Centralized derivatives trading has long been a necessary evil for crypto traders offering leverage and liquidity, but at the cost of trust, transparency, and control. From unexpected account freezes to opaque liquidation engines and catastrophic collapses like FTX, traders have had to navigate a system where power is centralized and users are exposed.

The consequences have been devastating. Billions in user funds vanished from failed exchanges. Traders in restrictive jurisdictions were cut off without notice. Even seasoned professionals faced rug-pulls hidden behind sleek UIs and institutional branding. The promise of crypto freedom was often compromised by the very platforms meant to serve it.

But 2025 marked a turning point. For the first time, decentralized perpetuals platforms began offering a real alternative combining non-custodial security with the speed, sophistication, and scale traders expect. DEX-to-CEX futures trading ratios surged to 17% in July 2025, up from just 4.66% a year earlier. The shift isn’t just quantitative it’s ideological. Traders are choosing self-custody, transparency, and global access over black-box institutions.

Why Decentralized Perpetuals Matter

The rise of decentralized perpetuals isn’t just a tech trend, it’s a direct response to the failures of centralized platforms. These protocols solve three of the most persistent problems in crypto trading:

1. True Asset Ownership – Centralized exchanges hold your funds, until they don’t. Decentralized platforms let you trade directly from your wallet, eliminating counterparty risk and giving you complete control over your capital at all times.

2. Unrestricted Market Access – Whether you're in Nigeria, Brazil, or the U.S., DEXs don’t discriminate. As long as you have a wallet and internet connection, you can access high-leverage perpetuals markets without KYC hurdles or regional lockouts.

3. Built-In Transparency – Every trade, fee, and liquidation rule lives on-chain. There are no black boxes. Decentralized perpetuals protocols operate on auditable code, making trust optional – not required.

What You'll Learn in This Guide

This guide is your map to the top decentralized perpetuals platforms of 2025 – what they offer, who they’re best suited for, and where the risks and trade-offs lie.

You’ll get a clear view of how the leading DEXs stack up when it comes to fees, leverage, supported chains, trading experience, and transparency. Each platform deep dive includes personal insights, unique features, limitations, and usage tips so you can pick what fits your style.

We’ve also included curated comparison tables to help you quickly spot the right fit – whether you’re after high leverage, low fees, or early-stage upside.

If you’re serious about DeFi-native trading, this guide gives you the tools to start comparing, experimenting, and building your own go-to stack – without getting burned in the process.

The Decentralized Derivatives Landscape in 2025

Before we dive into specific recommendations, it’s helpful to understand the broader landscape. While hundreds of DeFi protocols exist, only a small group of decentralized perpetuals platforms account for the majority of trading volume and innovation.

Some focus on speed and leverage, others on security, cross-chain accessibility, or institutional-grade features. They span ecosystems like Ethereum, Solana, Cosmos, and custom appchains, each with trade-offs in fees, liquidity, and user experience.

This diversity means there’s no single “best” platform, only the one that best matches your trading goals, risk tolerance, and preferred assets.

How to Choose the Right Platform for You

With dozens of decentralized perpetuals platforms now live across multiple chains, finding the right one can be overwhelming. Factors like leverage, supported assets, fees, UI quality, and security vary widely between platforms. To help narrow it down, we’ve mapped out top-performing DEXs based on specific trading needs, from high-volume pros to yield farmers and beginners.

| Trader Profile | Recommended Platforms | Key Features | Why It's Best |

|---|---|---|---|

| 🏆 High-Volume Professional | Hyperliquid | • $10B+ open interest • Pro-grade tools • Deep liquidity • Fee tier system | Institutional-grade execution and CEX-like speed without giving up custody |

| ⚡ Maximum Leverage | Ostium (200x) Drift (101x) | • Up to 200x leverage • Real-world synthetics • Fast UX • Vault-backed liquidity | Highest leverage in DeFi with rapid execution and diverse market exposure |

| 🔗 Cross-Chain Flexibility | ApeX Protocol | • Multi-chain access • Arbitrum, Base, BNB, Ethereum, Mantle • Unified interface | Seamlessly trade across ecosystems without juggling wallets or interfaces |

| 🎯 Beginner-Friendly | Drift | • Flat fees • User-friendly UI • Educational content • Gasless trading | Best entry point for new traders in the Solana ecosystem with low friction and helpful tooling |

| 🏛️ Institutional/TradFi | Extended Exchange dYdX | • TradFi markets (SPX, Gold, EUR/USD) • Appchain or L2 infra • No custody or KYC | Self-custodial access to traditional markets via trusted infrastructure |

| 🧪 Early-Phase & Points Programs | Lighter Ostium Extended Exchange | • Active points campaigns • Beta or capped access • High yield vaults | High-upside platforms for early adopters seeking airdrops, alpha, and LP incentives |

| 🔒 Security-Focused | GMX | • $100B+ volume • No major exploits • On-chain transparency | Proven security record and battle-tested architecture trusted across ecosystems |

Pro Tip: Many successful traders use multiple platforms – Hyperliquid for high-volume trading, Drift for Solana ecosystem plays, and GMX for steady yield farming.

Top 8 Decentralized Perpetuals Platforms

Now that you have a sense of which platforms suit different trader profiles, let’s take a closer look at the most active and influential platforms in 2025. This section highlights each project’s core features, security status, fee model, and ideal use case, so you can make informed decisions, not just follow the hype.

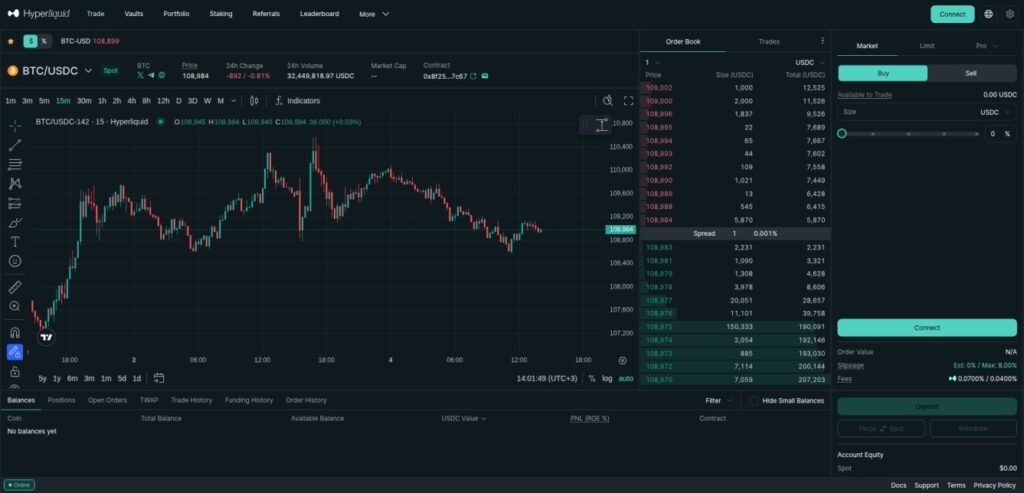

Hyperliquid: Leading the On-Chain Perp Market

Hyperliquid currently dominates the decentralized perpetuals landscape, commanding over 80% of total market share. Built on its own custom Layer 1 chain, it delivers a CEX-like trading experience with full on-chain transparency, deep liquidity, and a native ecosystem governed by the HYPE token. The platform has become the go-to for professional and high-volume traders seeking performance without giving up custody.

Key Features

- Market-Leading Volume & Liquidity

Hyperliquid processes over $8 billion in daily trading volume, with deep order books rivaling Binance and Bybit. Its growing dominance in decentralized perpetuals is clearly visible through volume and liquidity comparisons with centralized exchanges.

- Gasless Trading with Tiered Fee Discounts

Trades on Hyperliquid incur no gas fees. Instead, taker and maker fees are determined by a volume-based fee tier system (see table below) and can be further reduced by staking HYPE.- Tier 0 (<$5M 14-day volume)

- Perps: 0.045% taker / 0.015% maker

- Spot: 0.070% taker / 0.040% maker

- Users staking up to 500,000 HYPE receive up to 40% fee discounts across all tiers.

- Tier 0 (<$5M 14-day volume)

- HLP Vault for Yield Seekers

Liquidity providers can earn passive yield by supplying to the HLP vault, which currently holds $373M in TVL and offers around 6% APR. This vault supports the trading engine while giving users non-inflationary yield from trading fees.

- On-Chain Transparency & Order Book

All trading actions are fully on-chain and verifiable, allowing users to track every order, fill, and liquidation. Whales and market trends can be observed in real-time, making the platform highly transparent and data-rich.

- Advanced Trading Tools

Hyperliquid offers features tailored for active traders, including one-click trading (no confirmation delays), simultaneous stop loss and take profit on entry, TWAP execution, scale-in order types, and up to 40x leverage.

What to Know

Hyperliquid launched with one of the largest airdrops in DeFi history and became the first platform to seriously challenge centralized markets head-on. Its deep liquidity, innovative HLP vault model, and CEX-like execution set it apart. With the HyperEVM ecosystem just beginning to grow, the platform is only getting started. For professional traders and users seeking speed, depth, and full self-custody, Hyperliquid offers a rare combination of raw performance and self-custody.

ApeX: Cross-Chain Trading with Deep Liquidity

ApeX Protocol launched in 2022 shortly after GMX and has remained a high-volume decentralized perps platform ever since. Applauded by many DeFi veterans especially those who avoided the FTX fallout by trading on ApeX, it’s built for users who want a non-custodial, KYC-free experience with advanced tooling. Powered by the APEX token, the protocol continues to expand its cross-chain reach, liquidity, and trader-focused rewards.

Key Features

- Multi-Chain Asset Coverage with Deep Liquidity

Trade a wide range of perpetual markets against USDT – including meme coins, L1s, and DeFi majors sourced from liquidity across Base, Arbitrum, Ethereum, BNB Chain, and Mantle. ApeX integrates with Bybit for deep liquidity on select pairs.

- Gasless Trading with Transparent Fee Tiers

Trades incur no gas costs. Standard fees on ApeX Omni are:- Maker: 0.0200%

- Taker: 0.0500%

During special campaigns or for lower-volume users, maker fees can drop to 0% and taker fees to 0.025%.

- Protocol Insurance Vaults

ApeX offers its own vault infrastructure where users can deposit into protocol vaults or create their own. Current protocol vaults are earning yields up to 30% APR, funded directly by trading fees on the platform.

- Social Rewards & APEX Token Incentives

Users can earn social points through competitions, platform activity, and trading quests, often tied to ongoing airdrop campaigns. Staking APEX or esAPEX provides a share of protocol revenue and unlocks higher reward tiers.

- Pro Trading Features with High Leverage

Full-featured trading terminal supports order book views, advanced charting, and simultaneous stop loss / take profit setup during trade entry. Traders can use up to 100x leverage.

What to Know

ApeX remains a fully functional, high-volume DEX that has never suffered an exploit or downtime. Its cross-chain infrastructure and deep integration with Bybit allow users to access liquidity from multiple ecosystems without leaving the app. Governed by APEX token holders, the platform is considered by many to be one of the most truly non-custodial places to trade perps today. Its mix of incentives, stable infrastructure, and community-led direction continue to attract both retail and pro traders across chains.

dYdX: The Original DeFi Perps Pioneer

Once the undisputed leader in decentralized perpetuals, dYdX pioneered on-chain perpetuals starting in 2021 and at one point held nearly 100% of the market share. Now operating as an appchain in the Cosmos ecosystem, the dYdX Chain continues to be trusted by many institutional traders. The DYDX token powers the network and staking system, and up to $2.2M worth of DYDX is still distributed monthly to active traders.

Key Features

- Time-Tested at Scale

With over $1.4 trillion in lifetime volume, dYdX supports 220+ tradable markets and leverage up to 50x, making it one of the most diverse and proven platforms in the space.

- Gasless Trading with Fee Tiers

All trades are gasless. Maker and taker fees follow a volume-based fee structure, with the most active traders receiving rebates as high as -1.1 bps (for makers).- Tier 1 (<$1M 30d volume): 5.0 bps taker / 1.0 bps maker

- Tier 9 (>$125M & ≥4% maker share): 2.5 bps taker / -1.1 bps maker

- MegaVault for Passive Yield

dYdX v4 introduced MegaVault, a market-neutral vault that allows users to earn protocol revenue with an estimated 18% APR. Similar to Hyperliquid’s HLP, this provides yield without exposure to directional risk.

- Advanced Trading Features

Offers full suite of pro tools: real-time order book, trade history, advanced charting, and simultaneous stop loss/take profit setups on entry. Leverage capped at 50x across supported markets.

What to Know

dYdX went from early domination to losing ground to newer players like GMX and Hyperliquid. While still heavily farmed due to ongoing DYDX incentives, its UI now feels dated compared to more modern interfaces like Lighter or Hyperliquid. The move to a Cosmos appchain introduces some friction for Ethereum-native users unfamiliar with the tooling, but is also seen as a plus by those aligned with Cosmos infrastructure. For institutional players, dYdX remains a respected option, but whether it evolves or gets left behind will depend on how it responds to the next wave of competition.

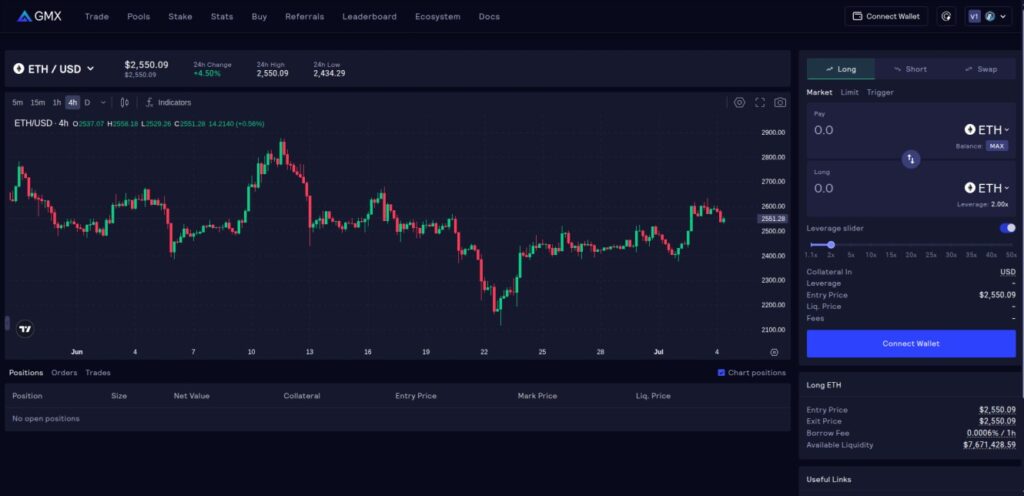

GMX: The Battle-Tested On-Chain Perps Engine

GMX is the most battle-tested decentralized perpetual trading platform, operating fully on-chain across Arbitrum, Avalanche, and, since 2025, Solana via its GMXSOL deployment. Known for its security-first architecture, consistent volume, and strong community governance, GMX remains a go-to choice for users who prioritize transparency, ownership, and long-term resilience.

Key Features

- Multiple Protocol Tokens with Fee Sharing

GMX features a unique, multi-token model:- GMX – Governance and utility token. Earns 30% of V1 and 27% of V2 trading fees.

- GLP – V1 liquidity provider token. Earns 70% of V1 fees.

- GM – V2 LP token. Earns 63% of V2 fees.

- GLV – LP aggregator for GMX V2 vaults, capturing fees across GM tokens.

- GT (Solana) – Trade-to-earn token on Solana. Can be deposited into the Treasury and sold for USDC.

- Advanced Order Types & Leverage

Users can open long and short positions with up to 50x leverage, using market or limit orders. Take profit and stop loss orders can be set post-entry.

- Multiple Trading Modes

- Classic Mode – Full self-custody with on-chain confirmations. Gas paid in ETH.

- Express Mode – Off-chain signing via GMX premium RPCs. Gas paid in WETH or USDC.

- Express + One-Click – CEX-style flow without per-trade signing, still fully non-custodial.

- On-Chain Transparency & Ecosystem Tools

Every trade is executed on-chain, enabling full visibility into trader behavior, positions, and volume. A robust set of third-party dashboards and analytics tools has emerged to support the GMX ecosystem.

What to Know

GMX is widely viewed as the most secure and reliable decentralized perpetuals platform to date. While it experienced a minor oracle manipulation incident in 2022 on Avalanche (resulting in a $565,000 loss), its core contracts have never been exploited. Unlike more aggressive platforms like Hyperliquid, GMX focuses on a smaller set of high-quality trading pairs, which may limit variety for traders seeking niche assets. Still, its token architecture, proven resilience, and multi-chain presence continue to make it a favorite among DeFi-native traders.

Drift: Solana’s Native Powerhouse for Perpetuals

Drift is the leading perpetual futures platform on Solana, built for fast, efficient on-chain trading. Its design focuses on delivering low slippage, tight spreads, and gasless execution, supported by a modular suite that includes perps, spot, margin, and lending markets. With over $900M in TVL, Drift is deeply integrated into the Solana DeFi stack and backed by its native DRIFT token, which powers governance, staking, and fee discounts.

Key Features

- Modular Trading Suite

Drift offers four core products – Perpetuals, Spot, Borrow & Lend, and Passive Liquidity Provision (BAL). Users can seamlessly switch between trading, lending, and liquidity strategies within a single platform.

- High TVL & Market Depth

With over $900M in total value locked and 40+ supported perp markets, Drift provides deep liquidity and capital efficiency across top trading pairs.

- Gasless Trading with Tiered Fee Discounts

Drift charges no gas fees, and trading fees follow a tiered structure based on 30-day volume or insurance fund stake. Maker fees are -1 bps across all tiers (rebates), while taker fees drop from 10 bps to 3 bps for VIPs. Users can stake DRIFT for additional fee discounts and governance rights.

- Vaults for Yield Farmers

Drift has launched a range of permissionless vaults, enabling users to passively earn yield by backing the insurance fund or participating in protocol-defined strategies. Vaults vary by asset and risk exposure.

- Flexible Collateral System & Basic Tooling

Users can collateralize trades using base or quote assets (e.g. ETH or USDC for ETH-PERP), and can set stop-loss and take-profit orders at entry. Max leverage goes up to 101x.

What to Know

Drift is the go-to perpetuals platform in the Solana ecosystem, offering a highly efficient and composable trading experience. However, it does not offer a visible order book interface like dYdX or Hyperliquid. Instead, trades are matched using Just-In-Time (JIT) liquidity, where liquidity providers and market makers fill orders on demand. This approach reduces latency and slippage but may feel less transparent to some traders. Still, for those who want fast execution, Solana-native design, and true self-custody, Drift delivers.

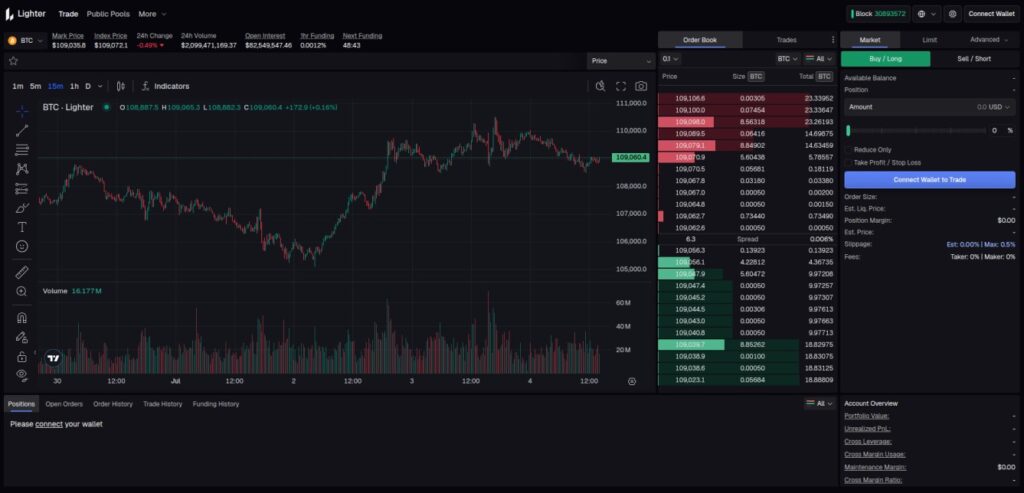

Lighter: Zero-Fee Trading at HFT Speed

Lighter is a newcomer in private beta that’s already being seen as the first serious challenger to Hyperliquid. Built by HFT veterans and leveraging an application-specific zk-rollup, it delivers unmatched execution speed with verifiable order matching and liquidations – all while operating gas-free and fee-free.

Key Features

- Private Beta & Points Program

Access is currently invite-only. A live points system is already running pre-mainnet, signaling early contributor rewards and a likely airdrop on launch.

- Zero Gas and Trading Fees

All trading actions – opening, closing, modifying positions – are completely fee-free. There are no gas fees and no taker/maker costs during beta.

- LLP Vault for Liquidity Providers

Liquidity providers can deposit to the Lighter Liquidity Provider (LLP) vault and earn up to 79.73% APR. However, deposits are gated based on your points balance:- 0–299 points → 25% of funds deposited to Lighter

- 300+ points → 50%

- 1500+ points → 75%

- 10,000+ points → 100% access

Points are earned exclusively through trading activity on the platform.

- zk-Rollup Infrastructure for Speed & Integrity

Lighter uses ZK-SNARKs and custom data structuring to create a verifiable, scalable trading layer on Ethereum, bringing CEX-level performance to a transparent, decentralized system.

- Pro-Level Trading Features

Offers advanced tools for active traders: one-click trading, combined stop-limit and take-profit orders, scale orders, TWAP execution, detailed charting, and deep order book visibility.

What to Know

Lighter has grown quickly into a platform viewed as the most credible Hyperliquid alternative. While the current beta is exclusive, the points program and fee-free structure make it attractive for early users seeking edge and airdrop potential. For liquidity providers, it's critical to understand that you cannot withdraw funds from Lighter at all if you have an active LLP deposit. To enable withdrawals, you must first remove your funds from the LLP vault. Bridging out also comes with friction: there’s a $3 fee to Arbitrum and a 1.5-hour wait when exiting to Ethereum.

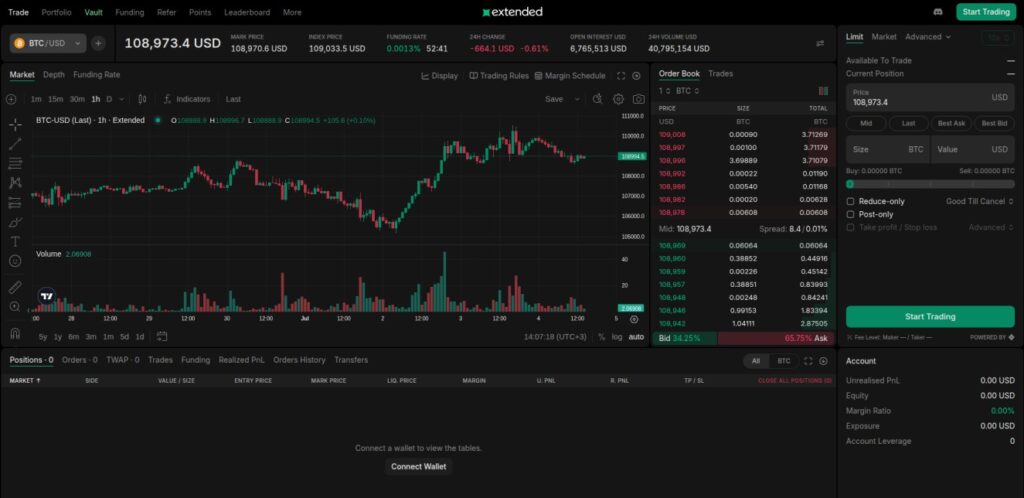

Extended Exchange: Bridging DeFi and TradFi

Extended Exchange is a rising platform designed to blur the lines between traditional finance and DeFi. Built on Starknet for self-custody and full transparency, Extended combines on-chain crypto trading with access to traditional markets like S&P 500 (SPX), gold (XAU), and forex pairs such as EUR/USD. Backed by former Revolut, Goldman Sachs, and Deutsche Bank talent, plus Bitget, it’s gaining traction quickly through its robust infrastructure and ongoing points campaign.

Key Features

- Starknet Infrastructure

Extended runs on Starknet, providing a high-speed, gasless experience with on-chain trade settlement and verifiability, ideal for traders seeking a CEX-quality experience without giving up custody.

- TradFi Market Access

Extended goes beyond crypto by offering traditional finance markets directly in a self-custodial DeFi environment. Traders can access indices, metals, and forex without KYC or centralized risk.

- Zero Maker Fees & Flat Fee Model

Trading is gasless, with a flat fee structure of 0.025% taker / 0.000% maker. Active market makers can earn rebates based on share of volume, up to 0.01% back with just 2.5% market share.

- Points Program & League System

Extended runs a chess-inspired league system for traders, LPs, and referrers – ranging from Pawn to King. Points earned through platform activity qualify users for future rewards and potential airdrops.

- Extended Vault for Passive Yield

The Extended Vault deploys capital across all markets using market-making strategies and performs liquidations. It currently returns an estimated 17.52% APR. Note: deposit cap is $7.5M and currently full.

- Advanced Trading Tools

Extended delivers a full CEX-like interface with pro features: real-time order books, market depth, conditional orders, TWAP, scale-in orders, and a sleek charting system. Users can set TP/SL orders at entry, and trade with up to 50x leverage.

What to Know

Extended Exchange stands out by enabling traditional asset trading in a fully decentralized, self-custodial setup. For DeFi users seeking TradFi exposure, or TradFi traders exploring crypto, it’s a unique proposition. With its ongoing points campaign and TradFi asset suite, the platform is well-positioned to serve a hybrid user base. Just note: all functionality is currently USDC-based, and the main vault is already at capacity. But if you're looking for the future of regulated-feel DeFi with pro-grade tooling, Extended is one to watch.

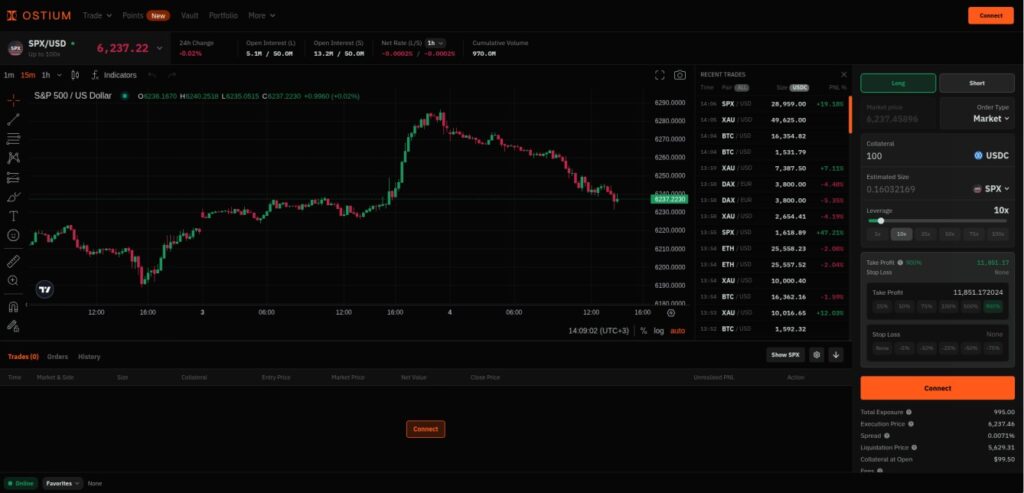

Ostium: Synthetic Markets for the On-Chain Trader

Ostium is a newer decentralized platform aiming to bring synthetic trading of traditional assets into the DeFi space. Rather than competing head-to-head with protocols like Hyperliquid, Ostium takes aim at centralized platforms like eToro and Plus500, enabling high-leverage trading of forex, stocks, indices, and commodities, all without giving up custody or privacy.

Key Features

- Traditional Market Coverage

Ostium allows users to trade synthetic perpetuals for forex pairs, gold, silver, oil, stocks, and indices like the S&P 500 – assets rarely accessible in DeFi without centralized middlemen.

- Up to 200x Leverage

Leverage on Ostium can go as high as 200x, depending on the market. This makes it one of the most aggressive platforms in terms of risk/reward exposure.

- Liquidity Buffer & LP Market-Making Vault

Ostium’s shared liquidity layer uses a Liquidity Buffer and MM Vault system that backs trades and enables users to earn yield by providing liquidity.

- Points Program

Ostium currently runs a points campaign that rewards active traders and LPs – strongly hinting at a future airdrop or rewards mechanism.

- Optional Gasless One-Click Trading

Trades are executed directly on-chain by default, requiring user signatures. However, users can opt into gasless one-click trading by setting an allowance for assets, offering speed and convenience with DeFi control. Additional per-asset-class fees still apply.

What to Know

Ostium doesn’t include a full order book, only recent trades are visible, but its focus isn’t on competing with hyperliquid-style platforms. Instead, it brings synthetic TradFi market exposure to DeFi, opening up new possibilities for traders interested in non-crypto assets. With high leverage, LP yield opportunities, and an active points campaign, Ostium is quickly gaining ground as a flexible and unique tool in the decentralized trading stack.

Full Platform Comparison: Fees, Leverage, Yield & More

Now that you’ve seen the detailed breakdowns, here’s a streamlined comparison of all eight platforms featured in this guide. These tables highlight key differences in fees, leverage, vault yields, supported chains, and security – helping you quickly spot which platform fits your strategy, risk profile, and trading style.

Whether you're chasing airdrops, farming vault yields, or pushing high-leverage trades, these breakdowns highlight what each platform offers, and where the tradeoffs lie.

1. Platform Overview Table (Quick Glance)

Start with a high-level snapshot of each protocol’s core features, including supported chains, leverage, yield options, and point programs.

| Platform | Max Leverage | Chains | Points Program | Vaults/Yield | Order Book UI |

|---|---|---|---|---|---|

| Hyperliquid | 40x | Hyperliquid L1 | ❌ (Airdrop done) | ✅ HLP (~6% APR) | ✅ Yes |

| ApeX | 100x | Ethereum, Arbitrum, Base, BNB, Mantle | ✅ XP & Social Points | ✅ Insurance Vault (~30.77% APR) | ✅ Yes |

| dYdX | 50x | dYdX Appchain (Cosmos) | ✅ Ongoing incentives | ✅ MegaVault (~18% APR) | ✅ Yes |

| GMX | 50x | Arbitrum, Avalanche, Solana | ❌ (Complete) | ✅ GLV (~26%) | ✅ Yes |

| Drift | 101x | Solana | ❌ (Airdrop done) | ✅ Strategy Vaults (5–10%+) | ❌ No (JIT only) |

| Lighter | Est. 100x | Ethereum zk-rollup | ✅ (points beta) | ✅ LLP Vault (~80%) | ✅ Yes |

| Extended | 50x | Starknet | ✅ (points & leagues) | ✅ Vault (~17%) | ✅ Yes |

| Ostium | 200x | Ethereum L2 | ✅ OP Points | ✅ OLP Vault (6% APR, locked) | ❌ No (recent trades only) |

2. Fee Comparison Table (Standard Trades)

Next, compare standard maker and taker fees across platforms, along with notes on gas costs and reward mechanisms like staking or rebates.

| Platform | Maker Fee | Taker Fee | Gas Fees | Notes |

|---|---|---|---|---|

| Hyperliquid | 0.015% (Tier 0) | 0.045% | ❌ | Tiered fees, reduced via HYPE staking |

| ApeX | 0.02% | 0.05% | ❌ | Often reduced via promotions |

| dYdX | 0.01% → -0.011% | 0.05% → 0.025% | ❌ | Rebates for high-volume traders |

| GMX | Varies | 0.1% flat | ✅ (on-chain) | Fee-sharing via GLP/GM tokens |

| Drift | -0.01% maker | 0.10% → 0.03% taker | ❌ | Reductions via DRIFT staking/volume |

| Lighter | 0% | 0% | ❌ | No fees during beta |

| Extended | 0% | 0.025% | ❌ | Market makers can earn rebates |

| Ostium | 0.03% | 0.10% (crypto) / 0.03–0.15% (TradFi) | ✅ (on-chain) | Per-asset fees + one-click toggle |

3. Security & Transparency Table

Finally, review historical security incidents and protocol transparency – a critical step for traders allocating serious capital or vault deposits.

| Platform | Exploits / Incidents | Transparency Level |

|---|---|---|

| Hyperliquid | ⚠️ $4M loss in HLP vault from memecoin algo trade (not a hack) | ✅ Full on-chain, including order book |

| ApeX | ✅ No known exploits | ✅ On-chain vaults, Bybit-affiliated team |

| dYdX | ❌ Exploit on v3 (Nov 2023, $9M via price manipulation) | ✅ Cosmos-based appchain, open UI |

| GMX | ❌ Oracle manipulation attack in 2022 | ✅ Fully on-chain Arbitrum infra |

| Drift | ✅ No known exploits | ⚠️ JIT liquidity limits visibility |

| Lighter | ✅ No public exploit reports (still early-stage) | ✅ zk order book visible |

| Extended | ✅ No exploit reports | ✅ Starknet-native with full UI |

| Ostium | ✅ No known exploits (early-phase) | ⚠️ Limited trade data, basic vault UI |

The Future of Decentralized Perpetuals

What started with basic perpetual swaps on Ethereum has exploded into a multichain arms race.

Since early 2024, perpetual DEX volumes and derivatives protocol TVL have skyrocketed, making on-chain perps one of the most explosive verticals in all of DeFi. Platforms are now competing not just on features and fees, but through points programs, innovative vault mechanics, and sticky incentive loops.

And this is just the beginning.

As more traders go self-custodial and realize they no longer need to blindly trust some CEX in the headlines with their funds, decentralized alternatives are gaining real ground. You don’t have to wait for a withdrawal freeze or a bankruptcy tweet to learn the lesson – you can trade transparently, directly from your wallet, right now.

Expect more innovation, more performance, and yes – more competition.

New protocols will continue to emerge, often with sharper incentives, better execution, and designs that make full custody the default. The traders who adapt early and stay informed will benefit most.

Final Thoughts & Recommendations

At the moment, Hyperliquid stands as the undisputed king of decentralized perpetual trading platforms. Its dominance isn’t just over DeFi-native competitors – it’s actively eating into the volume share of centralized exchanges. With unmatched liquidity, execution speed, and a sticky ecosystem, Hyperliquid isn’t just ahead – it’s rewriting the rules.

The tokenomics of HYPE are hard to match. As the gas token of its own native L1, HYPE fuels an expanding HyperEVM ecosystem. It’s used for fee discounts, governance, and is subject to buybacks and burns. On top of that, stakers earn yield and unlock deeper fee tiers. It’s no surprise the protocol dropped one of the largest airdrops in DeFi history – and still feels like it’s just getting started.

So what about the competition?

Here’s the playbook: many of the new protocols launching in 2025 are trying to replicate what Hyperliquid built, speed, yield, and incentives – but with their own twist. That’s where the opportunity lies.

If you’re exploring alternative platforms, why not also position yourself for an airdrop?

Protocols like Ostium, Lighter, and Extended Exchange are still early, have active points programs, and no token – yet.

That combination of upside and experimentation makes them the top picks we recommend watching right now.

A Final Reminder:

Not every perp DEX made it into this guide, and that’s intentional. The space is evolving fast, and we’ve focused here on the most credible, active, and rewarding platforms at the time of writing.

But if you’re hungry for more:

- Browse all active perp DEX listings on our Margin Trading hub

- Hunt high-potential airdrops using our DeFi Airdrops tracker

- Don’t miss fee discounts – check our Deals page for the latest offers

- Stay ahead with our free newsletter – alpha, platform updates, and guides, straight to your inbox

Happy trading – and may your profits be strong.