Unlock the power of data-driven decision-making with our meticulously curated DeFi Analytics Services. These platforms provide you with in-depth insights, real-time data, and comprehensive analytics, helping you navigate the complex landscape of decentralized finance with confidence and clarity. Whether you're a seasoned investor, a DeFi enthusiast, or a project developer, our selection of analytics services offers valuable tools for monitoring network activities, tracking portfolio performance, and analyzing market trends. Immerse yourself in a reservoir of knowledge, where data points transform into actionable insights, guiding you through the ever-evolving terrain of DeFi opportunities and challenges. With DeFi Analytics Services, illuminate your path to financial freedom with the brilliance of data intelligence.

APY Vision

APY.Vision is an analytics platform tracking liquidity pool gains and impermanent loss, helping investors optimize returns across various decentralized finance protocols.

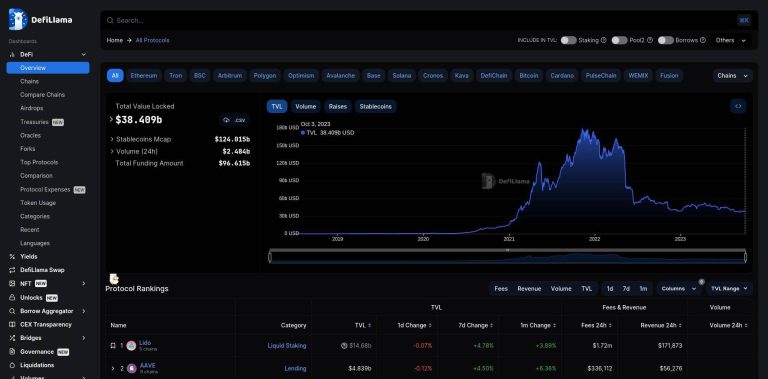

DeFiLlama

DeFiLlama is a comprehensive DeFi dashboard aggregating data across multiple blockchains, enabling users to compare protocols, and monitor yields.

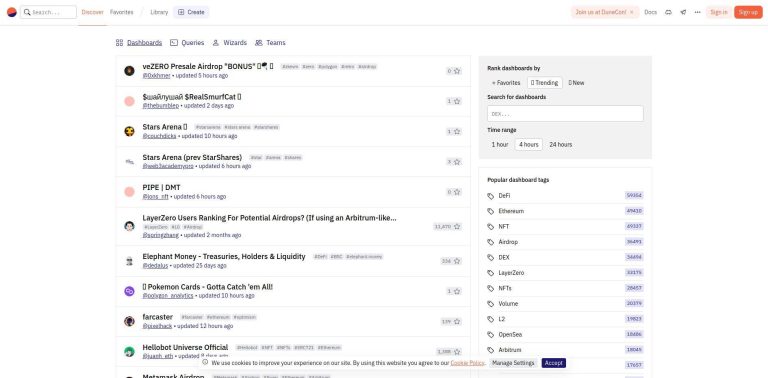

Dune

Dune provides blockchain ecosystem analytics, enabling users to explore, visualize, and share decentralized finance data across various blockchains using SQL.

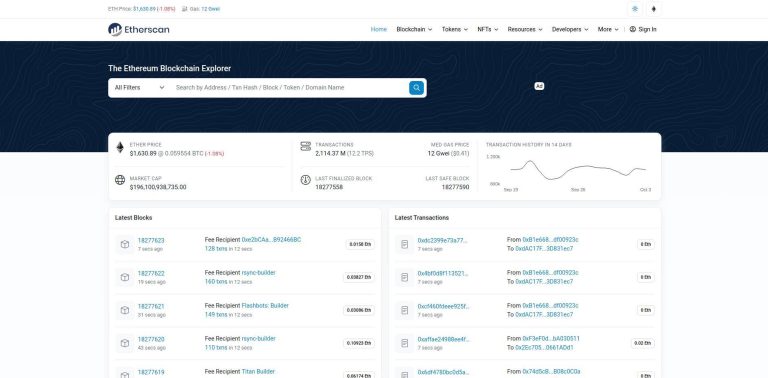

Etherscan

Etherscan is an Ethereum blockchain explorer for searching, verifying, and exploring transactions, addresses, with tools to monitor network activity, and execute transactions.

Getmoni

Moni is a Web3 analytics platform using machine learning to discover and track early crypto projects. It offers social stats analysis, project tracking, watchlists, alerts, and daily alpha reports.

L2BEAT

L2BEAT is a Layer 2 analytics platform examining Ethereum's Layer 2 projects, offering insights on technologies, market shares, usage, and total value locked on DeFi.

Llama Airforce

Llama Airforce provides analytics and insights tailored to the Curve ecosystem, with a specialized design catering to Votium and Hidden Hand bribe markets.

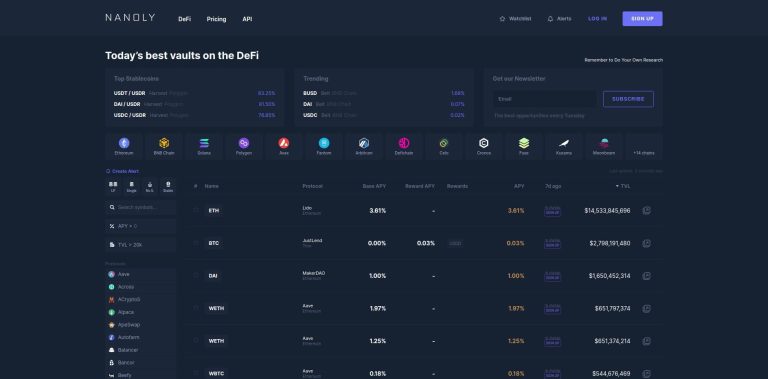

Nanoly

Nanoly showcases top DeFi vaults daily across multiple blockchains, aiding users in identifying trending vault opportunities for enhanced asset management.

Nansen

Nansen offers on-chain insights for decentralized finance (DeFi) investors and teams, providing analytics and data to identify top investors and investment opportunities.

Step Finance

Step Finance is the front page of Solana, providing a dashboard to track and manage DeFi activities. It supports portfolio visualization, swaps, staking, yield farming, and NFT management.

Token Terminal

Token Terminal aggregates financial data from various blockchains and decentralized applications, aiding users in analyzing and comparing crypto projects based on diverse metrics.

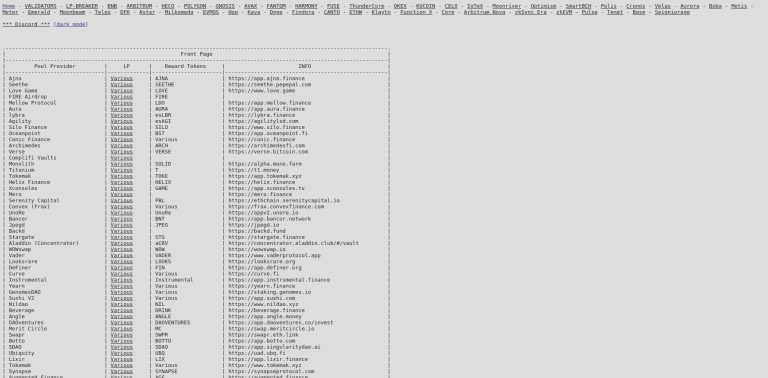

vfat.tools

vfat.tools provides a platform for exploring yield farming opportunities across various blockchains and DeFi projects, aiding users in navigating the yield farming landscape.

Zapper

Zapper provides DeFi portfolio management and analysis, offering insights on your and others financial activities within the decentralized finance ecosystem.

Zerion

Zerion aggregates various DeFi protocols, enabling users to manage portfolios, track investments, and explore DeFi opportunities through a unified interface.