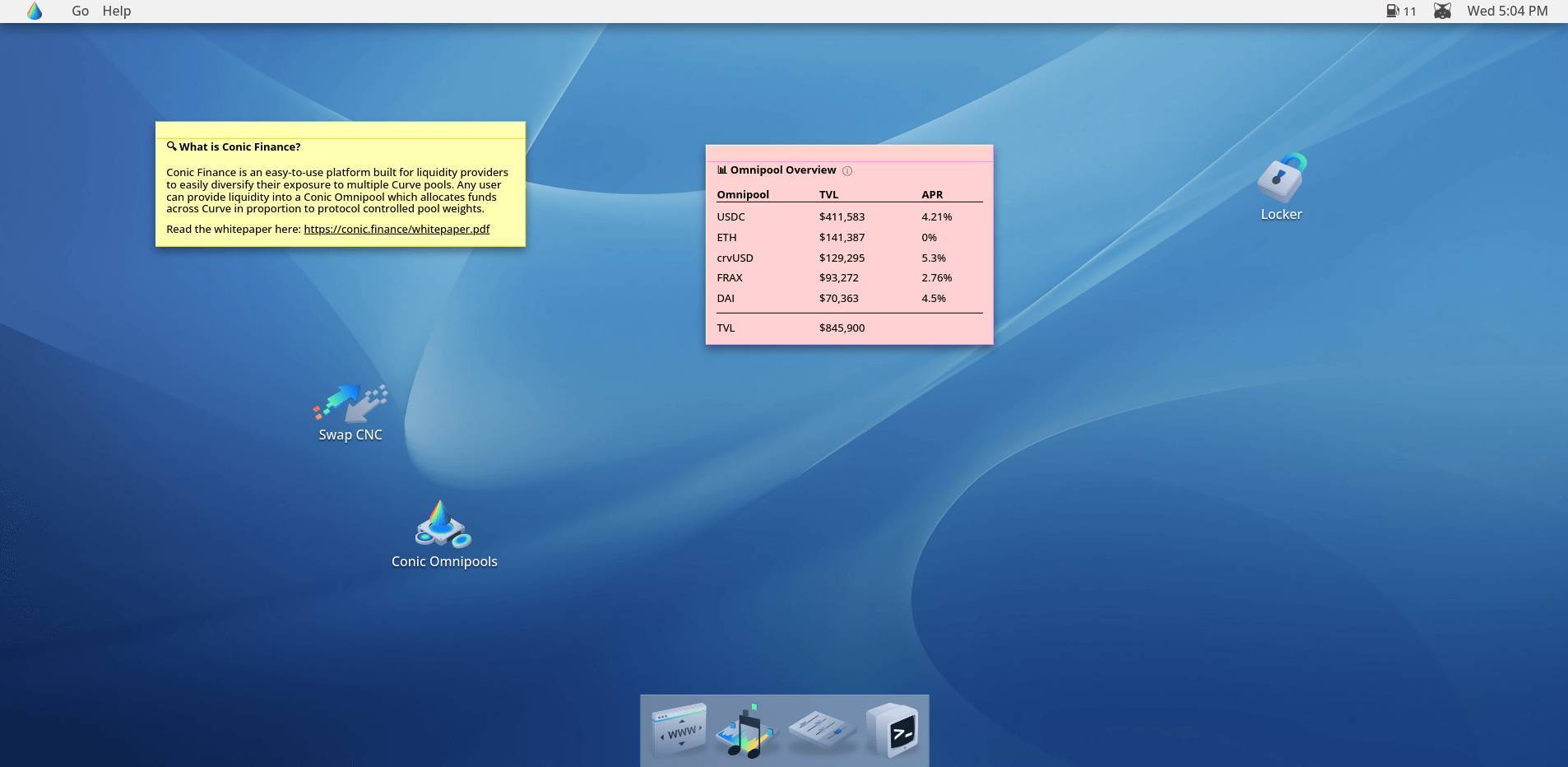

What is Conic Finance?

Conic Finance is a decentralized finance (DeFi) protocol on Ethereum that introduces “Omnipools,” allowing users to deposit a single asset and gain exposure to multiple Curve Finance pools. This mechanism provides liquidity providers (LPs) with the advantage of diversifying their investments across several Curve pools using a single LP token. The platform automatically stakes all Curve LP tokens on Convex Finance to earn additional rewards, such as CVX and CRV, along with Conic's native CNC token.

Conic's Omnipools allocate liquidity to various Curve pools based on liquidity allocation weights, which are determined by bi-weekly liquidity allocation votes (LAVs). These votes are conducted by vlCNC holders, who have locked their CNC tokens to gain voting rights. The results of these votes dictate how liquidity is distributed across different Curve pools, optimizing returns for LPs.

The native token of Conic Finance, CNC, is used to incentivize liquidity provision and participation in governance. Users can earn CNC by staking their Omnipool LP tokens or during rebalance periods, which align liquidity distribution with updated allocation weights. The total supply of CNC is capped at 10 million tokens, and they can also be purchased on decentralized exchanges like Curve.