking protocol (like Lido or Rocket Pool), connect your wallet to the protocol's platform, decide how much cryptocurrency you want to stake, and then receive liquid staking tokens that represent your staked assets.

What is the future outlook for liquid staking?

The future of liquid staking looks promising with new opportunities emerging in protocols and concepts such as restaking. Additionally, yield opportunities through layer 2 networks are expected to enhance the landscape of liquid staking further.