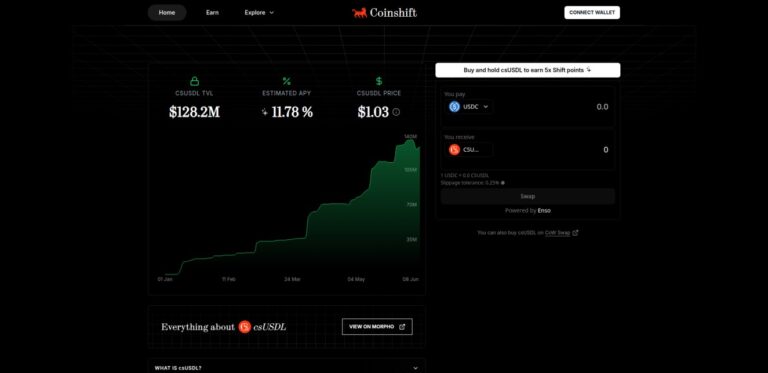

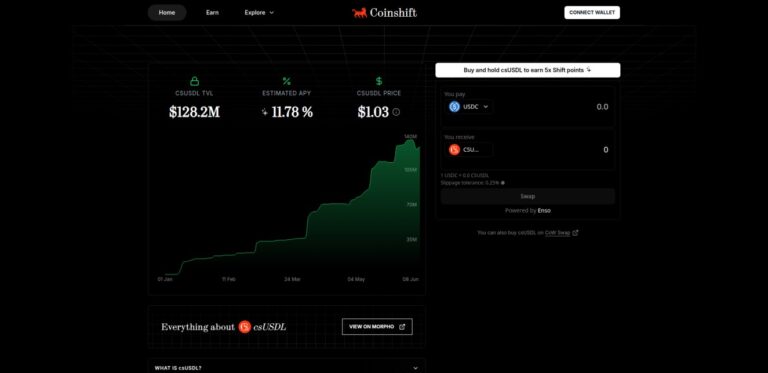

Coinshift

Coinshift is a self-custodial treasury platform for DAOs and teams. Mint csUSDL, an institutional-grade stablecoin backed by secure DeFi yield. Earn real yield while farming SHIFT points.

Coinshift is a self-custodial treasury platform for DAOs and teams. Mint csUSDL, an institutional-grade stablecoin backed by secure DeFi yield. Earn real yield while farming SHIFT points.

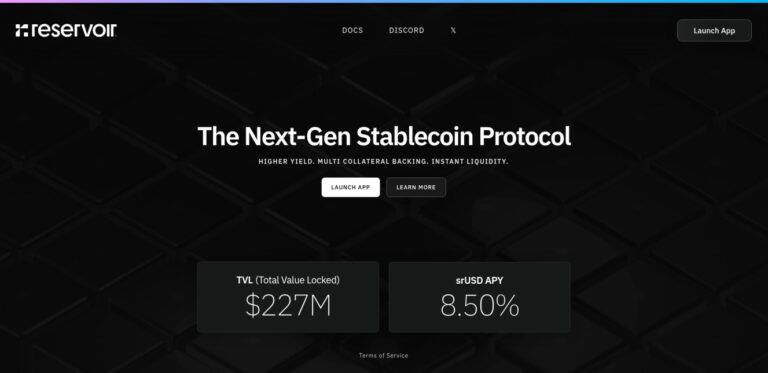

Reservoir is a next-gen stablecoin system issuing rUSD, srUSD, and trUSD. Backed by DeFi and real-world collateral, it offers liquid, savings, and term yield.

Level is a stablecoin protocol offering lvlUSD, a yield-bearing asset backed by USDC and USDT. Users can stake lvlUSD to earn slvlUSD, enhancing returns through DeFi lending strategies.

Resolv is a DeFi protocol offering USR, a delta-neutral stablecoin backed by ETH and BTC. It maintains price stability through hedging strategies and an insurance layer.

eBTC is a decentralized protocol allowing users to borrow Bitcoin against staked ETH collateral with no fees. It offers capital efficiency and lower liquidation risk, integrating seamlessly into DeFi.

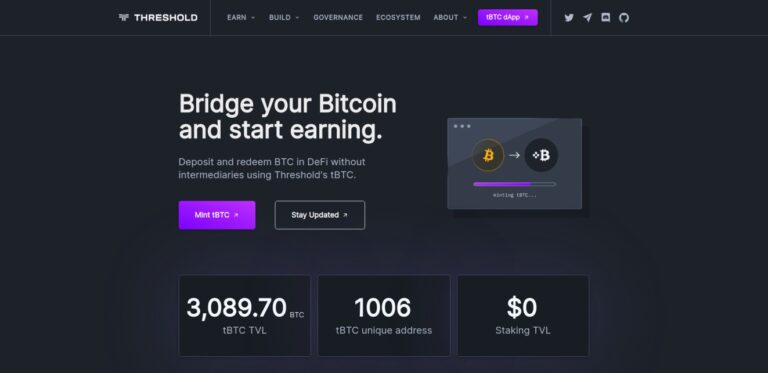

Threshold Network is a protocol that bridges Bitcoin to Ethereum with tBTC, a fully backed Bitcoin token. It enables trustless use in DeFi while maintaining security and decentralization.

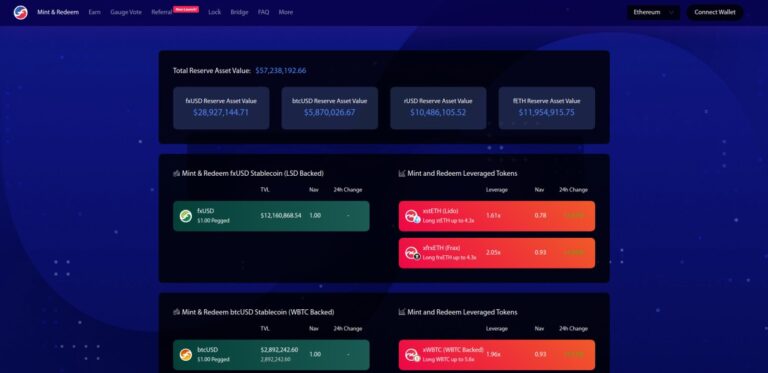

f(x) Protocol by AladdinDAO is a DeFi protocol on Ethereum that offers a decentralized stablecoin (fxUSD) and leveraged ETH tokens (fETH and xETH), all backed by staked ETH.

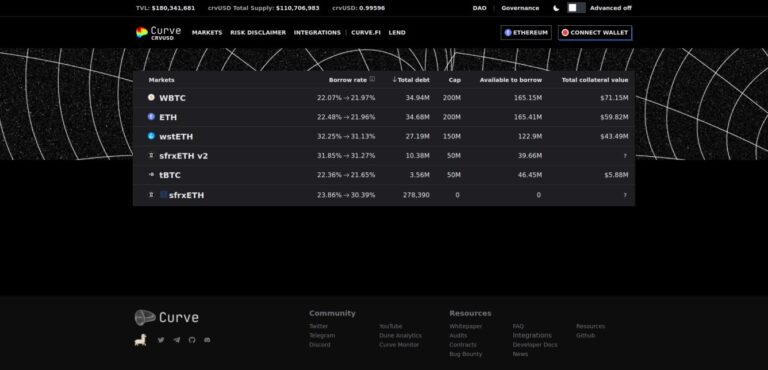

crvUSD is a decentralized stablecoin launched by Curve Finance. It is overcollateralized and pegged to the US dollar. Users mint crvUSD by depositing collateral such as ETH.

GHO is a decentralized, multi-collateral stablecoin on Aave. It is minted using assets supplied as collateral on Ethereum markets. The Aave DAO manages GHO's supply and interest rates.

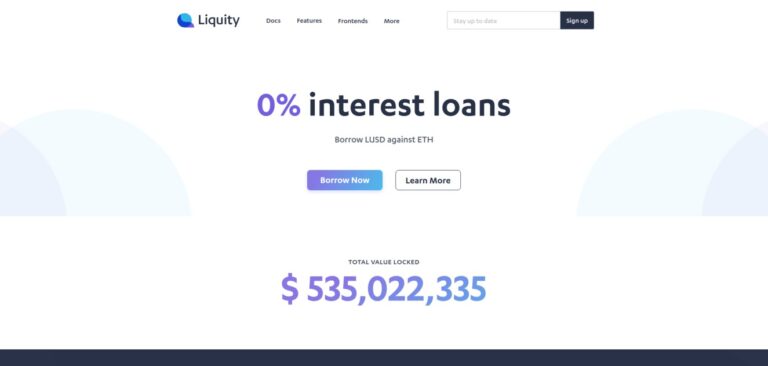

Liquity (LUSD) is a decentralized borrowing protocol on Ethereum. It offers 0% interest loans against ETH collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

MakerDAO is a DeFi platform on Ethereum for generating Dai, a stablecoin, governed by MKR token holders, enabling decentralized financial activities.

Frax Finance is a decentralized algorithmic stablecoin, Frax, for stable value maintenance, enabling minting, redeeming, and transacting across various DeFi applications.