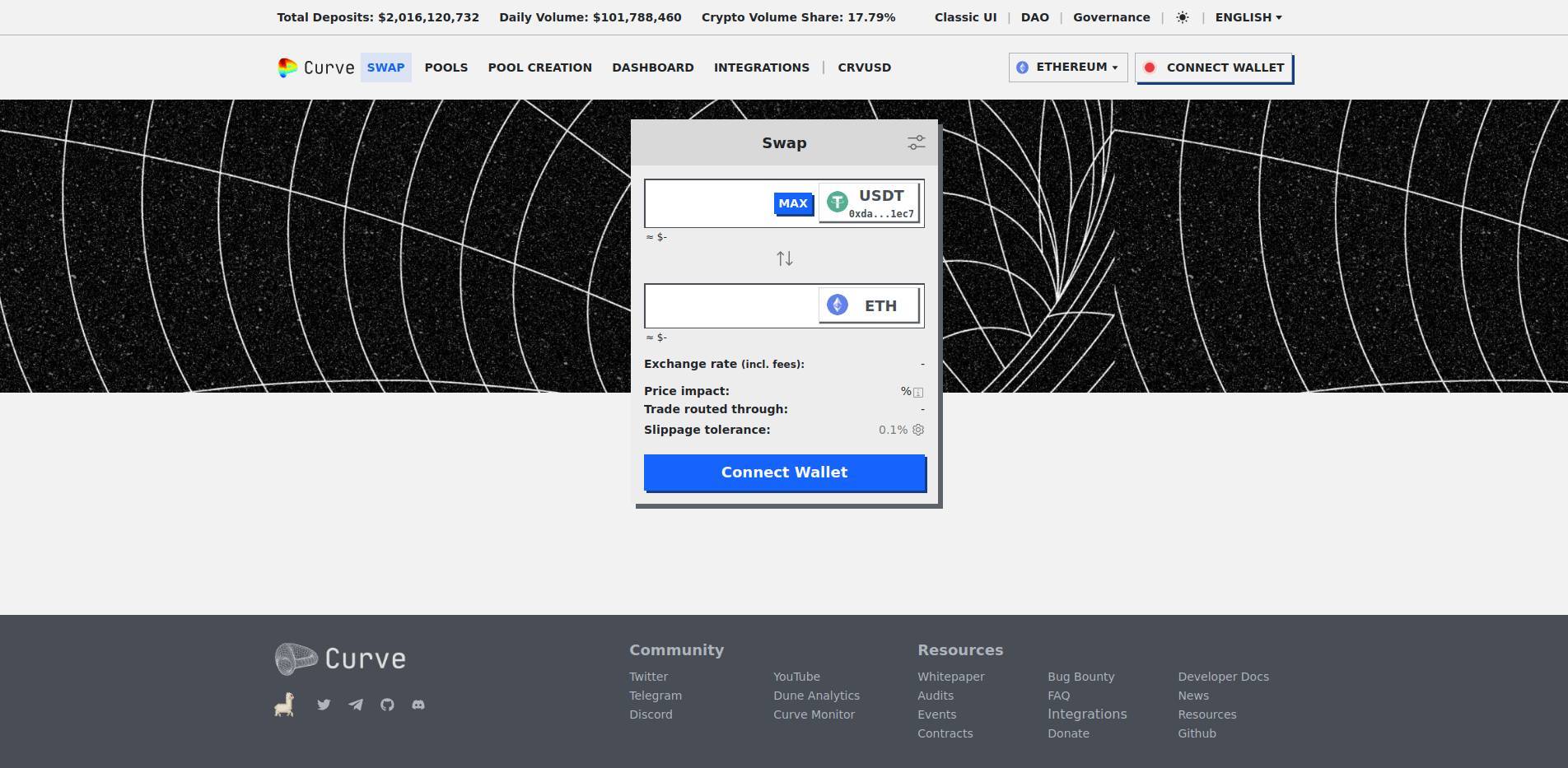

What is Curve Finance?

Curve Finance is a decentralized exchange (DEX) protocol on the Ethereum blockchain, primarily designed for efficient stablecoin trading with low fees and minimal slippage. Launched in 2020 by Michael Egorov, Curve has become a pivotal platform in the DeFi ecosystem, known for its innovative approach to liquidity provision and yield optimization.

A key innovation introduced by Curve is the veTokenomics model through its native token, CRV. By locking CRV tokens, users receive veCRV (vote-escrowed CRV), which provides several benefits. veCRV holders have governance rights, allowing them to influence protocol decisions and determine CRV emission allocations to various liquidity pools. Additionally, veCRV holders earn a portion of the trading fees generated on the platform and can boost their CRV rewards up to 2.5 times, enhancing their liquidity provision incentives.

Curve's automated market maker (AMM) model employs the StableSwap algorithm, optimized for stablecoin trading, which significantly reduces slippage compared to traditional DEXs. The introduction of Curve V2 further enhances this by accommodating assets with varying volatility and offering advanced liquidity management features, such as dynamic fee adjustments based on market conditions.

The platform operates across multiple EVM-compatible blockchains, including Ethereum, Arbitrum, Avalanche, and Polygon, enhancing its accessibility and usability within the multi-chain DeFi ecosystem. Curve’s liquidity pools are non-custodial and non-upgradable, ensuring that users retain full control over their assets and the smart contract logic remains immutable.

Curve has established itself as the backbone of DeFi, supporting various protocols and integrating seamlessly with other DeFi applications. Its robust security measures, backed by thorough audits, have maintained secure operations, managing billions in assets and reinforcing its reputation as a reliable DeFi platform.