What is crvUSD?

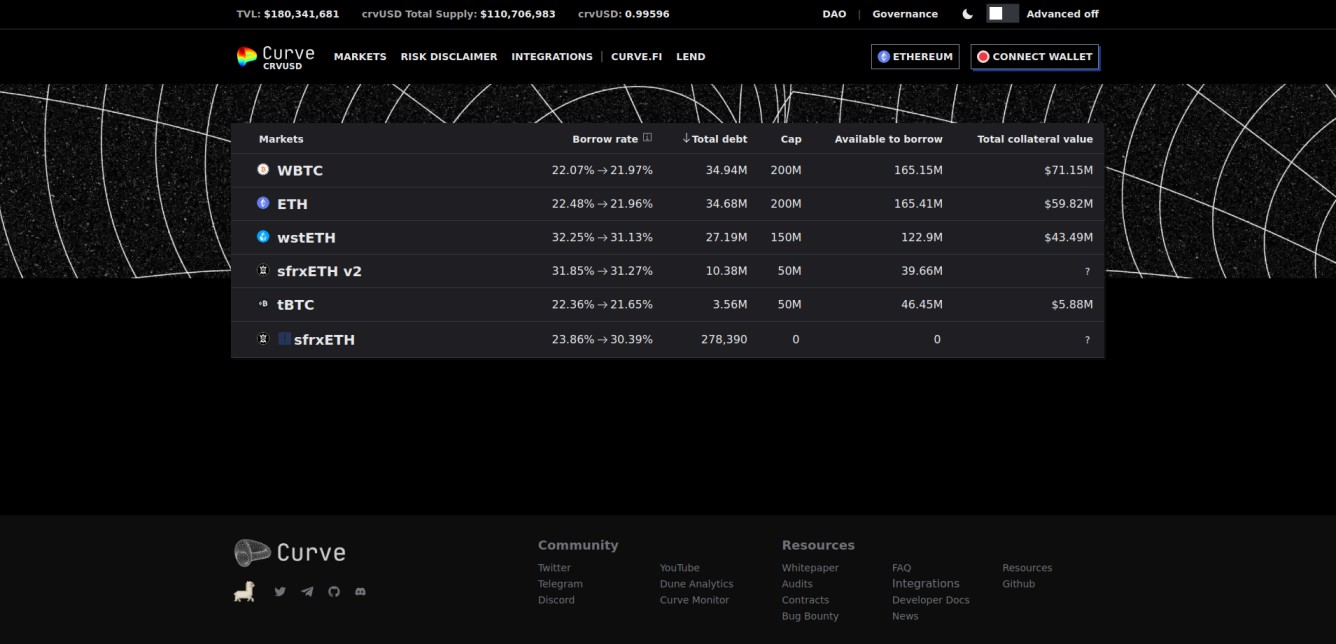

crvUSD is a decentralized stablecoin introduced by Curve Finance, a prominent DeFi protocol. It is designed as a collateralized debt position (CDP) stablecoin, where users deposit collateral to mint crvUSD. Initially, ETH is the primary collateral, but there are plans to include other assets such as liquidity pool (LP) tokens in the future. crvUSD maintains its peg to the US dollar through overcollateralization and innovative mechanisms to manage liquidation risks.

A key feature of crvUSD is the Lending-Liquidating AMM Algorithm (LLAMMA). This algorithm continuously manages the collateralization of crvUSD, replacing traditional discrete liquidations with a process that rebalances collateral across different price bands. This means that as the price of the collateral falls, portions of it are gradually converted into crvUSD, and as the price rises, crvUSD is converted back into the collateral. This approach helps to minimize the losses typically associated with liquidations and provides a smoother and more predictable management of the collateral.

To maintain the stablecoin's peg to $1, crvUSD utilizes several mechanisms, including Peg Keepers and dynamic interest rates. Peg Keepers can mint or burn crvUSD to manage its supply based on market conditions, similar to Algorithmic Market Operations (AMO). When crvUSD trades above $1, Peg Keepers can mint more crvUSD to lower the price, and when it trades below $1, they can burn crvUSD to increase the price. Additionally, the interest rates on loans dynamically adjust depending on crvUSD's price deviation from the peg, incentivizing borrowing or repayment as needed to stabilize the price.