What is Silo Finance?

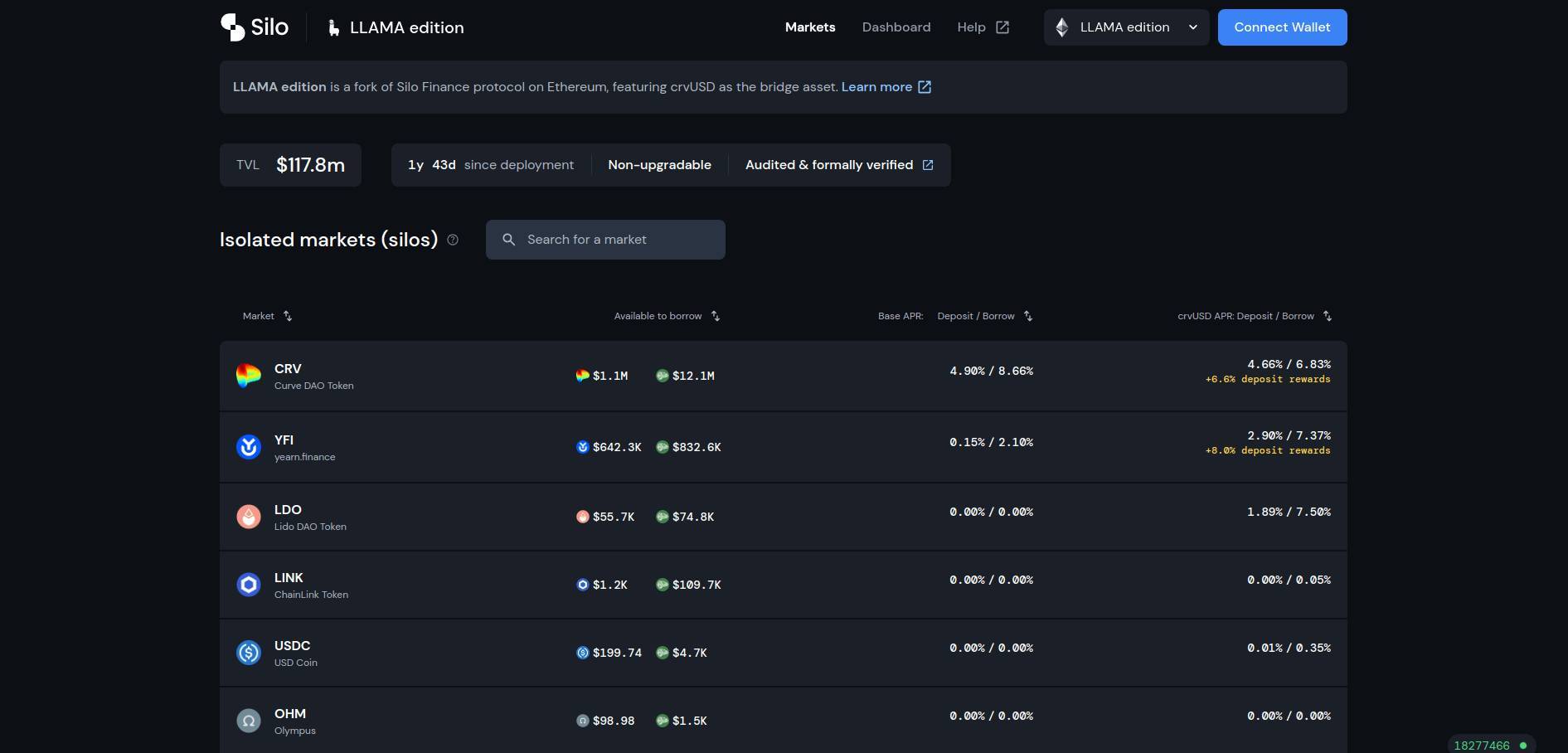

Silo Finance is a decentralized, non-custodial lending protocol designed to offer secure, efficient, and permissionless money markets for all crypto assets. Unlike traditional shared-pool platforms, Silo operates with isolated risk by creating individual lending markets (or “Silos”) for each base asset. This means that the risk associated with one asset does not affect others, providing a safer lending environment.

Each Silo comprises two assets: a unique token and a bridge asset (e.g., ETH). This structure allows any token to be used as collateral to borrow another, ensuring liquidity is concentrated and efficient. The protocol supports dynamic interest rates that adjust based on utilization, optimizing the balance between liquidity and yield.

Silo's permissionless nature means any user can create a market for any token, fostering inclusivity and broadening access to DeFi lending services. The platform employs robust security measures, including smart contract audits and a bug bounty program, to ensure the safety and reliability of its operations.

Governance of the Silo protocol is managed by the Silo DAO, where token holders can participate in decision-making processes. This decentralized approach ensures the community has a significant role in shaping the protocol's future.