NFTs have revolutionized asset ownership, but their illiquidity limits holders who need quick funds. This dilemma keeps valuable digital assets locked, pushing NFT holders to either sell or forgo potential capital. NFT lending offers a solution: unlocking liquidity while retaining ownership. With protocols like NFTfi and JPEG'd, lenders and borrowers can now navigate a new financial landscape, accessing cash without parting with prized assets.

Introduction to NFTs as Financial Assets in DeFi

NFTs have rapidly evolved from unique digital collectibles to robust financial assets within decentralized finance (DeFi). Originally, NFTs were primarily valued for their scarcity and appeal as digital art or in-game assets. However, the growth of DeFi has enabled a new financial use for NFTs: borrowing and lending against them. Through DeFi platforms, NFT holders can now use their assets as collateral to secure loans, unlocking liquidity without needing to sell the NFTs.

This intersection of DeFi and NFTs represents a major shift in the utility of NFTs, transforming them into financial instruments. Platforms like Gondi, Arcade, and JPEG'd lead the way in this innovation, each offering unique mechanisms for staking NFTs and accessing funds. With these platforms, users retain ownership of their NFTs while leveraging them as collateral, allowing digital assets to serve functional financial purposes beyond traditional marketplaces.

How NFT Collateralization Works in DeFi

NFT collateralization allows holders to leverage the value of their digital assets without selling them. This process enables users to secure liquidity, usually in the form of stablecoins or other cryptocurrencies, by staking their NFTs as loan collateral. Here’s a comprehensive look at the steps and models involved in NFT collateralization within DeFi:

The Collateralization Process

1. Selecting an NFT Lending Platform

- NFT holders begin by selecting a lending platform that supports NFT-backed loans, with options such as Gondi, Arcade, NFTfi, and JPEG’d. Each platform offers a unique loan structure tailored to different asset types and borrower requirements.

2. Staking the NFT as Collateral

- Once a platform is selected, the NFT is staked as collateral by transferring ownership temporarily into a smart contract or escrow account on the platform. This setup allows the lender or platform to retain the NFT until the loan is fully repaid.

- The smart contract safeguards both parties by ensuring that, in the event of default, the protocol or lender can claim the NFT, thereby mitigating lender risk.

3. Loan Terms and LTV Ratio

- Platforms like NFTfi, Gondi, Arcade, and Teller offer structured, fixed-term loans. Here, NFT holders specify loan duration, loan amount, interest rate, and other repayment terms. These fixed loans provide clarity and stability for both borrowers and lenders.

- The loan-to-value (LTV) ratio is also set, determining how much liquidity the borrower can access relative to the appraised value of the NFT. High-value NFTs (e.g., blue-chip collections) often yield higher LTV ratios, maximizing loan potential while balancing risk.

4. Collateralized Debt Positions on JPEG’d

- Unlike traditional lending structures, JPEG’d introduces a unique model where users can create a collateralized non-fungible debt position. This structure allows borrowers to mint stablecoins or assets such as pUSD or pETH against their NFTs.

- Borrowers can then use these newly minted tokens within the DeFi ecosystem, participating in yield farming, liquidity pools, or other financial applications, which effectively extends the utility of NFTs in DeFi beyond static loans.

5. Receiving the Loan in Stablecoins or Cryptocurrency

- Once collateralized, the borrower receives the agreed-upon loan amount in a stablecoin (such as USDT or DAI) or a cryptocurrency. This liquidity can be used directly within the DeFi ecosystem for further investment, asset diversification, or any other financial need, giving borrowers flexibility in managing their assets.

6. Repayment and Asset Retrieval

- If the borrower repays the loan with interest by the end of the loan term, they regain full ownership of the NFT, with the asset being released from escrow back to their wallet.

- If the borrower defaults, the protocol or lender claims the NFT as compensation. Depending on the platform, the NFT may be retained as an investment or sold on the open market. This risk-managed approach ensures that lenders can recover the loan’s value through the NFT.

NFT collateralization within DeFi is a powerful financial tool, offering NFT holders a way to retain their assets while accessing liquidity. By leveraging structured loans, collateralized debt positions, and fixed terms, platforms like Gondi, Arcade, NFTfi, and JPEG’d are shaping a new landscape for NFTs in decentralized finance. This expanding utility transforms NFTs from static assets into versatile financial instruments, integrating them into the broader DeFi ecosystem.

Popular DeFi Platforms for NFT Collateralization

NFT collateralization in DeFi has grown rapidly, with various platforms offering distinct features for NFT-backed loans. Here’s a look at some of the most popular DeFi platforms for NFT collateralization:

1. Gondi: A Flexible and Capital-Efficient NFT Lending Protocol

Gondi is a decentralized, non-custodial NFT lending protocol that emphasizes flexibility and capital efficiency, making it ideal for users looking to unlock liquidity from their NFTs in a peer-to-peer structure. Through Gondi, borrowers and lenders negotiate terms directly, creating a highly customizable experience where borrowers can select their desired loan conditions, including interest rate and repayment terms, while lenders can control risk exposure. Interest is calculated on a pro-rata basis, meaning borrowers only pay for the loan duration they actually use, offering cost-effective and adaptable options for managing loans.

Gondi also introduces “Tranche Seniority,” allowing lenders to prioritize loans based on custom risk parameters, and collection-wide offers, where lenders can target an entire NFT collection. These features provide additional control and broaden opportunities for capital allocation, making Gondi an efficient tool for lenders looking to diversify investments across multiple NFTs or collections.

Setting itself apart, Gondi avoids forced liquidations triggered by sudden market fluctuations. Instead, borrowers retain the ability to sell collateral to repay the loan, and any value above the loan amount remains with the borrower, providing a more stable and borrower-friendly approach. Combined with low gas fees, instant loan refinancing, and ease of use, Gondi is a versatile and accessible option for those interested in NFT-backed loans.

2. Arcade: A High-Value NFT Collateralization Platform with Advanced Collateral Options

Arcade is a decentralized lending platform tailored for high-value NFT collateralization, providing unique features designed to meet the needs of sophisticated investors and NFT holders with premium assets. Arcade’s peer-to-peer structure supports multi-asset collateralization, allowing users to bundle several NFTs into a single loan, maximizing borrowing potential for collectors with high-value items like rare digital art and blue-chip collectibles. This multi-collateral feature is especially beneficial for borrowers seeking to aggregate the value of multiple assets for a larger loan.

As a decentralized peer-to-peer marketplace, Arcade offers an open environment where lenders and borrowers can negotiate loan terms directly, creating a flexible lending experience. Lenders can make offers on specific NFTs or even entire collections, which reduces time spent waiting for matches and allows for efficient capital allocation. Additionally, borrowers benefit from options for loan extensions, partial repayments, and refinancing, making the platform a highly customizable lending environment.

Arcade places a strong emphasis on security and risk mitigation, incorporating Ethereum-based smart contracts and NFT vaults to safeguard assets throughout the loan period. These features, combined with a rigorous auditing process, provide a high level of trust and protection for users handling valuable digital assets. With its advanced collateral options, robust lending marketplace, and strict security measures, Arcade.xyz stands out as a comprehensive solution for those seeking reliable and flexible options for high-value NFT collateralization in the DeFi ecosystem.

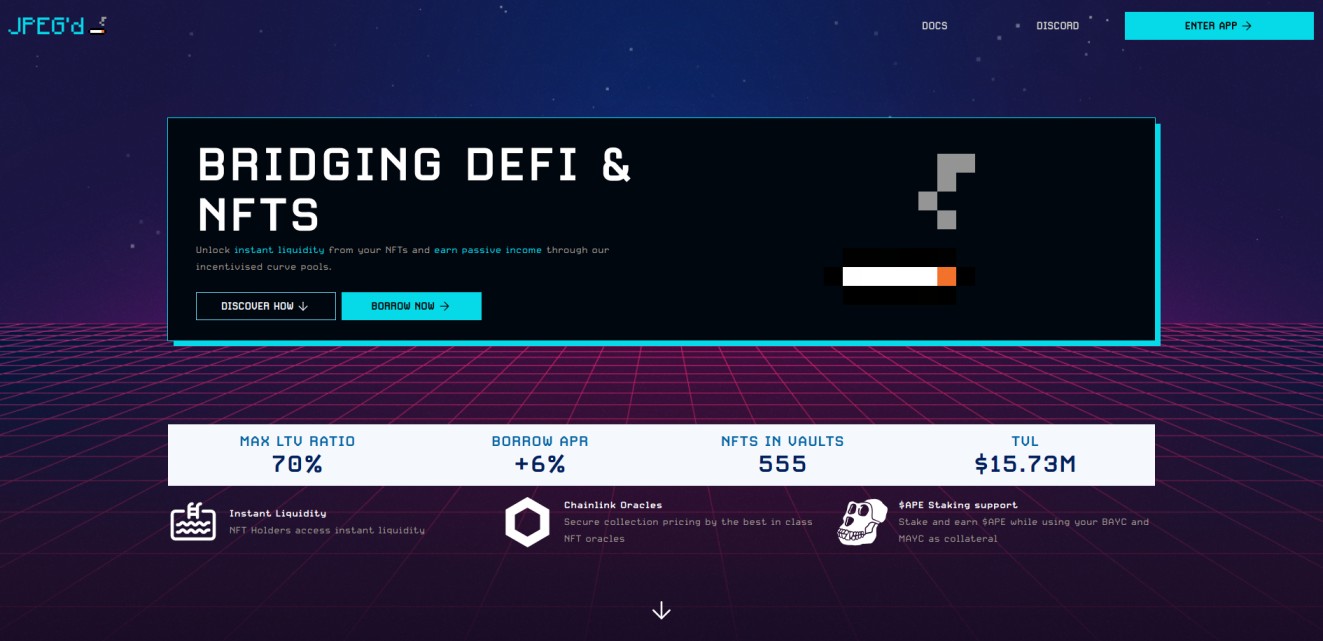

3. JPEG'd: A Comprehensive NFT Collateralization Platform

JPEG’d is a decentralized protocol that enables NFT holders to access liquidity by collateralizing their digital assets through a peer-to-protocol model. Unlike traditional lending, JPEG’d allows users to leverage NFTs as collateral without the need for direct borrower-lender matching. Instead, NFT holders can create a collateralized debt position (CDP) on the platform, minting synthetic tokens such as pETH (a synthetic Ethereum token) or PUSd (a stablecoin) at a loan-to-value (LTV) ratio of up to 70%, with enhanced rates for NFTs with rare traits.

Beyond its core lending function, JPEG’d includes liquidation insurance to safeguard against NFT price volatility, using Chainlink oracles to ensure accurate pricing. This insurance adds an extra layer of security, particularly for high-value assets prone to rapid price changes. Additionally, borrowers can use their minted tokens in DeFi pools, generating yield on their loans and expanding the utility of NFTs beyond traditional holding.

Governed by the $JPEG token, JPEG’d is a fully decentralized platform that empowers token holders to shape the protocol through governance decisions, keeping platform development in the hands of its community. By combining NFT collateralization, liquidation safeguards, and integrated yield opportunities, JPEG’d transforms NFTs into versatile financial assets within the DeFi landscape.

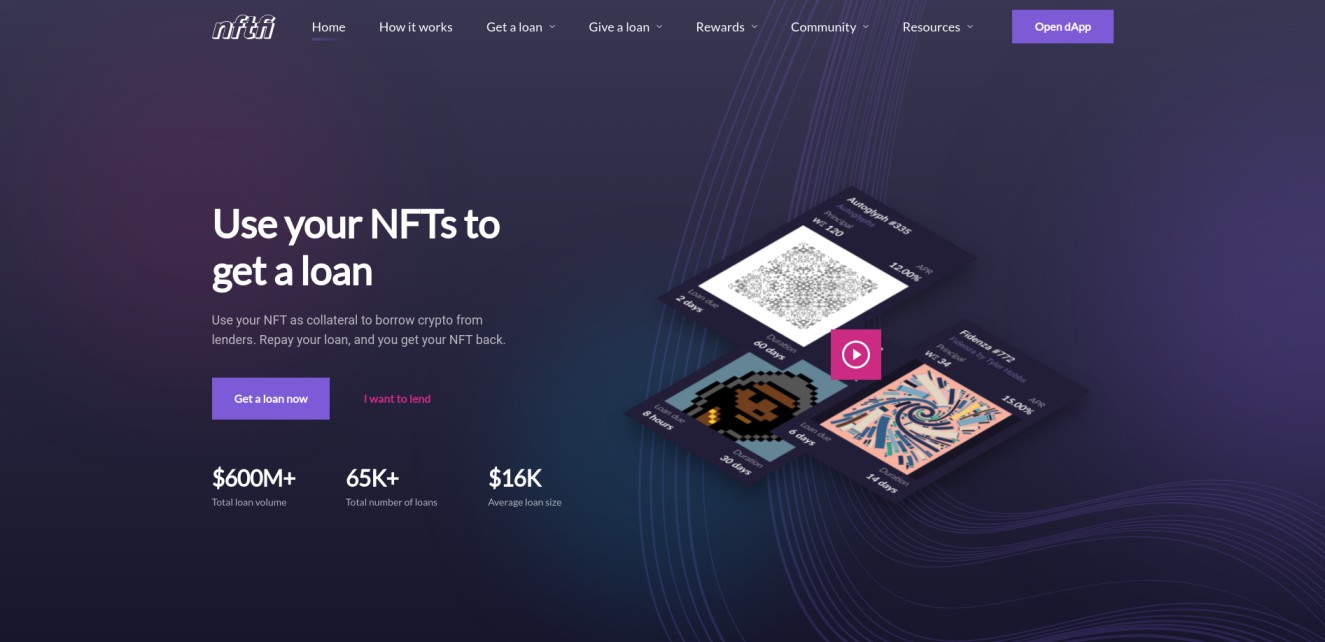

4. NFTfi: A Flexible Peer-to-Peer NFT Lending Platform

NFTfi is a decentralized, peer-to-peer lending platform that enables NFT holders to unlock liquidity by using their digital assets as collateral for loans. Unlike traditional loan structures, NFTfi operates as a marketplace where lenders and borrowers can negotiate terms directly, allowing for flexible loan arrangements that meet varied financial needs. Borrowers can select loans with fixed terms and rates tailored to their preferences, while lenders set conditions based on their risk tolerance and yield goals.

One of NFTfi’s standout features is its support for loan bundling, which allows users to collateralize multiple NFTs within a single loan. This multi-asset option increases the loan amount while reducing reliance on a single NFT’s value. Additionally, lenders have the option to make collection-wide offers, enabling them to target an entire NFT collection, which optimizes capital allocation and expands investment opportunities across high-demand assets.

NFTfi also provides unique flexibility with its renegotiation feature, allowing borrowers to adjust loan terms mid-loan. Coupled with a non-custodial model that ensures users retain full control of their NFTs until a default, NFTfi maintains a secure and user-centric environment. Supporting Wrapped Ethereum (wETH), USD Coin (USDC), and Dai (DAI) as loan currencies, the platform offers versatility in loan agreements, positioning NFTfi as a dynamic tool for both borrowers and lenders in the NFT financial ecosystem.

5. Teller: A Decentralized Protocol for Flexible, Time-Based Loans

Teller is a non-custodial lending protocol that supports a broad range of digital assets, including NFTs, as collateral for fixed-duration, time-based loans. Operating on Ethereum, Arbitrum, Polygon, and Base, Teller allows borrowers to leverage any crypto asset without the risk of price-based liquidation for the loan’s duration. This structure makes Teller distinct from other DeFi lending platforms by eliminating margin call liquidations and allowing borrowers to secure predictable loans backed by NFTs, ERC20 tokens, or ERC1155 tokens.

In Teller’s system, lenders or liquidity providers have the flexibility to set loan terms through open offers or custom requests. They define parameters such as collateral type, loan duration, and yield, creating an order book of deterministic lending options. Borrowers can either choose from existing offers that meet their criteria or submit a custom loan request that can be funded by a lender. This model supports over-collateralized, under-collateralized, or no-collateral loans, offering diverse options to suit varying borrower needs.

Default procedures on Teller focus on collateral seizure rather than price-triggered liquidation, meaning collateral assets are only forfeited if a borrower fails to meet scheduled repayments or complete the loan term. Through this approach, Teller mitigates the volatility risks associated with typical NFT and crypto loans, prioritizing loan stability and lending customization within the DeFi ecosystem.

Each of these platforms provides a distinct approach to NFT collateralization, catering to diverse borrower needs—from instant liquidity pools to high-value asset loans and integration with DeFi. Together, they exemplify how NFTs are expanding beyond collectibles to become functional, financial assets in the DeFi ecosystem.

Benefits of Borrowing Against NFTs

Borrowing against NFTs opens up a range of financial possibilities for holders, allowing them to leverage their digital assets without giving up ownership. Here’s a closer look at the primary benefits:

1. Liquidity Access Without Selling

- By using NFTs as collateral, holders can access cash while retaining ownership of their assets, which is especially valuable for high-value collectibles or rare items. This approach is ideal for NFT owners who believe in the long-term appreciation of their assets and prefer not to sell in volatile markets. NFT-backed loans allow users to manage short-term financial needs without compromising on the potential long-term value of their NFTs, creating a flexible, low-risk method to unlock value temporarily.

2. Earning Yield on Locked NFTs

- Borrowing against NFTs allows users to generate income from assets that might otherwise sit idle. By collateralizing NFTs, holders can earn yield on their locked assets, providing an additional income stream while keeping the assets intact. Furthermore, users can reinvest borrowed stablecoins or crypto assets in yield-generating opportunities within the DeFi ecosystem, such as liquidity pools or yield farms, effectively doubling their earning potential with returns from both the locked NFTs and the invested funds.

3. Expanding Utility for NFTs

- As NFTs become integrated into DeFi, they evolve from static collectibles into versatile financial tools. NFTs now serve not only as unique digital assets but also as functional assets within the financial system, expanding their utility and applications. By using NFTs as collateral, holders can leverage these assets in innovative ways, interacting with decentralized financial structures and enhancing the overall versatility of their digital portfolios.

NFT collateralization within DeFi broadens the possibilities for holders, providing them with liquidity, yield potential, and a new way to enhance the utility of their digital assets. As NFTs continue to integrate with DeFi, their role as functional financial assets is likely to expand, offering even more ways to benefit holders without requiring sales.

Types of NFTs Commonly Used as Collateral

When using NFTs as collateral, certain types of NFTs are better suited due to their high value, liquidity, and recognition within the crypto ecosystem. Here’s a look at the most commonly used types of NFTs for collateralization:

1. Art and Collectibles

- High-value, highly liquid NFTs like CryptoPunks and Bored Ape Yacht Club are frequently used as collateral due to their strong market presence and established value. These collectibles are among the most liquid assets in the NFT space, making them attractive options for borrowers and lenders alike.

2. Game Assets

- Virtual land and assets from popular blockchain-based games such as Decentraland and The Sandbox are also commonly used as collateral. These gaming NFTs hold intrinsic utility within their respective virtual worlds and maintain strong demand due to their in-game applications and resale value.

3. DeFi-Native NFTs

- Utility-driven NFTs like ENS (Ethereum Name Service) names are also gaining traction as collateral. These digital assets, which can represent unique Ethereum addresses or domain names, are increasingly used in lending protocols like Teller, where they are accepted as collateral due to their growing functionality within the Ethereum ecosystem.

By categorizing NFTs based on their value, utility, and demand, these types offer flexibility and reliability in collateralized lending, allowing borrowers to access liquidity while holding onto valuable digital assets across art, gaming, and finance.

Risks and Mitigation Strategies in NFT Collateralization

Using NFTs as collateral in DeFi offers significant financial advantages but also introduces risks that differ for borrowers and lenders. Here’s an overview of the primary risks each party faces and the strategies available to mitigate them effectively.

For Borrowers

1. Volatility and Liquidation Risk

- Risk: NFT values are subject to market fluctuations driven by demand, rarity, and trends. Sudden drops in value can lead to liquidation if the collateral no longer covers the loan.

- Mitigation: Borrowers can protect against this by maintaining a low loan-to-value (LTV) ratio, which provides a buffer during price volatility. If the collateral value declines, borrowers can often add more collateral or repay part of the loan to avoid liquidation. Choosing platforms that allow multi-NFT collateralization also helps stabilize the loan by spreading risk across several assets.

2. Smart Contract Security

- Risk: The decentralized nature of NFT lending relies heavily on smart contracts, which, if improperly coded, can be vulnerable to exploits or hacks, posing risks for borrowers’ assets.

- Mitigation: Borrowers should select platforms with robust smart contract audits and strong security protocols. Opting for reputable platforms that partner with third-party security firms ensures greater protection and reliability for the assets held as collateral.

For Lenders

Liquidity Challenges

- Risk: Unlike cryptocurrencies, NFTs often lack immediate liquidity. In cases of borrower default, selling collateralized NFTs might be challenging, especially for niche or lower-demand assets, potentially resulting in financial losses.

- Mitigation: Lenders can reduce this risk by prioritizing highly liquid, well-known assets like top-tier collectibles or virtual land. Some platforms also support collection-wide offers and multi-asset collateralization, which provides exposure across multiple assets, reducing the impact of any single NFT’s liquidity limitations.

By understanding these risks and actively engaging in mitigation strategies, borrowers and lenders can navigate NFT-backed loans with greater confidence. As the NFT lending ecosystem matures, these practices contribute to a safer and more reliable DeFi environment for both parties.

Conclusion

NFT collateralization is transforming NFTs from static collectibles into functional financial assets with real utility in the DeFi ecosystem. By leveraging NFTs as collateral, holders can unlock liquidity, earn yield, and diversify their portfolios without sacrificing ownership. This innovative approach not only expands the financial potential of NFTs but also broadens the applications for DeFi, bridging digital ownership with flexible financial options.

NFT collateralization offers an exciting new avenue for liquidity and utility, allowing NFT holders to maximize the value of their digital assets. As platforms continue to evolve and introduce new risk mitigation measures, NFT-backed loans are likely to become an integral part of the DeFi landscape, unlocking further possibilities for digital asset holders across the crypto space.

FAQs (Frequently Asked Questions)

What are NFTs and how do they function as financial assets in DeFi?

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of specific items or content on the blockchain. In the context of DeFi (Decentralized Finance), NFTs have evolved beyond simple collectibles to become valuable financial assets that can be used for collateralization, enabling holders to access liquidity without selling their digital assets.

How does NFT collateralization work in DeFi?

NFT collateralization allows NFT holders to leverage the value of their digital assets by using them as collateral to secure loans. This process typically involves selecting a lending platform, where users can deposit their NFTs and receive funds in return while retaining ownership of the NFTs.

What are some popular platforms for NFT collateralization?

Several platforms have emerged for NFT collateralization, including Gondi, Arcade, JPEG'd, NFTfi, and Teller. Each platform offers unique features such as flexible lending options, advanced collateral choices, and peer-to-peer lending capabilities tailored specifically for NFTs.

What are the benefits of borrowing against NFTs?

Borrowing against NFTs provides various financial advantages including access to liquidity without the need to sell assets, the ability to earn yield on locked NFTs through interest payments, and expanding the utility of NFTs within the broader DeFi ecosystem.

What types of NFTs are commonly used as collateral?

Common types of NFTs used as collateral include high-value art and collectibles like CryptoPunks and Bored Ape Yacht Club items, game assets from popular blockchain games, and utility-driven NFTs such as ENS (Ethereum Name Service) names which have inherent functional value.

What risks are associated with NFT collateralization?

NFT collateralization carries risks including volatility and liquidation risk due to fluctuating NFT values. For lenders, liquidity challenges arise since NFTs are often less liquid than cryptocurrencies. It is essential for both borrowers and lenders to understand these risks and implement mitigation strategies when engaging in NFT lending.