Managing a diverse DeFi portfolio can be overwhelming, with assets scattered across multiple platforms and protocols. Missing out on critical updates or mismanaging investments can lead to unnecessary losses and missed opportunities. Fortunately, DeFi portfolio trackers simplify this chaos by offering a centralized and efficient way to monitor and optimize your investments. Discover how the best trackers can transform your DeFi experience and ensure you never lose sight of your financial goals.

Introduction

Decentralized Finance (DeFi) has revolutionized the financial world by offering a trustless and permissionless ecosystem where users can lend, borrow, trade, and earn yield without intermediaries. As DeFi continues to grow and diversify, effectively managing investments across various platforms has become increasingly crucial. With rapid market movements and numerous protocols to track, staying organized is vital to avoid missed opportunities or unplanned losses. This article serves as your ultimate guide to the best DeFi portfolio trackers, helping you optimize and simplify your investment journey.

Understanding DeFi Portfolio Trackers

DeFi portfolio trackers are digital tools designed to help investors monitor and manage their decentralized finance investments seamlessly. These trackers aggregate data from multiple DeFi platforms, providing users with a comprehensive overview of their holdings, including assets, yields, and market trends.

Using a portfolio tracker offers several benefits: real-time insights into asset performance, streamlined analysis for informed decision-making, and enhanced risk management to mitigate potential losses. When choosing the right tracker, key features to consider include robust security measures, compatibility with various blockchains and platforms, an intuitive user interface, affordability, and additional tools like tax reporting and analytics.

Top DeFi Portfolio Trackers in 2024

Effectively managing a diverse DeFi portfolio requires reliable tools that offer comprehensive insights and seamless integration. Below are detailed reviews of leading DeFi portfolio trackers in 2024:

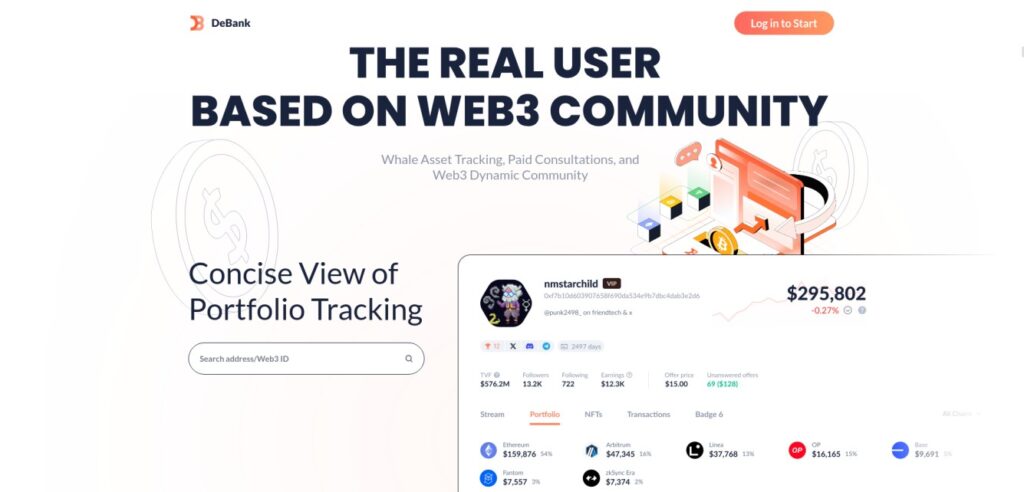

1. DeBank

DeBank stands out as one of the most comprehensive and versatile DeFi portfolio trackers available today. It is also the creator of Rabby Wallet, a highly secure and advanced DeFi extension wallet, making the two products seamlessly integrated for users seeking enhanced security and functionality.

DeBank boasts the highest DeFi coverage in the market, allowing users to view transactions, track their complete portfolio across multiple blockchains, and monitor DeFi dApps. One of its standout features is the ability to bundle multiple accounts together, enabling users to view combined portfolios effortlessly. Additionally, DeBank offers social features that elevate it beyond a traditional portfolio tracker: users can follow and engage with top Web3 accounts, post and comment on content, and grow their followers while climbing the Web3 leaderboard.

DeBank is essentially free to use, with paid features designed for advanced analysis rather than essential portfolio management. Premium features include:

- Time Machine: Compare asset changes between any two dates for detailed historical analysis.

- Transaction History Analysis Mode: Analyze transaction data like a pro for any address.

- Follow up to 3,000 Users: Extend your ability to track and follow influential Web3 accounts.

- “Change View” of Portfolio: View 24-hour asset changes of any address in real-time.

- “Summary View” of Portfolio: Access a summarized view of asset changes for any address.

- Set Non-NFT Avatar: Customize your profile with any picture as an avatar.

- Set Cover Picture for Profile Page: Personalize your profile page with a custom cover image.

- Follow up to 300 Official Accounts: Expand your ability to follow more official accounts.

These advanced tools make DeBank a community-driven platform for both portfolio tracking and engaging with the broader Web3 ecosystem.

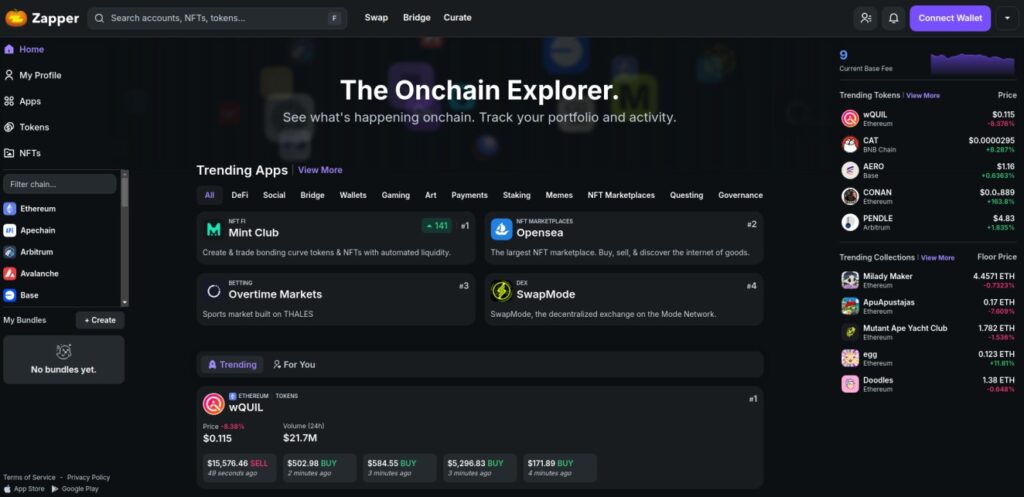

2. Zapper

Zapper is a high-coverage DeFi dashboard designed to simplify asset management by aggregating multiple protocols into one intuitive interface. Users can track investments, execute transactions, and explore new DeFi opportunities seamlessly, without the need to switch between various platforms. The platform offers extensive support for a wide range of DeFi protocols and features yield farming, liquidity provision, and token swaps.

One of Zapper's standout features is its exceptional ability to track claimable yields from DeFi protocols. Users can bundle multiple wallets into a single portfolio, making it easy to monitor all holdings simultaneously. Additionally, Zapper's on-chain explorer lets users discover trending dApps across various categories and stay updated on popular NFT collections.

Zapper also enables users to customize their experience by creating personalized feeds based on accounts and protocols they follow. This feature fosters a more tailored and efficient way to keep up with DeFi trends.

Another impressive capability of Zapper is the option to manually add DeFi positions within the app, ensuring complete portfolio visibility even if a specific protocol is not natively supported. Furthermore, Zapper provides quick access to essential DeFi tools like token swapping and bridging across different networks, enhancing the convenience of managing decentralized finance investments in one place.

3. CoinStats

CoinStats offers robust coverage for tracking essential DeFi activities, including wallet balances, DeFi positions, claimable yields, and NFTs. Users can easily view detailed information on transactions associated with their wallets, bundle up to 10 portfolios for streamlined tracking, and explore new, trending DeFi opportunities. The platform’s user-friendly interface ensures that all critical aspects of DeFi portfolio management are within easy reach.

Where CoinStats truly shines is in deeper wallet and portfolio analysis. Users can access tools for evaluating asset allocation and assessing portfolio health, which includes a unique Health Score and a detailed breakdown of assets and associated risks. Additional features such as portfolio performance tracking, wallet analysis, visual heatmaps, and a summary of fees paid enhance the user experience and provide critical insights for effective portfolio management.

However, many of these advanced features require a subscription to unlock their full potential, making the premium version ideal for those who need more in-depth analytics and comprehensive tracking.

4. Zerion

Zerion is a versatile crypto wallet and DeFi portfolio tracker that supports both DeFi and NFT assets, allowing users to browse and manage their digital holdings across multiple networks with ease. The platform seamlessly integrates with Zerion’s own DeFi wallet extension, providing a cohesive and efficient experience for managing all aspects of decentralized finance.

Zerion offers a full suite of features for tracking wallet balances, DeFi positions, and NFTs. One of its standout features is the ability to visualize transactions on a chart, showing exactly where you’ve bought, sold, or actively managed specific tokens and coins, along with the average cost displayed directly to the user. This visual representation adds significant clarity to your investment history.

Additional premium features include advanced Profit and Loss calculations, making it easier to assess overall portfolio performance. The built-in Explore tab highlights new opportunities, while integrated swapping functionality ensures that users can execute transactions effortlessly from the dashboard. While Zerion provides all major features needed for effective portfolio tracking at no cost, premium options are available for those who wish to perform deeper analysis, download CSV files, or unlock other advanced tools and perks.

This combination of a user-friendly interface and powerful features makes Zerion an excellent choice for investors looking to interact seamlessly with the decentralized web.

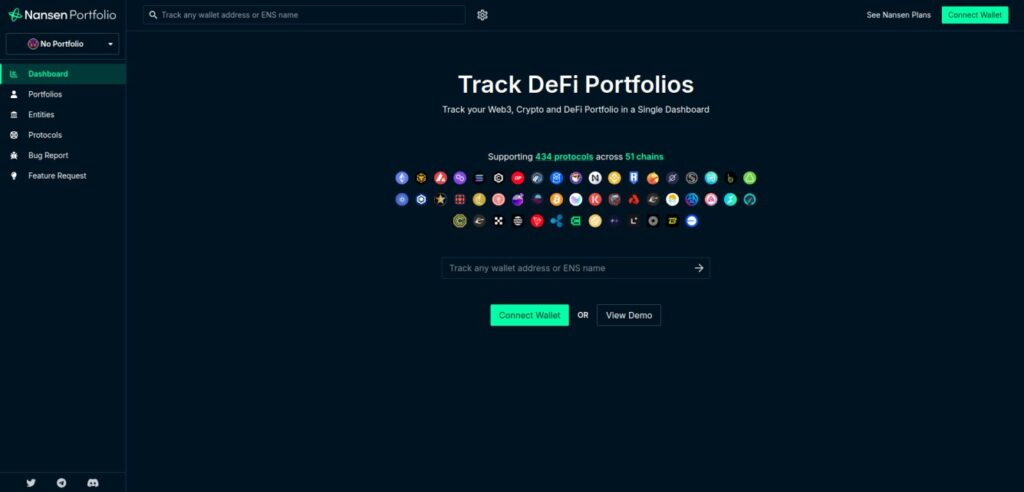

5. Nansen Portfolio

Nansen Portfolio offers advanced analytics and unparalleled insights into DeFi investments, seamlessly integrating with Nansen’s powerful on-chain analytics tool. This unique combination sets Nansen apart from other portfolio trackers, making it an essential platform for those looking to gain a deeper understanding of on-chain activities.

With Nansen Portfolio, users can connect their wallets to access real-time data on their assets, monitor performance, and explore new investment opportunities with ease. What makes Nansen truly exceptional is its ability to provide a bird’s-eye view of everything happening on-chain. The platform features labeled addresses and smart wallet insights, allowing users to see detailed activity across the blockchain ecosystem.

Users can query data to discover what smart wallets are buying or selling, track NFT collections, observe token movements, and gain critical insights into market trends. This powerful integration means that users not only manage their portfolio effectively but also have access to rich, data-driven insights that give them a competitive edge.

While Nansen Portfolio features are free to use, the more advanced on-chain analytics and data querying capabilities require a subscription. These premium features are well-suited for both individual investors and institutions that need comprehensive and actionable intelligence to navigate the DeFi landscape.

6. De.Fi

De.Fi is a unique DeFi portfolio tracker and dashboard that offers a comprehensive overview of decentralized finance assets across multiple blockchains. It provides standard features such as wallet tracking, monitoring DeFi positions, and real-time analytics. Users can connect their wallets to easily track and manage investments across various DeFi protocols.

What sets De.Fi apart is its strong focus on wallet security and risk management. The platform evaluates the health of users' wallets, assigning risk scores and identifying potential vulnerabilities. It highlights risky contract approvals, allowing users to revoke permissions and enhance the security of their assets. Additionally, De.Fi offers detailed analytics of holdings and other DeFi projects, complete with risk assessments to help users make informed decisions.

While general portfolio tracking features are free, De.Fi also offers a Pro subscription for those who want to unlock additional advanced tools. These include:

- Custom Security Alerts: Receive personalized notifications about potential threats to your wallet.

- Full Transaction History: Access a complete log of all transactions.

- Advanced Bundles: Manage multiple wallets with enhanced bundling capabilities.

- Personalized Explore Yield: Discover tailored yield farming opportunities.

- Transaction Special Filters: Apply filters for a more refined transaction analysis.

- Download Transactions: Export data as CSV or PDF for record-keeping and analysis.

De.Fi’s unique focus on risk management and security makes it an excellent choice for DeFi users who prioritize protecting their assets while efficiently managing their portfolios.

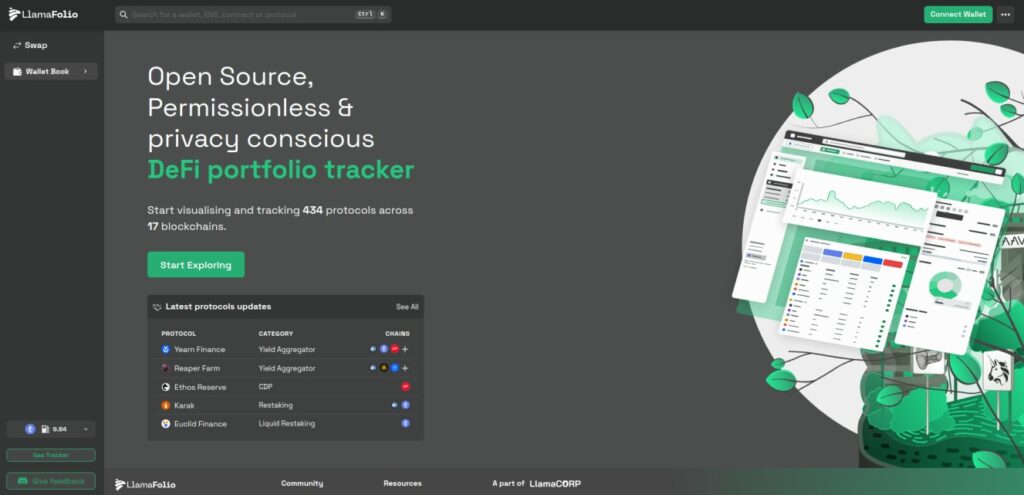

7. LlamaFolio

LlamaFolio is an open-source, permissionless, and privacy-conscious DeFi portfolio tracker, developed as part of the LlamaCorp product suite. While still under active development, it already offers a robust set of features for DeFi enthusiasts. Users can visualize and track their assets across 434 protocols on 17 different blockchains, all while maintaining a strong emphasis on privacy and security.

LlamaFolio covers all the essential DeFi tracking activities, making it easy for users to monitor wallet balances, DeFi positions, and transaction histories. One unique feature is the integrated calendar, which allows users to stay on top of governance proposals and other important events in protocols they are involved with. This ensures they remain engaged and up-to-date with the decentralized ecosystem.

Additional perks include the ability to quickly view current gas prices and a convenient history of past transactions. Users can also execute token swaps directly from the platform, making LlamaFolio a one-stop solution for managing DeFi investments efficiently.

These platforms offer a range of features tailored to different investment needs, enabling users to effectively manage and optimize their DeFi portfolios in 2024.

Comparative Analysis

To help you choose the best DeFi portfolio tracker for your needs, we’ve put together a detailed comparative analysis focusing on key functionalities and cost considerations. This analysis highlights the differences between free and premium features, making it easier to identify which platform aligns best with your investment strategy.

Feature Comparison Table

| Tracker | Supported Blockchains | Real-Time Tracking | NFT Support | DeFi Protocol Coverage | Additional Tools |

| DeBank | 112+ | Yes | Yes | Extensive (Top Tier) | Web3 Social Community, Rabby Wallet |

| Zapper | 25+ | Yes | Yes | Extensive (Top Tier) | Yield farming, swaps, transaction history |

| CoinStats | 10+ | Yes | Yes | Broad (Second Tier) | Tax reporting, alerts, bundling portfolios |

| Zerion | 41+ | Yes | Yes | Broad (Second Tier) | Token swaps, staking, transaction charts |

| Nansen Portfolio | 51+ | Yes | Yes | Moderate (Third Tier) | Institution-grade insights, smart wallet tracking |

| De.Fi | 32+ | Yes | Yes | Moderate (Third Tier) | Security dashboard, risk scores, analytics |

| LlamaFolio | 17 | Yes | Yes | Developing (Fourth Tier) | Privacy-focused features, governance alerts |

Cost-Benefit Analysis: Free vs. Premium Versions

- DeBank: Portfolio tracking is completely free to use. Additional premium features focus on Web3 social community enhancements and do not impact core portfolio management functionalities.

- Zapper: Entirely free to use, with no premium features or plans for monetization. All essential portfolio tracking and DeFi tools are available at no cost.

- CoinStats: Offers both free and premium versions. The premium plan is ideal for users seeking advanced analytics and additional portfolio management tools.

- Zerion: Free for most features. Premium options may be added in the future to provide deeper portfolio analysis, such as advanced Profit and Loss calculations and data export capabilities.

- Nansen Portfolio: Provides free basic features, but advanced on-chain analytics and insights require a premium subscription, appealing to professional and data-driven investors.

- De.Fi: Core portfolio tracking features are free. The Pro subscription unlocks enhanced security alerts, advanced tracking tools, and options to export data.

- LlamaFolio: Completely free and open-source, emphasizing user privacy and simplicity without any cost.

This analysis offers a clear comparison of each platform's cost structure and key features, helping you determine which DeFi portfolio tracker aligns best with your investment strategy and needs.

How to Choose the Right DeFi Portfolio Tracker

Selecting the ideal DeFi portfolio tracker requires a clear understanding of your investment strategy and specific needs. Here’s a comprehensive guide to help you make the best choice:

1. Assess Your Personal Investment Needs and Goals

- Consider whether you require a simple tracker for monitoring basic assets or a comprehensive tool for yield farming, NFT tracking, and advanced analytics. For those heavily involved in yield farming, DeBank and Zapper are standout choices. DeBank offers extensive protocol coverage and a Web3 ranking system, making it excellent for discovering new opportunities. Zapper, on the other hand, shines in its ability to import and manage custom positions, providing flexibility for tracking specific investments.

- If your focus is more on trading DeFi tokens, meme coins, or engaging in general DeFi projects, platforms like Nansen or CoinStats may be better suited. Nansen offers advanced on-chain analytics, ideal for professional investors, while CoinStats provides a feature-rich experience, especially for tracking diverse crypto assets.

2. Explore Additional Features

- Look for added functionalities that can simplify investment management. These may include yield tracking, risk assessment tools, and alerts for market movements. Some platforms, like CoinStats, offer bundling of portfolios and in-depth analytics, while Nansen provides detailed insights into on-chain activity. If you require features like CSV exports, profit and loss calculations, or personalized security alerts, consider platforms with these premium offerings.

3. Test and Experiment

- Ultimately, the choice of a DeFi portfolio tracker depends on individual needs. Evaluate whether your focus is on yield farming, trading DeFi tokens, managing NFTs, or simply monitoring wallet balances. Fortunately, most platforms allow you to either connect your wallet or input your wallet address and get started immediately. Testing multiple trackers can help you determine which one best suits your investment strategy.

By taking these factors into account, you can select a DeFi portfolio tracker that aligns with your financial goals, provides a secure environment, and enhances your overall investment experience.

How to Use DeFi Portfolio Trackers Effectively

Effectively managing your DeFi portfolio goes beyond simply tracking assets. By using DeFi portfolio trackers strategically, you can optimize your financial management and enhance your decision-making. Here’s how to get the most out of these powerful tools:

1. Get to Know Your DeFi Dashboard

- Start by exploring the full range of features your chosen DeFi portfolio tracker offers. Many dashboards have hidden features and settings you might not notice at first glance. Take the time to properly set it up, especially if you have multiple wallet addresses you use regularly. Bundle your portfolios for easier tracking and customize alerts to stay on top of asset performance and market opportunities. Configuring your dashboard for optimal visibility will ensure you’re making the most of your tracker.

2. Expand Beyond Portfolio Tracking

- While these trackers are excellent for monitoring your DeFi investments, they shouldn’t be your only tools. Effective portfolio management involves much more than watching over your assets. Get familiar with additional DeFi analytics platforms that can provide deeper insights into market trends and on-chain data. For a comprehensive list, check our resources on Analytics. Combining these analytics tools with your portfolio tracker can elevate your investment strategy.

3. Use Charting Tools for Market Analysis

- Understanding price movements and trends is crucial for making informed decisions. Subscribing to a dedicated charting service like TradingView can be incredibly beneficial. Alternatively, you can use free platforms like Dexscreener or GeckoTerminal for detailed token charts and market analysis. Integrating these resources into your routine will give you a more holistic view of your investments.

4. Prioritize Wallet Security

- Basic wallet security practices are essential to protect your assets. If you haven’t done so already, invest in a hardware wallet to add an extra layer of protection. Make it a habit to regularly revoke transaction permissions, especially when dealing with new or untested DeFi protocols. Many DeFi portfolio trackers, such as De.Fi, offer built-in tools for revoking approvals, making it easy to manage security risks.

5. Stay Informed and Follow Influential Traders

- Staying updated with the latest developments in DeFi is crucial for making timely investment decisions. Use Web3 social features like those offered by DeBank to follow influential DeFi traders and gain insights from their activities. Engaging with the DeFi community can provide valuable knowledge and keep you ahead of the curve. Additionally, many portfolio trackers aggregate news and market updates, which can help you quickly adapt to changes in the DeFi landscape.

Remember, successful portfolio management involves a combination of proper setup, security practices, staying informed, and using complementary tools to gain a comprehensive view of the DeFi market.

Conclusion

Effective portfolio tracking is crucial in the dynamic and fast-paced world of DeFi. It ensures you stay informed, make strategic decisions, and manage risks efficiently. By leveraging the tools discussed in this guide, you can optimize your investment management and maximize your returns. Each portfolio tracker offers unique features, so choose the one that aligns best with your goals and preferences. We’d love to hear your experiences and insights—feel free to share how you track your DeFi investments and any tips you’ve found valuable!

FAQs (Frequently Asked Questions)

What are DeFi portfolio trackers?

DeFi portfolio trackers are digital tools designed to help individuals manage and monitor their decentralized finance investments. They provide insights into asset performance, portfolio diversification, and overall financial health in the DeFi space.

What are some of the top DeFi portfolio trackers in 2024?

Some of the top DeFi portfolio trackers in 2024 include DeBank, Zapper, CoinStats, Zerion, Nansen Portfolio, De.Fi, and LlamaFolio. Each of these platforms offers unique features to assist users in effectively managing their crypto investments.

How do I choose the right DeFi portfolio tracker?

Selecting the ideal DeFi portfolio tracker requires evaluating your specific needs such as supported blockchains, real-time tracking capabilities, NFT support, and whether you prefer a free or premium version. Consider what features are most important for your investment strategy.

Are there free options available for DeFi portfolio tracking?

Yes, many DeFi portfolio trackers offer free versions with essential features. For instance, DeBank provides comprehensive portfolio tracking at no cost. However, premium versions may offer advanced analytics and additional functionalities.

What should I consider when using a DeFi portfolio tracker effectively?

To use a DeFi portfolio tracker effectively, regularly update your asset information, utilize the analytical tools provided to assess your investment performance, and ensure you are diversifying your holdings based on market trends and personal investment goals.

Why is effective portfolio tracking important in DeFi?

Effective portfolio tracking is crucial in the dynamic and fast-paced world of decentralized finance. It allows investors to make informed decisions based on real-time data, enhances risk management strategies, and helps optimize returns on their crypto investments.