Introduction

Decentralized exchanges (DEXs) are changing the crypto world by enabling a new way of peer-to-peer transactions. Unlike traditional centralized exchanges, DEXs work without a central authority, allowing users to trade assets directly with each other. This removes intermediaries, reducing the risk of the other party involved and making everything more transparent.

Significance of DEXs:

- Peer-to-Peer Transactions: Enable direct trading between users.

- Eliminating Intermediaries: Reduce reliance on central authorities.

- Financial Sovereignty: Empower individuals with full control over their funds.

The rise of Decentralized Finance (DeFi) is closely linked with the development of DEXs. DeFi uses blockchain technology to recreate traditional financial systems in a decentralized way, offering services like lending, borrowing, and trading without intermediaries. DEXs play a crucial role in this system by providing a platform for easy and secure asset exchange.

By embracing the principles of decentralization, DEXs are not just changing how we handle money but also promoting more people to have access and control over their finances.

How Do Decentralized Exchanges Work?

Decentralized exchanges (DEXs) use blockchain technology to enable direct transactions between users, without the need for a middleman. This article explains the inner workings of DEXs and their impact on the world of cryptocurrency.

Smart Contracts and Blockchain Technology

At the heart of DEX operations are smart contracts — self-executing agreements with terms written directly into code. These contracts automate the trading process, ensuring that trades only happen when specific conditions are met. By removing intermediaries, smart contracts increase transparency and security.

Blockchain technology supports these smart contracts by providing a decentralized record of all transactions. Each transaction is verified by a network of computers (nodes), ensuring its accuracy and immutability.

Key Steps in a Typical DEX Transaction

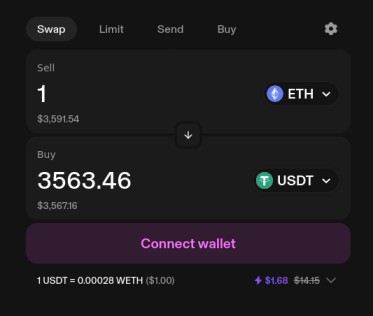

- Wallet Integration: Users link their cryptocurrency wallets to the DEX platform. Wallets like MetaMask or Rabby Wallet allow easy interaction with DEXs by integrating with their interfaces.

- Asset Selection: Traders choose which cryptocurrencies they want to trade. The DEX interface usually shows available trading pairs and current market prices.

- Order Placement: Depending on the type of DEX, users can either set limit orders or do direct swaps:

- Limit orders: Users specify the desired price and quantity for their trade.Limit orders: Users specify the desired price and quantity for their trade.

- Direct swaps: Trades happen instantly at current market prices.Direct swaps: Trades happen instantly at current market prices.

- Order Matching: In order book DEXs, trades are matched based on price and availability. Automated Market Makers (AMMs), on the other hand, use liquidity pools and algorithms to determine prices and enable immediate trades.

- Trade Execution: Once the conditions are met, smart contracts automatically execute the trade. The traded assets are directly transferred between users' wallets, without any central authority involved.

- Settlement: The transaction details are recorded on the blockchain, ensuring transparency and traceability. Throughout the entire process, users have complete control over their funds, minimizing the risk of third-party involvement.

Understanding these steps highlights how decentralized exchanges offer a secure and efficient alternative to traditional centralized exchanges, fostering financial independence within the crypto ecosystem.

Types of Decentralized Exchanges

Automated Market Makers (AMMs)

Automated Market Makers (AMMs) represent a revolutionary approach within decentralized exchanges. Instead of relying on an order book, AMMs employ algorithmic pricing mechanisms driven by liquidity pools contributed by users acting as liquidity providers (LPs). This means that the users of DEXs perform the same role that market makers do in traditional finance, fostering transparency and decentralization.

How AMMs Work

Algorithmic Pricing Mechanisms

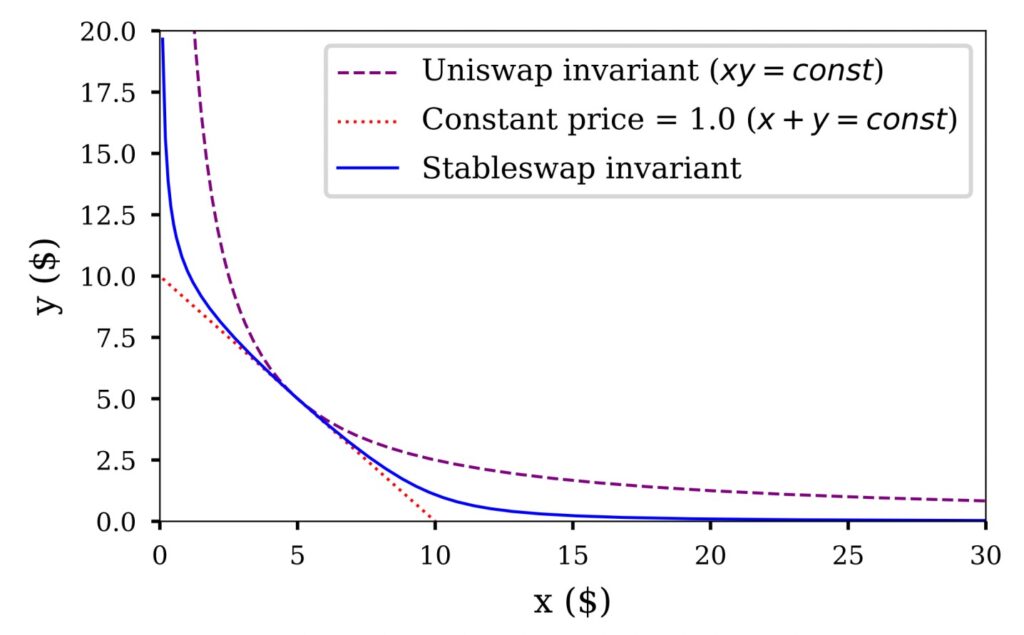

At the core of AMMs is a mathematical formula that automatically sets the price of tokens in a liquidity pool. The most common formula is the constant product formula: x⋅y=kx \cdot y = kx⋅y=k.

- x: The amount of Token A in the pool.

- y: The amount of Token B in the pool.

- k: A constant value that remains unchanged.

Example:

Imagine a pool with Token A (ETH) and Token B (USDT). If someone buys ETH from the pool, the amount of ETH (xxx) decreases and the amount of USDT (yyy) increases, but the product (kkk) remains constant. This ensures that as one token's supply decreases, its price increases, and vice versa.

- Initial State:

- ETH: 10

- USDT: 1000

- k = 10 × 1000 = 10000

- After Buying ETH:

- ETH: 9

- USDT: 1111.11

- k = 9 × 1111.11 = 10000

Role of Liquidity Providers (LPs)

Liquidity pools are essential for AMM DEXs to function. Users called liquidity providers (LPs) contribute pairs of tokens into these pools, making trading possible. In exchange for their contribution, LPs earn fees generated from trades within the pool. This system allows anyone to contribute liquidity and earn rewards based on their share in the pool. This incentivizes users to contribute liquidity, enhancing overall market depth.

Key Benefits of AMMs:

- Continuous Liquidity: Unlike order book DEXs that may suffer from low liquidity during off-peak hours, AMMs provide continuous liquidity due to their constant product formula.

- Simplified Trading: Traders benefit from instant swaps enabled by smart contracts without waiting for order matching.

- Incentives for Participation: LPs are incentivized through fee earnings, promoting broader participation in liquidity provision.

Challenges of AMMs:

- Impermanent Loss: LPs may experience impermanent loss when the price of tokens in the pool diverges significantly from their original values.

- Slippage: Large trades can result in significant slippage due to changes in token ratios within small pools.

Prominent examples of AMM-based DEXs include Uniswap, SushiSwap, and Balancer, each using different algorithms and fee structures to attract both traders and liquidity providers. These platforms highlight the dynamic nature of decentralized finance, continuously evolving to meet user demands while pushing the boundaries of traditional financial systems.

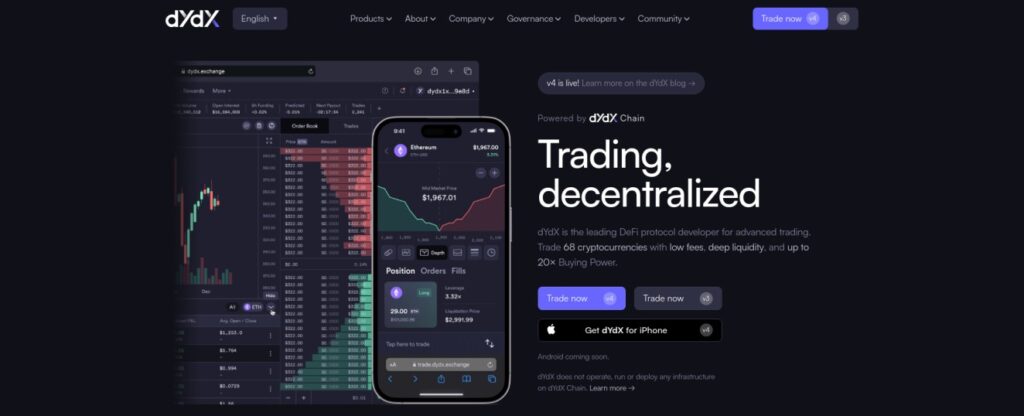

Order Book Decentralized Exchanges

Order book decentralized exchanges (DEXs) are structured in a manner that closely mirrors traditional centralized exchanges (CEXs). They maintain a ledger of buy and sell orders, known as the order book, to facilitate trading between users. This order book can be managed either on-chain or off-chain, depending on the priorities and goals of the project. The basic structure allows traders to place limit orders or market orders just as they would on a CEX, but with the added benefit of maintaining custody of their own assets and leveraging decentralization.

Structure and Functionality

Order book DEXs operate using smart contracts to manage the order book and execute trades directly on the blockchain. When a user places an order, it gets recorded in the order book. If another user places a matching order, the smart contract executes the trade automatically, transferring assets between wallets without needing an intermediary.

Key components include:

- Order Types: Limit orders allow users to specify the price at which they wish to buy or sell, while market orders execute immediately at the current market price.

- Matching Engine: This system matches buy and sell orders based on predefined criteria, ensuring fair and transparent execution.

- Smart Contracts: These automated contracts handle trade execution and settlement securely through blockchain technology.

Pros and Cons

Pros:

- Price Efficiency: Due to their structured nature, order book DEXs can offer better price discovery mechanisms. Users can see all available bids and asks, enabling more informed trading decisions.

- Familiarity: Traders accustomed to traditional CEXs will find the interface and functionalities of order book DEXs familiar, easing their transition into decentralized finance.

Cons:

- Lower Liquidity: Compared to CEXs, order book DEXs often suffer from lower liquidity. This can result in larger spreads between bid and ask prices, making it harder for traders to execute large orders without significant price slippage.

- Complexity: Managing limit orders and understanding the intricacies of an order book can be daunting for new users who are not experienced traders.

Examples of popular order book DEXs include Serum and dYdX. These platforms aim to bridge the gap between centralized efficiency and decentralized security by providing robust trading environments built on blockchain technology.

Advantages and Disadvantages of Using DEXs

Advantages

1. Enhanced Privacy and Control Over Funds

Decentralized exchanges (DEXs) offer users unparalleled privacy and control over their funds. Unlike centralized exchanges (CEXs), which require users to deposit their assets into an exchange-controlled wallet, DEXs allow traders to maintain full custody of their assets. Transactions occur directly between users' wallets through smart contracts, ensuring that private keys remain in the hands of the individual traders.

2. Reduced Counterparty Risk

By eliminating intermediaries, DEXs reduce counterparty risk—a significant concern in traditional finance and centralized crypto exchanges. Since trades are executed via smart contracts on the blockchain, the risk of default or fraud by a central authority is minimized. This decentralized approach ensures a higher level of trust and security within the trading environment.

3. Increased Transparency

Blockchain technology underpins all transactions on a DEX, providing an immutable and transparent ledger. Every trade, order, and liquidity provision can be publicly verified, promoting transparency and accountability. This open-access model contrasts sharply with the opaque operations often seen in centralized platforms.

Disadvantages

1. Impermanent Loss

One of the critical risks associated with DEX trading is impermanent loss, particularly for liquidity providers in Automated Market Maker (AMM) platforms. Impermanent loss occurs when the price of deposited assets changes compared to when they were added to the pool. This price volatility can lead to a situation where holding assets in a liquidity pool yields less value than simply holding them in a personal wallet.

2. Limited Order Book Depth

Unlike CEXs, which often boast deep order books due to high user activity and institutional participation, many DEXs suffer from limited order book depth. This constraint can result in slippage—where large orders significantly impact market prices—and reduced liquidity for certain trading pairs. Traders might experience less efficient price execution compared to more established centralized counterparts.

Decentralized exchanges present a compelling alternative to traditional trading platforms by offering enhanced privacy, control over funds, reduced counterparty risk, and increased transparency. However, potential drawbacks such as impermanent loss and limited order book depth highlight the need for careful consideration when engaging with DEXs.

The Changing World of Decentralized Exchanges

Decentralized exchanges have seen a lot of changes lately, with many platforms standing out for their unique features and contributions to the ecosystem. For a comprehensive list of decentralized exchanges categorized by blockchain, visit DeFiShills DEX Directory.

Popular DEXs

Uniswap: Pioneering Automated Market Maker (AMM) Model

Uniswap is still a leading force in the world of decentralized exchanges. It was launched in 2018 and uses an Automated Market Maker (AMM) model, which allows users to trade tokens directly from their wallets. This means there's no need for an order book; instead, trades are facilitated through liquidity pools and smart contracts.

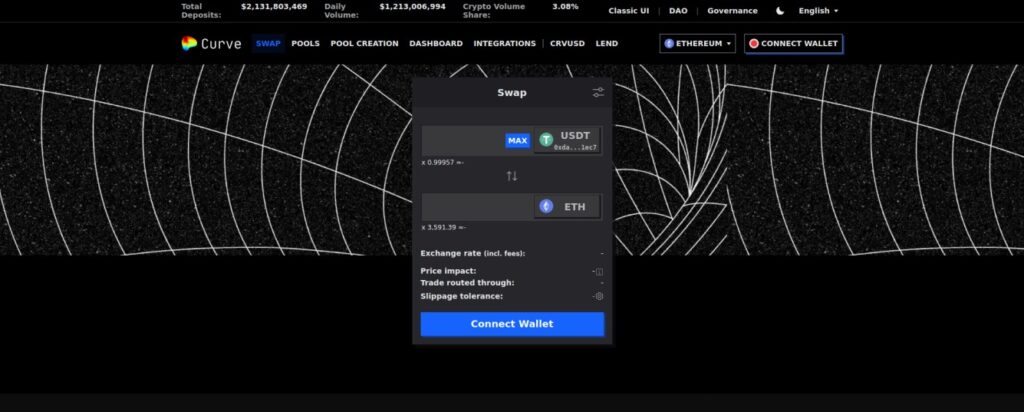

Curve: Optimizing Stablecoin Trading with Advanced AMM

Curve is another prominent decentralized exchange, specifically designed for stablecoin trading. It uses a unique market-making algorithm that minimizes slippage and maximizes efficiency in stablecoin swaps. Launched in 2020, Curve has quickly gained traction due to its niche focus and efficient trading mechanisms.

Stablecoin Trading: Curve's primary advantage is its specialization in stablecoins, which ensures lower volatility and more predictable trading outcomes.

Liquidity Pools: Similar to Uniswap, Curve also relies on liquidity pools. However, it optimizes these pools for stablecoins, allowing for more efficient trades with reduced fees.

Yield Farming: Users can also participate in yield farming by providing liquidity to Curve's pools, earning rewards based on the volume of trades facilitated by their assets.

Governance: Curve has a governance token called CRV, which allows users to vote on protocol changes and improvements. This decentralized governance model ensures that the platform evolves according to the community's needs.

By focusing on stablecoins and providing an efficient trading environment, Curve has carved out a unique niche in the decentralized exchange ecosystem.

GMX: Innovative Liquidity and High Leverage Trading

GMX is a decentralized exchange that combines features of Automated Market Makers (AMMs) and innovative liquidity mechanisms to offer a unique trading experience, especially known for its spot and perpetual trading options.

GMX uses a unique liquidity pool structure called GLP (GMX Liquidity Pool). This pool supports zero slippage trading and up to 100x leverage for perpetual trading. Here’s how it works:

- Automated Market Maker (AMM): Like Uniswap, GMX uses AMMs to facilitate trades directly from users' wallets, without intermediaries. This ensures ease of access and continuous liquidity.

- GLP Liquidity Pool: Users can contribute various assets to the GLP pool, which serves as the backbone for both spot trading and perpetual contracts. This pool provides liquidity for leveraged trading, allowing traders to borrow against their collateral for up to 100x leverage. The GLP token represents the provider's stake in this multi-asset pool.

Liquidity Pools

- Provision Mechanism: Users deposit assets into the GLP pool, earning rewards based on the pool's trading activity. This system allows for a diversified and deep liquidity pool that supports the platform's unique trading mechanisms.

- Zero Slippage: One of the standout features of GMX is its ability to offer zero slippage trading. This is achieved by aggregating prices from major exchanges and using Chainlink’s Decentralized Oracle Network to ensure accurate and real-time pricing.

Yield Farming

- Incentives: Users can earn rewards by providing liquidity or participating in staking activities. The platform distributes a portion of its fees to liquidity providers, enhancing the attractiveness of yield farming on GMX.

- Staking Rewards: GMX offers staking rewards in the form of its native tokens and other incentives, encouraging long-term participation and liquidity provision.

Governance

- Decentralized Model: GMX features a governance token that allows users to vote on protocol changes and improvements. This ensures that the platform evolves in line with the community’s interests.

- Community Proposals: Users can submit proposals for new features or changes to existing mechanisms, fostering a collaborative and decentralized environment.

By integrating a unique liquidity pool mechanism and high leverage trading capabilities, GMX provides a versatile and efficient trading platform that caters to various types of traders, all while maintaining the core benefits of decentralization.

Case Study: How Uniswap Became a Success

The sudden success of Uniswap can be attributed to two main factors: its user-friendly interface and its ability to provide ample liquidity. By allowing anyone to become a liquidity provider and earn fees, Uniswap made market-making accessible to everyone. This had a significant impact on the Ethereum ecosystem:

- Liquidity Provision: Users can easily add their tokens to liquidity pools, earning fees based on trading activity.

- Token Launches: New projects often choose Uniswap for initial token distribution, taking advantage of its extensive user base.

- Decentralization: As one of the first AMMs, Uniswap showed that decentralized trading without intermediaries is possible.

Since it was created, Uniswap has gone through several upgrades. The most recent one, called Uniswap V3, introduced new features like concentrated liquidity and customizable fee tiers.

Introduction to SushiSwap and Yield Farming Mechanisms

SushiSwap, another well-known decentralized exchange, emerged as a direct competitor to Uniswap. It initially caused controversy because of its “vampire attack” strategy, which involved incentivizing users to move their liquidity from Uniswap. However, SushiSwap has since proven itself as a strong player in the world of decentralized finance (DeFi).

Some of the key innovations that SushiSwap brought to the table are:

- Yield Farming: Liquidity providers can earn extra rewards in the form of SUSHI tokens, making it more enticing to provide liquidity.

- Governance: Holders of SUSHI tokens have a say in important decisions about the platform, influencing its future direction.

- Additional Features: Apart from basic token swaps, SushiSwap also offers opportunities for staking and lending through integrations with BentoBox and Kashi.

Both Uniswap and SushiSwap are great examples of how decentralized exchanges are not just changing the way we trade, but also introducing new financial mechanisms that encourage user participation and help the ecosystem grow.

Decentralized Exchanges for Bitcoin

Bitcoin, as the original cryptocurrency, lacks the smart contract functionality natively available on other blockchains like Ethereum. However, the decentralized ethos of Bitcoin has spurred the development of innovative software solutions that enable peer-to-peer networks for decentralized exchanges. Two prominent examples of such platforms are Bisq and ThorChain.

Bisq: A Peer-to-Peer Bitcoin Exchange

Bisq is a fully decentralized exchange that allows users to trade Bitcoin for fiat currencies and other cryptocurrencies without relying on a central authority. It operates on a peer-to-peer network, ensuring that users maintain control over their funds throughout the trading process.

Key Features:

- Privacy:

- Bisq emphasizes user privacy by facilitating transactions directly between peers. This approach helps preserve the anonymity of users, as there is no need for a centralized intermediary to handle trades or hold personal information.

- Security:

- Funds on Bisq are secured using multisignature addresses, which require multiple parties to approve a transaction. This reduces the risk of theft and fraud, as no single party has control over the funds at any given time.

- Open-source:

- Bisq is an open-source platform, meaning its code is publicly available for anyone to review, audit, and contribute to. This transparency fosters trust within the community and encourages continuous improvement and innovation.

- Decentralized Governance:

- Bisq operates with a decentralized governance model, where decisions about the platform's development and policies are made collectively by its community. This ensures that the platform remains aligned with the interests of its users.

Bisq represents a significant advancement in the realm of decentralized exchanges by enabling truly peer-to-peer Bitcoin trading. It upholds the core principles of Bitcoin—decentralization, privacy, and security—making it a valuable tool for those seeking to trade Bitcoin without the need for centralized intermediaries.

ThorChain: Pioneering Cross-Chain Liquidity

ThorChain is another groundbreaking project that extends the concept of decentralized exchanges by enabling cross-chain liquidity pools. This allows users to swap Bitcoin with other cryptocurrencies seamlessly, providing a bridge between different blockchain networks.

Key Features:

- Cross-chain Compatibility:

- ThorChain facilitates trading between different blockchain networks, including Bitcoin, Ethereum, and other major cryptocurrencies. This cross-chain functionality is achieved through the use of liquidity pools and a unique consensus mechanism.

- Decentralized Liquidity:

- ThorChain uses liquidity pools to provide efficient trading without relying on centralized order books. Users can contribute their assets to these pools and earn rewards, while traders can access deep liquidity for their swaps.

- Node-based Security:

- The security and reliability of ThorChain's network are maintained by a decentralized set of nodes. These nodes validate transactions, manage the liquidity pools, and ensure the integrity of the cross-chain swaps.

- Rune Token:

- ThorChain utilizes its native token, RUNE, as a utility token within the ecosystem. RUNE is used to facilitate liquidity, pay fees, and incentivize node operators, creating a robust and self-sustaining network.

ThorChain's approach to decentralized exchanges addresses one of the major limitations in the crypto space—the fragmentation of liquidity across different blockchains. By enabling seamless cross-chain swaps, ThorChain enhances the interoperability of the crypto ecosystem, allowing users to trade assets across multiple blockchains without the need for centralized exchanges.

Both Bisq and ThorChain exemplify the innovative spirit of the cryptocurrency world, each addressing unique challenges associated with decentralized trading. Bisq provides a secure, private, and open-source platform for Bitcoin and fiat trading, while ThorChain offers a solution for cross-chain swaps, enhancing liquidity and interoperability within the crypto ecosystem. Together, these platforms highlight the ongoing evolution of decentralized exchanges and their critical role in shaping the future of finance.

The Future of Decentralized Exchanges in a Tokenized World

Decentralized exchanges (DEXs) are set to play a big role in the tokenized world, making it easy to trade non-fungible tokens (NFTs) and other new types of digital assets. As digital assets change, DEX platforms are changing too, so they can handle these unique tokens better.

Trading New Types of Assets with Tokens

- Non-Fungible Tokens (NFTs): NFTs are special digital assets that can be bought, sold, and traded on blockchain networks. They're different from regular tokens like cryptocurrencies, which is why decentralized exchanges are perfect for them. DEXs let NFT traders deal directly with each other, without needing middlemen. This means more transparency and control over who owns what.

- Fractional Ownership: People are starting to like the idea of fractional ownership, where you can own just a part of something valuable. With DEXs, users can trade these small pieces of high-value things like real estate or fine art. It's a way to let more people invest in things that used to be only for rich individuals or big organizations.

- Interoperability: DEX platforms now want to work together with different blockchain networks. This is important because it lets people trade all kinds of tokens across many systems, without needing someone in charge. The new cross-chain DEX systems mean users can trade tokens smoothly, no matter what blockchain they come from.

New Technology Ideas

- Layer 2 Solutions: To solve the problem of not being able to handle lots of transactions at once, many DEXs are trying out Layer 2 solutions. These upgrades make trading cheaper and faster, so people can trade small-value tokens without paying huge fees.

- Better User Interfaces: Designers are finding ways to make decentralized exchanges easier for regular people to use. They're making it simple to connect your wallet and understand how trading works. This means even if you're new to crypto, you can still join in on the fun of tokenized markets.

Changing the Financial World

Decentralized exchanges are just one part of a bigger change happening in finance. It's called decentralized finance (DeFi), and it's all about using blockchain technology to make traditional financial things better. As DEXs keep getting better and offering more services, they're going to have a big impact on how money works around the world.

Conclusion

Decentralized exchanges have the potential to change the financial industry by offering a trading environment that is trustworthy, transparent, and accessible to all. DEXs give users more control over their assets, increased privacy, and the opportunity to be part of a global financial system without intermediaries.

For an extensive and detailed directory of all decentralized finance (DeFi) exchanges, categorized by blockchain, visit the DeFiShills Exchanges Directory. This resource offers comprehensive information on various exchanges, helping you navigate the diverse DeFi landscape effectively. Explore it here.

Using DEX platforms can bring new opportunities for both experienced traders and beginners. Here's why:

- Financial Sovereignty: Trade directly from your wallet, keeping complete control of your funds.

- Transparency: Transactions are recorded on the blockchain, ensuring openness and traceability.

- Accessibility: Take part in trading without relying on traditional financial systems.

However, it's important to be aware of risks like impermanent loss and regulatory uncertainties. Do your research and stay updated on security measures to protect your investments.

Join the world of decentralized exchanges and contribute to the movement that is making finance more democratic.

FAQs (Frequently Asked Questions)

How do decentralized exchanges (DEXs) work?

Decentralized exchanges (DEXs) use blockchain technology to facilitate peer-to-peer cryptocurrency trading without the need for a central authority or intermediary. Smart contracts are at the heart of DEX operations, enabling automated and trustless transactions.

What are the key steps in a typical DEX transaction?

The key steps in a typical DEX transaction include wallet integration, where users link their cryptocurrency wallets to the DEX platform, and the actual trading process which is facilitated by smart contracts. Users maintain control over their funds throughout the entire transaction.

What are the types of decentralized exchanges?

There are different types of decentralized exchanges, including Automated Market Makers (AMMs) which use mathematical formulas to determine asset prices, order book decentralized exchanges which operate based on traditional order book systems, and hybrid models that combine AMM and order book mechanisms.

What are the pros and cons of using DEXs?

Some advantages of using DEXs include enhanced privacy and control over funds, price efficiency, and yield farming opportunities. However, there are also disadvantages such as impermanent loss associated with liquidity provision.

How have decentralized exchanges changed recently?

Decentralized exchanges have seen significant changes lately, with new models such as yield farming mechanisms gaining popularity. Additionally, governance tokens and new asset types like NFTs have become integral parts of the DEX ecosystem.

How do decentralized exchanges impact Bitcoin trading?

Decentralized exchanges provide a way for Bitcoin trading to occur without relying on centralized intermediaries. Projects like Bisq and ThorChain have extended their functionalities to include Bitcoin trading in a decentralized manner.