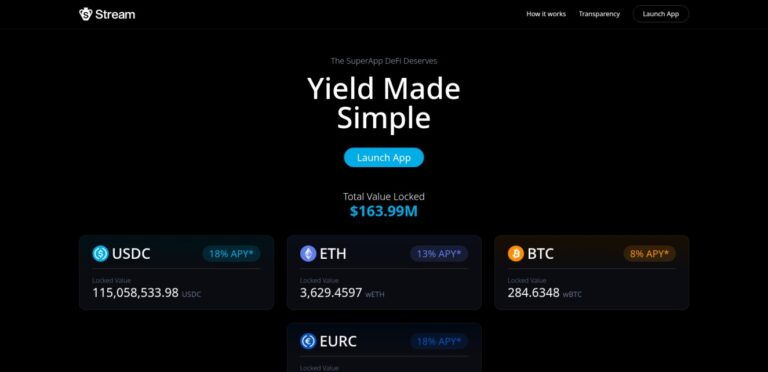

Stream Protocol

Stream is a delta-neutral yield protocol using market-making and funding rate strategies. Deposit USDC, EURC, ETH, or wBTC into vaults that bridge across chains via LayerZero.

Stream is a delta-neutral yield protocol using market-making and funding rate strategies. Deposit USDC, EURC, ETH, or wBTC into vaults that bridge across chains via LayerZero.

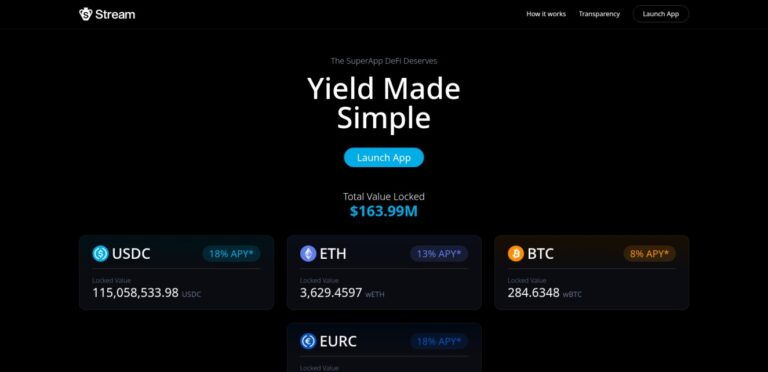

YO is a multi‑chain, risk‑aware yield optimizer protocol. Deposit BTC, ETH, SOL or USDC into trusted vaults. Receive static ERC‑4626 yoTokens (e.g. yoETH) that auto‑accrue yield.

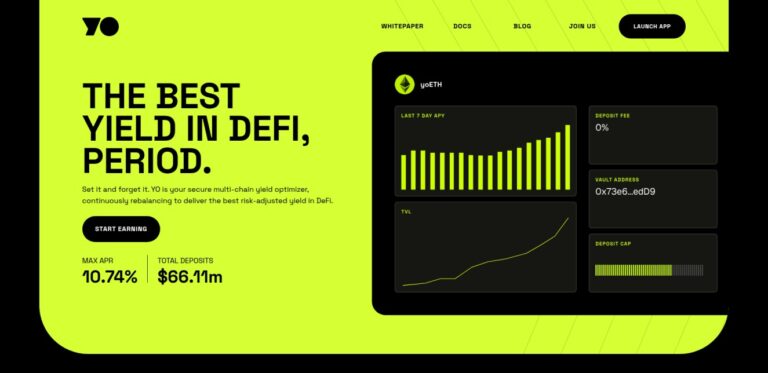

vfat vfat is a yield farming dashboard that aggregates DeFi protocols. Track rewards and LP positions across multiple chains. Scan APRs, compare farms, and find new opportunities.

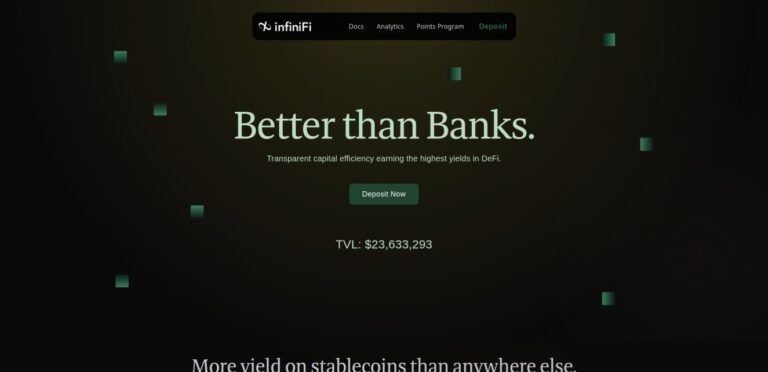

infiniFi is a fractional-reserve yield aggregator minting iUSD/iETH against USDC/ETH. Lock or remain liquid to optimize yield via both liquid and illiquid farms.

Superform is a cross-chain yield router and aggregator. Users deposit assets into SuperVaults and earn optimized yield across vaults-on any chain-in a single transaction.

YieldFi is a fully on-chain asset management protocol offering curated yield index tokens like YUSD, YETH, and YBTC. It combines institutional-grade strategies with DeFi-native transparency.

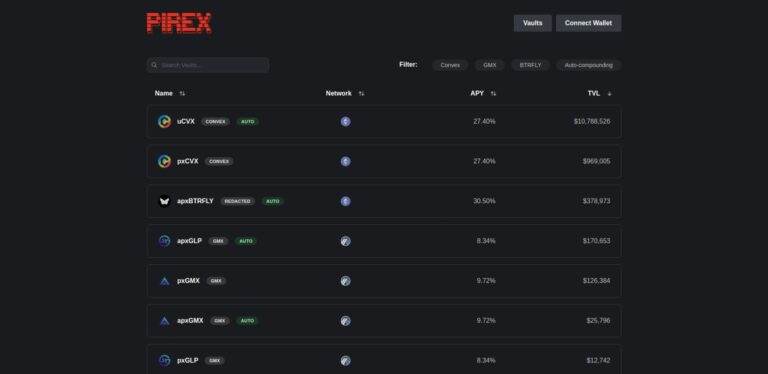

Pirex is a CVX wrapper designed to maximize yields on Convex Finance. It allows users to tokenize their locked CVX, providing liquidity and flexibility while continuing to earn rewards.

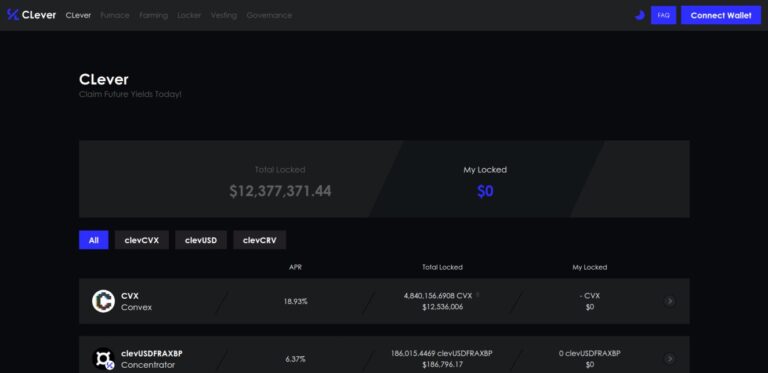

CLever is a CVX wrapper built on top of Convex, allowing users to earn boosted yields on their CVX tokens. It offers strategies for locking CVX and automating yield harvesting.

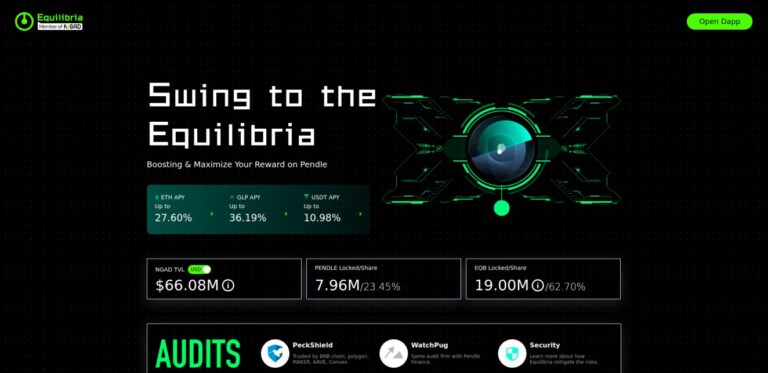

Equilibria is a DeFi platform built on top of Pendle, specializing in yield optimization and risk management. It offers structured financial products that enhance returns while managing volatility.

Asymmetry Finance is a DeFi protocol focused on yield generation through optimized liquidity provision. It offers afUSD, afETH, afeETH, and afCVX for diverse strategies and financial solutions.

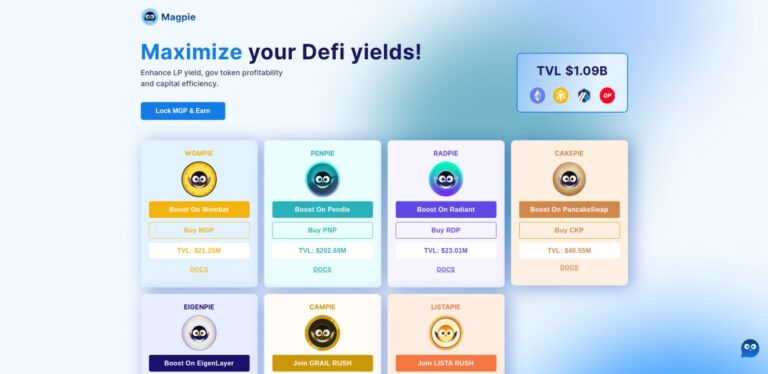

Magpie enhances yield strategies and governance in DeFi, integrating with platforms like Pendle Finance. The governance token, MGP, enables rewards and participation across protocols.

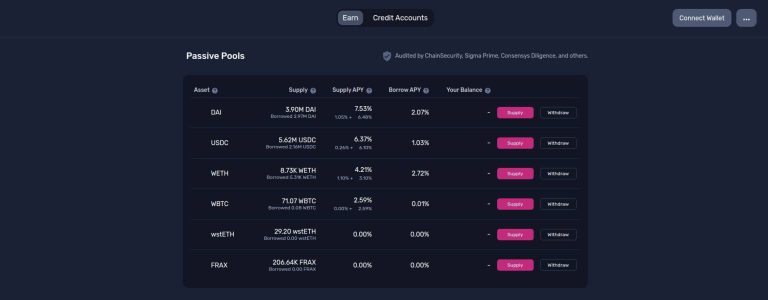

Gearbox offers a Composable Leverage Protocol enabling passive lending APY or up to 10X leverage for margin trading and farming on various DeFi platforms.

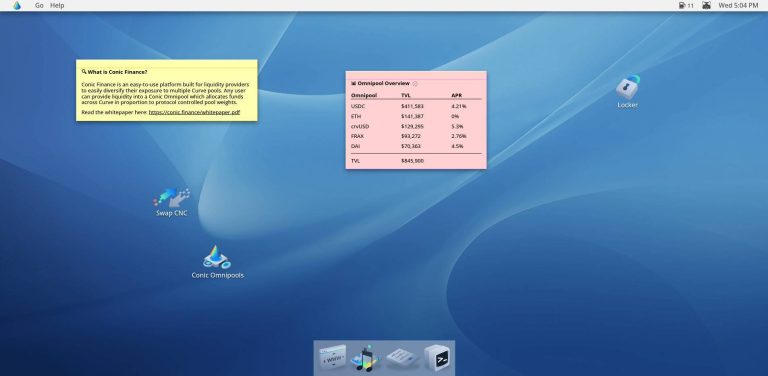

Conic Finance allows liquidity providers to diversify across multiple Curve pools via Omnipools on Ethereum ecosystem, governed by Conic DAO votes.

Beefy Finance is a decentralized finance, multichain yield optimizer and aggregator that maximizes DeFi rewards through smart-contract enforced strategies.

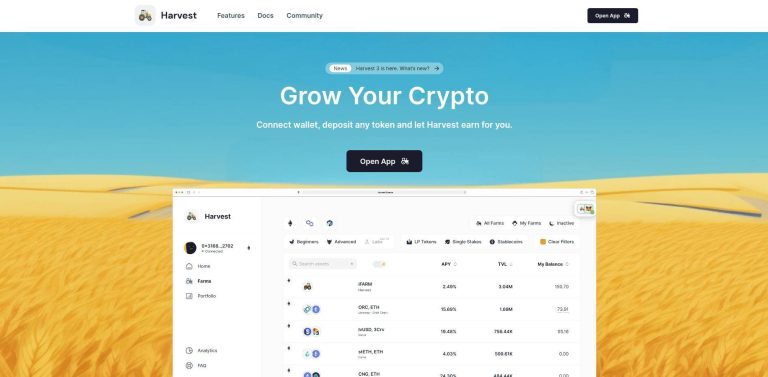

Harvest Finance automates yield farming via Ethereum-based vaults, optimizing returns, reducing gas costs, and offering user-friendly farming opportunities.

Pickle Finance enhances yields via auto-compounding rewards, ensuring time and gas savings for a more efficient user experience in the DeFi ecosystem.

Yearn Finance provides a decentralized suite of products for individuals, DAOs, and protocols to optimize earnings on their digital assets in the Ethereum ecosystem.

Convex Finance amplifies rewards for Curve liquidity providers and CRV holders, simplifying liquidity provisioning and decentralized finance yield optimization.

Aura Finance amplifies DeFi yield and governance, optimizing Balancer Pool Tokens, boosting BAL rewards, and enabling community-driven governance and innovation.