Introduction

Tracking token prices is essential for DeFi investors navigating the unpredictable and fast-moving crypto market. Without the right tools, it’s easy to miss key opportunities or make costly mistakes. Real-time data, multi-chain support, and in-depth analytics are crucial for analyzing tokens—whether you're tracking meme coins, DeFi projects, or technical patterns. Fortunately, advanced token price tracking platforms provide these capabilities, helping investors perform research, conduct technical analysis, and stay ahead in the DeFi ecosystem. In this guide, we’ll explore the best platforms to optimize your research and make smarter decisions.

Key Features to Look for in a Token Price Tracking Platform

Choosing the right token price tracking platform is essential for effective research and technical analysis in the fast-paced DeFi ecosystem. Different tools excel at different tasks, whether you’re looking for a quick overview of token prices or detailed insights for deeper analysis. Here are the key features to consider:

- Real-Time Price Updates and Accuracy

- For tracking price movements across thousands of tokens, platforms like CoinGecko and CoinMarketCap provide up-to-the-second data. This ensures you stay informed about market trends and act quickly on opportunities.

- Multi-Chain Support

- As DeFi spans multiple blockchains, a platform with extensive chain compatibility—covering Ethereum, Binance Smart Chain, Solana, and more—is critical. Tools like DexScreener and GeckoTerminal excel in multi-chain tracking for a deeper dive into specific token ecosystems.

- Liquidity and Trading Volume Insights

- Understanding liquidity and trading volume is essential for assessing token health and potential risks. Platforms like DexTools, DexScreener, and GeckoTerminal provide these insights, making them ideal for traders analyzing decentralized exchanges.

- User-Friendly Interface and Mobile Accessibility

- For quick checks and daily use, a clean and intuitive interface matters. CoinGecko and CoinMarketCap are excellent starting points, offering simple navigation, while tools like TradingView cater to advanced users with customizable features.

This guide will help you identify the right platform based on whether you need a high-level overview of token markets or advanced tools for technical analysis. By understanding these features, you can confidently navigate the dynamic DeFi landscape.

Top Token Price Tracking Platforms

In the rapidly evolving DeFi ecosystem, token price tracking platforms are indispensable for investors who need both high-level overviews and granular technical insights. Whether you’re researching new tokens, monitoring meme coins, or conducting detailed technical analysis of DeFi projects, these platforms provide the tools necessary to stay informed and make smarter investment decisions.

Below, we’ll explore the top token price tracking platforms. Each serves a specific purpose, from offering a comprehensive overview of token markets to enabling in-depth analysis of decentralized exchange activity and global market trends. By understanding their unique features, you can choose the platform that best aligns with your goals.

1. CoinGecko

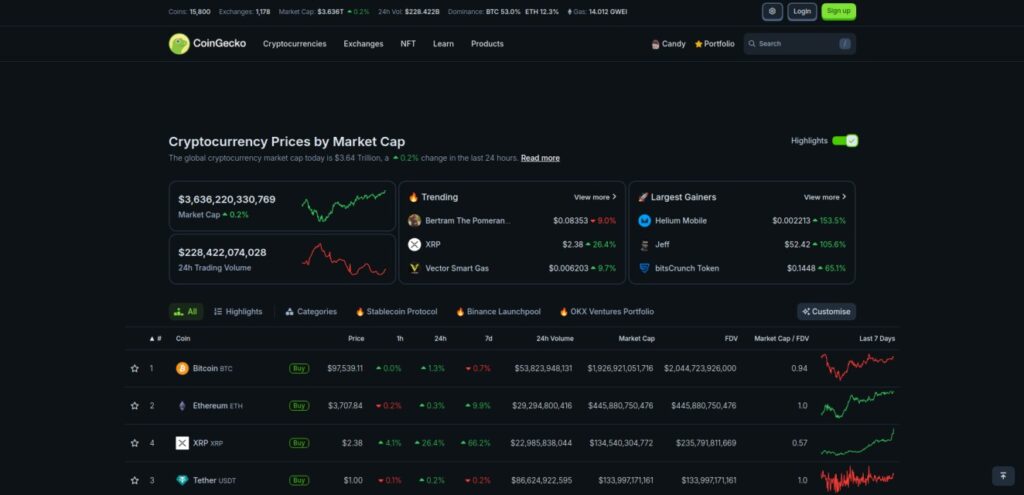

CoinGecko stands out as the top platform today for quickly accessing token prices and exploring different categories, making it a go-to tool for both beginner and advanced DeFi investors. It offers a simple yet powerful interface, providing a seamless experience that reflects what CoinMarketCap used to offer before being acquired by Binance.

CoinGecko excels in delivering a comprehensive first look at any token or project you're interested in. Whether it's a stablecoin, meme coin, or a new smart contract blockchain, the platform provides all the key metrics you need to evaluate tokens, such as market capitalization, fully diluted valuation, 24-hour trading volume, and circulating, total, and max supply—crucial for evaluating any token or project.

Beyond token data, CoinGecko stands out with features designed for convenience and security:

- Accurate Links: Social and website links are verified, ensuring you avoid phishing scams.

- Contract Addresses: Easily accessible for adding tokens to wallets or performing blockchain-specific research.

- Price Converter: Quickly convert token values to fiat or other cryptocurrencies.

- About Section: Offers concise project descriptions, helping you understand the token’s purpose and use case.

CoinGecko also offers a robust mobile app for iOS and Android, allowing you to track prices, manage your portfolio, and set customizable price alerts on the go. With its built-in portfolio tracking tools, CoinGecko ensures you can monitor your investments and respond to market movements anytime, anywhere.

Whether you’re researching a newly launched project or tracking the performance of a well-established DeFi token, CoinGecko is the best starting point. Its combination of simplicity, accuracy, and detailed data makes it a must-have tool for any DeFi investor.

2. CoinMarketCap

CoinMarketCap has long been a prominent platform for cryptocurrency data, offering comprehensive information on coins, tokens, and DeFi projects. It provides essential metrics such as market capitalization, 24-hour trading volume, fully diluted valuation (FDV), volume-to-market cap ratio, total supply, and max supply. Users can also access verified website links, social media profiles, contract addresses, blockchain explorers, and wallet information, ensuring a thorough understanding of each asset.

The platform features a portfolio tracker, available on both web and mobile applications, allowing investors to monitor their holdings and market movements conveniently.

However, since its acquisition by Binance in April 2020, some users have expressed concerns about potential biases favoring Binance-related projects.

This perception has led some investors to explore alternatives like CoinGecko.Despite these concerns, CoinMarketCap remains a valuable resource for cryptocurrency data, offering a wide range of information and tools for investors.

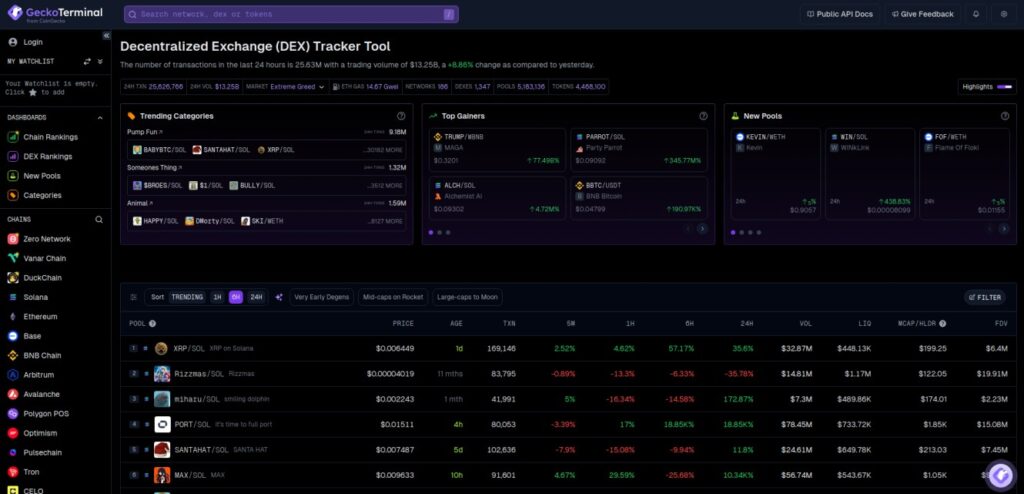

3. GeckoTerminal

GeckoTerminal by CoinGecko is a powerful tool for tracking decentralized exchange (DEX) activity, performing token-specific technical analysis, and accessing deeper insights into DeFi tokens. Supporting over 100 chains—including Ethereum, Solana, TRON, and various Layer 2 solutions—GeckoTerminal is an excellent resource for investors looking to dive deeper into token analytics.

The platform provides multiple dashboards to explore and rank activity:

- Chain Rankings: Compare blockchains based on token performance and activity.

- DEX Rankings: Analyze decentralized exchanges by volume and liquidity.

- New Pools: Identify recently launched liquidity pools for new tokens.

- Categories: Explore tokens grouped by themes or use cases.

When selecting a specific token, GeckoTerminal opens a TradingView chart, enabling detailed technical analysis. It also displays a wide array of supporting data, including:

- 24-Hour Volume and Liquidity

- Holders and Token Age

- Fully Diluted Valuation (FDV) and Market Cap

GeckoTerminal further stands out with its integrated risk analysis tools, which scan token contract addresses for potential issues, such as:

- Rugpull risks.

- Buy and sell taxes.

- Security scores from multiple sources.

The platform also provides transaction data, showing real-time buy and sell activity, along with holder and pool information for a complete overview of a token's ecosystem.

In summary, GeckoTerminal is a must-have tool for investors wanting to perform deeper token research or conduct technical analysis, making it an indispensable part of any DeFi toolkit.

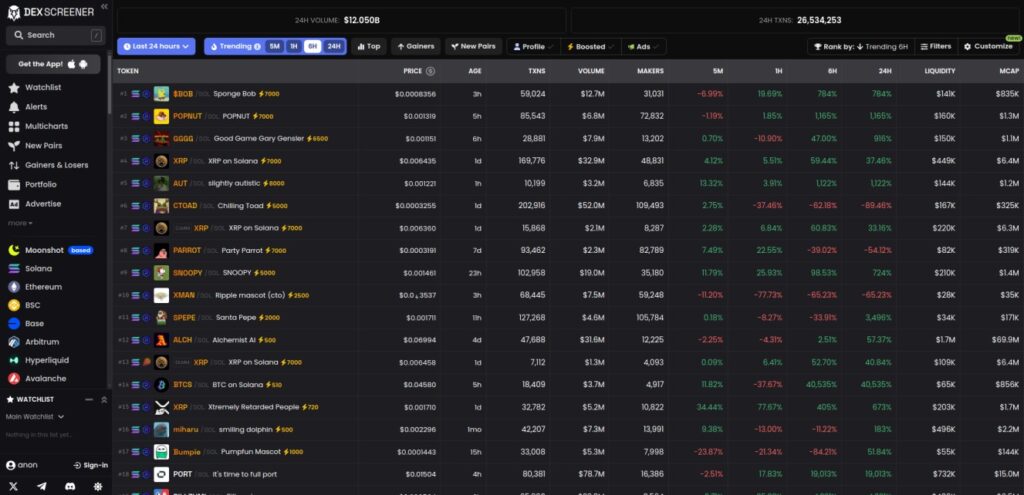

4. DexScreener

DexScreener lives up to its name by providing a comprehensive platform for screening decentralized exchanges (DEXs) and analyzing trending DeFi token pairs. Covering popular chains like Ethereum, Solana, Avalanche, Base, Arbitrum, and many more, DexScreener is a favorite among traders for its depth of insights and ease of use.

The platform offers a range of essential features:

- TradingView Charting: Get live, detailed charts for technical analysis.

- Trading History: Review the most recent transactions for any token.

- Liquidity Pool Insights: Dive into pool-specific metrics to understand liquidity and trading activity.

- Token-Specific Metrics: Includes key data points like:

- Liquidity

- Fully Diluted Valuation (FDV)

- Market Cap

- Transaction Volume

- Buy/Sell Ratios (Buy Volume, Sell Volume, Buyers, Sellers)

DexScreener also provides tools for discovering new opportunities:

- New Pairs: Quickly identify newly launched token pairs.

- Gainers and Losers: Track the biggest movers in real time.

- Multiple Chart Layouts: Compare several tokens side by side for advanced analysis.

Additionally, the platform includes features to enhance usability and workflow:

- Portfolio and Watchlist: Create and monitor your own custom lists of tokens.

- Price Alerts: Set notifications for specific price levels to act quickly on market movements.

Mobile App – Available as a mobile app for both Android and iPhone users, allowing you to access its features on the go.

DexScreener is an invaluable tool for traders seeking deeper technical analysis and a more granular view of token performance across multiple chains. Whether you’re tracking popular DeFi pairs or exploring new opportunities, it’s a must-have addition to any trader’s arsenal.

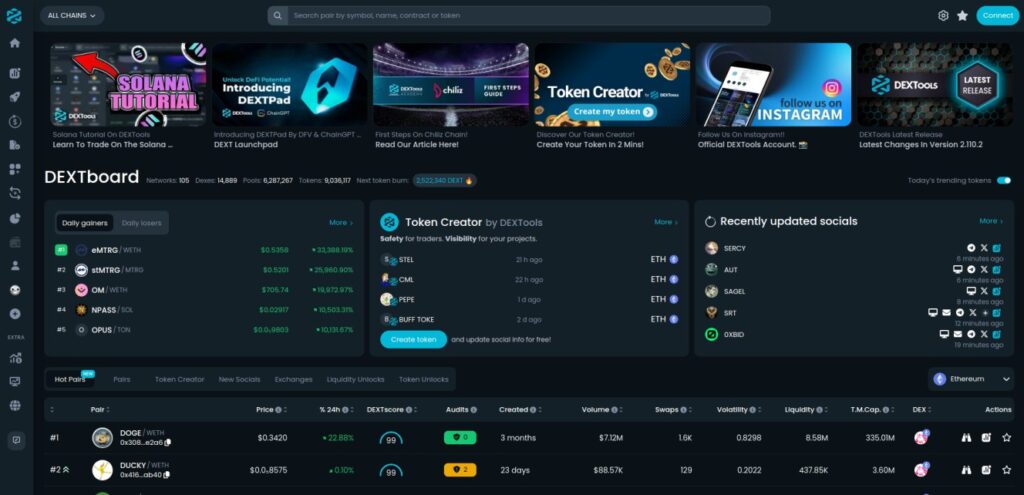

5. DexTools

DexTools is a comprehensive platform for DeFi token tracking, offering free TradingView charting tools across various blockchains. Supporting popular chains like Ethereum, BNB Chain, TRON, Solana, Avalanche, and numerous Layer 2s, DexTools is a powerful tool for both casual traders and seasoned DeFi investors.

The platform comes packed with features to enhance your trading experience:

- Pair Explorer: Analyze token pairs with in-depth data and metrics.

- Big Swap Explorer: Track large transactions for specific tokens or pairs.

- Multichart Layout: Compare multiple token charts side by side for a broader perspective.

- Aggregator: View token prices and liquidity across exchanges for the best trading opportunities.

- Token Creator: A unique feature for launching and managing tokens directly on the platform.

When inspecting a specific token, DexTools shows important details about market cap, liquidity, circulating supply, total market cap, 24-hour volume, total supply, and volatility metrics. You can also find the contract and pair addresses for each token.

Additional data includes risk scores for contract analysis, trade history, top traders, and holder information. You can also track your own swaps, set customizable price alerts, and access transaction-specific insights.

Mobile App – DexTools offers a mobile app for both Android and iPhone, allowing users to access charts, track tokens, and analyze markets on the go.

DexTools is an excellent choice for DeFi traders looking to quickly get up to speed on token prices or conduct deeper analysis. With its robust features and cross-chain support, it’s a valuable addition to any trader’s toolkit.

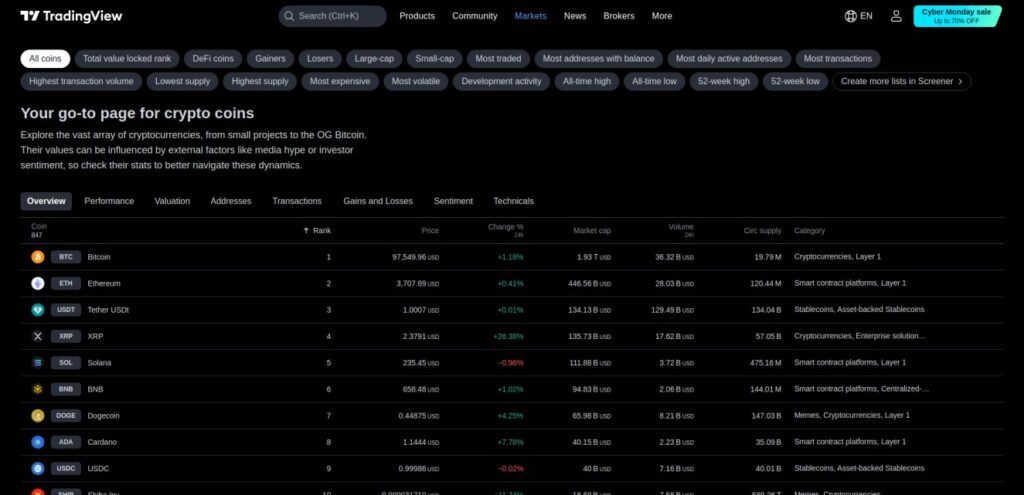

6. TradingView

TradingView is the ultimate platform for technical analysis and charting, widely regarded as the gold standard for traders and investors. It’s the charting software that every serious trader should have in their arsenal to achieve optimal performance.

While platforms like GeckoTerminal, DexScreener, and DexTools license TradingView charts for their interfaces, using the full TradingView platform unlocks its complete range of features. Although it doesn’t offer as many tokens as dedicated DeFi platforms, it covers the major large-cap cryptocurrencies, DeFi tokens, and global markets—making it an indispensable tool for a broader macroeconomic perspective.

Key Features of TradingView:

- Advanced Charting Tools: The most extensive suite of tools for technical analysis, including customizable layouts and indicators.

- Watchlists and Layouts: Create multiple watchlists and chart layouts tailored to specific trading strategies or assets.

- Custom Indicators: Use free indicators created by the community or leverage the built-in Pine Script to design your own.

- Community Insights: Engage with a vibrant community of traders by exploring shared technical analyses or publishing your own for feedback and visibility.

- Cross-Market Analysis: Go beyond crypto and analyze larger macro markets like stocks, forex, and commodities to understand their influence on cryptocurrency trends.

- Mobile App: Access all the powerful tools and features of TradingView on the go through its mobile app, available for both iOS and Android.

Why TradingView Stands Out:

TradingView’s flexibility, powerful toolset, and strong community make it the go-to charting solution for traders across all markets. The ability to integrate macro insights with crypto trends sets it apart, allowing traders to have a “third-eye view” of the entire market landscape.

Whether you’re analyzing DeFi tokens or broader market dynamics, TradingView remains the top choice for technical analysis. It’s no surprise that crypto was a key driver of its rise to prominence—it’s the best in the industry for good reason.

Mastering Token Research and Technical Analysis with Tracking Platforms

To effectively analyze tokens and conduct technical analysis, it’s crucial to have a structured approach that leverages the strengths of multiple platforms. Whether you’re starting with a specific token in mind or simply exploring, following a systematic workflow ensures you gather the most critical insights while avoiding costly mistakes.

Step 1: Start with the Basics

Begin your research by gaining a high-level overview of the token on platforms like CoinGecko or CoinMarketCap. These platforms provide essential details such as:

- Market Cap and Fully Diluted Valuation (FDV): Understand the token’s valuation.

- Circulating and Total Supply: Assess the token's scarcity or inflation potential.

- Trading Platforms: Identify where the token is listed and traded.

While you’re there, verify its socials and official links. Check for recent updates or announcements on social media, and ensure the contract address is legitimate to avoid scams.

Step 2: Dive Into Technical Analysis

For charting and deeper token analysis, move beyond CoinGecko and CoinMarketCap. Platforms like GeckoTerminal, DexScreener, or DexTools are essential for more advanced insights.

- Charting: Use these platforms for live TradingView charts that allow basic technical analysis like trendlines, support/resistance levels, and indicators. Avoid relying on CoinGecko or CoinMarketCap for charting accuracy.

- Risk Analysis: Check token contracts for risks such as rugpull indicators, buy/sell taxes, or unusual permissions.

- Volume and Liquidity Insights: Dive into transaction history, liquidity pool details, and buy/sell volume to understand market behavior.

Keep in mind that not all tokens appear on every platform, especially smaller or newly launched tokens. Be prepared to switch between platforms to find the data you need.

Step 3: Understand the Larger Picture

For a macroeconomic perspective and broader market analysis, TradingView is unmatched.

- Use it to analyze dominance charts, major crypto pairs like BTC/ETH, and top 100 tokens.

- Combine crypto insights with traditional markets like stocks, commodities, and indices to understand external factors influencing crypto trends.

- Leverage layouts and saved charts for streamlined workflows tailored to your strategies.

While TradingView is ideal for large-cap tokens and market-wide trends, rely on GeckoTerminal, DexScreener, or DexTools for small caps, meme coins, or tokens with DeFi-specific nuances.

Step 4: Combine Technical Analysis with DeFi Analytics

If you’re analyzing DeFi tokens, complement your research with DeFi-specific analytics tools and platforms that provide insights into liquidity pools, staking, or lending data. Ensure you keep track of your DeFi portfolio with a reliable portfolio tracker.

Step 5: Continuous Learning and Cross-Referencing

- Compare Across Platforms: Cross-reference metrics like liquidity and volume to ensure accuracy.

- Expand Your Knowledge: Learn the fundamentals of technical analysis, such as using indicators, understanding candlestick patterns, and identifying market trends.

- Use Alerts and Watchlists: Set alerts for specific price movements or create watchlists to track tokens effortlessly.

By following this approach and leveraging the strengths of each platform, you can perform effective token research and technical analysis. Remember, each tool serves a specific purpose, and combining them maximizes your ability to make informed decisions.

For deeper insights into DeFi analytics and portfolio tracking, check out these related articles:

- Top DeFi Portfolio Trackers: Complete Guide & Comparison

- The Ultimate Guide to DeFi Analytics: Tools & Strategies

Comparative Analysis of Token Price Tracking Platforms

Choosing the right token price tracking platform depends on your specific needs—whether you're looking for real-time data, multi-chain support, or advanced technical analysis tools. Here’s an updated comparison of the top platforms, focusing on their key strengths:

| Platform | Real-Time Data | Multi-Chain Support | Analytics Depth | User Experience | Cost |

| CoinGecko | ✅ High accuracy | ✅ Extensive (ETH, BSC, more) | Medium (price, supply, categories) | ✅ Simple and beginner-friendly | Free; Premium for advanced API access |

| CoinMarketCap | ✅ High accuracy | ✅ Extensive (ETH, BSC, more) | Medium (portfolio tools, rankings) | ✅ Clean and easy to navigate | Free; Premium subscription options |

| GeckoTerminal | ✅ High accuracy | ✅ 100+ Chains Supported | High (risk scores, liquidity, pairs) | ✅ Intuitive and powerful | Free |

| DexScreener | ✅ High accuracy | ✅ Broad DEX support | Medium (charts, liquidity pools) | ✅ Lightweight and responsive | Free |

| DexTools | ✅ High accuracy | ✅ DEX-focused chains | High (DEX liquidity, trade data) | ✅ Optimized for DEX traders | Free with ads; Premium features available |

| TradingView | ✅ High accuracy | ❌ Limited to major chains | High (professional charting tools) | ✅ Customizable and professional | Free with ads; Premium for full access |

Key Takeaways

- Best for Beginners: CoinGecko and CoinMarketCap offer the simplest interfaces and comprehensive overviews, perfect for getting started with token research.

- Best for Multi-Chain Analysis: GeckoTerminal leads with 100+ chains supported, while DexTools and DexScreener excel at analyzing activity on DEX-focused chains.

- Best for Advanced Charting: TradingView remains the top choice for professional-grade analysis, enabling macro-level insights beyond crypto.

- Best for Risk Analysis: GeckoTerminal stands out with built-in risk assessments for token contracts.

By leveraging the strengths of these platforms, you can create a well-rounded strategy tailored to your DeFi goals. Whether you're seeking comprehensive market overviews, DEX-specific insights, or advanced charting, there’s a platform to meet your needs.

Conclusion

Token price tracking platforms are indispensable for navigating the dynamic and volatile DeFi ecosystem. They provide investors with real-time data, multi-chain compatibility, and powerful analytics, enabling smarter decisions, better portfolio management, and effective risk mitigation.

However, no single platform can meet every need. Combining multiple tools—such as CoinGecko for a broad overview of token data, GeckoTerminal or DexScreener for in-depth DeFi token analysis, and TradingView for advanced charting and macro insights—delivers the most comprehensive results.

Whether you’re tracking meme coins, analyzing DeFi tokens, or examining market-wide trends, these platforms are essential for building a winning strategy. Start optimizing your approach today by integrating these tools into your workflow.

For deeper insights, explore our guides on DeFi dashboards and analytics tools to elevate your investment strategy and stay ahead in the fast-paced world of decentralized finance.

FAQs (Frequently Asked Questions)

Why is tracking token prices essential for DeFi investors?

Tracking token prices is essential for DeFi investors as it helps them navigate the rapidly evolving ecosystem, make informed investment decisions, and manage their portfolios effectively.

What key features should I look for in a token price tracking platform?

When choosing a token price tracking platform, look for features such as real-time price updates, comprehensive market data, user-friendly interface, advanced charting tools, and support for multiple tokens and exchanges.

What are some of the top token price tracking platforms available?

Some of the top token price tracking platforms include CoinGecko, CoinMarketCap, GeckoTerminal, DexScreener, DexTools, and TradingView. Each offers unique features tailored to different aspects of token analysis.

How can I effectively analyze tokens using these platforms?

To effectively analyze tokens, start with a high-level overview using basic metrics, dive into technical analysis through advanced charting tools, understand the larger macroeconomic picture, and continuously cross-reference data across multiple platforms.

Which platforms are best for beginners in DeFi token tracking?

For beginners in DeFi token tracking, CoinGecko and CoinMarketCap are highly recommended due to their user-friendly interfaces and comprehensive data that make it easier to understand the market.

How can I ensure my research is thorough when analyzing DeFi tokens?

To ensure thorough research when analyzing DeFi tokens, combine technical analysis with on-chain analytics, compare metrics like liquidity across different platforms, and engage in continuous learning to stay updated with market trends.