Over the past few months, I’ve been rotating more of my capital into EUR. Partly because I run a company in the EU and need to cover yearly expenses like taxes and salaries, and partly because EUR has strengthened against USD. Every time I convert revenue from USD to EUR, I’m reminded how early we still are.

Because here’s the problem: if you want to earn yield on EUR in DeFi, there are basically no good options.

The ecosystem is still entirely built around USD. And when it comes to euros, the situation is even worse, there’s basically no decentralized EUR stablecoin yet. The only one with any real adoption is EURC from Circle, which is fully custodial and centralized. Everything else is either illiquid, experimental, or doesn’t exist yet. And even when the stablecoin exists, actual yield opportunities are close to zero.

But that’s exactly why I’ve been digging into this space. This lack of infrastructure is a gap, one I expect to get filled over time. So I’ve started positioning early. Holding more EUR onchain. Paying attention to the few places offering yield. And experimenting with what’s usable, even if imperfect.

In this issue, I’ll break down:

- “What EUR stablecoins actually exist today”

- “Where real, usable yield can be earned”

- “How I’m allocating my EUR exposure in DeFi”

- “And why I think this space is still wide open”

Let’s get into it.

💶 What EUR Stablecoins Actually Exist Today?

The EUR stablecoin market is still incredibly small – just $414.29 million in total market cap. Compare that to the USD stablecoin market, which stands at $263.88 billion. That’s a difference of over 636x.

While USDT still dominates the USD market with 62.11% share, there’s at least a diverse landscape of alternatives – BOLD, crvUSD, fxUSD, GHO, and others. Many of these are decentralized, battle-tested, and backed by meaningful liquidity.

In the EUR stablecoin world? That kind of diversity doesn’t exist. At all.

Here are the largest EUR-denominated stablecoins today:

- EURC (Circle) – $209.53M

- Anchored Coins AEUR – $55.12M

- EUR CoinVertible (SG Forge) – $40.13M

- Monerium EUR emoney (EURE) – $24.17M

- EURA – $23.67M (backed by USDC, not fiat)

- Stasis Euro (EURS) – $22.57M

- StablR Euro (EURR) – $16.55M

All of these are centralized – either fiat-backed, bank-issued, or (in the case of EURA) collateralized with other centralized assets like USDC and EURC. Some are tied directly to regulated institutions, while others simply mirror EUR pricing synthetically. None are decentralized, and none are meaningfully integrated across DeFi in a way that makes them feel native or reliable.

👉 If you're curious about the full EUR stablecoin landscape, DefiLlama tracks it here.

So if you want to hold EUR onchain today, you're stuck with imperfect options. For yield farming or protocol integrations, EURC is still the most practical choice – simply because it has the most adoption and liquidity. For off-ramping and payments, EURe might be the one to look at. More on that later.

Until a real decentralized EUR stablecoin emerges, we have to work with what exists, and figure out where we can actually earn yield with it.

💸 Where the Yield Actually Is Right Now

These yield options focus strictly on pure EUR exposure. That means I’m skipping over higher-risk pools where you could end up with unwanted token exposure or impermanent loss.

Yes, there are opportunities like EURC-USDC in narrow range pools that can earn higher yields. But those require active management and careful sizing, and they fall outside the scope of this issue.

With that said, here’s what I’ve found so far:

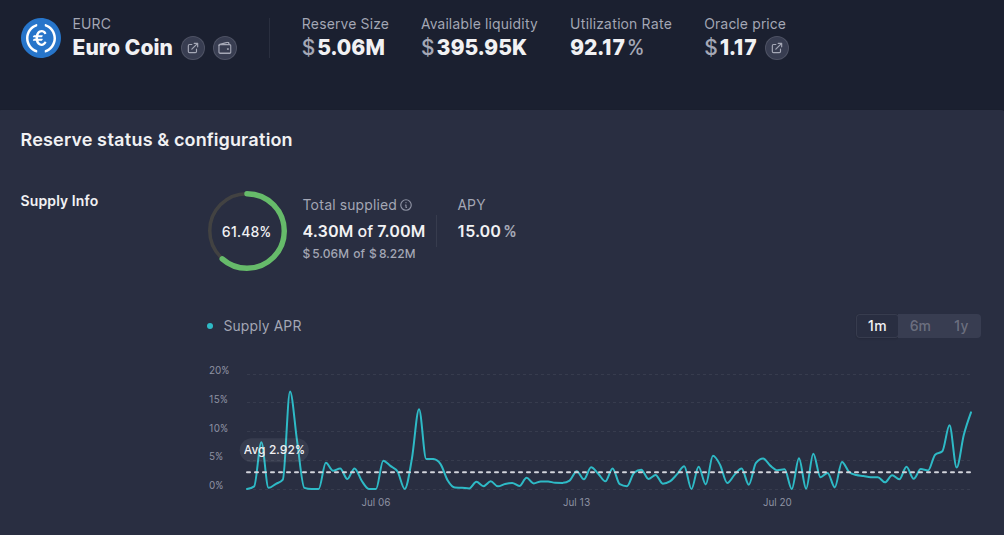

EURC on Aave (Ethereum Mainnet)

One of the safest and easiest ways to earn yield on EUR today is by supplying EURC on Aave v3.

The APY has been ranging around 4% for weeks, but utilization spikes can push it much higher. At the time of writing, it’s hitting 15% as borrowers drive the pool into high demand.

The same market also exists on Base, where EURC yields typically hover between 3–5%, depending on utilization.

It’s a simple, hands-off option for anyone who wants EUR exposure and passive yield. You can also borrow against your EURC, or even loop positions for amplified returns, though that adds complexity and risk.

Overall, this is the cleanest option I’ve found so far, low friction, decent yield, and battle-tested infrastructure.

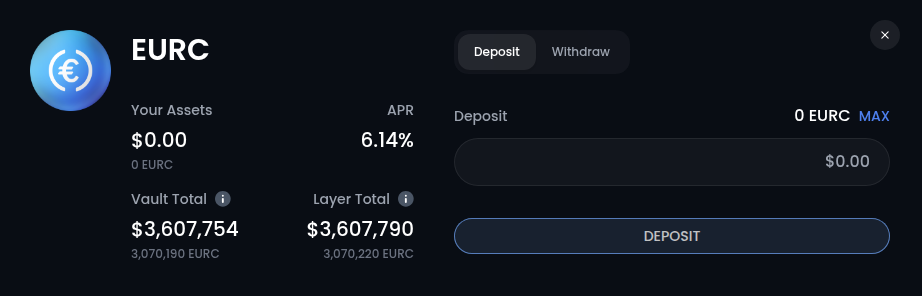

EURC on Fluid (Base)

Another hands-off option for earning EUR yield is Fluid Lending on Base. It’s been consistently yielding slightly more than Aave v3 on Ethereum, currently sitting at 6.14% APR.

This is another battle-tested, low-friction vault. Once your EURC is on Base, it’s as simple as deposit and earn.

The only real downside is bridging friction. While Base is the second most liquid chain for EURC, moving funds there from mainnet or elsewhere can still involve slippage and time delays, especially if bridging from protocols that don’t support EURC directly.

That said, if you’re coming from a CEX directly into Base, this becomes a clean and efficient yield path without touching Ethereum at all.

Overall, a strong alternative to Aave, with better rates lately and less competition for yield.

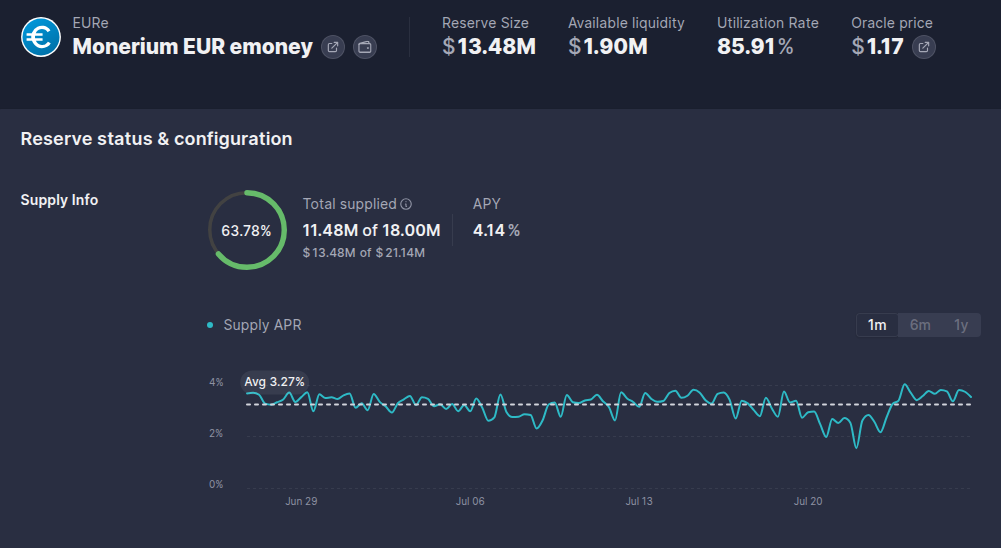

EURe on Aave (Gnosis Chain)

This is another simple, hands-off lending option, EURe is available on Aave v3 on Gnosis, currently yielding around 4.14% APY.

What sets EURe apart isn’t the yield, but its unique off-ramp utility. Issued by Monerium, EURe gives you access to a personal or business IBAN bank account in Estonia. That means you can:

- Hold EURe across multiple chains (Ethereum, Arbitrum, Gnosis, etc.)

- Bridge between them gaslessly

- And send EURe directly to any SEPA bank account – including your own

In practice, it works a lot like having 1 EURe = 1 EUR in a bank account, except with the flexibility of onchain transfers. It’s not the highest-yielding asset, but it’s arguably the easiest to spend or off-ramp when you actually need fiat.

That said, there are a few downsides:

- Market cap is still tiny (~$24M), and liquidity is thin on most chains

- Slippage can be a problem when buying or bridging

- EURe can’t be used as collateral on Aave (but you can borrow it against xDAI)

In fact, if you're willing to use xDAI as collateral, you can currently borrow EURe and get paid to do so, 6.00% APR in rewards at time of writing.

EURe isn’t where you’ll chase the highest yield, but it’s the closest thing to having an onchain euro bank account. For some setups, that’s worth more than a few extra percentage points.

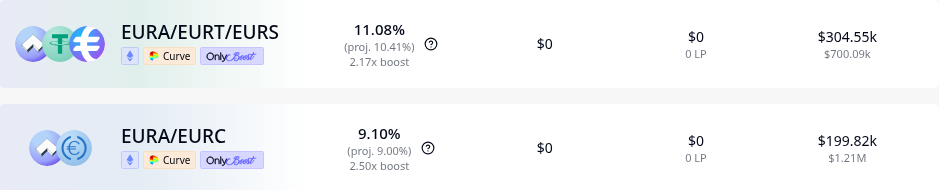

EURA Liquidity Pools on StakeDAO (Ethereum Mainnet)

If you're looking to provide liquidity instead of just lending, StakeDAO on Ethereum offers two solid options:

- EURA/EURC

- EURA/EURT/EURS

These are classic Curve-based pools that have been running since the agEUR era, long before EURA’s rebrand. So while they’re not new, they’ve been battle-tested and continue to offer competitive yields, currently in the 9–11% range.

You’ll earn CRV as part of the rewards, which you can either sell back to euros or keep depending on your strategy.

These same pools are also available on Convex, but typically with slightly lower APYs.

They won’t give you the simplicity of lending, but they’re great if:

- You already hold EURA

- You want to LP instead of lend

- You’re comfortable with euro-basket exposure (EURT, EURS, etc.)

Still one of the best yield options for euro LPs, especially if you want exposure to CRV rewards and don’t mind managing the occasional claim.

EURC on Drift (Solana)

While most EUR stablecoin opportunities live in the EVM world, Solana has quietly become a serious player, 18% of all EURC supply currently sits on Solana.

One of the most interesting places to put it to work is Drift Protocol, which offers:

- 8.33% APY through lending (hands-off)

- Up to 13.14% APY through Insurance Fund Vaults

Lending is simple and low-touch: you supply EURC, and earn interest from traders using leverage. The Insurance Vault, on the other hand, acts as a liquidity backstop, meaning higher yield, but also higher protocol risk if something breaks during volatile markets.

Both options offer some of the best EUR yields available today outside of Ethereum.

The main friction is bridging. While EURC liquidity on Solana has improved, getting assets in and out still takes some effort if you’re coming from the EVM side. That said, if you’re already active on Solana, or moving funds there directly from CEX, it’s one of the most attractive ecosystems for EUR-based strategies.

Not the easiest to access, but easily one of the highest-yielding options for EUR holders willing to go cross-chain.

EURC on Kamino (Solana)

Kamino is another strong lending venue for EURC on Solana. While the current yield sits at around 3.94% APY, utilization is relatively low, and as it rises, so does the interest rate.

It’s another hands-off, low-maintenance opportunity to earn on your euros. And Kamino adds one more layer on top: point farming.

As you supply EURC (or use other parts of the protocol), you accumulate points. These may convert to an airdrop or rewards in the future, adding potential upside beyond the base APY.

Between Drift and Kamino, Solana is quietly becoming one of the most rewarding ecosystems for EURC stablecoin holders, if you’re willing to bridge and operate outside of Ethereum.

Low effort, decent base yield, and a points meta kicker. Kamino is a solid passive option for EUR capital already on Solana.

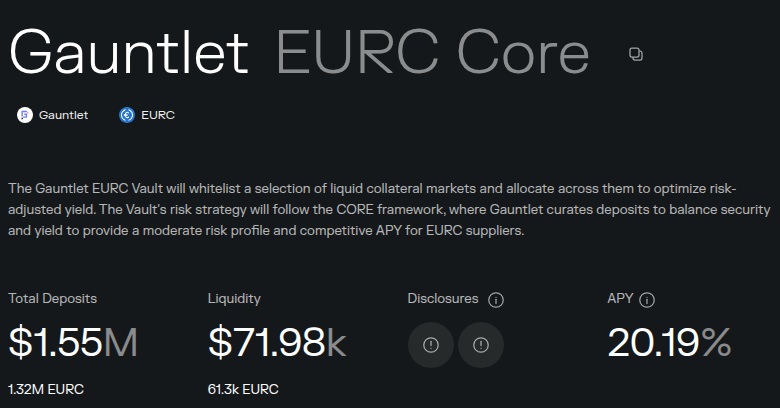

Gauntlet EURC Core Vault on Morpho (Ethereum Mainnet)

While I said earlier that I’d focus on low-risk, hands-off strategies, this vault is an exception. Not because it breaks the rule, but because it shows where things are heading.

The Gauntlet EURC Core Vault on Morpho (Ethereum mainnet) is an automated, risk-adjusted strategy that allocates EURC across several collateral markets to optimize yield. It’s not a simple lending position. It’s a managed vault with smart rebalancing.

Here’s how the allocations break down at time of writing:

- 50.31% to wstETH / EURC → earning 6.77%

- 25.03% to WETH / EURC → earning 30.44%

- 24.64% to WBTC / EURC → earning 33.73%

Combined, it’s delivering a 20.19% APY. But that comes with obvious tradeoffs.

Exposure to ETH/BTC LP risk, potential IL, and the complexity of a vault structure.

But the reason I’m including it is this: it’s a glimpse of what’s coming.

As EUR stablecoins grow in liquidity and protocol adoption, more structured products like this will emerge. Vaults, leverage strategies, hedged lending all optimized around euro positions instead of dollars.

It’s not for everyone, but it’s a great early example of the yield meta evolving around EUR.

EUR Yield Is Still Niche, But It’s Real

EUR stablecoins still feel like a niche topic in crypto, something most people ignore. But maybe they shouldn’t.

Whether you use euros or not outside of crypto, the reality is that the dollar has been steadily losing ground against most major fiat currencies. Demand for EUR stablecoins is growing, even if the space is still small.

A year ago, earning any yield on euros was basically a joke. That’s slowly starting to change.

For anyone in Europe, I’d strongly recommend looking into EURe. It’s made off-ramping way easier for me and is the closest thing to having a euro-native onchain bank account.

And if you’re more aggressive with your farming, EURC-USDC pairings, especially on Solana, have been putting up some insane APRs lately. That’s mostly thanks to short-term incentives. Just know what you’re getting into: managing ranges and dealing with IL is part of the deal.

Personally, I’m holding a mix of EURC and EURe, allocating into passive lending positions, and using EURe as my go-to off-ramp. As this market matures, I expect a lot more structured products and better yield sources to emerge.

The EUR yield landscape will look completely different in 12 to 18 months. We’ll have more vaults, more options, better bridges, and hopefully a truly decentralized EUR stablecoin.

We’re not there yet.

But this is how it starts.

-Seb