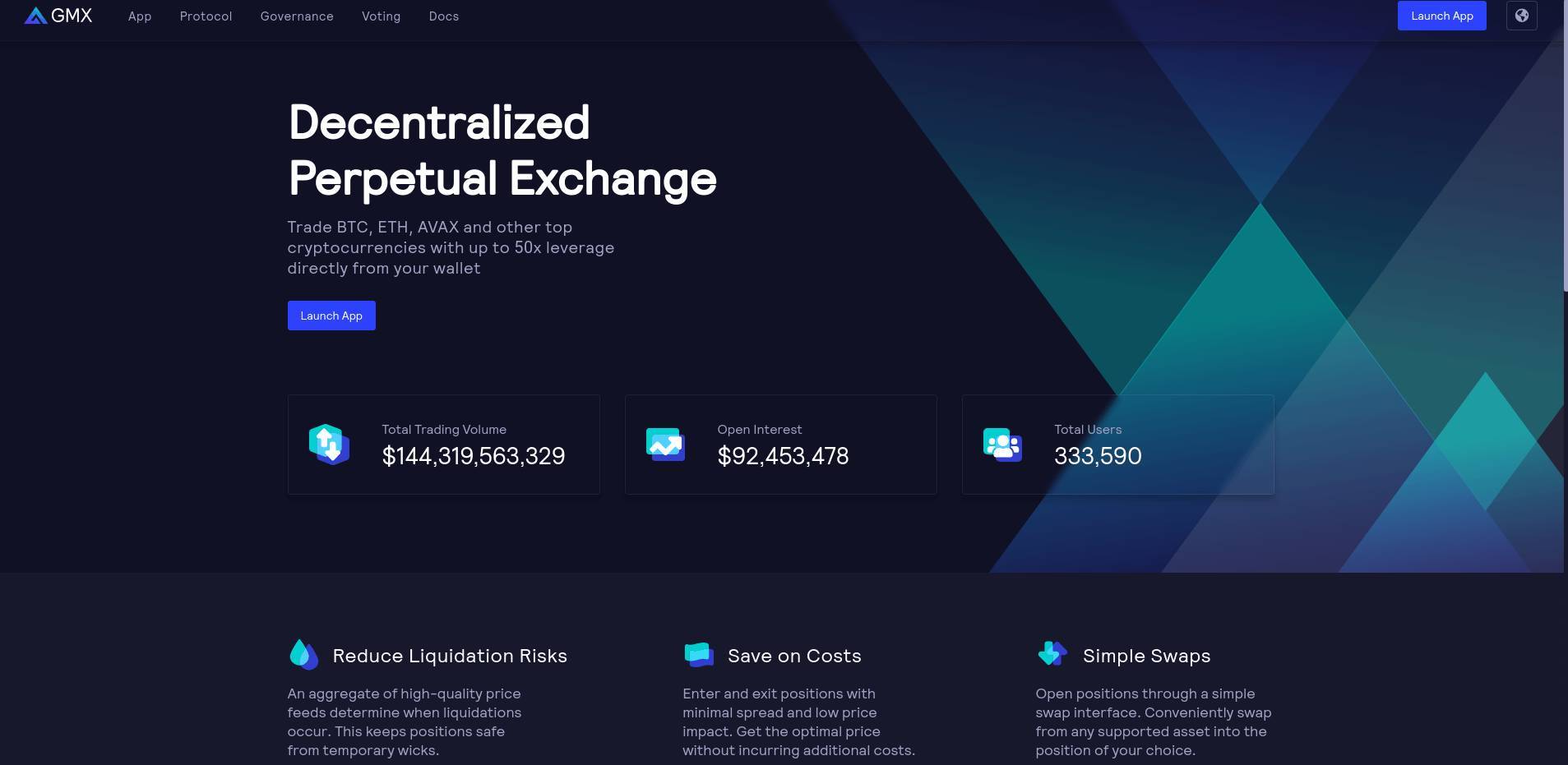

What is GMX?

GMX is a decentralized exchange (DEX) that specializes in spot and perpetual trading. Launched in September 2021, GMX operates on the Arbitrum and Avalanche blockchains, providing a platform for users to trade major cryptocurrencies such as Bitcoin, Ethereum, and Avalanche with up to 50x leverage. The protocol offers a decentralized, non-custodial trading experience where users maintain control of their assets through self-custodial wallets.

GMX is built on a unique multi-asset pool called GLP, which supports various assets including stablecoins, Bitcoin, Ethereum, and other major tokens. This pool facilitates both spot and leveraged trading, allowing users to execute trades with low fees and minimal price impact. Liquidity providers (LPs) can contribute to the GLP pool by depositing supported tokens, in return for GLP tokens which represent their share of the pool. These LPs earn 70% of the trading fees generated on the platform, with rewards distributed in esGMX and other tokens.

The GMX token serves as the platform’s governance and utility token. GMX stakers receive a share of the protocol’s fees, which are distributed in Ethereum on Arbitrum and Avalanche on Avalanche. Stakers also earn esGMX, which can be further staked for rewards or vested over time. Additionally, stakers accumulate Multiplier Points, boosting their rewards.

The platform leverages Chainlink oracles to provide real-time price feeds, ensuring accurate pricing for trades and minimizing the risk of liquidations caused by temporary market fluctuations. GMX also offers advanced trading features, such as stop-loss and take-profit orders, enabling users to manage their positions effectively.

GMX has seen significant growth, with substantial trading volumes and a high total value locked (TVL), making it one of the top DeFi protocols on Arbitrum and Avalanche. Its innovative approach to decentralized trading and robust reward mechanisms have attracted a large user base and substantial liquidity.