Morpho

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

Morpho is a decentralized lending protocol that boosts capital efficiency, offering higher yields and lower borrowing costs with similar risk parameters to Aave and Compound.

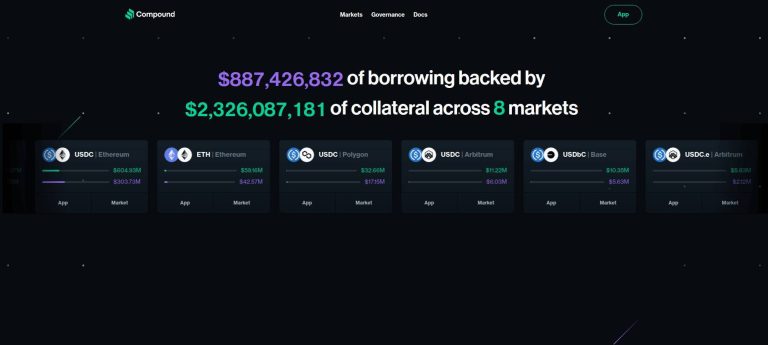

Compound is a decentralized protocol on the Ethereum ecosystem allowing users to lend or borrow cryptocurrencies, earning or paying interest based on supply and demand.

Abracadabra allows users to mint stablecoin MIM using interest-bearing collateral, leveraging yield-bearing assets for optimized DeFi investment strategies.

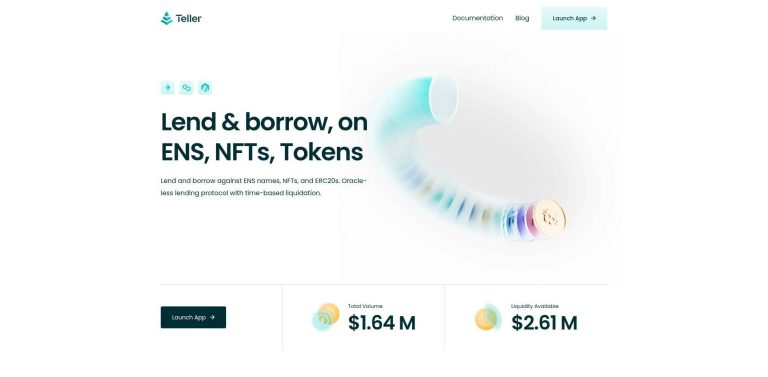

Teller is a decentralized lending protocol on Ethereum for lending and borrowing against ENS names, NFTs, and ERC20 tokens, offering oracle-less, time-based liquidation.

Aave is a decentralized, open-source protocol on Ethereum for lending and borrowing cryptocurrencies, with instant interest compounding, governed by smart contracts.