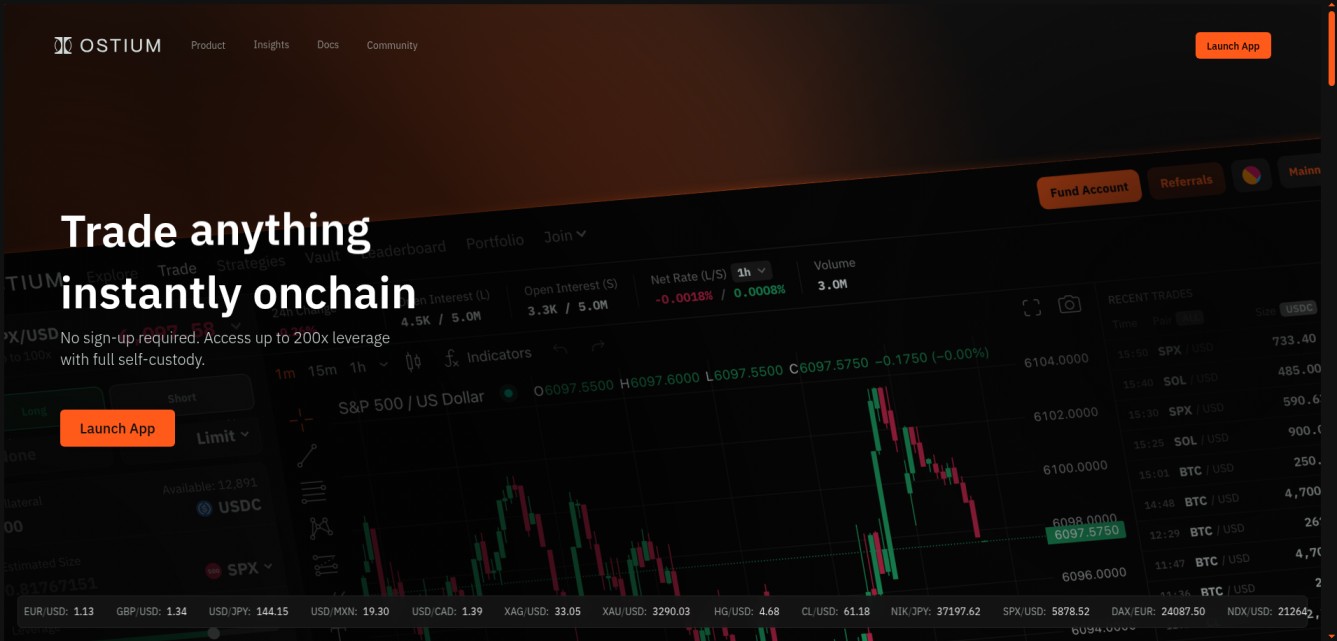

What is Ostium?

Ostium is a decentralized perpetuals exchange built on Arbitrum, designed to bring real-world assets (RWAs) into on-chain trading. It enables users to speculate on commodities, indices, forex pairs, and cryptocurrencies with leverage up to 200x—all within a self-custodial, fully transparent trading environment.

At the core of Ostium is its synthetic asset system, where assets are represented as on-chain instruments priced using trusted oracle feeds. This allows the platform to offer traditional financial markets—like gold, oil, S&P 500, and EUR/USD—in a decentralized format.

Traders deposit USDC as collateral and can take long or short positions across various markets, with real-time PnL and liquidation engines ensuring fair execution. Ostium’s high leverage options and efficient margining system cater to both high-frequency traders and DeFi-native speculators.

Risk management is further enhanced by Ostium's on-chain settlement and transparent pricing models, eliminating hidden costs and off-chain manipulation. The platform’s infrastructure is optimized for capital efficiency, allowing users to trade across multiple asset classes with minimal slippage.

Ostium is part of the growing wave of protocols pushing real-world financial products into the DeFi space, offering a decentralized alternative to centralized trading platforms while keeping user funds secure and positions verifiable on-chain.

Ostium Airdrop (Points Program)

Ostium has launched a comprehensive Points Program that tracks user activity and engagement across their decentralized perpetuals exchange. While no token has been officially announced, the structured points system strongly indicates preparation for a potential future token distribution. The program began on March 31, 2025, with 10 million points already allocated retroactively to early users and a minimum of 500,000 points distributed weekly to active participants.

This protocol brings real-world assets (RWAs) to on-chain trading, allowing users to trade commodities, stocks, forex pairs, and indices with up to 200x leverage. By participating in the platform now and accumulating points, you may position yourself for any future token distribution that materializes.

✅ How to Qualify for the Potential Airdrop:

- Join Ostium: → Referral Link – defishills.com/ostium (Signing up with this referral link gives you a 5% boost on all your trading scores!)

- Trade on the Platform:

- Execute trades on various asset classes (commodities, stocks, forex)

- Focus on consistent trading activity throughout the week

- Consider higher volume trades for potentially more points

- Real-time score tracking shows your progress immediately

- Provide Liquidity:

- Deposit USDC into Ostium's vault system

- Consider using the locking period for additional OLP boost

- Maintain consistent liquidity for optimal score accumulation

- Points for liquidity provision are tracked separately from trading points

- Build Your Referral Network:

- Access your referral link from your profile page

- Earn 1 trading score for every 5 trading scores generated by referred users

- Remind referrals they'll receive a 5% boost on all their trading scores

- Share your experiences on social media to attract more referrals

- Make Technical Contributions (Optional):

- Submit critical bug reports

- Contribute technical research to the protocol

- Participate in open-source development

- Note that contributions must be substantial to qualify

- Monitor Weekly Conversions:

- Scores convert to points every Sunday at midnight UTC

- Score tracking resets weekly for a fresh competition

- Check the leaderboard regularly to track your ranking

⚠️ Important Note:

The official documentation states that points have no monetary value, cannot be transferred, and do not represent any ownership interest or investment opportunity. However, as with similar points programs in the DeFi ecosystem, they may factor into future token distributions.