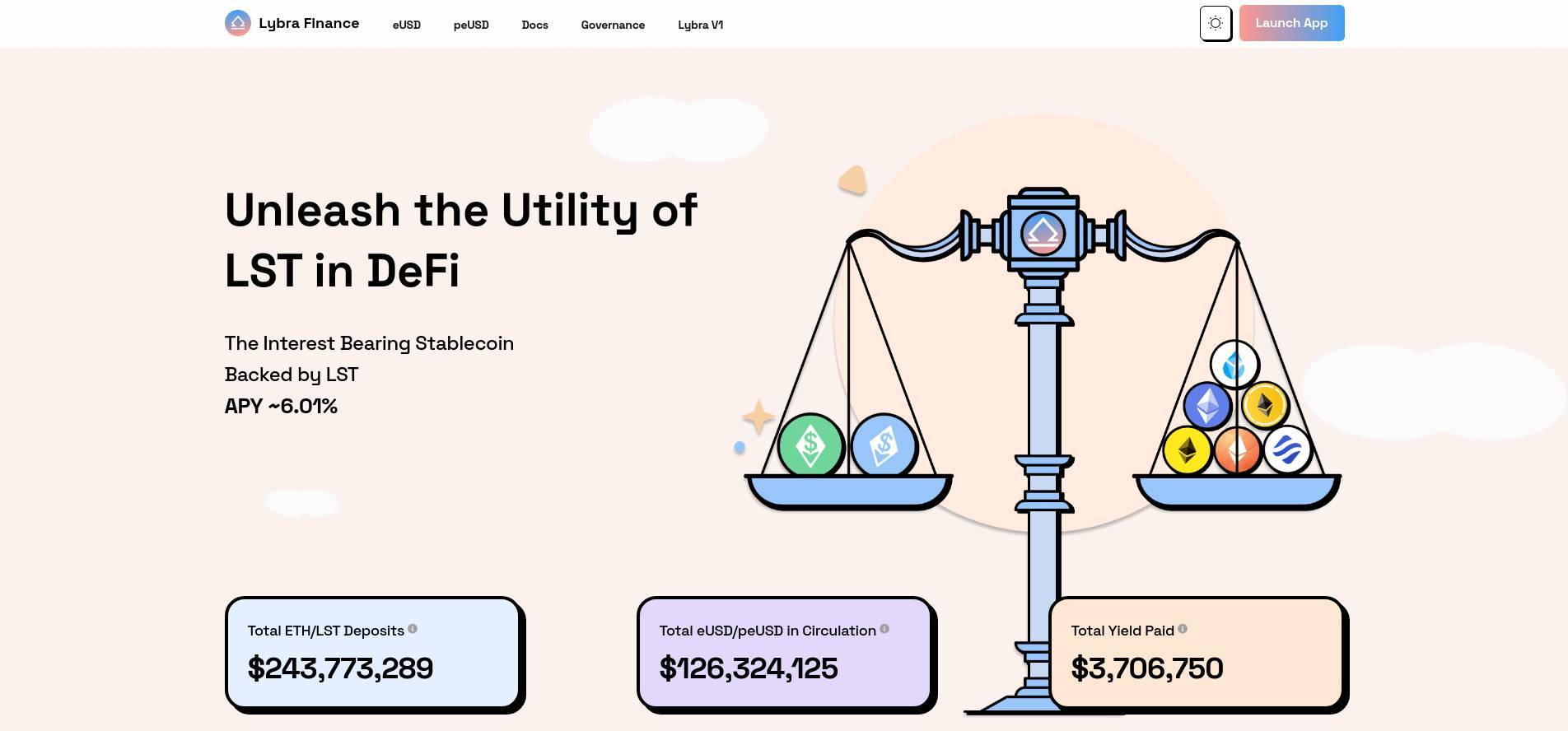

What is Lybra Finance?

Lybra Finance is a decentralized finance (DeFi) platform that maximizes the utility of Liquid Staking Tokens (LST) by providing an interest-bearing stablecoin called eUSD, backed by LST. Users can deposit ETH or LST as collateral to mint eUSD, which offers an approximate annual percentage yield (APY) of 8%. The stability of eUSD is maintained through overcollateralization, liquidation mechanisms, and arbitrage opportunities. The platform also offers peUSD, an omnichain version of eUSD, enabled by LayerZero’s Omnichain Fungible Token (OFT) standard.

Lybra Finance aims to provide a stable and profitable environment for DeFi users. By leveraging LST, the platform ensures that users can earn significant yields while maintaining the stability of their assets. eUSD’s stability is achieved through a combination of overcollateralization and a robust liquidation mechanism, ensuring that the value of eUSD remains consistent even in volatile market conditions. Additionally, the introduction of peUSD expands the utility of eUSD across multiple blockchain networks, providing greater flexibility and opportunities for users.

The platform's approach to integrating LST with stablecoin issuance and cross-chain functionality represents a significant innovation in the DeFi space, offering users new ways to earn yields and utilize their assets effectively.