The world of DeFi is complex and ever-changing, making it tough to make well-informed investment decisions. Without reliable data, you’re left guessing, which can cost you dearly in this volatile market. But what if you had the power to see every trend, risk, and opportunity before it’s too late? DeFi analytics platforms are the key to unlocking these insights, empowering you to invest smarter and stay ahead of the game.

Introduction

In the fast-paced world of decentralized finance, data-driven decisions are not just beneficial—they're crucial. With market conditions constantly evolving, DeFi investors need analytics tools to monitor trends, optimize investments, and mitigate risks. Without accurate data, even a well-thought-out strategy can falter. This article dives deep into the best DeFi analytics platforms to keep you ahead of the curve. For those interested in broader on-chain analysis, be sure to check out our guide on top on-chain analysis tools at BitShills.

Ready to unlock smarter DeFi investing? Let’s get started.

What Is DeFi Analytics?

DeFi analytics refers to the comprehensive analysis of data within the decentralized finance ecosystem, enabling investors, developers, and researchers to make informed and strategic decisions. As the DeFi space continues to evolve at lightning speed, understanding and interpreting data is essential for navigating market fluctuations, identifying investment opportunities, and managing potential risks.

The Role of DeFi Analytics

DeFi analytics serves as a critical tool in a market driven by volatility and innovation. With billions of dollars moving through decentralized protocols, relying on guesswork can be costly. Instead, data-driven insights empower users to track emerging trends, optimize yield farming strategies, and assess the overall health of various DeFi projects. This analytical approach has become the foundation for smarter investing and risk management in decentralized finance.

Key Metrics Analyzed in DeFi

- Total Value Locked (TVL): TVL measures the total capital locked within DeFi protocols. It serves as a benchmark for protocol trustworthiness and user interest, with higher TVL generally indicating a more secure and established project.

- Transaction Volumes: Tracking the volume of transactions on DeFi platforms helps gauge the activity level and adoption rate. Spikes in transaction volumes often signal increased interest or significant market events.

- User Activity: Analyzing active user numbers and their behavior provides insights into the community’s engagement and can indicate whether a protocol is gaining or losing traction.

- Yield Farming Returns: These metrics help investors compare potential returns across different yield farming opportunities, optimizing their strategies for maximum profitability.

- Protocol Health: This metric covers aspects like liquidity, smart contract security, and governance. Understanding the health of a protocol can prevent investors from falling victim to vulnerabilities or liquidity crises.

On-Chain vs. Off-Chain Analytics

- On-Chain Data Analytics: This type of analysis pulls data directly from the blockchain, offering real-time visibility into asset movements, wallet activities, and liquidity flows. On-chain analytics is foundational for transparency, allowing investors to validate data without third-party intervention.

- Off-Chain Data Analytics: Off-chain data encompasses market sentiment, social media activity, and centralized exchange data that influences the DeFi market. Though not recorded on the blockchain, this information can shape market trends and impact investment decisions.

Both on-chain and off-chain analytics are crucial for a well-rounded view of the DeFi ecosystem. By understanding the importance of these metrics and data types, investors can gain a strategic edge in an unpredictable market.

Key Benefits of DeFi Analytics Platforms

Decentralized finance (DeFi) is a rapidly evolving and data-driven ecosystem. To navigate this complex landscape effectively, investors and traders need reliable analytics tools. DeFi analytics platforms offer a wealth of benefits, enhancing decision-making, improving risk management, and providing critical market insights. Here's how these tools can transform your investment approach:

1. Improved Decision-Making

DeFi analytics empower investors and traders with data-driven insights, enabling more strategic and informed decisions. By analyzing historical data on token prices, trading volumes, and liquidity trends, you can identify patterns and market signals that reveal investment opportunities. For example, understanding how portfolio allocation affects risk and reward allows you to optimize your holdings. Whether you’re evaluating potential yield farming strategies or choosing which protocol to invest in, DeFi analytics give you the information needed to make decisions with greater confidence.

2. Enhanced Risk Management

The DeFi space is known for its volatility and inherent risks, making effective risk management crucial. Analytics platforms help you assess and mitigate these risks by providing data on transaction volumes, token liquidity, and smart contract vulnerabilities. By monitoring this information, you can gauge the security and reliability of different protocols, identify signs of potential exploits, and avoid projects with high-risk profiles. In essence, these tools offer a way to make calculated decisions, safeguarding your investments against unforeseen market shifts and technical failures.

3. Actionable Market Insights

Staying ahead in the DeFi market requires a deep understanding of trends and user behavior. Analytics tools provide invaluable insights into market dynamics, such as trading volume fluctuations and liquidity shifts. By observing these trends, you can anticipate market movements and adjust your strategy accordingly. Additionally, some platforms use advanced machine learning algorithms to analyze user behavior, offering predictions that can guide your investment approach. Whether you're monitoring whale activity, identifying new DeFi opportunities, or keeping an eye on user engagement, these insights help you remain agile in a fast-paced market.

DeFi analytics platforms are essential for anyone looking to optimize their investment strategies, minimize risks, and gain a competitive edge. By providing comprehensive insights into the performance of different DeFi protocols, user behavior, and market trends, these tools enable you to make informed choices and stay ahead in the ever-evolving world of decentralized finance.

Top DeFi Analytics Platforms and Their Unique Offerings

Navigating the decentralized finance landscape requires powerful tools that can turn complex data into actionable insights. Here’s an in-depth look at the top DeFi analytics platforms and what makes them stand out.

DefiLlama

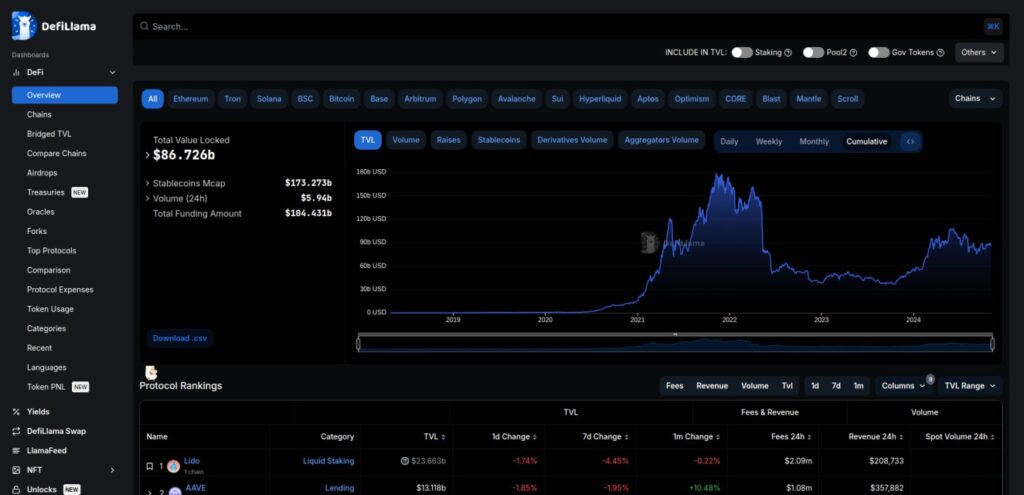

DefiLlama stands as one of the most trusted and comprehensive platforms for tracking Total Value Locked (TVL) across decentralized finance protocols. Acting as the “CoinMarketCap of DeFi,” DefiLlama provides an extensive and transparent, community-driven source of analytics, with all data sourced directly from blockchains.

At its core, DefiLlama offers essential tools for understanding the DeFi landscape, including TVL tracking and historical data, allowing you to analyze the growth and performance of various protocols. It gives you insights into capital distribution across different blockchains, making it easier to identify where the market is moving. Beyond these foundational metrics, DefiLlama covers stablecoin analytics, letting you compare market caps, supply changes, and usage across chains. It also provides in-depth information on DeFi loan liquidations, which is crucial for risk assessment, as well as token unlock schedules that could influence token prices and market behavior.

For those interested in governance and community engagement, DefiLlama tracks governance proposals and statistics, showing how decentralized protocols evolve and make decisions. The platform also offers insights into trading volumes, DeFi fundraising activities (DeFi Raises), and security incidents, like hacks, that have impacted the ecosystem. Additionally, DefiLlama includes specialized data for ETH liquid staking, offering a detailed look at staking metrics and yields.

DefiLlama’s ecosystem expands further with products like DefiLlama Swap, a DEX aggregator ensuring optimal rates for token swaps, LlamaNodes, which provides reliable public and premium RPC endpoints, and LlamaFolio, an open-source portfolio tracker that lets users monitor and visualize their DeFi investments with a focus on privacy.

DefiLlama is your go-to resource for getting a comprehensive overview of what’s happening in DeFi. Whether you’re exploring new Layer 2 networks, yield opportunities, or emerging protocols, this platform is your essential starting point. The wealth of information may feel overwhelming at first, but taking the time to learn how to use DefiLlama effectively can significantly enhance your DeFi research and investment strategy. It’s a one-stop shop for data-driven decisions in a constantly evolving market.

Dune Analytics

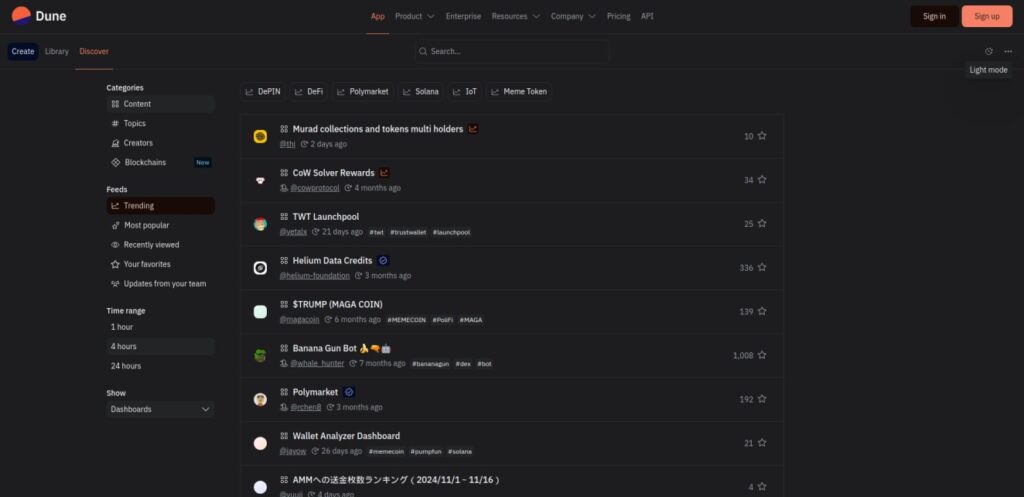

Dune Analytics is a powerful and versatile platform that allows users to create custom data queries using SQL, making it a highly flexible tool for conducting in-depth DeFi research. Widely used by analysts, developers, and data enthusiasts, Dune provides a window into blockchain data that can be tailored to specific needs. This makes it an invaluable resource for extracting meaningful insights and identifying trends within the decentralized finance ecosystem.

Dune’s key strength lies in its ability to empower anyone to build bespoke analytics dashboards based on any metric that exists within blockchain data. This flexibility is unmatched, as it enables users to dive deep into the protocols and metrics that matter most to them. For example, if you are researching a particular DeFi protocol, you will often find multiple community-created dashboards dedicated to it, offering various perspectives and data breakdowns.

A great example of this is the Railgun privacy protocol on Ethereum. By visiting the Railgun DAO dashboard, you can see a detailed, community-created view that includes metrics such as TVL, rewards, transaction volume, treasury growth, and more. Each dashboard is crafted with a unique focus, reflecting the diverse priorities and insights of the Dune community.

In essence, Dune Analytics is the ultimate analysis tool for DeFi enthusiasts. Its ability to adapt to your research needs, combined with the wealth of community-generated content, makes it an essential platform for anyone looking to understand the complexities of DeFi. While the learning curve may be steep for those unfamiliar with SQL, the platform’s flexibility and depth of data make the investment in learning well worth it.

Token Terminal

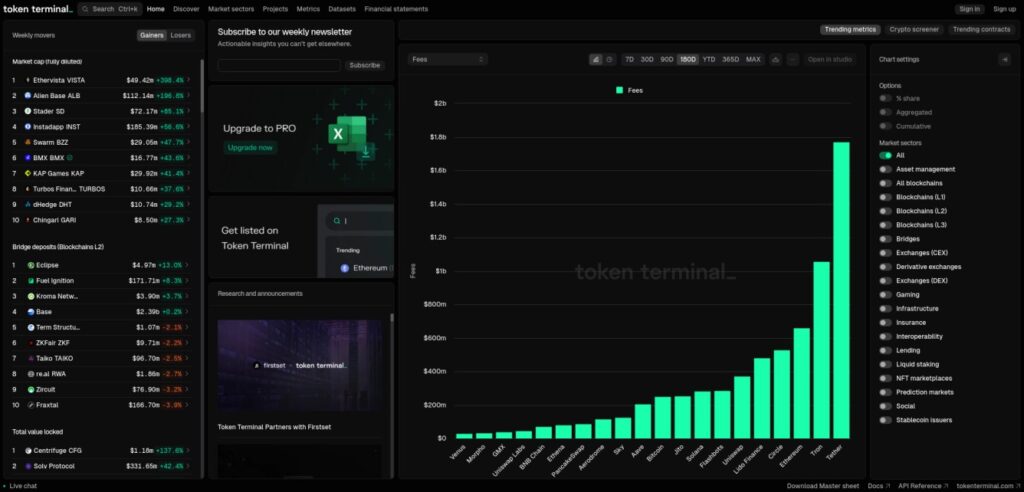

Token Terminalserves as a bridge between traditional finance and decentralized finance by transforming complex blockchain data into familiar financial metrics. Designed for investors who want to assess the economic sustainability and long-term potential of DeFi projects, Token Terminal provides an in-depth look into protocol financials, revenue streams, and market trends. By emphasizing financial fundamentals, it makes DeFi analysis accessible to those used to traditional market evaluations.

With Token Terminal, users have access to a range of features that simplify the analysis of DeFi ecosystems. The Discover tab offers detailed dashboards for each DeFi project, displaying key metrics such as Total Value Locked (TVL), trading volumes, and active user counts. Depending on the type of protocol or project you’re exploring—whether it’s a decentralized exchange, lending protocol, or yield aggregator—you’ll find relevant data tailored to that specific category. This feature makes it easy to conduct a deep dive into the performance and growth of individual DeFi protocols.

The Market Sectors tab provides a broader view of the DeFi landscape, allowing you to evaluate and compare entire sectors within the ecosystem. For example, you can compare Layer 1 blockchains, assess the lending markets as a whole, analyze derivative DEXes, or even look at NFT marketplaces. By selecting specific metrics, such as revenue or user activity, you can effectively analyze and compare different projects within these sectors, gaining insights into the health and competitiveness of various market segments.

One of Token Terminal’s standout features is the ability to access financial statements for DeFi projects. This gives a more traditional, finance-oriented perspective on what is happening on-chain. Users can review income statements, balance sheets, and cash flow summaries to understand how protocols are monetizing their services and whether their financial models are viable. This financial transparency enables investors to make data-driven decisions with a level of rigor often found in traditional finance.

Overall, Token Terminal is ideal for investors looking to understand the financial underpinnings of DeFi projects. Whether you’re comparing protocols, analyzing sector-wide trends, or reviewing detailed financial statements, Token Terminal provides the tools needed to make informed, long-term investment decisions. It’s a comprehensive resource for evaluating the economic dynamics of the DeFi space, ensuring that investors have a solid foundation for navigating this rapidly evolving market.

Artemis Terminal

Artemis is a comprehensive analytics platform designed to deliver deep insights across the entire DeFi ecosystem. Unlike platforms that limit their focus to individual networks or specific projects, Artemis provides powerful data aggregation and cross-chain analytics, making it an essential tool for strategic investors seeking a holistic view of decentralized finance.

A standout feature of Artemis is the Artemis Terminal, which allows users to explore and compare metrics for a wide range of blockchains, projects, and sectors. Whether you want to analyze stablecoins, lending protocols, decentralized exchanges, or other DeFi categories, Artemis has you covered. The Terminal provides detailed information on key metrics, such as transaction volumes, supply, active addresses, Total Value Locked (TVL), and much more. This level of analysis helps investors and analysts understand both the individual performance of projects and the broader dynamics of different sectors.

In addition to project-specific data, Artemis excels at cross-chain analytics, enabling users to track liquidity inflows and outflows between blockchains. This feature helps investors identify capital movements and emerging trends across the DeFi landscape. Artemis also offers insights into developer activity, allowing users to see which blockchains are experiencing significant development efforts, a key indicator of an ecosystem's growth potential.

Another valuable feature is the ability to download data directly to Google Sheets. This makes it easy to conduct custom analyses, create personalized reports, or integrate Artemis data into existing financial models for more in-depth research.

Whether you're comparing various blockchains, assessing the financial health of DeFi projects, or analyzing trends across different sectors, Artemis provides a versatile and powerful suite of tools to make informed investment decisions. With comprehensive coverage and easy data export options, Artemis empowers you to stay ahead in the ever-evolving DeFi landscape.

Nansen

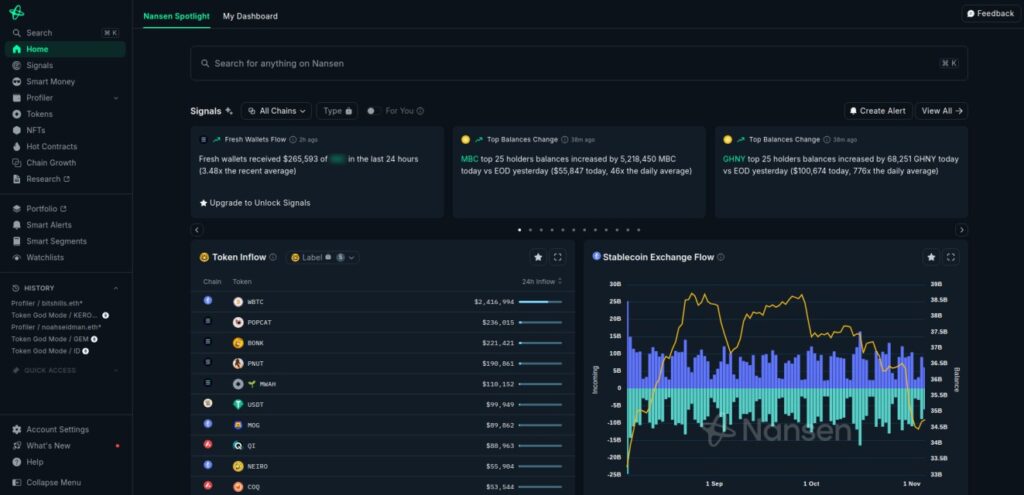

Nansen is a premier on-chain analytics platform that provides unparalleled insights into the world of DeFi. Known for its sophisticated wallet labeling and smart money tracking capabilities, Nansen empowers traders and investors to make data-driven decisions by analyzing the behavior of major players in the market. Its detailed dashboards and extensive labeling system make it a favorite tool among professional traders and institutional investors looking to gain a competitive edge.

Nansen allows you to dive into any specific Ethereum or Solana address, presenting a comprehensive dashboard with in-depth information. Users can access the portfolio breakdown, historical data, trading summaries, token balances, and transaction activity, with metrics available on both hourly and daily scales. The platform also reveals related wallets and counterparties, mapping out whom the address interacts with and which tokens are exchanged. It even tracks NFTs and provides details on profits and losses, giving a complete view of on-chain behavior.

Subscribing to Nansen unlocks even more advanced features. With over 300 million wallet labels, the platform categorizes addresses into groups like “smart money,” enabling you to quickly identify influential traders and entities. This labeling system helps users see exactly who a particular wallet belongs to and what their strategies are. You can view trade highlights, analyze their largest wins and losses, check their win rate, and study trade performance in both realized and unrealized gains. For traders, this is an invaluable resource for monitoring where the most successful players are putting their money.

Moreover, subscribers can personalize their data feeds, tailoring the information to their specific trading or investment needs. This customization ensures that users stay updated on the most relevant and impactful market movements.

Nansen is particularly useful for anyone interested in trading on-chain or keeping track of DeFi market trends. The platform provides a front-row seat to the actions of smart money players, allowing you to learn from their strategies and better navigate the complex DeFi landscape. Whether you’re looking to follow whale movements, analyze successful traders, or uncover emerging market trends, Nansen delivers the data and tools needed to stay ahead.

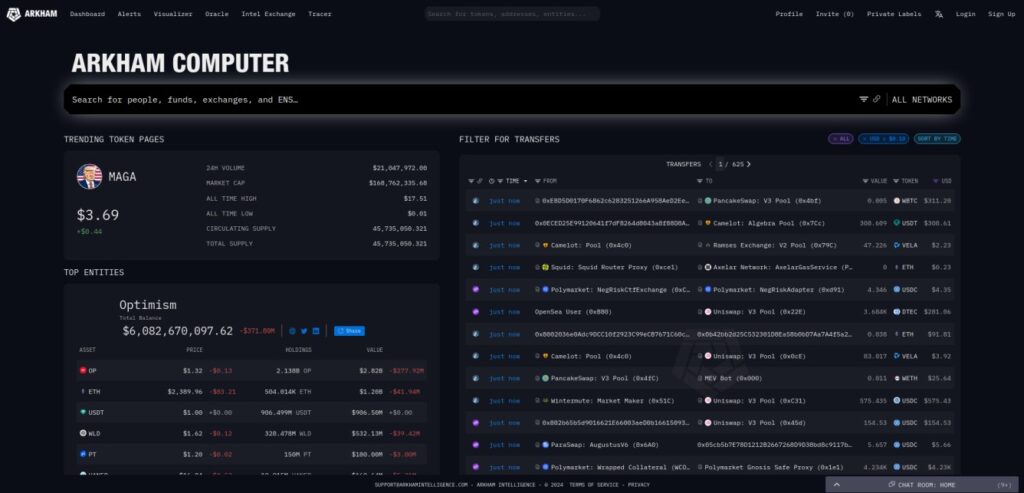

Arkham Intelligence

Arkham Intelligence stands out as a unique on-chain analytics platform known for its investigative approach to blockchain data. It addresses the challenge of blockchain transparency versus data complexity by offering a powerful suite of tools that allow users to dig deep into transaction information and uncover the hidden narratives within blockchains. By transforming raw blockchain data into actionable intelligence, Arkham makes it easier for both casual users and institutions to trace fund flows and monitor security issues.

One of the most compelling features of Arkham is its ability to deanonymize blockchain transactions. It provides users with tools to identify and visualize the movement of funds, making transparent blockchains even more accessible and understandable. For instance, using Arkham’s platform, you can analyze holdings like those of the Royal Government of Bhutan’s investment entity, Druk Holding & Investments. By examining their deposits, withdrawals, and overall fund flows, Arkham enables users to create visualized dashboards that trace how money moves through the blockchain. This is invaluable for uncovering the activities of significant entities or tracking high-stakes investments.

Arkham also allows users to set up custom alerts, notifying them of specific activities related to chosen blockchain addresses. Additionally, the platform features an Intel Exchange, a unique marketplace where users can request detailed information about blockchain addresses or entities for a fee. This adds another layer of utility for those who require targeted insights into blockchain transactions, be it for security, compliance, or investigative purposes.

Unique Value

What sets Arkham apart is its emphasis on making blockchain data both accessible and actionable. By enabling users to deanonymize and visualize complex fund flows, the platform helps reveal the often-hidden stories within blockchain networks. For investors, developers, and institutions focused on security and transparency, Arkham offers a crucial layer of protection and insight, transforming opaque data into comprehensible intelligence.

Arkham Intelligence ultimately serves as a vital tool for those who want to harness the power of blockchain transparency, making it possible to uncover the secrets of decentralized finance and beyond.

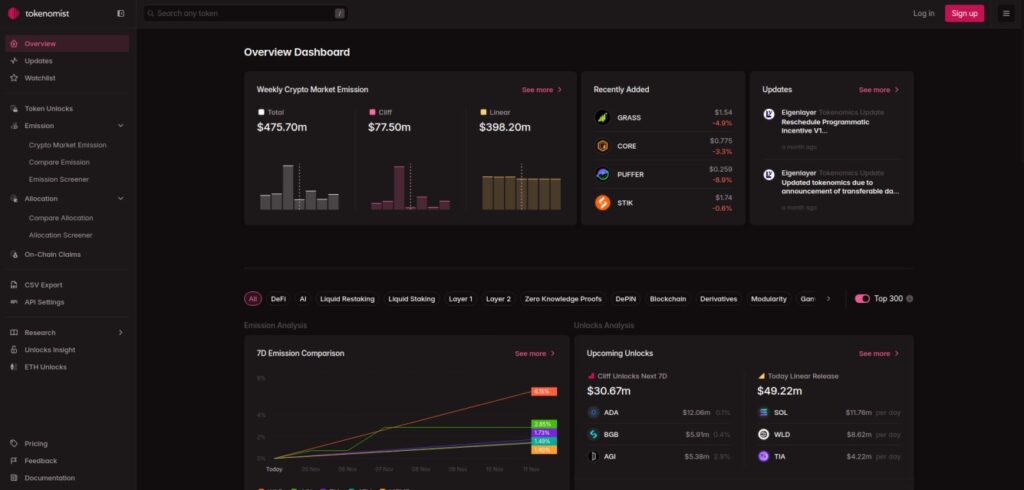

Tokenomist

Tokenomist is a specialized analytics platform that focuses on the intricacies of tokenomics and economic modeling within the DeFi ecosystem. Understanding tokenomics is crucial for evaluating the long-term sustainability and value potential of any DeFi project, and Tokenomist provides the in-depth data needed to make these assessments. By offering insights into token distribution, emission schedules, and economic sustainability, Tokenomist is an essential tool for investors and analysts aiming to dig deeper into the mechanics of DeFi protocols.

A key feature of Tokenomist is its detailed tracking of Token Unlocks and Emission Schedules. For anyone researching or evaluating new projects, understanding the flow of tokens into the market is critical. Tokenomist provides comprehensive data on when tokens are set to be released, how they are allocated, and the potential impact of these emissions on token supply and price dynamics. This is especially important when analyzing projects with complex tokenomics, where factors like inflation, locked tokens, and scheduled unlocks can significantly affect market behavior. By giving users visibility into these details, Tokenomist enables a deeper understanding of how a project’s tokenomics might influence its economic health and investment potential.

By using Tokenomist, you gain a critical edge in understanding how token flows and economic models shape the viability of DeFi protocols. In a market where tokenomics can make or break a project’s future, having access to this level of detail is invaluable.

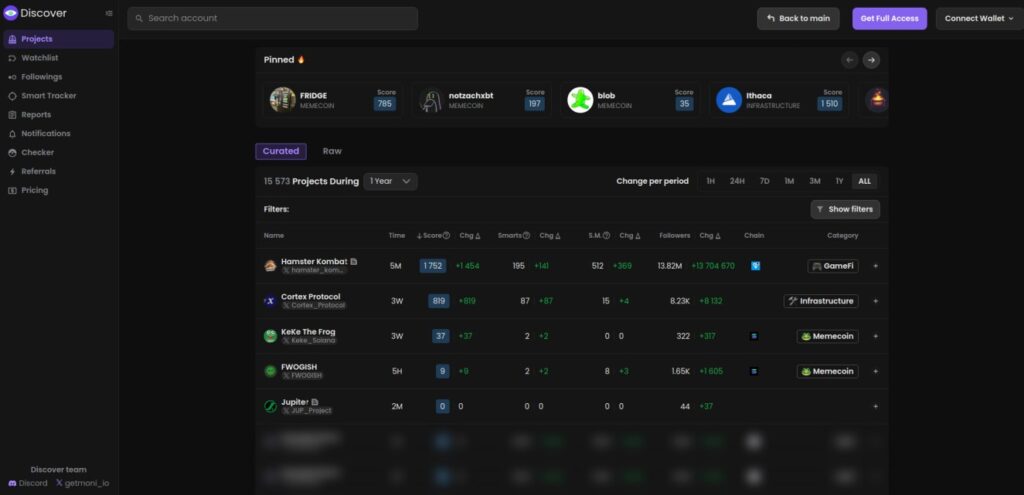

Moni

Moni is a Web3 social analytics platform that offers a unique approach to cryptocurrency analysis by focusing on off-chain data, particularly from social media platforms like Twitter. This focus makes it especially valuable for users aiming to identify emerging trends and projects early in their development.

A standout feature of Moni is its ability to provide detailed insights into the activities of influencers and projects on Twitter. The platform assigns scores to both influencers and projects, allowing users to gauge their credibility and impact within the crypto community. It offers comprehensive statistics, including metrics like smart followers, smart mentions, total followers, and total mentions. Additionally, Moni categorizes entities with labels such as VC/fund members, project members, DAO/group members, influencers, and projects, facilitating a nuanced understanding of the social dynamics at play.

For projects gaining traction, Moni provides labels indicating their specific categories, enabling users to search and filter projects based on these classifications. This functionality is particularly beneficial for alpha hunters, smart investors, and teams seeking a social-based edge in the market. By leveraging off-chain data, Moni empowers users to make informed decisions by understanding the social sentiment and engagement surrounding various crypto projects.

To access the full suite of features offered by Moni, a subscription is required. This investment grants users comprehensive access to the platform's analytics tools, enhancing their ability to stay ahead in the rapidly evolving crypto landscape.

In summary, Moni distinguishes itself from other analytics platforms by emphasizing off-chain social data, providing users with valuable insights into the social dynamics influencing the crypto market. Its focus on Twitter analytics, influencer tracking, and project categorization makes it an indispensable tool for those looking to discover hidden trends and gain a competitive edge in the cryptocurrency space.

This section provides an overview of each platform's strengths and use cases. Whether you need in-depth financial metrics, risk assessment tools, or smart money tracking, there’s a DeFi analytics platform that fits your investment strategy.

For readers interested in exploring even more analytics platforms, DeFiShills offers an extensive list of resources covering a wide range of tools. Be sure to visit DeFiShills Analytics Resources to discover additional platforms and expand your toolkit for smarter investment decisions.

How to Use DeFi Analytics for Smarter Investment Decisions

DeFi analytics platforms provide a wealth of data, but the key to investment success lies in knowing how to use this data effectively. Here’s how you can leverage these insights to make more informed and profitable decisions.

1. Identifying High-Yield Opportunities

Yield farming can be highly profitable but comes with significant risks. DeFi analytics tools like DefiLlama and Token Terminal enable you to compare APRs across protocols and discover opportunities that maximize your returns. By analyzing metrics such as Total Value Locked (TVL) and the rate of capital inflow, you can identify where liquidity is being deployed most profitably. Use these insights to strategically allocate your assets, focusing on pools and farms with the best risk-to-reward ratios.

2. Monitoring Market Sentiment

Market sentiment can greatly influence DeFi token prices and protocol activity. Platforms like Nansen and Arkham Intelligence track wallet activity and large transactions to provide real-time insights into market behavior. By monitoring the actions of “smart money” or prominent investors, you can gauge whether the sentiment is bullish or bearish. Additionally, tracking social media mentions and trading volumes through off-chain analytics can help you make timely decisions, whether that means entering a new position or protecting your assets from market downturns.

3. Assessing Protocol Health

Understanding the stability and security of a DeFi protocol is crucial for effective risk management. DeFi analytics platforms offer features that reveal potential red flags, such as declining liquidity, smart contract vulnerabilities, or concerning governance activity. Tools like Tokenomist provide detailed insights into tokenomics and emission schedules, helping you evaluate the economic sustainability and overall structure of a project. Platforms like DeFiLlama track key metrics, such as liquidity depth and TVL changes, giving you a broader perspective on the protocol’s health. Before committing significant capital, consider factors like audit histories, community engagement, and the protocol's ability to withstand market fluctuations to ensure your investment is secure.

4. Analyzing Token Performance

Not all DeFi tokens are created equal, and understanding which ones have growth potential is essential. To make well-rounded investment decisions, platforms like Tokenomist offer comprehensive tokenomics data, including details on token distribution and unlock schedules. Analyze key metrics like token flow, whale activity, and overall market cap trends to gauge a token’s adoption and potential risks of price manipulation. Combining this data with insights into the project’s roadmap, team credibility, and community support can help you identify promising investment opportunities while being mindful of underlying risks.

5. Portfolio Diversification Strategies

Effective portfolio diversification can reduce risk while maximizing returns. Tools like DeBank and Zapper help you monitor your entire DeFi portfolio, showing how your assets are distributed across different protocols and risk levels. Use this data to balance your investments, ensuring that you are not overexposed to a single asset or strategy. For example, consider allocating a portion of your funds to stablecoin yield farms for lower risk while keeping a smaller percentage in higher-risk, high-yield opportunities. DeFi analytics can also highlight correlations between assets, helping you further refine your diversification strategy.

To explore more top portfolio trackers that can enhance your investment management, check out our guide at DeFiShills: Top DeFi Portfolio Trackers.

By utilizing these strategies, you can transform raw DeFi data into actionable investment plans. Whether you’re a seasoned investor or a newcomer to DeFi, analytics platforms are your best ally for staying informed, mitigating risks, and seizing high-yield opportunities.

Tips for Choosing the Right DeFi Analytics Tool

Selecting the right DeFi analytics tool can make a significant difference in your investment strategy and risk management. Here are some key considerations to keep in mind when evaluating which platform suits your needs.

Assess Your Needs

Start by identifying your specific requirements and goals within the DeFi ecosystem. Are you a beginner looking for simple, user-friendly dashboards, or do you need advanced analytics with custom queries and in-depth financial metrics? For those new to DeFi, platforms like DeBank or DeFiLlama may offer enough insights to track investments and understand the basics. However, more experienced investors and developers might benefit from the customizable features of Dune Analytics or the in-depth financial reports of Token Terminal. Make sure the tool you choose aligns with your expertise and investment strategy.

Evaluate the Cost vs. Benefit

Many DeFi analytics platforms come with both free and premium versions. While free tools can be highly useful, premium plans often offer more comprehensive data and advanced features like wallet tracking, risk analysis, and custom reports. Consider the value these paid features provide relative to their cost. If you’re a casual investor, free or lower-cost tools may be sufficient. However, if you’re managing a substantial DeFi portfolio or need high-level insights, investing in a premium plan from a platform like Nansen could be worthwhile. Always weigh the potential benefits against the expense to determine the best value for your use case.

Choosing the right DeFi analytics tool is about finding a balance between usability, cost-effectiveness, and the depth of data you need. By carefully evaluating your needs, the cost-benefit ratio, and integration capabilities, you’ll be better equipped to make informed investment decisions and manage your DeFi portfolio with confidence.

Conclusion

In the fast-paced world of decentralized finance, staying informed is the key to success. DeFi analytics platforms empower you with the data needed to make strategic investment decisions, monitor risks, and seize new opportunities as they arise. As the DeFi ecosystem continues to evolve, experimenting with different tools and finding the ones that best suit your investment strategies is essential. Remember, the right data at the right time can make all the difference.

For more insights and resources on DeFi tools and strategies, be sure to visit the rest of our resources. Your journey to smarter investing starts here!

FAQs (Frequently Asked Questions)

What is DeFi analytics?

DeFi analytics refers to the comprehensive analysis of data within the decentralized finance space, enabling investors to make informed decisions based on market trends, protocol health, and other key metrics.

What are the key benefits of using DeFi analytics platforms?

The key benefits include improved decision-making through data-driven insights, enhanced risk management due to better understanding of market volatility, and actionable market insights that help investors stay ahead in the competitive DeFi landscape.

What is Total Value Locked (TVL) and why is it important?

Total Value Locked (TVL) measures the total capital locked in a DeFi protocol. It is an essential metric as it indicates the overall health and popularity of a platform, reflecting investor confidence and potential liquidity.

How can I use DeFi analytics for smarter investment decisions?

You can utilize DeFi analytics to identify high-yield opportunities, monitor market sentiment, assess protocol health, analyze token performance, and develop effective portfolio diversification strategies.

What should I consider when choosing a DeFi analytics tool?

When selecting a DeFi analytics tool, assess your specific needs and goals, evaluate the cost versus benefit of different platforms, and consider factors such as usability, data coverage, and unique features offered by each tool.

Can you name some top DeFi analytics platforms?

Some of the top DeFi analytics platforms include DefiLlama for comprehensive data, Dune Analytics for versatility, Token Terminal for bridging traditional finance with DeFi, Nansen for premier on-chain analysis, Arkham Intelligence for blockchain transparency, and Moni for social analytics in Web3.