In a world where digital art, gaming assets, and virtual real estate are soaring in value, understanding NFTs has become essential. Yet, for many, the concept remains confusing—what exactly is an NFT, and why does it matter? By demystifying NFTs, we’ll uncover how these unique digital assets are reshaping ownership online, opening doors to new opportunities in art, entertainment, and beyond. Let’s dive in to decode the world of NFTs.

Introduction to NFTs

What is an NFT?

An NFT, or non-fungible token, is more than just a digital asset; it's a revolutionary concept that signifies ownership and authenticity in the digital world. Unlike standard digital files, which can be easily duplicated, an NFT is unique and cannot be replaced or replicated. Stored on a blockchain, NFTs use this decentralized, immutable ledger technology to ensure transparency and security, creating a verified and tamper-proof record of ownership.

Unique Digital Asset

NFTs differ from traditional digital files by ensuring the digital item they represent is one-of-a-kind. While digital images or videos can be endlessly copied, an NFT provides proof that only one person holds the “original” or “authentic” version. This feature has transformed digital art, collectibles, and other virtual assets into exclusive, valuable items.

Ownership Representation

Think of an NFT as a digital certificate of authenticity. Much like owning a signed painting or a rare baseball card, an NFT confirms ownership of digital items such as art, music, video, and even virtual real estate. This proof of ownership is stored securely on the blockchain, allowing owners to buy, sell, or trade their digital assets without fear of duplication or forgery.

Proof of Authenticity

NFTs provide irrefutable proof that a digital asset is genuine and not merely another copy circulating on the internet. This is especially valuable in creative industries, where creators can issue authentic, limited versions of their work, protecting their intellectual property and offering collectors a verifiable link to the creator.

The Uniqueness of NFTs and Non-Fungibility

The core of an NFT’s value lies in its non-fungibility. Unlike fungible assets (such as Bitcoin or traditional currency) where each unit is identical and interchangeable, NFTs are unique and hold distinct characteristics that make them irreplaceable. This uniqueness adds intrinsic value, making NFTs particularly attractive for digital items where individuality and originality are key.

Comparison with Fungible Assets

Interchangeability:

- Fungible Assets (e.g., Bitcoin, U.S. dollars): Each unit is identical and can be exchanged on a one-to-one basis. One dollar is worth the same as another dollar, just as one Bitcoin equals another Bitcoin.

- Non-Fungible Tokens (NFTs): No two NFTs are alike. Each token has unique attributes and data that set it apart, making it impossible to exchange on an equal basis with another NFT.

Value Determination:

- Fungible Assets: The value remains consistent across units and is determined by market forces. One Bitcoin has the same value as any other Bitcoin.

- NFTs: The value varies widely and is influenced by factors such as rarity (the number of similar assets), provenance (the history of ownership), and the creator’s reputation. For instance, an NFT by a well-known digital artist or an exclusive collectible with a rich backstory can command significantly higher prices.

NFTs as Digital Collectibles

In many ways, NFTs resemble physical collectibles like rare stamps or vintage cars. Their value comes not only from the intrinsic worth of the digital item but also from the scarcity and historical significance associated with it. Just as the earliest collectibles hold special status, pioneering NFT projects like CryptoPunks have become iconic symbols within the digital landscape, adding cultural and monetary value to the NFT concept.

The Rise of NFTs: How CryptoPunks Shaped the Digital Collectibles Market

Historical Context

NFTs have a rich history dating back to the early 2010s, but they truly gained momentum in 2017 with the launch of CryptoPunks, a pioneering NFT project that transformed digital collectibles.

Created by software developers Matt Hall and John Watkinson of Larva Labs, CryptoPunks were originally a set of 10,000 unique, algorithmically generated characters, each with its own distinct features. What made CryptoPunks extraordinary was that anyone with an Ethereum wallet could initially claim one for free; they only had to pay the gas fees to mint it on the Ethereum blockchain.

The Rise of CryptoPunks

When CryptoPunks were first launched, there was little to no market demand for these digital characters. For a long time, they traded for minimal amounts, often overlooked by the general public and even NFT enthusiasts. However, as the NFT ecosystem matured, these pixelated characters started to gain recognition for their historical significance and rarity. By 2021, the demand for CryptoPunks surged, with some selling for millions of dollars each, turning them into one of the most valuable NFT collections ever. Today, CryptoPunks are widely recognized as the ultimate symbol of digital ownership, and the project has grown into a cultural phenomenon that represents the origins of NFT art and collectibles.

What Makes CryptoPunks Unique?

CryptoPunks are often referred to as the “Bitcoin of NFTs” due to their foundational role in the digital collectibles space. Each of the 10,000 punks is unique, featuring a mix of traits such as hairstyles, accessories, and facial expressions, which are randomly assigned and non-replicable. The collection includes both male and female characters, as well as rarer types like zombies, apes, and aliens, the latter of which are particularly valuable due to their scarcity. Unlike modern NFTs, CryptoPunks do not have advanced metadata or interactive features. Instead, their value lies in their scarcity, cultural impact, and status as one of the first NFT projects on Ethereum, making them irreplaceable icons in the NFT world.

CryptoPunks: The Blueprint for Modern NFTs

Just as Bitcoin is the original and irreplaceable cryptocurrency, CryptoPunks hold a similar place within the NFT ecosystem. They set the standard for rarity, provenance, and community-driven value, influencing countless NFT projects that followed. The limited quantity and simple, pixelated design contribute to their appeal, embodying the decentralized and experimental spirit of early blockchain innovation. For collectors, owning a CryptoPunk is like owning a piece of digital history—a reminder of the early days of NFTs and a symbol of their continued evolution.

CryptoPunks Today

Today, CryptoPunks remain one of the most recognizable NFT collections, frequently featured in high-profile sales and cultural events. Their influence is visible across the NFT industry, inspiring numerous derivatives and establishing the foundational principles of digital ownership and scarcity in the art world. With a market cap valued in the hundreds of thousands of ETH, CryptoPunks not only demonstrate the potential value of NFTs but also act as a testament to the permanence and significance of early blockchain projects in shaping the future of digital assets.

How NFTs Work

Blockchain Technology Basics

At the core of NFTs lies blockchain technology, a decentralized ledger that securely records transactions across a network of computers. Each entry on the blockchain is transparent, tamper-proof, and chronologically ordered, ensuring verifiable ownership of digital assets. While multiple blockchains support NFTs, Ethereum is the most popular, thanks to its early adoption and robust smart contract capabilities. However, new blockchains like Solana and TON are gaining traction, offering lower transaction fees and faster processing, making NFTs more accessible and affordable.

NFT Standards: ERC-721, ERC-1155, and Beyond

NFTs are built on specific blockchain standards that define their structure and functionality. The ERC-721 standard, developed on Ethereum, is the foundational framework for NFTs, enabling each token to have unique properties and be individually identifiable. In contrast, ERC-1155 allows for a blend of fungible and non-fungible tokens within the same contract, making it ideal for applications like gaming, where unique items and standardized assets often coexist. These standards ensure compatibility with wallets, marketplaces, and apps, creating a consistent user experience across platforms.

Smart Contracts

Smart contracts are self-executing programs on the blockchain that handle NFT creation, ownership transfers, and transaction records. When an NFT is created, or “minted,” a smart contract generates the token, assigns its metadata, and records ownership details. This system also facilitates direct sales, resales, and even royalty distributions, automatically executing terms based on predefined rules without intermediaries. In this way, smart contracts give NFT creators and collectors a transparent, reliable framework for interacting with digital assets securely.

Different Types of NFTs

Art and Collectibles

NFTs first gained mainstream attention through digital art and collectibles, where they allow artists to tokenize their work, selling digital pieces that can’t be replicated or pirated. Notable examples include Pudgy Penguins and projects like Bored Ape Yacht Club, which have become cultural icons in the digital art world. For collectors, owning an NFT can mean holding a piece of digital history, creating a modern form of collecting where ownership, rarity, and artist royalties play central roles.

Gaming and Virtual Items

In the gaming world, NFTs offer players true ownership of in-game items, like weapons, skins, and characters. Unlike traditional games where items are confined to a single ecosystem, NFTs allow assets to be bought, sold, and even transferred across compatible games. Projects like Axie Infinity pioneered the play-to-earn model, where players earn rewards by engaging in the game, merging entertainment with a real-world economy in a way that challenges conventional gaming dynamics.

Music and Media NFTs

NFTs are reshaping the music and media industries by giving artists more control over their work. Musicians can tokenize their songs, albums, or even concert footage, offering fans exclusive ownership and access. Platforms like Royal and Audius allow artists to mint NFTs representing songs or albums, with royalties embedded directly into the contract. This approach not only supports creative control but also offers new revenue streams by allowing artists to sell digital rights, concert tickets, or exclusive media to fans.

Event Tickets and Memberships

NFTs have found applications in event ticketing, where they act as verifiable, tamper-proof proof of entry. For instance, platforms like YellowHeart use NFTs to eliminate fraud and scalping, ensuring that tickets are traceable and that resale is fair and secure. NFTs also facilitate memberships, offering holders exclusive benefits, such as access to virtual or real-life events, exclusive merchandise, or behind-the-scenes content, allowing for a deeper, more personalized fan experience.

Real Estate and Virtual Real Estate

NFTs are venturing into both physical and virtual real estate, tokenizing property to simplify ownership transfer and create fractional ownership opportunities. Virtual real estate platforms, such as Decentraland and Sandbox, allow users to buy, sell, and develop parcels of land in digital worlds, creating unique virtual environments. For physical real estate, NFTs can simplify complex property transactions, with some real-world property sales beginning to experiment with tokenized deeds that can be securely transferred on the blockchain.

NFT Use Cases and Industries

Art Market Transformation

NFTs have revolutionized the art world by allowing artists to tokenize their creations, offering verifiable ownership and authentic resale channels for digital art. Unlike traditional art sales, NFTs give artists ongoing royalties with every resale, creating a sustainable income model. This shift empowers artists, as platforms like Foundation and SuperRare enable direct-to-collector sales, reducing reliance on intermediaries and expanding accessibility to global audiences.

Entertainment and IP Rights

In the entertainment sector, NFTs are redefining intellectual property (IP) rights and content ownership. Musicians, filmmakers, and content creators can tokenize their work, selling NFTs that grant buyers exclusive access to songs, behind-the-scenes footage, or film scenes. These tokens can incorporate IP rights directly into smart contracts, allowing creators to retain control and receive royalties on each resale. Platforms like Mintable and Audius support artists by offering tools to create IP-protected NFTs, opening new revenue streams while protecting creative ownership.

Gaming Industry & Metaverse

NFTs are central to the development of the metaverse—a shared digital space where users interact through avatars, assets, and environments. NFTs enable players to own, trade, and carry digital assets across compatible games and virtual worlds, driving interoperability. For instance, Axie Infinity and Sandbox allow users to create and trade virtual goods, land, and avatars within immersive worlds. This cross-platform potential elevates NFTs beyond static assets, transforming them into functional, interactive tools within a sprawling digital ecosystem.

Fashion and Luxury Goods

In fashion, NFTs are unlocking new ways to buy, sell, and wear virtual luxury items, from digital sneakers to designer outfits. Brands like Gucci and Dolce & Gabbana have collaborated with digital artists to create exclusive virtual goods, often limited in quantity to retain rarity. These digital wearables can be displayed in the metaverse, and some even come with real-world counterparts, creating a bridge between physical and virtual worlds. This blending of luxury with digital innovation has attracted high-profile buyers and positioned NFTs as a staple in the next era of fashion.

Branding and Marketing

NFTs offer brands a unique avenue for customer engagement, loyalty programs, and brand storytelling. Companies like Coca-Cola and Nike have launched NFT campaigns to offer fans exclusive collectibles, limited-edition digital items, and experiences. NFTs can also act as membership tokens, granting holders perks such as early product access, exclusive events, or branded content. These NFT-based marketing initiatives foster deeper customer loyalty and allow brands to create lasting connections in a digital-first economy.

NFT Marketplaces

Popular NFT Marketplaces

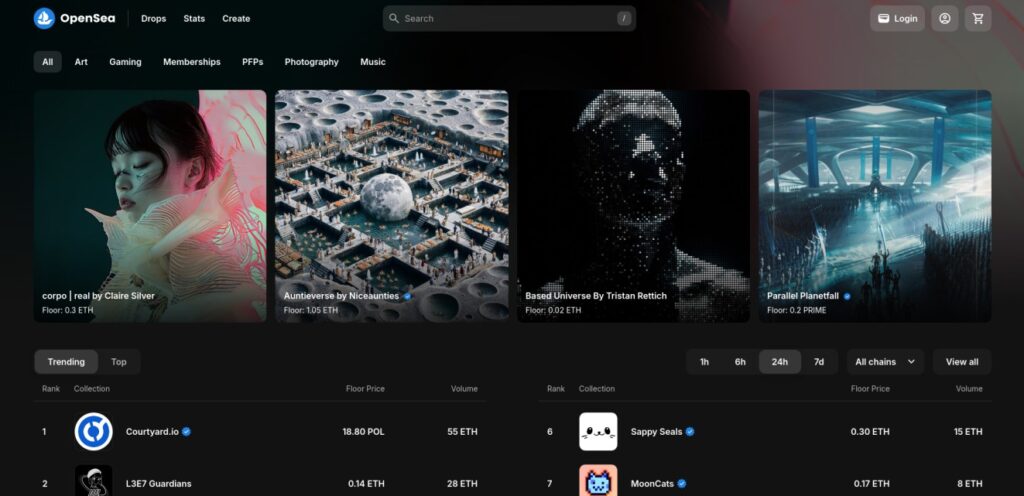

NFT marketplaces are digital platforms where users can buy, sell, and explore NFTs across various categories, including art, gaming, and collectibles. For a long time, OpenSea held the position as the largest and most influential NFT marketplace, with its extensive range of NFTs across multiple blockchains and user-friendly interface. However, recent shifts in the market have seen Blur surpass OpenSea in trading volume, positioning it as a new leader, especially among professional traders seeking faster, more data-driven trading experiences.

Below is an overview of the most popular NFT marketplaces, highlighting each platform’s unique features and primary use cases.

1. OpenSea

OpenSea is a versatile and user-friendly platform that supports a wide variety of NFTs, from digital art and collectibles to virtual real estate. It operates across multiple blockchains, including Ethereum, Polygon, and Solana, making it accessible for a broad audience. Known for its simple interface, OpenSea is ideal for beginners and collectors, offering tools like auction options, creator royalties, and comprehensive browsing features. Despite recent competition, OpenSea remains a foundational marketplace with strong brand recognition.

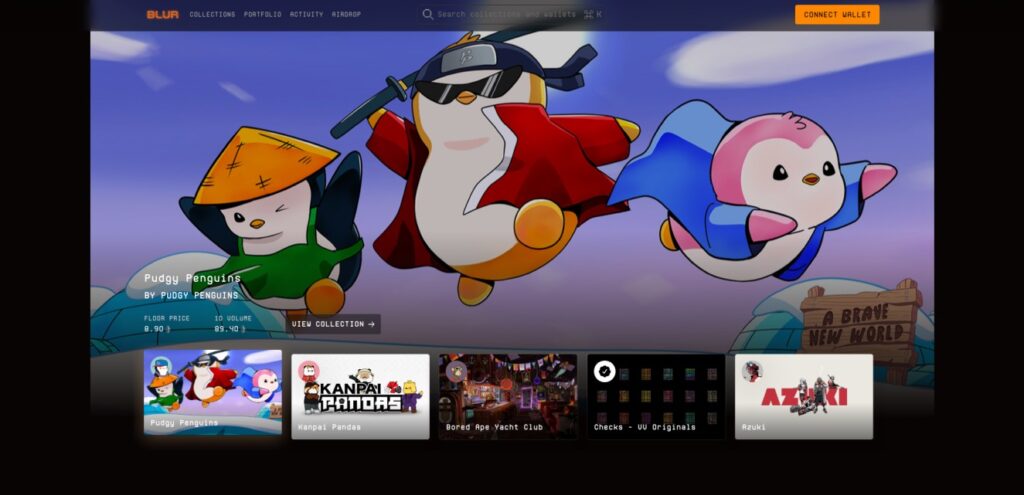

2. Blur

Blur is a rapidly growing NFT marketplace that has recently overtaken OpenSea in terms of trading volume. Targeted at professional traders, Blur offers advanced trading tools, including real-time data, portfolio management, and low-fee trading options. It’s particularly popular for those looking to flip NFTs or manage large collections, as it provides a fast, data-centric experience. Blur’s aggressive approach to incentives and low-fee structure has made it a favorite for high-volume users and competitive traders.

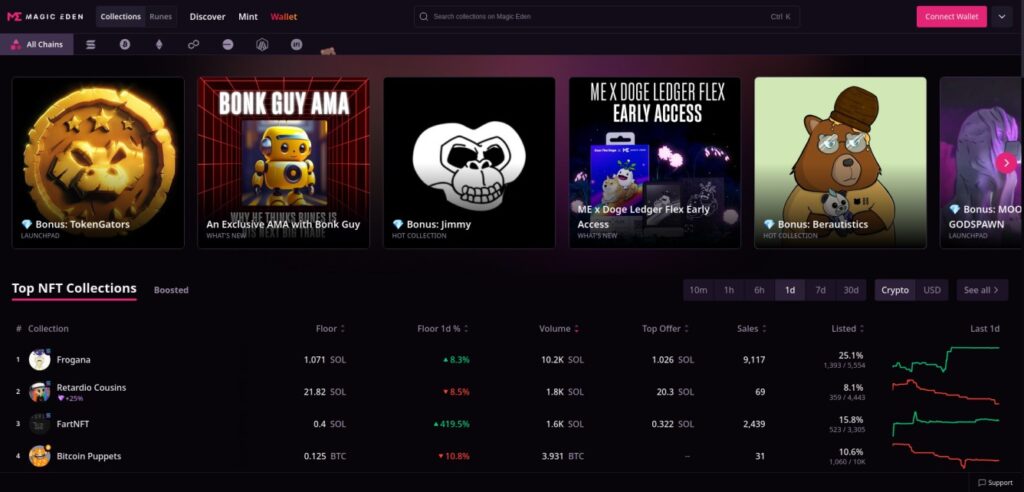

3. Magic Eden

Magic Eden originated as a Solana-focused marketplace but has since expanded to support Ethereum and Polygon. It’s known for its strong community and extensive collection of gaming and metaverse NFTs. Magic Eden also features launchpad services, helping creators and projects mint and list NFTs with ease. It’s a go-to for gaming and virtual world enthusiasts, offering curated collections and a user-friendly experience for exploring NFTs within niche digital ecosystems.

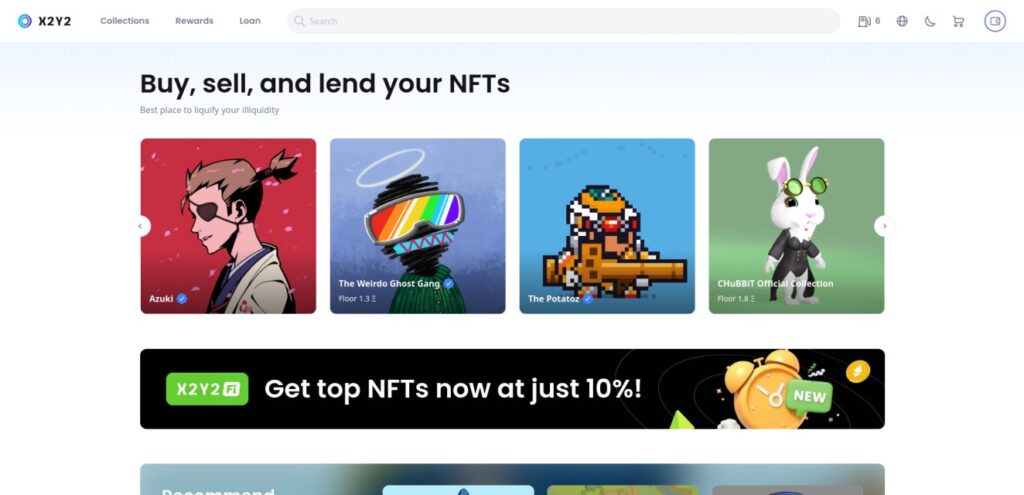

4. X2Y2

X2Y2 is an Ethereum-based NFT marketplace that emphasizes decentralized, community-driven trading. It differentiates itself by providing staking rewards to X2Y2 token holders and low fees for traders, aiming to create a more equitable marketplace. X2Y2 also focuses on providing a smooth experience for peer-to-peer transactions and has built a loyal user base interested in decentralized finance (DeFi) integrations within the NFT space.

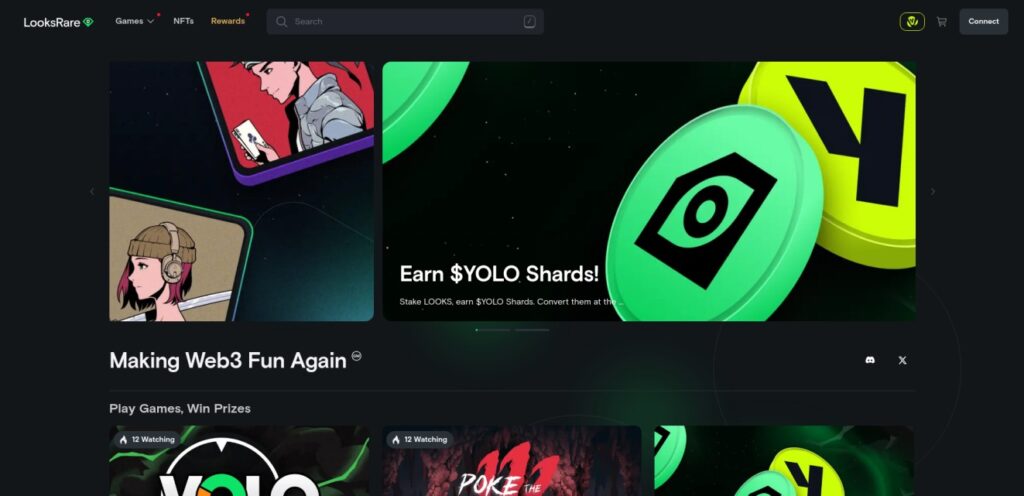

5. LooksRare

LooksRare is a community-focused marketplace that rewards users for buying and selling NFTs through its native LOOKS token. This platform is designed to prioritize and reward active users, creating a unique incentive structure that encourages trading. LooksRare is popular among users looking for an alternative to traditional marketplaces, as it combines NFT trading with DeFi-inspired rewards. This makes it appealing to both traders and token stakers who seek a marketplace that values user engagement.

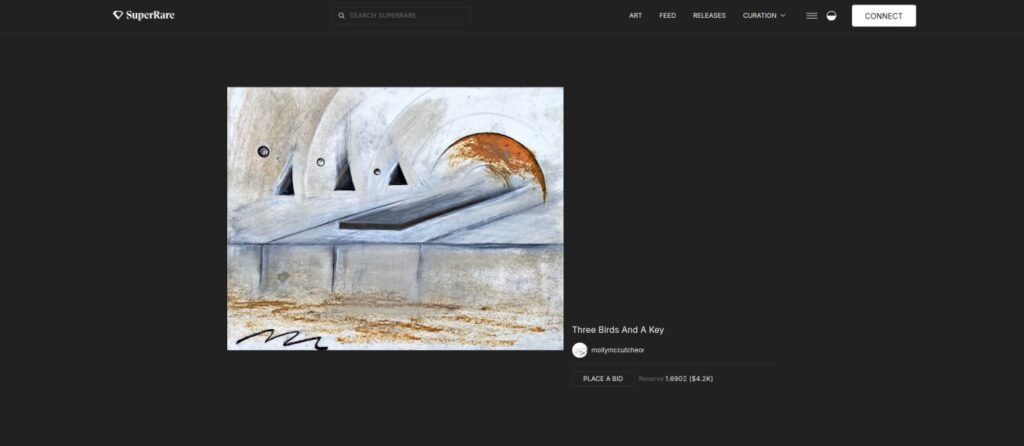

6. SuperRare

SuperRare is an art-focused NFT marketplace that curates high-quality digital artworks, supporting a more exclusive and gallery-like experience. Each artist must be invited or approved, ensuring that all art on the platform meets high standards. SuperRare is a favorite among collectors and art investors looking for unique, limited-edition pieces, and it includes features like artist royalties and profiles that showcase the creator’s work history. It’s ideal for serious art collectors and those looking to support individual artists.

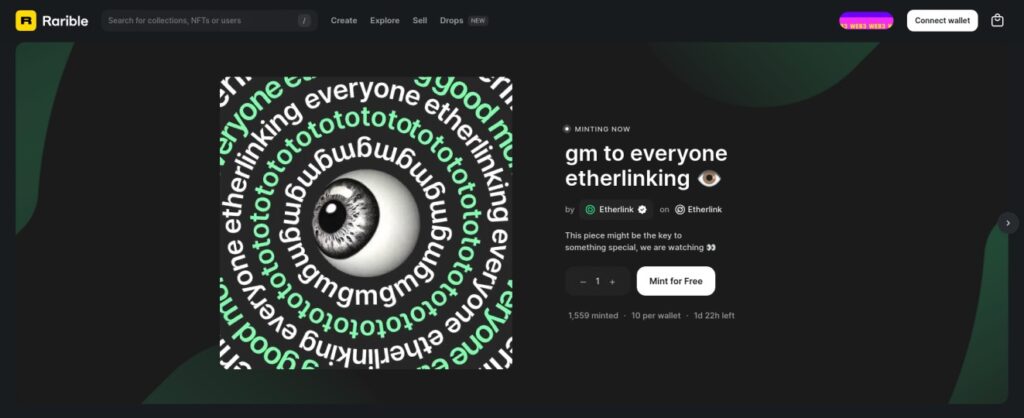

7. Rarible

Rarible is a versatile NFT marketplace known for its focus on community governance, where users can vote on platform changes through its native RARI token. Rarible supports multiple blockchains, including Ethereum, Flow, and Tezos, catering to a diverse user base. It allows users to easily mint, buy, and sell NFTs, making it a great choice for both creators and collectors. Its community-driven model and multi-chain support make it a flexible choice for those looking for a platform with democratic elements.

Each of these marketplaces brings a unique approach to NFT trading, catering to various user preferences, from casual collectors to professional traders. Whether you’re interested in fine art, gaming assets, or community rewards, these platforms offer a wide range of options to explore the world of NFTs.

Step-by-Step Guide to Getting Started with NFTs

Setting Up a Wallet

To start with NFTs, you'll need a compatible digital wallet that can store both cryptocurrency and NFTs. We recommend Rabby Wallet, which supports multiple blockchains, is user-friendly for beginners, and has top-notch security features by default. For Solana users, Phantom is the best choice. After installing your wallet, set up a secure password and, most importantly, back up your seed phrase—a set of words that acts as a recovery key. Store this phrase safely, as it’s the only way to recover your wallet if you forget your password.

Explore our detailed article on Rabby Wallet and Hardware wallet integrations for more information.

Buying Cryptocurrency for NFTs

Most NFT transactions require cryptocurrency, commonly Ether (ETH) on the Ethereum network. To purchase ETH or another cryptocurrency needed for NFTs, explore recommended exchanges on Bitshills for insights on reputable platforms.

The basic steps are straightforward:

- Sign up on the Exchange: Register an account and complete identity verification.

- Deposit Funds: Add funds via bank transfer, debit card, or other available options.

- Purchase ETH or Necessary Currency: Buy the crypto required for your preferred NFT marketplace.

- Transfer to Your Wallet: Send your funds to your digital wallet by entering your wallet address.

Navigating NFT Marketplaces

Once you have your wallet set up and funded, connect it to an NFT marketplace like OpenSea or Blur. Here’s how to explore and choose NFTs:

- Connect Wallet: Click “Connect Wallet” on the marketplace’s homepage and follow the prompts.

- Browse Categories: Explore different categories like art, gaming, collectibles, or music to find NFTs that interest you.

- Research the NFT: Review the NFT’s details, including creator information, description, price, and past sales history.

- Purchase or Bid: Follow the buying instructions for fixed-price purchases or bidding for auctioned NFTs. Confirm the transaction in your wallet.

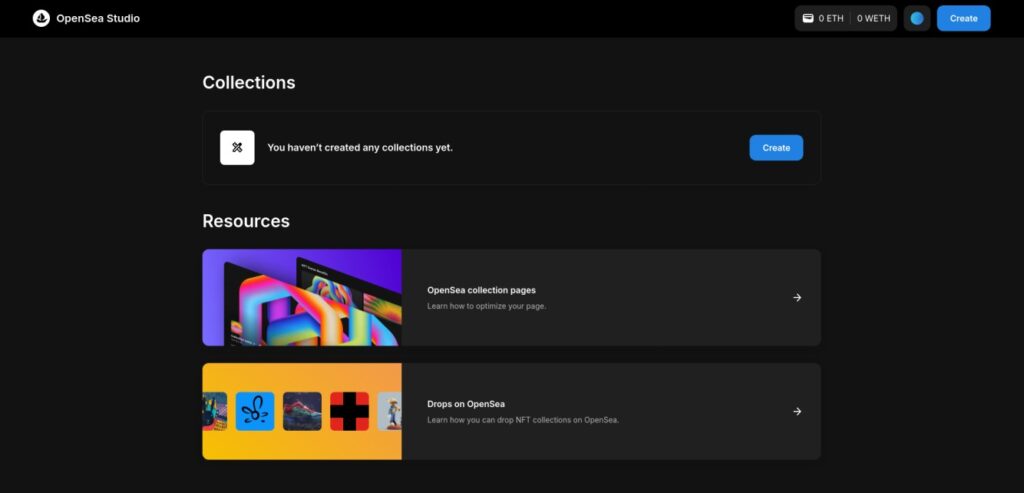

Minting Your Own NFT on OpenSea

Creating and selling your own NFT involves a process called “minting,” where your digital file becomes a blockchain asset. You can use any NFT marketplace to mint and sell your NFT, but for this guide, we’ll walk you through the process using OpenSea, one of the most popular NFT platforms.

Step 1: Head to OpenSea Studio

Go to OpenSea Studio to start creating your NFT. This is the centralized hub where you can manage collections, create items, and add essential details for each NFT.

Step 2: Connect Your Wallet

If you haven’t already, connect your digital wallet (e.g., MetaMask or Rabby Wallet). Click Connect Wallet at the top right and follow the prompts to sign in. Once your wallet is connected, you’re ready to start creating NFTs.

Step 3: Add a New NFT (Create an Item)

After clicking the Create button, you’ll be prompted to decide whether you want to create a Drop or an Item within a collection:

- Choose “Collection or Item”: Select this option to create a standalone NFT or add an item to an existing collection.

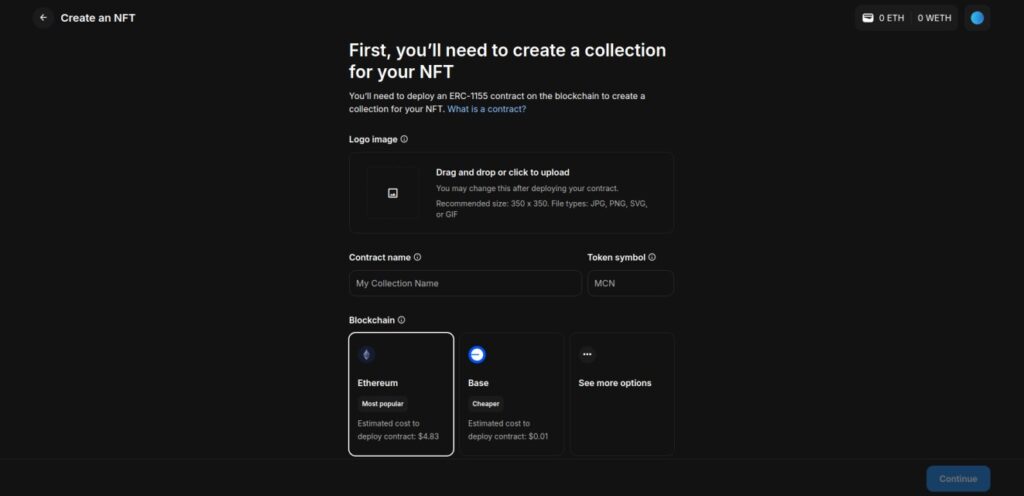

Step 4: Create a New Collection

To create an NFT, you first need to set up a Collection. In OpenSea Studio, click on Create under the Collections section. Here, you'll need to fill out basic details for your collection:

- Logo Image: Upload a 350x350px image for the collection logo.

- Contract Name: Enter a name for the smart contract associated with this collection.

- Token Symbol: Choose a token symbol to represent your collection.

- Blockchain: Select the blockchain for your collection, such as Ethereum or Base. Each choice shows estimated deployment costs.

Click Continue when you’re ready.

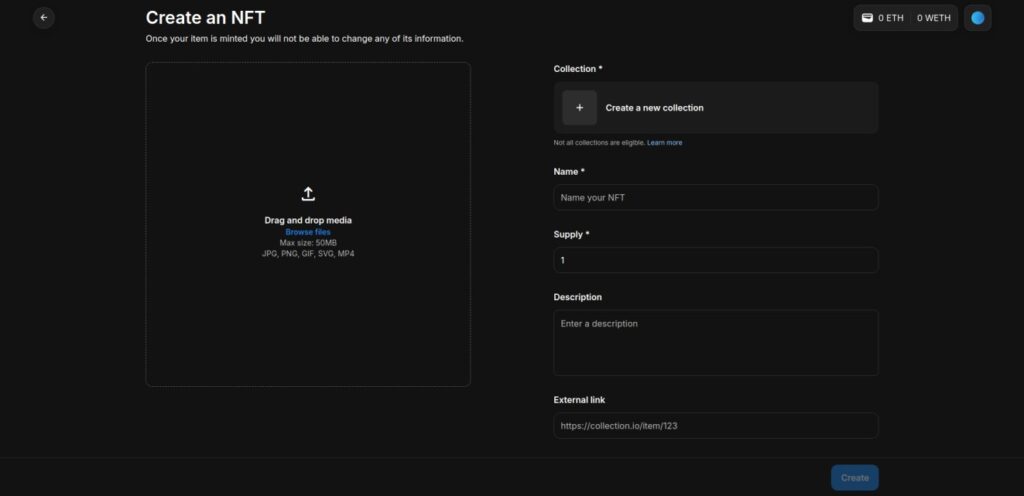

Step 5: Upload Your NFT and Customize Details

Now, you’ll be directed to the NFT creation page. Here, add essential details for your NFT:

- Upload Media: Drag and drop your media file (image, video, audio) into the upload area. Supported formats include JPG, PNG, GIF, SVG, and MP4.

- Name: Enter a title for your NFT.

- Supply: Define how many editions of this NFT will be available if it's part of a limited series.

- Description: Describe your NFT to potential buyers.

Click Create to proceed to minting.

Step 6: Confirm and Mint the NFT

After entering the details, OpenSea will guide you through the minting process. Minting will deploy the NFT to the blockchain, which involves a gas fee. Confirm the transaction in your wallet, and your NFT will be recorded on the blockchain.

NFT Applications and Emerging Technologies

NFTs in DeFi: Borrowing Against NFTs

NFTs are no longer limited to collectibles; they are now functional financial assets within decentralized finance (DeFi). DeFi platforms allow NFT holders to use their NFTs as collateral, unlocking liquidity without selling the asset. High-value NFTs can be staked on platforms like Gondi, Arcade, and JPEG’d, where users can borrow against their NFTs and access funds while retaining ownership. This ability to leverage NFTs in DeFi offers new liquidity options for holders, combining digital ownership with financial utility.

Ordinals on Bitcoin: NFTs on the Bitcoin Network

Traditionally, NFTs have been associated with blockchains like Ethereum, but Ordinals now bring NFT capabilities to the Bitcoin network. Ordinals allow unique digital assets to be inscribed directly onto individual satoshis—the smallest unit of Bitcoin—giving each satoshi a distinct identity without needing smart contracts. This approach enables a minimalist form of NFT creation on Bitcoin, appealing to collectors who value Bitcoin’s stability and simplicity. While more straightforward than Ethereum-based NFTs, Ordinals offer an innovative way to establish digital ownership within the Bitcoin ecosystem.

Risks and Challenges with NFTs

Security and Scams

The popularity of NFTs has unfortunately led to a rise in scams targeting both new and experienced users. Fake marketplaces mimic legitimate platforms to trick users into providing their wallet information or completing fraudulent transactions. Phishing attacks are also common, with malicious links or fake airdrops designed to gain access to users’ wallets. To stay secure, it's essential to verify marketplace URLs, use reputable wallets like Rabby, and avoid clicking on unsolicited links. Always double-check the legitimacy of an NFT project by researching its website, social media presence, and community reputation.

Market Volatility and Financial Risk

NFTs are highly speculative, with prices that can fluctuate wildly based on market demand, trends, and overall sentiment. This volatility presents financial risks, as buyers may purchase NFTs at high prices only to see their value drop significantly over time. Additionally, the relatively young NFT market can lead to price bubbles, where rapid gains are often followed by steep declines. Before investing, it's crucial to assess the potential for long-term value and consider NFTs as part of a broader investment strategy to manage risks associated with speculation.

Conclusion

NFTs have introduced a revolutionary shift in digital ownership, unlocking possibilities in art, entertainment, gaming, and beyond. By allowing creators to retain direct control and secure ongoing royalties, NFTs are transforming traditional markets and creating entirely new revenue streams. This unique technology has empowered artists, musicians, game developers, and other creators to reach global audiences, offering buyers a new, verifiable way to collect and invest in digital assets.

As applications of NFTs continue to expand, they have the potential to reshape the way we value, own, and interact with digital content, bridging the gap between the virtual and physical worlds in ways that were previously unimaginable. Whether as collectibles, access tokens, or elements in immersive gaming environments, NFTs are redefining digital engagement, making ownership as meaningful online as it is offline.

With such a promising future, NFTs represent more than just a trend; they’re a foundational technology for the evolving digital economy. For anyone interested in exploring or participating in this space, now is an exciting time to learn, create, and be part of the innovation NFTs bring to the digital world.

FAQs (Frequently Asked Questions)

What is an NFT?

An NFT, or non-fungible token, is a unique digital asset that represents ownership of a specific item or piece of content on the blockchain. Unlike traditional digital files, NFTs ensure the distinctiveness and authenticity of each asset.

How do NFTs provide proof of authenticity?

NFTs provide irrefutable proof that a digital asset is genuine through blockchain technology. Each NFT contains metadata that links it to its creator and ownership history, serving as a digital certificate of authenticity.

What are some common uses for NFTs?

NFTs have various applications, including digital art and collectibles, gaming assets, music and media rights, event tickets and memberships, as well as real estate in both physical and virtual environments.

How can I create and sell my own NFT?

To create and sell your own NFT, you'll need to set up a compatible digital wallet, buy cryptocurrency (typically Ether), connect your wallet to an NFT marketplace like Rarible, upload your digital file, customize your NFT details, mint it, set pricing, and promote it for sale.

What are some popular NFT marketplaces?

Some well-known NFT marketplaces include OpenSea, Blur, Magic Eden, X2Y2, LooksRare, SuperRare, and Rarible. Each platform offers different features and focuses on various types of NFTs.

What risks should I be aware of when dealing with NFTs?

When engaging with NFTs, it's important to consider potential risks such as security threats and scams due to their rising popularity. Additionally, the market is highly volatile with prices that can fluctuate significantly, posing financial risks.