DeFi Lending & Borrowing: Empowering Financial Flexibility and Autonomy

Step into a dynamic ecosystem with our carefully selected DeFi Lending & Borrowing Platforms, where your assets are not static, but active participants in a vibrant financial dance. These platforms facilitate seamless lending and borrowing of cryptocurrencies, allowing you to earn attractive interest rates on your idle assets or secure crucial funds without liquidating your holdings. With smart contracts at their core, these platforms ensure transparent, secure, and efficient transactions, all while you maintain complete control over your assets. Engage with a financial environment where opportunities abound, offering you the flexibility to maximize your capital's potential while minimizing risks. With DeFi Lending & Borrowing Platforms, experience the epitome of decentralized financial empowerment, where every asset has a role to play in your financial symphony.

Aave

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.

Abracadabra

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

Arcade

Arcade is a decentralized lending platform for NFT-backed loans. Users can bundle assets into Smart Vaults for larger loans. Loans are peer-to-peer, fixed-term, and non-liquidating.

Avalon Finance

Avalon Finance is a CeDeFi lending platform enabling Bitcoin holders to borrow stablecoins at fixed rates. It offers USDa, a Bitcoin-backed stablecoin, and operates across multiple chains.

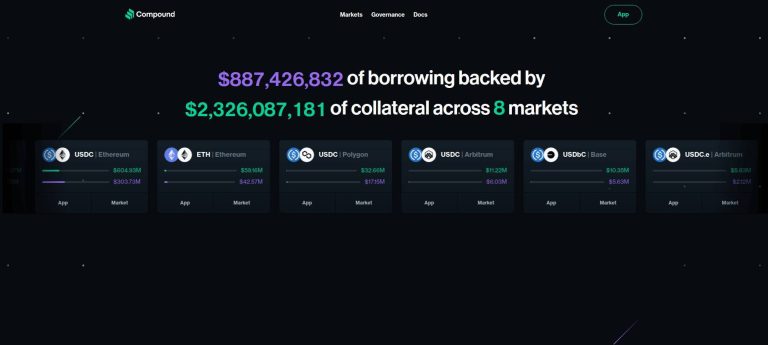

Compound

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

Euler Finance

Euler is a modular, permissionless lending & borrowing protocol. Users can create or use vaults for any ERC‑20 asset. Capital efficiency is enabled by isolated risk markets and dynamic rates.

Morpho

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

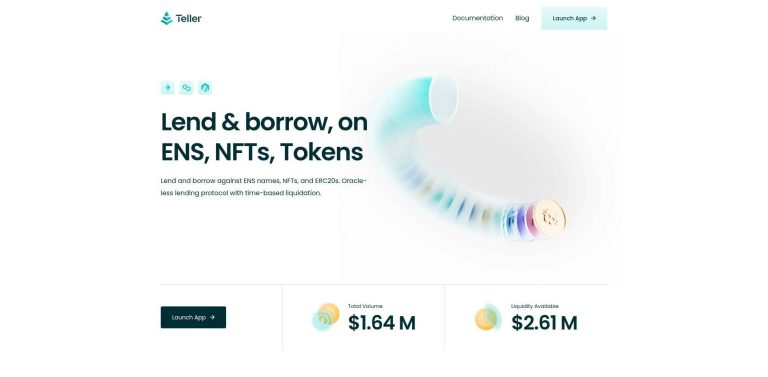

Teller

Teller is a decentralized lending protocol on Ethereum for lending and borrowing against ENS names, NFTs, and ERC20 tokens, offering oracle-less, time-based liquidation.