DEX Aggregators: Amplifying Your Trading with Optimal Routes

Navigate through the vast oceans of decentralized finance with ease and precision using our top picks of DEX Aggregators. These powerful platforms optimize your trading by scanning and routing your transactions through various decentralized exchanges to secure the best prices and liquidity available. With DEX Aggregators, you not only gain access to a broader liquidity pool but also benefit from reduced slippage and enhanced capital efficiency. Experience trading that is not just decentralized but also intelligent, as DEX Aggregators work tirelessly in the background to ensure that every trade you make is executed at the most favorable terms, maximizing your returns and trading efficiency in the dynamic DeFi market.

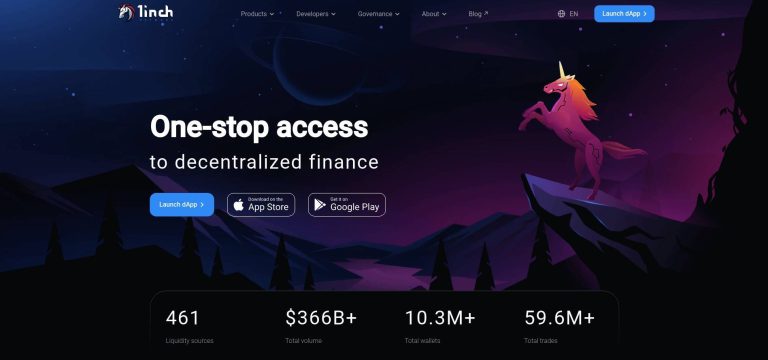

1inch

1inch is a DeFi aggregator optimizing trades across multiple DEXes, ensuring best rates, low slippage, with a feature-rich wallet, and various protocols enhancing capital efficiency and trading capabilities.

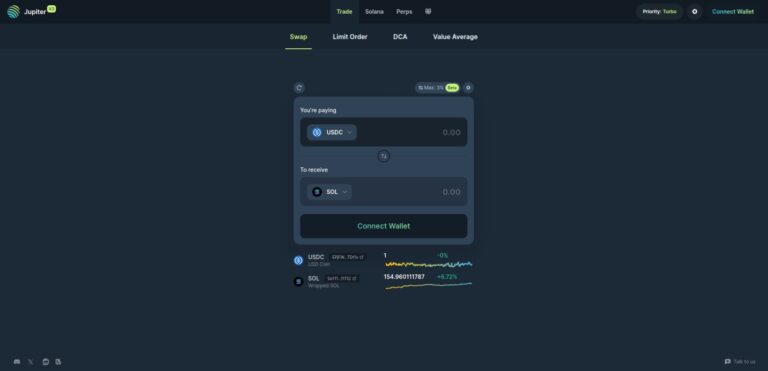

Jupiter

Jupiter is a decentralized exchange aggregator on Solana, offering fast transactions, low fees, and access to most SOL-based tokens. It features limit orders and cross-chain swaps.

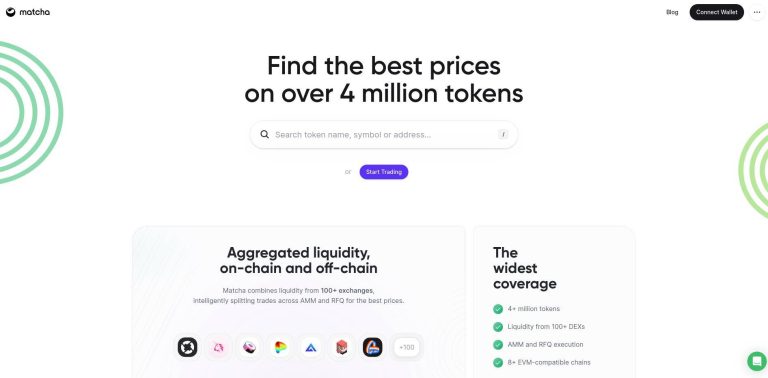

Matcha

Matcha is a 0x Labs-powered DEX offering peer-to-peer token swaps, best price aggregation across DEX networks, and extensive token access for decentralized finance.

OpenOcean

OpenOcean aggregates liquidity across 19+ blockchains for optimal swap rates, reducing slippage and gas costs in Decentralized Finance (DeFi) trading.