This issue we’re diving into a token I’ve been watching and accumulating for a while now. One I think is seriously undervalued, not just based on fundamentals but also on where things are heading next.

That token is LQTY.

I’ll walk through the full picture. The history, the tokenomics, what changed with v2, and why I see this as one of the highest conviction bets in DeFi right now.

But before we get into that, let’s start with a bit of context.

How We Got Here

On May 11, 2021, Liquity v1 hit its peak: over $4.5 billion in TVL. Aave, at the same time, was sitting at $11 billion. Both looked like they were on a path to dominance. And today, Aave still holds that crown with over $33 billion in TVL.

But Liquity took a completely different route.

While Aave evolved through governance and constant updates, Liquity was built for a different kind of purity. It was fully immutable, truly decentralized, and free from human control. No governance, no upgrades, no backdoors. Just code as law. And it worked. Flawlessly.

But that came at a cost.

Liquity isn’t a lending market like Aave. It’s a CDP system where users mint their own stablecoin, LUSD, by locking up ETH as collateral. The design is elegant, but it introduced one major friction.

In Liquity v1, “redeeming” means swapping LUSD back into ETH directly from the protocol at face value – 1 LUSD for $1 worth of ETH. This mechanism helps keep LUSD pegged to the dollar.

But here's the catch.

Whenever someone redeemed LUSD, it pulled from the riskiest troves – the ones with the lowest collateral ratio. That meant users constantly had to top up collateral just to stay safe. Over time, this made the whole system inefficient. Capital dried up, and TVL collapsed.

Not because the protocol failed, but because it was too pure for its own good.

From 2022 onward, Liquity v1 stayed untouched. And by design, it couldn’t be fixed. LUSD kept its peg, but the ecosystem stalled. There was no way forward.

Until now.

In 2025, Liquity v2 launched.

Enter Liquity v2: A New Era Without Compromise

In January 2025, Liquity v2 went live. A complete redesign, but one that stayed true to what made the original great. Still immutable, still decentralized, still with zero reliance on TradFi. No governance, no backdoors, no human intervention. Just pure Ethereum-native money.

At the center of it all is a new stablecoin called BOLD – a hard-pegged Ethereum Dollar that actually scales.

Liquity v2 introduced a bunch of changes that directly solve the pain points of v1:

- User-set interest rates – Borrowers set the rate they’re willing to pay, creating a live interest rate market.

- Multiple collateral types – ETH, wstETH, and rETH. All highly decentralized assets.

- Improved redemptions – No more punishing the lowest-collateral users. Redemptions now start from borrowers paying the lowest interest.

- No more Recovery Mode – That rigid system from v1 is gone.

- Protocol-Incentivized Liquidity (PIL) – The protocol can now direct a portion of revenue to LPs through native bribes.

But the real innovation is in how interest rates and redemptions are handled.

Redemptions are still the backbone of the peg, but this time they work differently. Instead of liquidating based on collateral ratios like in v1, redemptions now start with the borrowers offering the lowest interest. This creates a natural competition and keeps the peg intact without punishing users.

That alone fixes what broke v1. The system is now capital-efficient, scalable, and much easier to use without fear of getting randomly drained.

And even with all these upgrades, the team didn’t launch a new token.

They kept LQTY – the same token from v1. Only now, its role has evolved.

Back in v1, LQTY was just a rewards token tied to the Stability Pool. In v2, it’s directly involved in directing protocol incentives and capturing value from fee flows.

More on that next.

The Bullish Case for LQTY

LQTY is an old coin. By modern standards, it falls into the “dino coin” category, a term used for early-cycle projects. And in this case, that would technically be accurate.

But unlike most of those so-called dino coins, LQTY has actually been completely revamped, like we covered earlier.

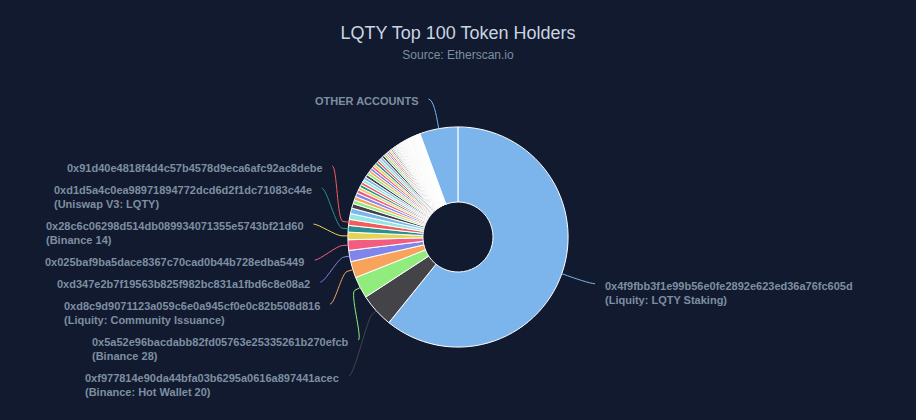

It’s not just been in accumulation for over three years. Its circulating supply is at 97,597,356, with the total capped at 100 million. So it’s already close to being fully distributed. Once the last 2.4 million tokens are emitted from the Liquity v1 Stability Pool, that’s it. No more LQTY will ever be created.

And on top of that, over 60 percent of all LQTY in circulation is currently staked. That says a lot about the conviction of its holders. You rarely see that high of a staking ratio in this space.

Let’s continue.

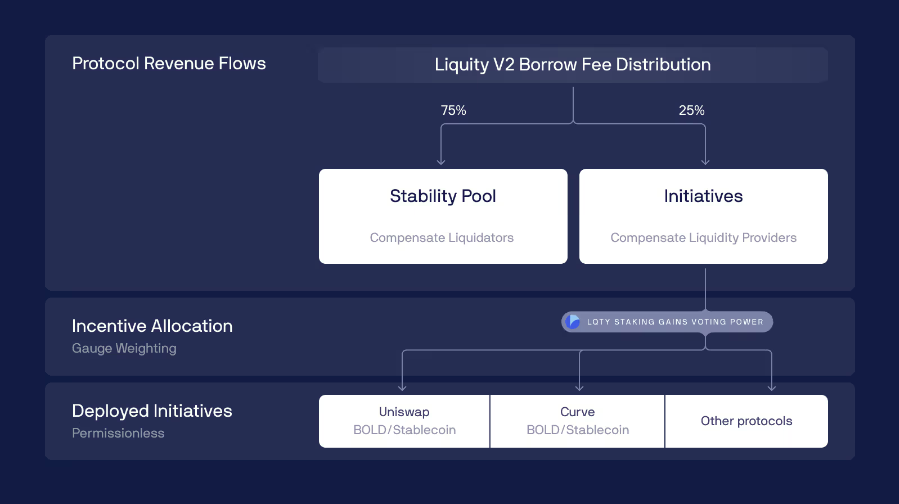

25% of protocol revenue is directed by LQTY. The more you stake, the more you get to influence where that liquidity goes. It works in a similar way to how Curve does it.

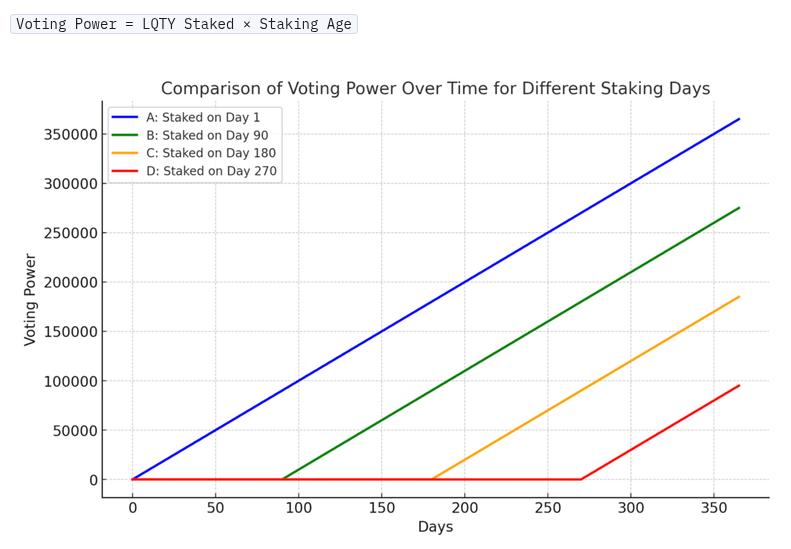

Liquity v2 also introduced Voting Power. The longer you stake your LQTY, the more weight your vote has in the weekly gauge votes. This can be tracked live through the Liquity v2 dashboard, where you can see how your voting power grows relative to staking age.

📌 LQTY Staking & Voting – official docs

As Liquity v2 allocates 25 percent of its revenue to PIL, and that gets directed by LQTY stakers through weekly voting, the setup creates a constant stream of protocol revenue with real growth potential.

The Bribe Markets

Bribe markets already exist across DeFi. They were made popular by the CRV and CVX ecosystems, and now Liquity v2 is stepping into the same model. The idea is simple: third parties compete for a share of protocol revenue by offering incentives to token holders who direct that revenue—in this case, LQTY stakers.

Bribes, explained:

- Bribes are payments made by third parties to influence how LQTY stakers vote on PIL allocations

- In return, those parties receive a stream of BOLD rewards

- Payments are distributed weekly based on voter participation

This creates a potentially lucrative reward stream for early LQTY stakers.

Let’s run a basic example:

If BOLD supply grows to $250 million and the average borrow rate is 5%, that produces an annual PIL pool of $3.125 million.

As BOLD expands to $500 million, $1 billion, and beyond, the size of that pool increases.

And with it, the rewards for voters grow too.

Your rewards are directly tied to a growing BOLD supply.

As bribe markets mature around Liquity v2, early stakers will benefit from being among the first to capture those third-party incentives. And since the system doesn’t rely on token emissions, these rewards are tied directly to real economic activity. That makes them more sustainable, and more valuable, over time.

This creates a self-reinforcing loop:

Bribes → Active Voting → Efficient PIL Allocation → Revenue Growth → Higher Bribe Value

So what do we have here?

✅ The most decentralized and immutable protocol built on Ethereum

✅ The most capital-efficient way to borrow an Ethereum-native stablecoin (BOLD)

✅ A fully distributed token that directs revenue and receives bribes

✅ A market cap 37x smaller than AAVE, with no governance risk

- AAVE market cap: $4,953,237,371

- LQTY market cap: $133,395,410

So where does that leave us?

Let me walk you through how I’m thinking about this LQTY play – and why it’s one of the few tokens I’m comfortable just holding and letting time do its thing.

How I'm Thinking of This LQTY Play

LQTY is one of those rare plays you only get in crypto every now and then. Maybe once or twice a year if you're lucky.

It’s a clear value mismatch with a clear path to re-pricing.

In other words:

- You can see it’s undervalued compared to its peers

- You can see exactly how it can close that gap

- And somehow, it's still not being front-run

That’s rare.

So for me, this play is simple.

Liquity v2 is just doing so many things right.

Let’s start with distribution, which is one of the hardest problems for any protocol.

How do you get tokens into real users’ hands without having them dumped immediately?

Liquity v1 actually did that right. LQTY has been around for years. It’s already widely distributed. And now, with v2, it’s been re-activated. Same token, new purpose, real upside.

Anyone who stuck around farming the v1 Stability Pool just got rewarded for it. That’s real alignment.

Meanwhile, in the TradFi world, yield games are locked behind doors. Institutions extract value for themselves, but can’t legally pass it to holders. That creates an obvious funnel toward decentralized alternatives like Liquity and BOLD.

Ethereum-native users already prefer pure, immutable DeFi. And with the stablecoin narrative heating up, and TradFi just getting started, it’s clear people are going to chase the best systems. The ones that offer real yield, actual decentralization, and zero governance risk.

So if you can:

- Borrow under market rates

- Avoid centralized risks

- Hold a stablecoin that actually earns (while TradFi coins legally can’t)

Then why wouldn’t you use Liquity and hold BOLD instead?

As Ethereum climbs, so does the amount people can borrow.

That means:

- More ETH entering Liquity

- More BOLD minted

- More revenue flowing through the protocol

- Bigger bribes

- More value going to LQTY stakers

And this is all happening while LQTY is already close to fully diluted, and the market cap is still tiny.

So how am I playing this bag?

Simple.

Buy, hold, and forget.

The value mismatch here is just too big. I don’t see a need to trade it.

I’m staking my LQTY to grow my share of the pie. Let BOLD issuance do its thing, and I’ll sit back and watch the bribe rewards stack up.

It’s not flashy. It’s just clean DeFi logic.

And I’m betting the market catches up.

–Seb

Track Your Progress

Want to see the numbers move in real time? These dashboards make it easy:

- Liquity v2 Overview:

https://dune.com/liquity/liquity-v2 - Protocol-Incentivized Liquidity (PIL) Flows:

https://dune.com/liquity/protocol-incentivized-liquidity - Liquity V2 – Leaderboard:

https://dune.com/liquity/v2-leaderboard